Finance

How Often Does Macy’s Increase Credit Limit?

Modified: January 15, 2024

Discover how frequently Macy's increases credit limits and get insights into managing your finances effectively with our informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the dynamic world of credit limits and how they can impact your shopping experience at Macy’s. As one of the largest department stores in the United States, Macy’s offers a wide range of products and services to its loyal customers. One aspect that can greatly enhance your shopping power is the credit limit on your Macy’s credit card. Understanding how Macy’s determines credit limit increases and how often they occur can help you make the most of your shopping experience.

Having a higher credit limit can provide you with more purchasing power, flexibility, and opportunities to take advantage of sales and promotions at Macy’s. But how does Macy’s determine when and how much to increase your credit limit? In this article, we will take a closer look at the factors that affect Macy’s credit limit increases, the process involved, how often they occur, and some valuable tips on how to increase your chances of getting a higher credit limit at Macy’s.

Whether you’re a seasoned Macy’s shopper or considering opening a new Macy’s credit card, understanding how credit limits work can help you manage your finances effectively and take full advantage of the benefits Macy’s has to offer. So, let’s dive in and explore the fascinating world of Macy’s credit limit increases!

Factors Affecting Macy’s Credit Limit Increases

When it comes to credit limit increases at Macy’s, several factors come into play. Macy’s, like other credit card issuers, assesses various aspects of your financial profile to determine whether to grant you a higher credit limit. Understanding these factors can help you gauge your likelihood of receiving a credit limit increase and take appropriate steps to improve your chances. Here are the key factors that Macy’s considers:

Payment History

Your payment history is one of the most influential factors in determining credit limit increases. Macy’s closely examines your past payment behavior to assess your creditworthiness. Making timely and consistent payments on your Macy’s credit card demonstrates responsible financial management, increases your chances of a credit limit increase, and builds a positive credit history.

Credit Utilization Ratio

Macy’s also evaluates your credit utilization ratio, which is the percentage of your available credit that you’re currently using. A low credit utilization ratio indicates that you’re effectively managing your credit and may increase your chances of a credit limit increase. It’s recommended to keep your credit utilization ratio below 30% to demonstrate responsible credit usage.

Income and Employment Stability

Macy’s considers your income and employment stability when assessing credit limit increases. A higher income and stable employment history indicate a strong financial standing and the ability to handle a higher credit limit. If your income has increased since you obtained your Macy’s credit card, it may positively impact your chances of a credit limit increase.

Credit History Length

Your credit history length is another essential factor in determining credit limit increases. A longer credit history demonstrates responsible credit management and stability. If you have a relatively short credit history, it may be helpful to establish a positive track record with Macy’s by consistently making on-time payments before requesting a credit limit increase.

Overall Creditworthiness

In addition to the factors mentioned above, Macy’s evaluates your overall creditworthiness based on your credit report and score. They consider factors such as the number of open credit accounts, any derogatory marks or delinquencies, and your overall credit behavior. A strong credit profile, characterized by responsible credit management and a positive credit history, can significantly impact the likelihood of receiving a credit limit increase.

Understanding these factors can help you make informed decisions when managing your Macy’s credit card and increase your chances of receiving a credit limit increase. It’s important to note that while these factors play a significant role, there is no guarantee of a credit limit increase as it ultimately depends on Macy’s evaluation of your unique financial situation.

Macy’s Credit Limit Increase Process

Now that we understand the factors that influence credit limit increases at Macy’s, let’s delve into the process itself. Macy’s has a straightforward procedure that cardholders can follow to request a credit limit increase. Here are the general steps involved:

Step 1: Assess Your Credit Readiness

Before requesting a credit limit increase, it’s important to assess your credit readiness. Review your payment history, credit utilization ratio, and overall creditworthiness. If you have consistently made timely payments and adhered to responsible credit practices, you may be in a better position to request a credit limit increase.

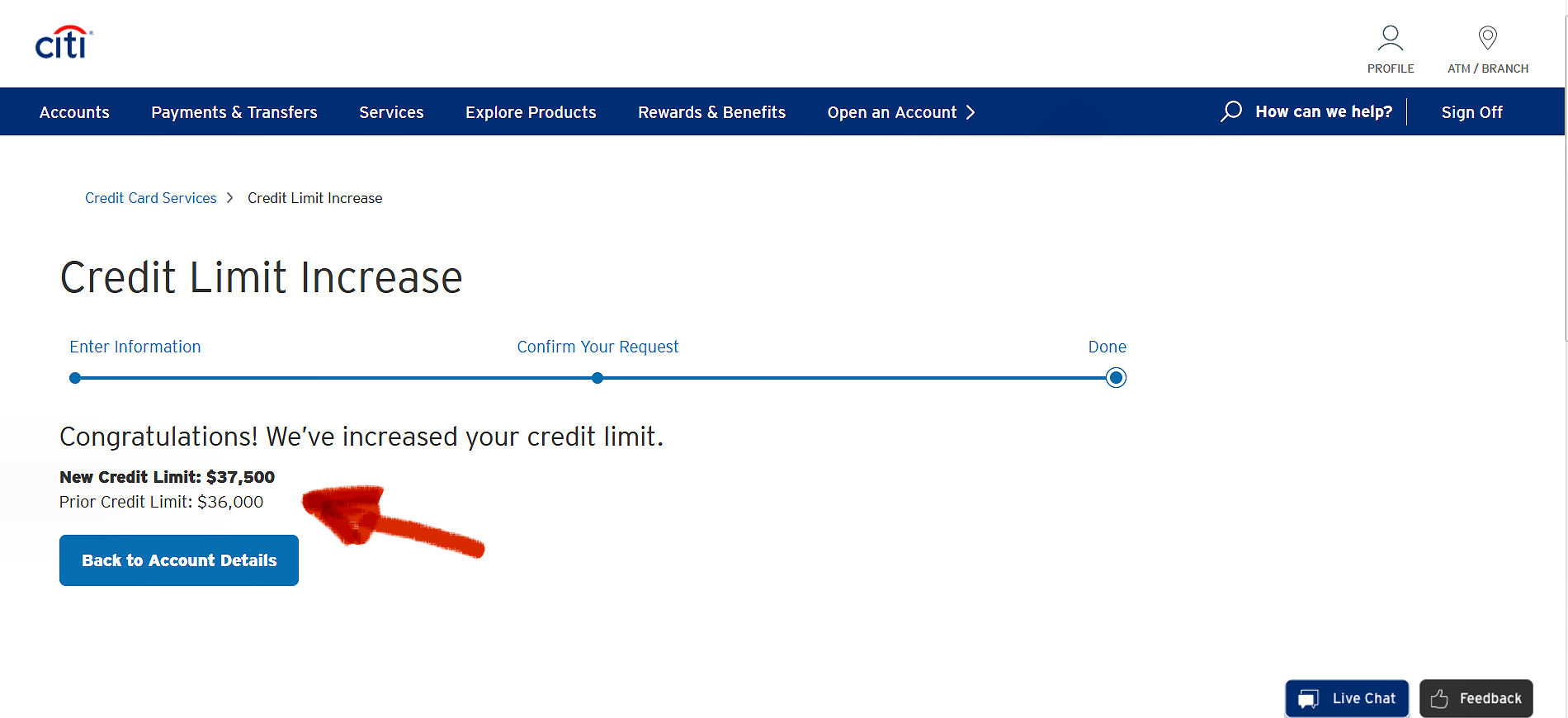

Step 2: Log into Your Macy’s Account

To initiate the credit limit increase request, log into your Macy’s online account or reach out to Macy’s customer service. You will need to provide your account details and personal information for verification purposes. Alternatively, you can also contact the customer service number on the back of your Macy’s credit card.

Step 3: Request a Credit Limit Increase

Once you are logged into your Macy’s account or connected with a customer service representative, express your desire to request a credit limit increase. Provide any necessary information or documentation they may require to evaluate your request, such as proof of increased income or updated employment details.

Step 4: Wait for a Decision

After submitting your request, you will need to wait for Macy’s to review and process it. The time taken for a decision can vary, but typically it takes a few business days. Macy’s will assess your financial profile and creditworthiness based on the factors we discussed earlier.

Step 5: Receive a Decision

Once Macy’s has reviewed your credit limit increase request, you will receive a decision. If your request is approved, you will be notified of the new credit limit. If your request is denied, Macy’s will provide you with an explanation for the decision.

Step 6: Utilize Your Higher Credit Limit Responsibly

If your credit limit increase request is approved, it’s important to utilize the higher limit responsibly. Use the increased credit limit to your advantage, but avoid overspending or accruing excessive debt. Build a positive payment history by making timely payments and managing your credit responsibly.

Following these steps will help you navigate the credit limit increase process at Macy’s. Remember that approval is not guaranteed, and it’s important to assess your financial readiness before requesting an increase. Utilize your increased credit limit wisely to enhance your shopping experience at Macy’s while maintaining good financial health.

Frequency of Credit Limit Increases at Macy’s

One common question that Macy’s credit cardholders often have is how frequently they can expect credit limit increases. While there is no exact timeframe for credit limit increases at Macy’s, there are some general guidelines to keep in mind.

Macy’s typically reviews credit limit increase requests periodically and evaluates the cardholder’s financial profile to determine if an increase is warranted. The frequency of these reviews can vary, but it’s common for Macy’s to conduct them every six to twelve months.

However, it’s important to note that Macy’s does not automatically increase credit limits for all cardholders during these reviews. The decision to grant a credit limit increase depends on factors such as payment history, credit utilization ratio, income stability, and overall creditworthiness, which we discussed earlier. If you have demonstrated responsible credit behavior and have a strong financial profile, you may have a higher likelihood of receiving a credit limit increase.

To increase your chances of a credit limit increase at Macy’s, it’s advisable to maintain a positive payment history by consistently making at least the minimum payments on time. Additionally, keeping your credit utilization ratio low and showcasing stable income can also work in your favor.

It’s important to note that you can also proactively request a credit limit increase from Macy’s by following the process outlined earlier. By demonstrating responsible credit usage and providing any necessary documentation to support your request, you increase your chances of receiving a higher credit limit.

Remember, credit limit increases are not guaranteed, as they depend on Macy’s evaluation of your financial situation and creditworthiness. It’s also important to be mindful of your own financial capability when requesting an increase. If you are unable to handle a higher credit limit responsibly, it may be best to wait until your financial situation improves before seeking a credit limit increase.

Keeping these considerations in mind, it’s a good practice to periodically review your credit profile and assess whether a credit limit increase is necessary or beneficial to your shopping needs. By managing your credit responsibly and understanding Macy’s credit limit increase process and frequency, you can make informed decisions to improve your creditworthiness and enhance your shopping experience at Macy’s.

Tips for Requesting a Credit Limit Increase at Macy’s

If you’re considering requesting a credit limit increase at Macy’s, there are several tips to keep in mind to increase your chances of a successful request. By following these recommendations, you can improve your creditworthiness and demonstrate responsible financial management to Macy’s:

1. Maintain a Positive Payment History

Consistently make timely payments on your Macy’s credit card. Paying at least the minimum amount due each month and avoiding late payments helps build a positive payment history, which is crucial for credit limit increases.

2. Keep Credit Utilization Ratio Low

Maintain a low credit utilization ratio by using only a small percentage of your available credit. Keeping your credit utilization below 30% demonstrates responsible credit usage and may improve your chances of receiving a credit limit increase.

3. Pay Off Existing Balances

If you have any outstanding balances on your Macy’s credit card, consider paying them off before requesting a credit limit increase. This shows responsible financial management and may increase your chances of a higher credit limit.

4. Increase Your Income

If possible, increase your income or demonstrate stable employment. A higher income or employment stability can positively impact your creditworthiness and enhance the likelihood of receiving a credit limit increase.

5. Proactively Monitor Your Credit Profile

Regularly monitor your credit profile and resolve any errors or discrepancies. A clean credit report and a strong credit score are essential for demonstrating creditworthiness and improving your chances of a credit limit increase.

6. Gradually Increase Your Credit Limit

If you have been granted a credit limit increase in the past, gradually increase your credit limit over time. Gradual increases show responsible credit management and may improve your chances of receiving further increases in the future.

7. Be Prepared to Provide Documentation

When requesting a credit limit increase, be ready to provide any necessary documentation to support your request, such as proof of increased income. This demonstrates transparency and credibility to Macy’s.

8. Use your card frequently and responsibly

Show Macy’s that you are an active and responsible cardholder by using your Macy’s credit card for regular purchases and making timely payments. This demonstrates your reliability and increases your chances of a credit limit increase.

Remember, while following these tips can improve your chances of receiving a credit limit increase at Macy’s, approval is not guaranteed. It’s essential to assess your own financial readiness before requesting an increase and ensure that you can handle a higher credit limit responsibly.

By implementing these tips and maintaining responsible credit management, you can enhance your creditworthiness and increase the likelihood of a successful credit limit increase request at Macy’s.

Benefits of a Higher Credit Limit at Macy’s

Having a higher credit limit on your Macy’s credit card can offer several advantages that can enhance your shopping experience and provide more financial flexibility. Here are some key benefits of having a higher credit limit at Macy’s:

1. Increased Purchasing Power

A higher credit limit allows you to make larger purchases at Macy’s without maxing out your credit card. This gives you the freedom to buy higher-priced items or take advantage of limited-time promotions and sales that require a higher spending limit.

2. Flexibility for Special Occasions and Events

Special occasions like birthdays, anniversaries, or holidays often involve shopping for gifts or treating yourself and loved ones. A higher credit limit provides the flexibility to shop for those special occasions without worrying about exceeding your credit limit.

3. Rewards and Benefits

Macy’s credit cardholders often enjoy rewards and benefits tied to their spending. With a higher credit limit, you have more opportunities to earn rewards, such as cashback, discounts, and exclusive offers, which can add value to your shopping experience.

4. Improved Credit Utilization Ratio

A higher credit limit can positively impact your credit utilization ratio. If you maintain the same level of spending while having more available credit, your credit utilization ratio decreases. A lower ratio demonstrates responsible credit usage and can improve your credit score over time.

5. Emergency Preparedness

Unexpected situations may arise that require immediate funds, such as car repairs, medical expenses, or home repairs. Having a higher credit limit provides a safety net and peace of mind in such emergency situations, allowing you to handle unforeseen expenses without undue financial stress.

6. Build Credit History

A higher credit limit allows you to responsibly manage and build a positive credit history. By using your Macy’s credit card and making timely payments on a higher credit limit, you demonstrate creditworthiness and create a strong foundation for future credit endeavors.

7. Access to Exclusive Benefits

Some credit cards offer exclusive benefits and privileges to cardholders with higher credit limits. This may include access to VIP events, concierge services, extended warranties, and travel benefits. Enjoying these exclusive perks can enhance your overall shopping and lifestyle experiences.

It’s important to note that while a higher credit limit offers advantages, it’s crucial to use it responsibly. Avoid overspending or accumulating debt that cannot be easily managed. Regularly monitor your credit card statements, budget your expenses, and make timely payments to maintain a good financial standing.

By understanding the benefits of a higher credit limit and utilizing it responsibly, you can optimize your shopping experience, enjoy rewards and benefits, and strengthen your financial foundation with your Macy’s credit card.

Conclusion

Understanding how credit limits work and how to navigate the credit limit increase process at Macy’s can significantly impact your shopping experience and financial management. By considering the factors that affect credit limit increases, following the steps to request an increase, and implementing the tips we discussed, you can increase your chances of securing a higher credit limit.

Having a higher credit limit at Macy’s offers a range of benefits, including increased purchasing power, flexibility for special occasions, access to rewards and benefits, and improved credit utilization ratio. However, it’s crucial to use a higher credit limit responsibly and within your financial means. Avoid overspending, regularly monitor your credit, and make timely payments to maintain a positive credit history.

Remember, a credit limit increase is not guaranteed and is subject to Macy’s evaluation of your financial profile and creditworthiness. It’s important to assess your own financial readiness before requesting an increase and ensure that you can manage a higher credit limit responsibly.

By maintaining a positive payment history, keeping your credit utilization ratio low, increasing your income stability, and periodically reviewing your credit profile, you can enhance your creditworthiness not only for Macy’s but for other financial endeavors as well.

In conclusion, understanding the factors influencing credit limit increases, navigating Macy’s credit limit increase process, and maintaining responsible credit usage can help you make the most of your Macy’s credit card. Enjoy the flexibility, rewards, and benefits that come with a higher credit limit while practicing sound financial management. Shop responsibly, stay within your means, and build a strong credit foundation for a brighter financial future.