Finance

How Much To Start A Credit Union

Published: January 5, 2024

Discover the cost of starting a credit union in the finance industry. Learn how much capital you need and the steps to launch your own credit union.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors to Consider when Starting a Credit Union

- Required Capital for Starting a Credit Union

- Funding Options for Credit Union Start-Up

- Costs Involved in Establishing a Credit Union

- Regulatory Compliance and Licensing Requirements

- Staffing and Operational Expenses

- Marketing and Growth Strategies for Credit Unions

- Conclusion

Introduction

Welcome to the world of credit unions, where individuals and communities come together to create a financial institution that is owned and governed by its members. Starting a credit union can be a fulfilling and empowering endeavor, providing access to affordable financial services to underserved populations and promoting financial inclusion. However, before embarking on this journey, it’s important to understand the factors involved in starting a credit union and the costs associated with it.

A credit union is a not-for-profit organization that operates on the principle of “people helping people.” Unlike traditional banks, credit unions are member-owned and have a democratic structure, giving each member an equal vote in decision-making processes. This cooperative model allows credit unions to prioritize the needs of their members and reinvest profits back into the organization.

When starting a credit union, it’s crucial to consider various factors that will impact the process and success of the institution. These factors include regulatory requirements, capital requirements, funding options, operational expenses, and growth strategies. By thoroughly understanding these factors, you can set a strong foundation for your credit union and ensure its sustainability in the long run.

In this article, we will explore the key considerations involved in starting a credit union, including the required capital, funding options, costs, regulatory compliance, staffing, and marketing strategies. By gaining a comprehensive understanding of these aspects, you can make informed decisions and navigate the path to establishing a successful credit union.

Factors to Consider when Starting a Credit Union

Before diving into the process of starting a credit union, it is crucial to evaluate and consider various factors that will shape the success and sustainability of your institution. These factors encompass both internal and external aspects that should be addressed during the planning phase. Let’s take a closer look at the key factors to consider:

- Market Demand: Assess the local or target market to determine the demand for credit union services. Identify any gaps in financial services and determine if there is a need for a credit union in the community. Understanding the market demand will help you tailor your services to meet the needs of potential members.

- Membership Eligibility: Define the eligibility criteria for membership in your credit union. This can include specific occupation groups, geographic location, or membership in certain organizations. Ensure that your eligibility requirements align with your target market and comply with regulatory guidelines.

- Board of Directors: Assemble a competent and diverse board of directors who will provide guidance and oversight for the credit union. Select individuals with expertise in finance, governance, and community engagement. A strong board of directors can contribute invaluable insights and help steer the credit union towards success.

- Business Plan: Develop a comprehensive business plan that outlines your credit union’s mission, vision, target market, services, and growth strategies. A well-crafted business plan is essential for securing funding, attracting members, and establishing a roadmap for the future.

- Technology Infrastructure: Invest in a robust technology infrastructure to support your credit union’s operations. This includes reliable banking software, secure data management systems, and online banking capabilities. Embracing technology will enhance the member experience and streamline internal processes.

- Compliance and Regulations: Familiarize yourself with regulatory requirements and licensing obligations for credit unions in your jurisdiction. Ensure that you comply with financial regulations, anti-money laundering laws, and consumer protection guidelines. Engage legal and compliance experts to navigate the complex regulatory landscape.

- Risk Management: Develop a robust risk management framework to identify, assess, and mitigate potential risks. Implement policies and procedures to safeguard member assets, maintain data security, and minimize operational and financial risks. Regularly review and update risk management strategies to adapt to evolving threats.

By considering these factors and developing strategies to address them, you can lay a solid foundation for your credit union and increase the chances of long-term success. Each of these factors requires careful planning, research, and alignment with your credit union’s mission and values.

Required Capital for Starting a Credit Union

Capital is a crucial component when starting a credit union. It represents the financial resources necessary to establish and operate the institution, meet regulatory requirements, and provide member services. Understanding the required capital and exploring various funding options is essential for the successful launch of your credit union.

The exact amount of capital needed will vary depending on factors such as the size and scope of your credit union, the range of services offered, and the regulatory requirements in your jurisdiction. Generally, credit unions are required to have a certain level of initial capital to ensure financial stability and the ability to meet members’ needs.

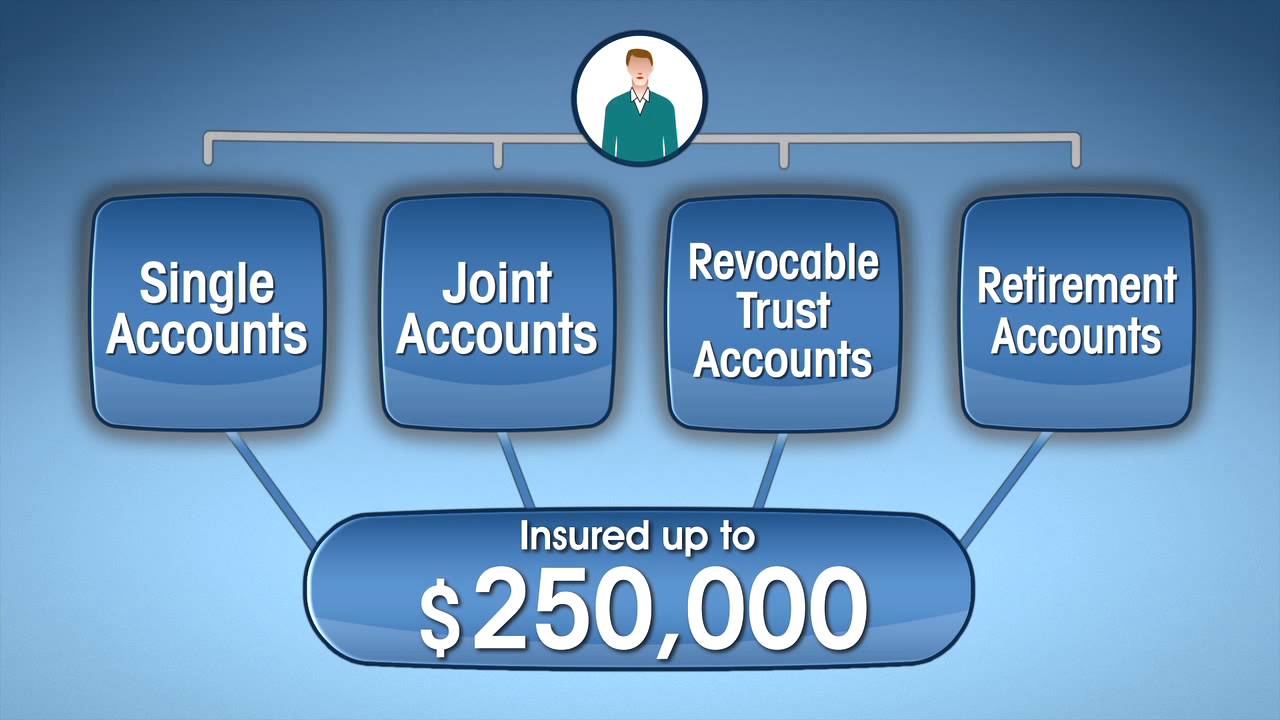

For example, in the United States, credit unions are typically required to have a minimum capital-to-asset ratio of 7%. This means that for every dollar in assets, the credit union must have at least 7 cents in capital. However, this requirement can vary by state and may be higher for specialized credit unions or those aiming to offer additional services like mortgage lending or business loans.

Raising the required capital can be done through various means, including:

- Member Shares: One of the primary sources of capital for credit unions is the sale of member shares. Members purchase shares in the credit union, which represents their ownership stake. The amount of shares required can vary, and some credit unions may have a minimum membership share requirement. Member shares not only provide initial capital but also act as a buffer for potential financial losses.

- Credit Union Loans and Lines of Credit: Credit unions can seek loans or lines of credit from other financial institutions to supplement their capital. These loans can provide additional financial resources to meet start-up costs and initial operational expenses. It is important to carefully review the terms and repayment obligations when considering this funding option.

- Government Grants and Programs: Depending on your jurisdiction, there may be government grants or programs available to support the establishment of credit unions. These funding sources can provide a significant boost to your capital base and help facilitate the launch of your credit union.

- Community Investments: Engaging with the community and soliciting investments from local businesses, organizations, and individuals can help raise capital for your credit union. This not only brings in additional funds but also fosters a sense of ownership and community involvement in the credit union’s success.

Prior to seeking funding, it is crucial to conduct a thorough analysis of your credit union’s capital needs and develop a clear plan for utilizing the funds. This will instill confidence in potential investors and lenders, increasing the likelihood of securing the necessary capital.

Remember, starting a credit union requires not only financial capital but also a dedicated team, a clear vision, and a commitment to serving your members. By carefully considering the required capital and exploring various funding options, you can set your credit union on the path to success.

Funding Options for Credit Union Start-Up

When starting a credit union, securing adequate funding is crucial for ensuring the successful launch and sustainable operations of the institution. There are various funding options available that credit unions can explore to obtain the necessary capital. Here are some common funding options to consider:

- Member Shares: Member shares are a primary source of funding for credit unions. Members purchase shares in the credit union, which not only demonstrates their ownership but also provides capital to the institution. Establishing a strategy to encourage members to invest in shares can significantly contribute to your credit union’s initial capital.

- Loans and Lines of Credit: Credit unions can seek loans or lines of credit from other financial institutions to supplement their capital needs. This option can help cover start-up costs and initial operational expenses. It is important to carefully consider the terms and interest rates associated with these loans before entering into any borrowing agreements.

- Government Programs and Grants: Many governments offer programs and grants specifically designed to support the establishment and growth of credit unions. These programs often provide financial assistance, training, and resources to help credit unions get off the ground and serve their communities. Research the government programs and grants available in your jurisdiction to see if your credit union qualifies for any financial assistance.

- Community Investments: Engaging with the local community and seeking investments from individuals, businesses, and organizations can be an effective way to raise capital for your credit union. This not only strengthens community ties but also fosters a sense of ownership and support for the credit union’s mission. Consider conducting community outreach campaigns and networking with local stakeholders to attract potential investors.

- Partnerships and Sponsorships: Explore opportunities for partnerships and sponsorships with organizations that share similar values or have an interest in supporting financial services for underserved communities. These partnerships can provide financial support, resources, and expertise that can greatly benefit your credit union’s start-up and growth.

- Grassroots Fundraising: Organize grassroots fundraising efforts within your community to generate funds for your credit union. This can involve events, donation drives, crowdfunding campaigns, or other creative initiatives that engage the community and raise both awareness and financial support for your credit union.

It is important to carefully evaluate each funding option and develop a well-rounded financing strategy that combines different sources of capital. This not only reduces dependency on a single funding source but also diversifies the credit union’s financial base. Additionally, maintaining transparency and effective communication with potential investors or lenders is crucial to gaining their trust and support.

Securing funding for your credit union start-up may require persistence and leveraging a combination of funding options. By being resourceful, building strong relationships, and promoting the value of your credit union’s mission, you can increase your chances of obtaining the necessary capital to establish and grow a successful credit union.

Costs Involved in Establishing a Credit Union

Establishing a credit union comes with various costs that need to be taken into consideration during the planning phase. These costs encompass both one-time expenses required for the initial setup and ongoing operational expenses. Understanding the costs involved will help you budget effectively and ensure the financial viability of your credit union. Here are some of the key costs to consider:

- Legal and Regulatory Compliance: Hiring legal and compliance professionals is essential to ensure that your credit union meets all necessary legal and regulatory requirements. These professionals will help guide you through the licensing process, draft bylaws, and establish governance protocols. Legal and regulatory compliance costs can vary based on the complexity of your credit union’s operations and jurisdiction-specific requirements.

- Technology Infrastructure: Investing in a robust technology infrastructure is crucial for the efficient operation of your credit union. This includes core banking systems, online banking platforms, security measures, and data storage solutions. Technology expenses may include software licenses, hardware purchases, network setup, data security measures, and ongoing maintenance costs.

- Physical Space and Equipment: Depending on the scale of operations, you may need to secure a physical space to house your credit union’s operations. This could include rental costs, office furnishings, computer systems, telephone systems, and other office equipment. Consider both the initial setup costs and ongoing monthly expenses when budgeting for your physical space.

- Staffing and Training: Hiring and training competent staff members is integral to the success of your credit union. This includes salaries, benefits, and professional development programs for employees. It’s essential to create a staffing plan that aligns with your credit union’s operational needs and growth projections.

- Marketing and Outreach: Promoting your credit union and attracting members is crucial for growth. Allocate a budget for marketing activities, such as developing a website, creating marketing materials, advertising campaigns, and community outreach initiatives. Marketing costs can vary depending on the scope and target audience of your credit union.

- Insurance: Protecting your credit union from potential risks is essential. Consider insurance policies that cover areas such as property, liability, Directors and Officers (D&O) insurance, and cybersecurity. The cost of insurance will depend on your credit union’s size, location, and the extent of coverage required.

- Operational Expenses: Ongoing operational expenses include utilities, office supplies, maintenance, licensing fees, and professional services like accounting and auditing. These costs are necessary for the day-to-day functioning of your credit union and should be factored into your budget planning.

It is crucial to thoroughly research and estimate the costs associated with each aspect of establishing and operating a credit union. Creating a detailed budget, considering both one-time and ongoing expenses, will help you allocate resources effectively and avoid any financial strain in the future.

Remember, the costs involved in establishing a credit union may vary based on factors such as your jurisdiction, the size of your credit union, the range of services offered, and the complexity of compliance requirements. Conducting thorough due diligence and seeking professional advice will ensure that you have a realistic estimation of the costs and can plan accordingly.

Regulatory Compliance and Licensing Requirements

When establishing a credit union, navigating the regulatory landscape and obtaining the necessary licenses is a critical step to ensure compliance with the law and operate legally. Understanding the regulatory compliance and licensing requirements specific to credit unions is essential for a smooth and successful launch. Here are some key aspects to consider:

- Regulatory Agencies: Familiarize yourself with the regulatory agencies overseeing credit unions in your jurisdiction. These agencies may include the Central Bank, Financial Services Authority, or other relevant regulatory bodies. Understand their role, responsibilities, and requirements for obtaining and maintaining a credit union license.

- Licensing Process: Research and understand the licensing process specific to credit unions in your jurisdiction. This may involve preparing documentation, submitting applications, paying fees, and undergoing a thorough review by the regulatory agency. Engage legal and compliance experts to navigate the process efficiently and ensure that all requirements are met.

- Capital Requirements: Credit unions are typically required to meet minimum capital requirements to ensure financial stability. These requirements may include a minimum capital-to-asset ratio or a specific amount of initial capital. Assess the capital requirements in your jurisdiction and plan accordingly to meet those requirements during the licensing process.

- Corporate Structure and Governance: Define the corporate structure of your credit union and establish appropriate governance mechanisms. This may involve drafting bylaws, creating a board of directors, and implementing governance policies and procedures. Ensure that your governance structure complies with regulatory guidelines and promotes transparency and accountability.

- Membership Eligibility and Bylaws: Establish clear eligibility criteria for credit union membership and reflect them in your bylaws. These criteria may include occupation groups, geographic boundaries, or membership in certain organizations. Your bylaws should also outline the rights and responsibilities of members, as well as rules for voting and decision-making processes.

- Continuing Regulatory Compliance: Once your credit union is licensed, ongoing compliance with regulatory requirements is necessary. This includes regular reporting, maintaining appropriate records, and adhering to the regulations governing areas such as anti-money laundering, consumer protection, and data privacy. Stay informed about regulatory updates and review your operations regularly to ensure continued compliance.

- Regulatory Examinations and Audits: Be prepared for regulatory examinations and audits that assess your credit union’s compliance with regulatory requirements. These examinations may include the review of financial records, operational procedures, internal controls, and risk management practices. Cooperate and provide the necessary documentation or information requested during these examinations.

- Compliance Training and Education: Invest in comprehensive compliance training programs for your staff members to ensure a strong culture of compliance within your credit union. Training should cover topics such as regulatory requirements, data protection, anti-money laundering, and ethical conduct. Keeping staff members informed and educated will help mitigate compliance risks and enhance the overall operations of the credit union.

Adhering to regulatory compliance and licensing requirements is vital for the long-term success and sustainability of your credit union. Failure to comply with regulations can result in reputational damage, financial penalties, or even the revocation of your credit union’s license. Therefore, it is crucial to prioritize regulatory compliance and seek professional guidance to navigate this complex landscape effectively.

Staffing and Operational Expenses

Staffing and operational expenses are integral components of running a successful credit union. Building a competent team and allocating resources efficiently are key to ensuring smooth day-to-day operations and delivering quality services to your members. Let’s explore the staffing and operational aspects that you should consider:

Staffing: Hiring the right individuals with the necessary skills and expertise is crucial for the success of your credit union. Here are some important staffing considerations:

- Qualified Leadership: Appoint a capable and experienced CEO or credit union manager who can provide strategic guidance, oversee operations, and ensure compliance with regulatory requirements. Their leadership will play a significant role in the credit union’s success.

- Member Service Representatives: Hire friendly and knowledgeable member service representatives who can assist members with their financial needs, provide personalized service, and build strong relationships. These front-line staff members are the face of your credit union and play a crucial role in member satisfaction.

- Financial Specialists: Consider hiring financial specialists such as loan officers, investment advisors, and financial planners to provide expert advice and assistance to members. These professionals can help members navigate the various financial products and services offered by the credit union.

- Operations and Administration: Staff positions involving operations, administration, accounting, compliance, and IT are essential for the smooth functioning of your credit union. These employees handle day-to-day processes, maintain records, ensure regulatory compliance, and support the overall operations of the credit union.

- Professional Development: Invest in ongoing professional development and training programs to enhance the skills and knowledge of your staff. This not only improves employee productivity and satisfaction but also enables your credit union to stay current with industry trends and best practices.

Operational Expenses: Managing operational expenses effectively is crucial for maintaining financial stability and ensuring the sustainability of your credit union. Here are some key operational expenses to consider:

- Rent and Utilities: Account for the costs associated with office space, rental agreements, and utilities such as electricity, water, and internet services.

- Technology and Software: Allocate funds for hardware, software, and technology infrastructure, including banking systems, online banking platforms, data security measures, and regular system updates and maintenance.

- Marketing and Advertising: Develop a marketing budget to promote your credit union’s services, attract new members, and enhance community awareness. Consider costs associated with advertising campaigns, website development, social media management, and other marketing initiatives.

- Compliance and Regulatory Fees: Factor in the costs of regulatory examinations, licensing renewals, compliance audits, and any fees associated with maintaining regulatory compliance. Consider engaging external auditors or consultants to assist with compliance-related matters.

- Insurance: Budget for insurance coverage to protect your credit union from potential risks, including property, liability, Directors and Officers (D&O) insurance, and cybersecurity coverage.

- Miscellaneous Expenses: Account for other miscellaneous expenses such as office supplies, professional services (e.g., legal and accounting), staff benefits, employee training, and ongoing staff development programs.

It is essential to develop a comprehensive budget that incorporates both staffing and operational expenses. Regularly review and assess your expenses to identify areas for optimization and cost-saving measures. Maintaining financial discipline and effective resource allocation will contribute to the overall financial health and success of your credit union.

Marketing and Growth Strategies for Credit Unions

Effective marketing and growth strategies are crucial for the long-term success and sustainability of a credit union. These strategies help attract new members, increase brand awareness, and promote the unique benefits and services offered by your credit union. Here are some key marketing and growth strategies to consider:

- Targeted Marketing: Identify your target audience and tailor your marketing efforts to reach them effectively. Conduct market research to understand the needs and preferences of potential members. Segment your target market based on demographics, occupation, or other relevant factors. This allows you to create personalized marketing campaigns that resonate with the specific needs and interests of your target audience.

- Online Presence: Establish a strong online presence to expand your reach and connect with potential members. Develop a user-friendly website that showcases your credit union’s mission, services, and benefits. Optimize your website for search engines to increase visibility. Leverage social media platforms to engage with your audience, share financial tips, and promote your credit union’s unique offerings.

- Community Involvement: Actively participate in community events and sponsor local initiatives to demonstrate your credit union’s commitment to the community. Engage in corporate social responsibility activities that align with your credit union’s values. Building strong community relationships fosters trust, enhances your brand reputation, and can lead to increased membership and growth.

- Referral Programs: Encourage your existing members to refer their friends, family, and colleagues to join your credit union. Implement a referral program that incentivizes members for successful referrals. Offer rewards such as cash bonuses, reduced fees, or exclusive perks. Word-of-mouth referrals are powerful and can significantly contribute to your credit union’s growth.

- Educational Content: Position your credit union as a trusted source of financial knowledge. Create educational content such as blog posts, articles, videos, or webinars to help your target audience make informed financial decisions. Focus on topics such as budgeting, saving, credit management, and financial planning. Sharing valuable educational content establishes credibility, builds trust, and attracts potential members.

- Partnerships and Co-branding: Collaborate with local businesses, organizations, or schools to expand your reach and tap into new member segments. Explore co-branding opportunities where your credit union and a partner organization mutually promote each other’s services. These partnerships can provide access to new markets and increase brand visibility.

- Member Engagement: Foster strong relationships with your existing members through personalized communication, excellent customer service, and member-exclusive events or perks. Engage with members through newsletters, surveys, or feedback mechanisms to gain insights and improve your services. Additionally, incentivize members to utilize additional credit union products and services to deepen their relationship with your institution.

- Innovation and Technology: Stay at the forefront of technology to meet evolving member expectations. Offer convenient digital banking solutions, mobile apps, and online account opening capabilities. Embrace fintech partnerships to enhance your product offerings and provide innovative financial solutions to your members. Demonstrating technological prowess will attract tech-savvy individuals and differentiate your credit union from competitors.

Remember, a well-rounded marketing and growth strategy requires a combination of online and offline initiatives, community involvement, member engagement, and continuous innovation. Regularly review and evaluate the effectiveness of your strategies, adapt to changing trends, and optimize your approach based on feedback and data analysis. By focusing on strategic marketing and sustainable growth, you can attract and retain members, expand your market presence, and position your credit union for long-term success.

Conclusion

Starting a credit union is an exciting and rewarding endeavor that allows you to make a positive impact on your community. However, it requires careful planning, solid financial resources, and a comprehensive understanding of the regulatory landscape. By considering the factors involved, such as market demand, membership eligibility, board composition, and business planning, you can set a strong foundation for your credit union’s success.

Obtaining the required capital is a critical step in starting a credit union. Whether through member shares, loans, government grants, or community investments, securing funding is essential for establishing and operating your credit union effectively.

Understanding and complying with the regulatory requirements and obtaining necessary licenses is vital for the legal and ethical operations of your credit union. Engaging legal and compliance experts can guide you through the process and ensure ongoing compliance with changing regulations.

Estimating the costs involved, such as legal and regulatory compliance, technology infrastructure, staffing, marketing, and operational expenses, is crucial for effective budgeting and resource allocation. Planning and budgeting for these expenses will contribute to the financial stability and long-term viability of your credit union.

Developing targeted marketing and growth strategies, creating an online presence, engaging with the community, and fostering member relationships will attract new members and promote the growth of your credit union. Embracing technology, prioritizing member education, and offering competitive products and services will position your credit union for success in today’s dynamic financial landscape.

In conclusion, starting a credit union requires careful consideration and planning in various areas. By addressing the factors discussed in this article and implementing effective strategies, you can establish a thriving credit union that provides accessible and affordable financial services to your community, fosters financial inclusion, and contributes to the financial well-being of your members.