Finance

How To Apply For An EMV Chip Debit Card

Published: March 6, 2024

Learn how to apply for an EMV chip debit card and enhance your financial security. Get step-by-step guidance on obtaining a finance-focused EMV card today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Applying for a new debit card can be a significant financial decision. With the rise of digital transactions and the increasing need for secure payment methods, the EMV chip debit card has become a popular choice for many individuals. Understanding the process of obtaining an EMV chip debit card can empower you to make informed decisions about your financial security and convenience.

In this guide, we will delve into the essential aspects of EMV chip debit cards and provide a comprehensive overview of the steps involved in applying for one. Whether you're new to the world of EMV chip technology or seeking to upgrade your current debit card, this article is designed to equip you with the knowledge and confidence to navigate the application process seamlessly.

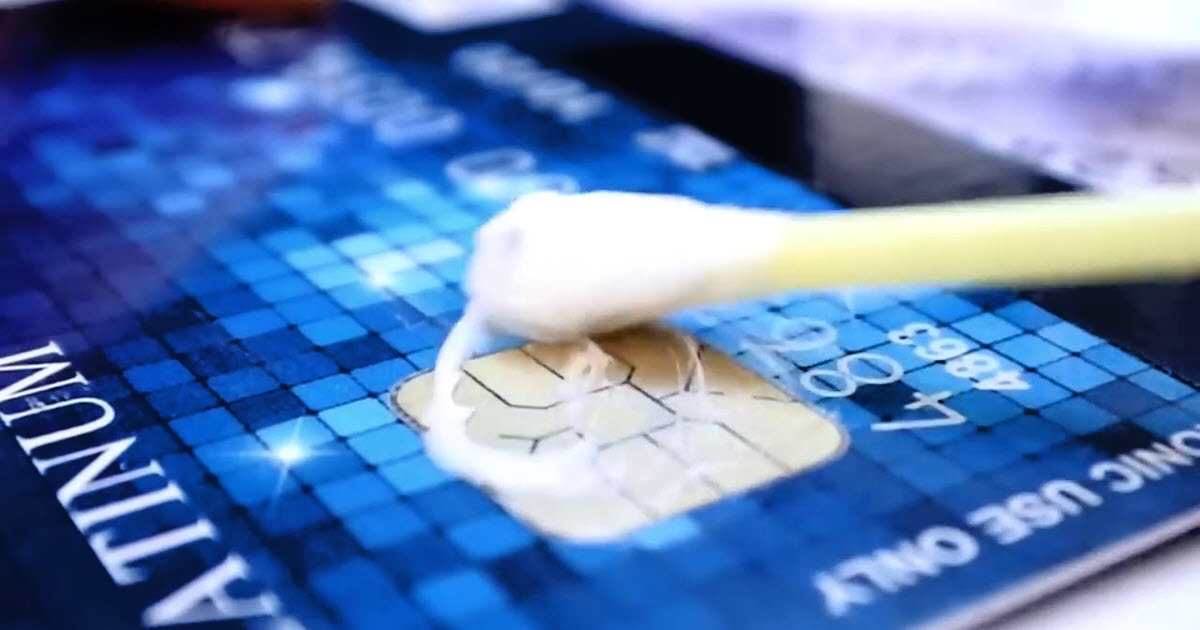

The transition from traditional magnetic stripe cards to EMV chip technology represents a pivotal advancement in payment security. By incorporating a microprocessor chip that generates unique transaction data for each purchase, EMV chip cards offer enhanced protection against counterfeit fraud. As a result, these cards have gained widespread acceptance and are now the standard for secure payment methods globally.

Join us as we explore the intricacies of EMV chip debit cards and uncover the straightforward steps to acquire this innovative financial tool. Whether you're eager to embrace the latest in payment security or simply curious about the application process, this guide is tailored to meet your needs and provide valuable insights into the world of EMV chip debit cards.

Understanding EMV Chip Debit Cards

EMV, which stands for Europay, Mastercard, and Visa, represents a global standard for credit and debit card payments. The primary feature that sets EMV chip debit cards apart from traditional magnetic stripe cards is the embedded microprocessor chip. This chip generates a unique code for every transaction, making it significantly more secure than the static data stored on magnetic stripes.

One of the key benefits of EMV chip technology is its ability to prevent counterfeit card fraud. The dynamic authentication process ensures that each transaction is uniquely encrypted, reducing the risk of unauthorized access to sensitive cardholder information. Additionally, EMV chip cards are compatible with point-of-sale terminals that require card insertion, commonly known as chip-and-PIN or chip-and-signature verification methods.

Furthermore, EMV chip debit cards are designed to provide a seamless and secure payment experience, whether used domestically or internationally. The widespread adoption of EMV technology has led to increased protection against fraudulent activities, benefiting both cardholders and merchants.

It’s important to note that EMV chip cards are not immune to all forms of fraud, but they significantly reduce the likelihood of certain types of unauthorized transactions. The multi-layered security features of EMV chip technology make it a valuable asset in safeguarding personal financial information.

As the financial industry continues to prioritize security and innovation, EMV chip debit cards have become an integral component of modern banking. By understanding the fundamental principles behind EMV chip technology, individuals can confidently embrace this advanced form of payment security and enjoy greater peace of mind when conducting transactions.

Steps to Apply for an EMV Chip Debit Card

Obtaining an EMV chip debit card involves a straightforward application process that can be completed through various channels offered by financial institutions. Whether you’re opening a new account or upgrading an existing card, the following steps outline the typical procedure for applying for an EMV chip debit card:

- Evaluate Your Current Debit Card: If you already have a debit card, assess whether it is equipped with EMV chip technology. If not, consider contacting your bank or credit union to inquire about the possibility of upgrading to an EMV chip card.

- Research Financial Institutions: If you’re in the market for a new debit card, research different banks and credit unions to compare their offerings. Look for institutions that provide EMV chip debit cards as part of their standard product lineup.

- Choose Your Preferred Card: Once you’ve identified a financial institution that aligns with your banking preferences, select the specific debit card that best suits your financial needs. Ensure that the chosen card features EMV chip technology for enhanced security.

- Complete the Application: Whether applying online, in person at a branch, or through a mobile app, fill out the debit card application form provided by the financial institution. Be prepared to provide personal identification, such as a driver’s license or passport, and any additional documentation required for account verification.

- Review Terms and Conditions: Carefully review the terms and conditions associated with the EMV chip debit card, including any fees, interest rates, and liability policies. Understanding the card’s usage guidelines and associated costs is essential for making informed financial decisions.

- Activate Your New Card: Upon approval of your application, follow the activation instructions provided by the financial institution. This typically involves calling a specified phone number or activating the card through the institution’s online banking portal.

By following these steps, you can seamlessly navigate the application process for an EMV chip debit card and enjoy the enhanced security and convenience that this advanced payment technology offers.

Additional Tips for Using EMV Chip Debit Cards

While EMV chip debit cards offer robust security features, it’s essential to complement their protective capabilities with responsible card usage and awareness of potential vulnerabilities. Consider the following tips to maximize the benefits of your EMV chip card:

- Keep Your Card Secure: Safeguard your EMV chip debit card to prevent unauthorized use. Store it in a secure location and avoid sharing card details with others, especially the card verification code (CVC) located on the back of the card.

- Regularly Monitor Your Transactions: Stay vigilant by reviewing your account statements and transaction history regularly. Report any unfamiliar or unauthorized transactions to your financial institution promptly.

- Enable Transaction Alerts: Take advantage of transaction alert services offered by your bank or credit union. These alerts can notify you of card transactions in real time, allowing you to identify and address potential fraudulent activity promptly.

- Use Secure Payment Terminals: When making purchases, ensure that the point-of-sale terminals support EMV chip card transactions. Look for terminals with chip card insertion slots and follow the prompts for secure card authentication.

- Be Mindful of Skimming Risks: Exercise caution when using ATMs and payment terminals, as these devices can be targeted by fraudsters attempting to capture card data through skimming techniques. Inspect card slots for any unusual devices or signs of tampering before inserting your card.

- Protect Personal Identification Numbers (PINs): If your EMV chip card requires a personal identification number (PIN) for transactions, avoid sharing your PIN with anyone and shield the keypad when entering it to prevent unauthorized access.

By incorporating these proactive measures into your card management practices, you can fortify the security of your EMV chip debit card and mitigate potential risks associated with card-based transactions. Additionally, staying informed about emerging security trends and fraud prevention strategies can further enhance your ability to safeguard your financial assets effectively.

Conclusion

Acquiring an EMV chip debit card represents a proactive step towards enhancing the security and reliability of your financial transactions. The transition from magnetic stripe cards to EMV chip technology signifies a significant advancement in payment security, offering consumers a robust defense against counterfeit fraud and unauthorized access to sensitive card data.

By understanding the fundamental principles of EMV chip technology and familiarizing yourself with the application process, you can confidently pursue the benefits of this innovative payment solution. Whether you’re seeking to upgrade your existing debit card or exploring new banking options, EMV chip cards provide a secure and versatile payment method for various financial needs.

As the financial industry continues to prioritize the integration of advanced security measures, EMV chip debit cards have emerged as a pivotal tool in fortifying the integrity of electronic payment systems. By adhering to best practices for card security and remaining vigilant against potential threats, individuals can maximize the protective capabilities of their EMV chip cards and enjoy greater peace of mind when conducting transactions.

Embracing the convenience and security offered by EMV chip debit cards involves a combination of informed decision-making, responsible card management, and proactive fraud prevention measures. By leveraging the insights provided in this guide, you are empowered to navigate the application process with confidence and utilize your EMV chip card with a heightened awareness of its protective features.

Ultimately, the adoption of EMV chip technology reflects a collective commitment to advancing payment security and empowering consumers to transact with greater assurance in an increasingly digital world. By integrating EMV chip debit cards into your financial arsenal and staying informed about evolving security practices, you can elevate your financial resilience and contribute to the ongoing evolution of secure payment solutions.