Finance

How To Add Liquidity To Your Token

Published: February 23, 2024

Learn how to add liquidity to your token and improve its financial stability with our comprehensive guide. Explore the best finance strategies for token liquidity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of decentralized finance (DeFi), where digital assets are traded and transacted in a trustless and permissionless manner. As you venture into the realm of cryptocurrencies and tokens, you may encounter the concept of liquidity and its pivotal role in the functioning of token markets. In this article, we will delve into the significance of liquidity and explore the process of adding liquidity to your token.

The financial landscape has evolved significantly with the emergence of blockchain technology and smart contracts, enabling the creation and exchange of digital assets with unprecedented efficiency and security. Within this ecosystem, liquidity serves as the lifeblood of token trading, facilitating seamless transactions and price stability. Whether you are a token issuer, investor, or trader, understanding how to enhance liquidity can greatly impact the success and viability of your token.

In the following sections, we will unravel the intricacies of liquidity, elucidate the benefits of augmenting liquidity for your token, and provide a comprehensive guide on how to effectively add liquidity to your token. By the end of this article, you will have gained valuable insights into the mechanisms of liquidity provision and be well-equipped to navigate the decentralized financial landscape with confidence. Let's embark on this enlightening journey to unlock the potential of liquidity for your token in the dynamic world of DeFi.

Understanding Liquidity

Liquidity, in the context of financial markets, represents the ease with which an asset can be bought or sold without causing a significant change in its price. In the realm of decentralized finance and token trading, liquidity is a fundamental pillar that underpins the efficiency and stability of markets. It is crucial to comprehend the dynamics of liquidity to navigate the complexities of token trading and investment.

At its core, liquidity reflects the depth of a market and the ability of market participants to execute trades swiftly and at a fair price. In the context of token trading, liquidity is typically provided by liquidity providers who contribute assets to liquidity pools, enabling seamless and decentralized trading. These liquidity pools serve as the cornerstone of decentralized exchanges (DEXs) and facilitate the swapping of tokens without the need for traditional intermediaries.

One of the key metrics used to assess liquidity is the concept of slippage, which refers to the difference between the expected price of a trade and the price at which the trade is executed. Higher liquidity generally results in lower slippage, providing traders with more predictable and favorable trading conditions. Understanding the interplay between liquidity, slippage, and trading volume is essential for gauging the robustness of a token’s market and the potential impact on trading outcomes.

Moreover, liquidity plays a pivotal role in price stability, as tokens with higher liquidity are less susceptible to drastic price fluctuations arising from large buy or sell orders. This stability is particularly valuable for both traders and token issuers, as it fosters confidence in the market and reduces the risk of significant price volatility.

By comprehending the nuances of liquidity and its implications for token markets, market participants can make informed decisions regarding trading strategies, investment opportunities, and the overall viability of tokens. In the subsequent sections, we will explore the compelling benefits of augmenting liquidity for your token and provide actionable insights into the process of adding liquidity to your token.

Benefits of Adding Liquidity to Your Token

Adding liquidity to your token can yield a myriad of compelling benefits that enhance the market dynamics and attractiveness of your token to potential traders and investors. By contributing to liquidity pools and bolstering the trading depth of your token, you can unlock opportunities for sustainable growth and heightened market efficiency. Let’s explore the notable advantages of augmenting liquidity for your token:

- Enhanced Market Stability: By adding liquidity to your token, you contribute to the overall market stability by mitigating the impact of large buy or sell orders on the token’s price. This fosters a more predictable trading environment and instills confidence in traders and investors, thereby reducing the likelihood of significant price slippage.

- Increased Trading Volume: Liquidity attracts trading activity, as traders are more inclined to engage with tokens that offer ample liquidity. Higher trading volume not only enhances the market depth but also contributes to a vibrant and active trading ecosystem, potentially leading to increased visibility and demand for your token.

- Competitive Pricing and Lower Slippage: Tokens with robust liquidity typically exhibit lower slippage, allowing traders to execute trades at prices closely aligned with the prevailing market rates. This competitive pricing advantage can incentivize traders to choose your token for their trading activities, bolstering its appeal and utility.

- Opportunity for Yield Generation: Many decentralized finance platforms incentivize liquidity providers with yield opportunities, allowing you to earn rewards in the form of trading fees or platform-specific tokens. By adding liquidity to your token, you can potentially access additional sources of income while contributing to the liquidity ecosystem.

- Attractiveness to DeFi Protocols: DeFi protocols and decentralized exchanges often prioritize tokens with substantial liquidity, granting them access to various DeFi applications, liquidity mining programs, and enhanced visibility within the decentralized finance ecosystem.

These benefits collectively illustrate the transformative impact of augmenting liquidity for your token, positioning it as a more resilient, attractive, and dynamic asset within the decentralized financial landscape. As we proceed, we will delve into the actionable steps involved in adding liquidity to your token, empowering you to harness these advantages and fortify the market presence of your token.

How to Add Liquidity to Your Token

Adding liquidity to your token involves participating in liquidity pools, where you contribute an equivalent value of two paired assets to enable seamless trading. This process typically occurs on decentralized exchanges (DEXs) and requires a step-by-step approach to ensure the efficient provision of liquidity for your token. Here’s a comprehensive guide on how to add liquidity to your token:

- Choose a Suitable Decentralized Exchange: Select a reputable decentralized exchange that supports the creation of liquidity pools for your token. Popular options include Uniswap, SushiSwap, and PancakeSwap, each offering user-friendly interfaces for liquidity provision.

- Access the Liquidity Pool Interface: Navigate to the liquidity or pool section of the chosen decentralized exchange and locate the option to add liquidity. You will typically encounter a pair of assets, such as ETH/YourToken, that form the basis of the liquidity pool.

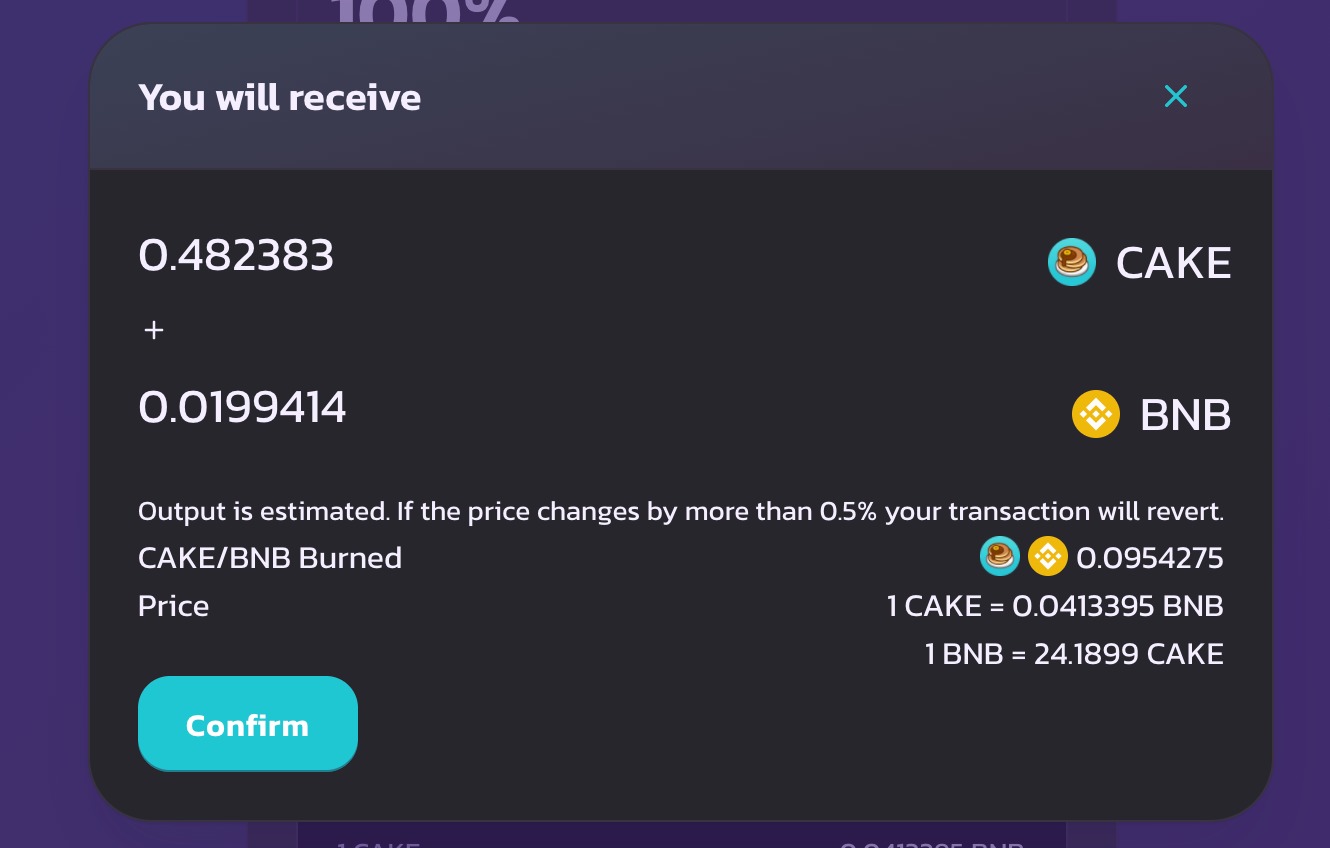

- Provide Paired Assets: Ensure that you possess an equivalent value of both your token and its paired asset, such as ETH, BNB, or another compatible cryptocurrency. Input the desired amounts of each asset to contribute to the liquidity pool, ensuring a balanced and proportional allocation.

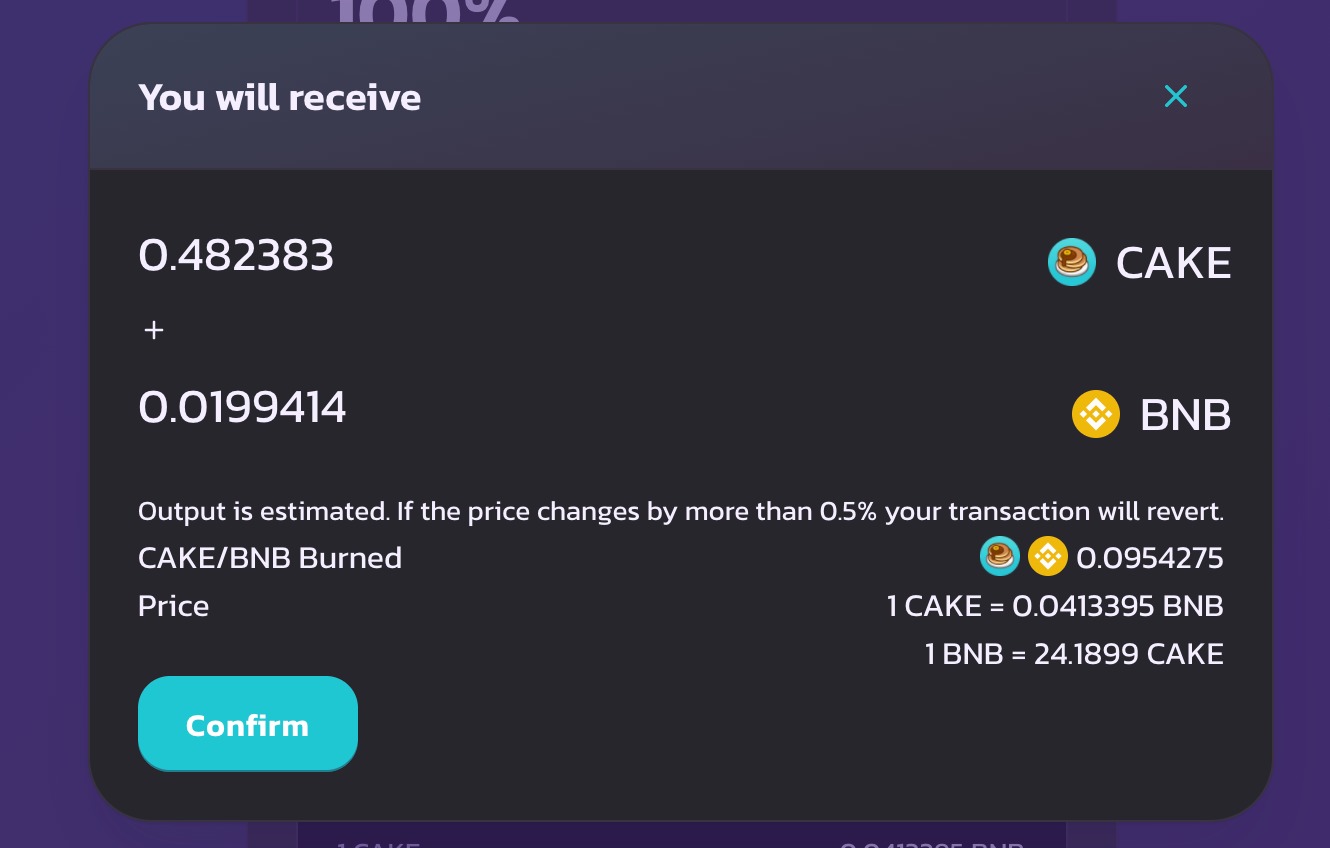

- Confirm the Transaction: Review and confirm the details of the liquidity provision transaction, including the specific amounts of assets being contributed and any associated fees. Be mindful of gas fees, as they can fluctuate based on network congestion and transaction complexity.

- Receive Liquidity Pool Tokens: Upon successfully adding liquidity, you will receive liquidity pool tokens that represent your share of the pool. These tokens entitle you to a portion of the trading fees generated within the pool, reflecting your contribution to the liquidity ecosystem.

- Monitor and Manage Your Liquidity: Regularly monitor the performance of your liquidity provision, as market dynamics and trading activity can impact the composition and value of the liquidity pool. You may also consider adjusting your liquidity allocation based on market conditions and your strategic objectives.

By following these steps, you can effectively add liquidity to your token and participate in the vibrant ecosystem of decentralized trading. It is essential to stay informed about the specific requirements and nuances of each decentralized exchange’s liquidity provision process, as they may vary in functionality and user experience.

As you navigate the process of adding liquidity to your token, keep in mind the potential benefits and opportunities that arise from actively contributing to the liquidity landscape. Your participation not only enhances the trading environment for your token but also fosters a more robust and inclusive decentralized finance ecosystem.

Conclusion

In the dynamic and rapidly evolving landscape of decentralized finance, the significance of liquidity cannot be overstated. As you embark on your journey in the world of token issuance, investment, or trading, understanding the pivotal role of liquidity and its implications for market dynamics is paramount. By augmenting the liquidity of your token, you can unlock a multitude of benefits that contribute to its resilience, attractiveness, and utility within the decentralized financial ecosystem.

From fostering market stability and competitive pricing to accessing yield opportunities and enhancing visibility within DeFi protocols, the advantages of adding liquidity to your token are compelling and far-reaching. By actively participating in liquidity provision, you not only bolster the trading environment for your token but also contribute to the broader liquidity landscape, empowering the growth and vibrancy of decentralized finance.

As you navigate the process of adding liquidity to your token, it is essential to stay informed about the evolving trends, best practices, and opportunities within the decentralized finance space. Engaging with reputable decentralized exchanges, monitoring market dynamics, and adapting your liquidity strategy can position your token for sustained growth and resilience in the face of market fluctuations.

Ultimately, the journey of adding liquidity to your token is a testament to your commitment to fostering a robust and inclusive decentralized financial ecosystem. By embracing the transformative potential of liquidity provision, you can elevate the market presence and appeal of your token, contributing to a more vibrant and efficient decentralized trading landscape.

As you continue to explore the intricacies of liquidity and its impact on token markets, remember that the journey is as enriching as the destination. Stay curious, adaptive, and informed, and let the principles of liquidity guide you toward unlocking the full potential of your token in the ever-evolving realm of decentralized finance.