Finance

How Much Is Flood Insurance In Virginia?

Published: November 19, 2023

Wondering how much flood insurance costs in Virginia? Find out the answers and get the best finance options for covering your property against floods.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Virginia is a beautiful state with a diverse landscape ranging from mountains to coastal areas. However, this geographical diversity also makes the state prone to various natural disasters, including floods. Flooding can cause significant damage to homes and properties, leading to costly repairs and financial burdens.

That’s where flood insurance comes in. Flood insurance is a specialized type of insurance coverage that provides financial protection in the event of flood-related damages. While homeowners insurance typically covers damages from fire, theft, and other perils, it does not typically include coverage for flood damage. Therefore, obtaining flood insurance is crucial for homeowners and property owners in Virginia.

Flood insurance not only helps protect your property and belongings but also provides you with the peace of mind knowing that you are financially safeguarded against the unpredictable nature of floods.

Before diving into the specifics of flood insurance rates in Virginia, it’s important to understand the factors that influence the cost of premiums. Flood insurance rates vary based on several key factors, including location, elevation, flood zone classification, property value, and the level of coverage you choose.

In this article, we will explore the importance of flood insurance in Virginia, delve into the factors that affect flood insurance rates, discuss the average cost of flood insurance in the state, and provide tips on how to get flood insurance and save money on premiums. So let’s get started!

Importance of Flood Insurance in Virginia

Floods can occur at any time and cause devastating damage to homes and properties. In Virginia, where the risk of flooding is significant, having flood insurance is of utmost importance. Here’s why:

- Protection from Financial Loss: Without flood insurance, homeowners are left to bear the financial burden of repairing and rebuilding their properties after a flood. The cost of flood damage can be astronomical, often exceeding tens of thousands of dollars. Flood insurance provides the necessary financial protection to cover these expenses, saving homeowners from substantial out-of-pocket costs.

- Mandatory Requirements: Depending on your location, obtaining flood insurance may be a mandatory requirement. In some high-risk flood zones, mortgage lenders may require homeowners to have flood insurance as a condition for getting a loan. By having flood insurance, you not only comply with the lender’s requirements but also protect your investment and ensure the security of your property.

- Peace of Mind: Natural disasters like floods can cause immense stress and anxiety. Having flood insurance allows homeowners to have peace of mind knowing that they are financially protected in the event of a flood. It eliminates the worry of how to cover the expenses associated with flood damage and allows homeowners to focus on the safety and well-being of their families.

- Protection for Personal Belongings: Floods not only damage the structure of homes but also destroy personal belongings such as furniture, appliances, electronics, and sentimental items. Flood insurance provides coverage for these personal belongings, allowing homeowners to replace or repair them in the aftermath of a flood.

- Community Recovery: When floods occur, entire communities are affected. Having flood insurance helps facilitate the recovery process by providing the necessary funds to rebuild homes and infrastructure. By being proactive and having flood insurance, homeowners contribute to the overall resilience of their community in times of natural disasters.

In summary, flood insurance is essential for homeowners in Virginia due to the state’s vulnerability to floods. It offers financial protection, fulfills mandatory requirements, provides peace of mind, protects personal belongings, and contributes to community recovery. Investing in flood insurance is a proactive step towards safeguarding your home, assets, and the well-being of your family in the face of unforeseen natural disasters.

Factors Affecting Flood Insurance Rates

When it comes to flood insurance rates in Virginia, several key factors come into play. Understanding these factors can help homeowners and property owners better anticipate and plan for the costs associated with flood insurance. Here are the main factors that influence flood insurance rates:

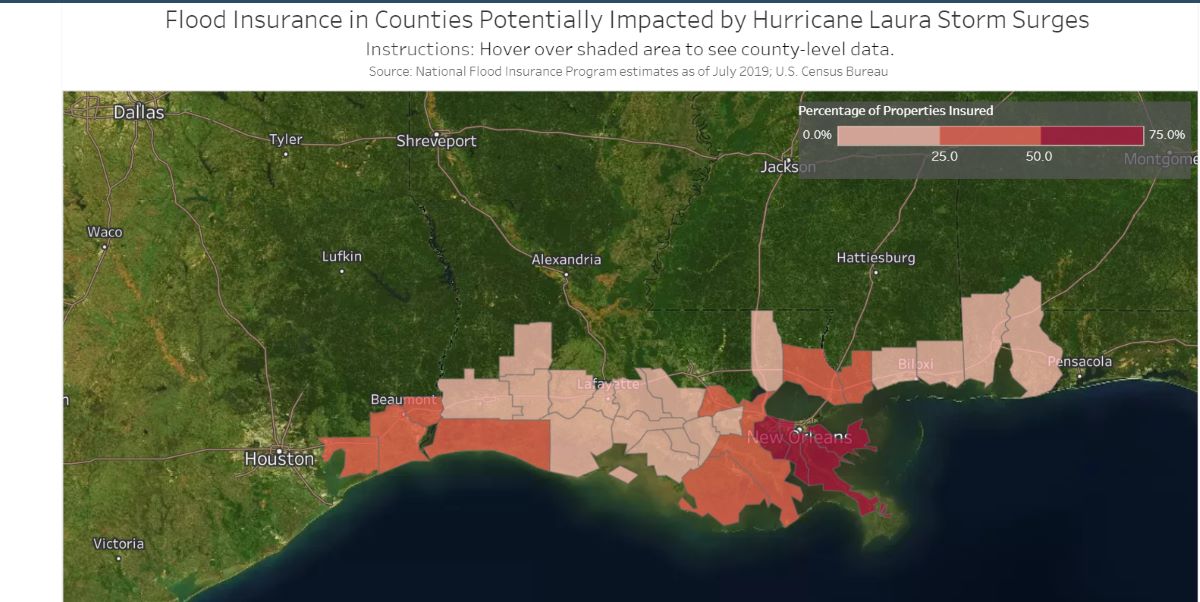

- Location: The location of your property plays a crucial role in determining flood insurance rates. Properties located in high-risk flood zones, such as coastal areas or near rivers, tend to have higher premiums due to the increased probability and severity of flooding. On the other hand, properties in low to moderate-risk zones may qualify for lower premiums.

- Elevation: The elevation of your property relative to the base flood elevation (BFE) is another important consideration. If your property is located below the BFE, you may face higher flood insurance rates as there is a higher risk of flood damage. Conversely, properties above the BFE may qualify for lower premiums.

- Flood Zone Classification: Flood zones are classified based on their risk levels. Zones labeled as “A” or “V” are considered high-risk zones and typically have higher premiums compared to low to moderate-risk zones labeled as “B,” “C,” or “X.” These flood zone classifications are determined by the Federal Emergency Management Agency (FEMA) and play an integral role in determining flood insurance rates.

- Property Value and Coverage Amount: The value of your property and the amount of coverage you choose also impact your flood insurance rates. Higher-valued properties require more coverage, resulting in higher premiums. It’s important to accurately assess the value of your property when determining the appropriate coverage amount.

- Age and Structure of the Property: The age and structure of your property can affect flood insurance rates. Older homes or structures that are more susceptible to flood damage may have higher premiums. Retrofitting your property with flood-resistant features, such as elevation or flood barriers, can help reduce premiums.

- Previous Flood Claims: If your property has a history of flood claims, it may impact your flood insurance rates. Multiple claims or significant damage from previous floods can result in higher premiums as it indicates a higher likelihood of future claims.

- Deductible: The deductible is the amount you must pay out-of-pocket before flood insurance coverage kicks in. Choosing a higher deductible can lower your premiums but also means you will bear a greater proportion of the costs in the event of a claim.

It’s important to note that these factors can vary depending on the insurance provider and the specific details of your property. Consulting with a reputable insurance agent can help you understand how these factors apply to your situation and provide you with accurate quotes and information regarding flood insurance rates.

Average Cost of Flood Insurance in Virginia

The average cost of flood insurance in Virginia can vary depending on several factors, including the location, flood zone classification, property value, and coverage amount. According to the National Flood Insurance Program (NFIP), the average premium for flood insurance in the United States is around $700 per year. However, it’s important to note that this is just an average, and the actual cost can be higher or lower depending on individual circumstances.

In Virginia, the cost of flood insurance is influenced by the state’s diverse geography and vulnerability to floods. Coastal areas, such as Virginia Beach and Norfolk, have a higher risk of flooding, which can lead to higher premiums. On the other hand, areas further inland may have lower premiums due to lower flood risk.

The flood zone classification of your property also plays a significant role in determining the cost of flood insurance. Homes located in high-risk flood zones, such as FEMA Zone A or V, generally have higher premiums compared to properties in lower-risk zones like Zone B, C, or X.

The size and value of your property, as well as the amount of coverage you choose, will also impact the cost of flood insurance. Higher-valued properties require more coverage, resulting in higher premiums. It’s important to accurately assess the value of your property and choose the appropriate coverage amount to ensure you have adequate protection without overpaying.

Additionally, it’s worth mentioning that there are variations in flood insurance rates depending on the insurance provider. It’s recommended to obtain quotes from multiple insurance companies to compare prices and coverage options. Working with an experienced insurance agent who specializes in flood insurance can help you navigate the process and find the best coverage at the most competitive rate.

While flood insurance premiums in Virginia can range from a few hundred to several thousand dollars per year, it’s important to remember that the financial protection it provides outweighs the upfront cost. Being prepared for the potential damages and expenses caused by a flood can save you from significant financial burdens in the long run.

How to Get Flood Insurance in Virginia

If you live in Virginia and want to protect your property and belongings from the devastating effects of floods, obtaining flood insurance is essential. Here are the key steps to get flood insurance in Virginia:

- Evaluate Your Flood Risk: Assess the flood risk of your property by determining its location, flood zone classification, and elevation relative to the base flood elevation (BFE). This information will help you understand your insurance needs and the potential cost of premiums.

- Contact an Insurance Agent: Reach out to an experienced insurance agent who specializes in flood insurance. An agent familiar with the intricacies of flood insurance in Virginia can guide you through the process and help you find suitable coverage options.

- Understand Coverage Options: Review different coverage options available to you. The National Flood Insurance Program (NFIP), administered by FEMA, offers flood insurance policies in many areas. Additionally, some private insurance companies may also provide flood insurance options.

- Provide Property Information: Gather detailed information about your property, including its address, size, age, and number of floors. This information will be used to assess the value and flood risk of your property, which will impact your flood insurance rates.

- Review and Compare Quotes: Request quotes from multiple insurance providers to compare prices and coverage options. It’s recommended to obtain quotes from both NFIP and private insurance companies to ensure you make an informed decision.

- Decide on Coverage and Deductible: Determine the appropriate amount of coverage based on the value of your property and personal belongings. Consider your financial situation and select a deductible that you can comfortably afford in the event of a claim.

- Complete the Application Process: Once you have selected an insurance provider and coverage option, complete the application process. This typically involves providing personal information, property details, and payment for the first premium.

- Pay the Premium and Secure Coverage: Pay the required premium to activate your flood insurance policy. Keep a copy of your policy documents in a safe place and make sure you understand the terms and conditions of coverage.

- Keep Your Policy Up to Date: Regularly review and update your flood insurance policy as needed. Inform your insurance provider of any changes to your property, such as renovations or additions, as these may affect your coverage and premiums.

Remember, flood insurance typically has a 30-day waiting period before coverage takes effect. Therefore, it’s important to act proactively and secure flood insurance well in advance to ensure you are protected in the event of a flood.

By following these steps and working with a knowledgeable insurance agent, you can acquire the necessary flood insurance coverage to safeguard your property and enjoy peace of mind, knowing you are financially protected from the damages caused by floods.

Comparing Different Flood Insurance Providers in Virginia

When searching for flood insurance in Virginia, it’s important to compare different insurance providers to find the best option for your needs. Here are some factors to consider when comparing flood insurance providers:

- Reputation and Financial Stability: Research the reputation and financial stability of each insurance provider. Look for established, reputable companies with a track record of customer satisfaction and prompt claims processing. Check their financial ratings with independent agencies like A.M. Best or Standard & Poor’s to ensure they have the resources to handle claims.

- Coverage Options: Review the coverage options provided by each company. Compare the types of coverage available, such as building coverage, contents coverage, and additional living expenses coverage. Ensure that the coverage options meet your specific needs and provide comprehensive protection against flood damages.

- Premium Rates: Obtain quotes from multiple insurance providers and compare the premium rates. Keep in mind that the rates can vary based on factors such as your property’s location, flood zone classification, and desired coverage amount. While cost is important, be cautious of excessively low premium rates, as they may indicate limited coverage.

- Customer Service: Consider the quality of customer service provided by each insurance provider. Are they responsive to inquiries? Do they have a dedicated claims department? Look for insurance companies that provide excellent customer service and have a reputation for prompt and fair claims processing.

- Policy Limits and Deductibles: Compare the policy limits and deductibles offered by each provider. Higher policy limits allow for more comprehensive coverage, while higher deductibles can result in lower premiums. Find a balance that provides adequate coverage without straining your finances in the event of a claim.

- Additional Benefits and Features: Consider any additional benefits or features offered by the insurance providers. Some companies may include extras such as loss avoidance programs, flood preparedness resources, or discounts for certain safety measures implemented in your property.

- Reviews and Recommendations: Read reviews and seek recommendations from friends, family, or trusted professionals who have experience with flood insurance providers. Their firsthand experiences can provide valuable insights and help you make an informed decision.

By carefully considering these factors and comparing different flood insurance providers in Virginia, you can find the one that offers the best combination of coverage, price, and customer service for your specific needs. Remember, it’s important to choose an insurance provider that not only provides adequate coverage but also offers reliable and responsive assistance in the event of a flood-related claim.

Tips to Save Money on Flood Insurance

While flood insurance is a crucial investment to protect your property against flood damage, you may still want to explore ways to save money on your premiums. Here are some tips to help you lower the cost of flood insurance in Virginia:

- Elevate Your Property: If your property is located in a flood-prone area, consider elevating it to reduce the risk of flood damage. This can lead to lower premiums as insurance companies recognize the proactive measures taken to mitigate flooding risks.

- Find the Right Coverage Amount: Assess the value of your property and belongings accurately to determine the appropriate amount of coverage. Overinsuring can lead to higher premiums, while underinsuring may leave you financially vulnerable. Work with an experienced insurance agent to strike the right balance.

- Consider a Higher Deductible: Opting for a higher deductible can lower your annual premiums. However, make sure you can comfortably afford the deductible amount in the event of a claim.

- Implement Flood-Resistant Measures: Take proactive steps to make your property more flood-resistant. Install flood barriers, elevate appliances and utilities, and implement other flood-resistant measures. These measures may qualify you for discounts on your premiums.

- Shop Around and Compare: Obtain quotes from multiple insurance providers and compare their rates and coverage options. Each company may have different pricing structures and discounts, so shopping around can help you find the most affordable flood insurance policy.

- Consider Private Flood Insurance: In addition to the National Flood Insurance Program (NFIP), explore private flood insurance options available in Virginia. Private insurers may offer competitive rates and alternative coverage options that could potentially result in cost savings.

- Bundle Your Insurance Policies: If you already have other insurance policies, such as homeowners or auto insurance, consider bundling them with your flood insurance. Many insurance providers offer discounts for bundling policies, which can help reduce your overall premium costs.

- Invest in Flood Prevention Measures: Implementing flood prevention measures such as installing sump pumps, improving drainage systems, or maintaining your property’s landscape can reduce the risk of flooding. Not only will this help protect your property but it may also lead to lower insurance premiums.

- Review and Update Annually: Regularly review your flood insurance policy and update it as needed. Changes in your property’s flood risk or upgrades made to your property may qualify you for lower premiums. Stay in touch with your insurance provider to ensure your policy accurately reflects your current circumstances.

Remember to consult with an experienced insurance agent who can guide you through the process and provide personalized advice tailored to your specific situation. By taking proactive steps and exploring these money-saving tips, you can effectively manage the cost of flood insurance while ensuring your property remains protected.

Conclusion

Flood insurance is a vital component of protecting your property and investments in Virginia. The state’s geographical diversity and susceptibility to flooding make it essential for homeowners to safeguard themselves against the financial devastation that floods can cause. By obtaining flood insurance, you not only ensure the protection of your property and belongings, but also gain peace of mind knowing that you have a safety net in the face of unexpected flooding events.

Throughout this article, we have explored the importance of flood insurance in Virginia, discussed the factors that influence flood insurance rates, explored the average cost of flood insurance in the state, and provided tips on how to obtain flood insurance and potentially save money on premiums.

When seeking flood insurance, it is crucial to evaluate your property’s flood risk, contact reputable insurance providers, understand coverage options, and compare quotes to find the best policy for your needs. Remember to consider factors such as location, flood zone classification, elevation, property value, and the level of coverage desired.

Additionally, exploring ways to mitigate flood risks and implementing flood-resistant measures can help lower your premiums. This can include elevating your property, implementing flood prevention measures, and considering a higher deductible. Shopping around and exploring private flood insurance options can also potentially lead to cost savings.

Ultimately, protecting your property and assets with flood insurance is a responsible and necessary step to secure your financial well-being. By understanding the importance of flood insurance, researching your options, and taking advantage of money-saving strategies, you can find peace of mind knowing that you are prepared for any potential flood events that may arise in Virginia.

Remember, flood insurance is not just a financial investment but also a safeguard against the unpredictability of nature. Take action today to protect your property and ensure a secure future for yourself and your loved ones.