Finance

How To Apply Spirit Credit

Modified: February 21, 2024

Learn how to apply for Spirit Credit and manage your finances effectively. Explore our step-by-step guide to secure your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Gather Required Documents and Information

- Step 2: Research Spirit Credit Options

- Step 3: Fill out Spirit Credit Application

- Step 4: Submit Application and Supporting Documents

- Step 5: Follow up on Application Status

- Step 6: Receive Spirit Credit Approval

- Step 7: Activate and Use Spirit Credit

- Conclusion

Introduction

Welcome to the world of Spirit Credit! Whether you’re looking to earn rewards, take advantage of low interest rates, or build your credit history, Spirit Credit offers a range of options to cater to your financial needs. In this comprehensive guide, we will walk you through the step-by-step process of applying for a Spirit Credit card and help you navigate the various opportunities available.

With Spirit Credit, you can enjoy a variety of benefits including cashback rewards, travel perks, and exclusive discounts. But before you can start reaping the benefits, you’ll need to complete the application process. Don’t worry, it’s easier than you think!

Applying for a Spirit Credit card is a straightforward process that can be done online or in-person at a Spirit Credit branch. By following our guide, you’ll have all the necessary information and tips to make your application a success.

Before we dive into the details, it’s important to note that Spirit Credit evaluates applications based on a variety of factors, including credit history, income, and employment status. Don’t be discouraged if you have a less-than-perfect credit score – Spirit Credit offers options for individuals with a wide range of credit profiles.

So, if you’re ready to take control of your financial future and unlock the benefits of Spirit Credit, let’s get started on your application journey!

Step 1: Gather Required Documents and Information

Before you begin the Spirit Credit application process, it’s important to gather all the necessary documents and information to ensure a smooth and efficient application. By having everything ready upfront, you can avoid delays and quickly move on to the next steps.

Here are the key documents and information you will need:

- Personal Identification: You will need a valid government-issued identification document such as a driver’s license, passport, or national identity card. Ensure that the identification document is up-to-date and not expired.

- Proof of Address: Spirit Credit requires proof of your current address. This can be established by providing a recent utility bill, bank statement, or rental agreement in your name. Make sure the document clearly displays your name and address.

- Income Details: Prepare documentation that verifies your income, such as recent pay stubs, tax returns, or bank statements. This will help demonstrate your ability to repay any credit extended to you.

- Employment Information: Have your employer’s name, address, and contact information readily available. This information is often required to verify your employment status and stability.

- Financial Information: Gather details about your current financial obligations, including existing loans, credit cards, and any other outstanding debts. This information will assist Spirit Credit in assessing your financial capacity.

Take the time to ensure that all the documents are accurate, up-to-date, and easily accessible. Missing or incorrect information can prolong the application process, so it’s important to double-check everything before proceeding.

Additionally, it’s a good idea to have a clear understanding of your credit history. Obtain a copy of your credit report and review it for any errors or discrepancies. If you notice any issues, make sure to address them before submitting your application. A strong credit history can increase your chances of approval and potentially qualify you for better credit terms.

By gathering all the required documents and information upfront, you’ll be well-prepared to complete your Spirit Credit application without any unnecessary delays or complications.

Step 2: Research Spirit Credit Options

Now that you have gathered all the necessary documents and information, it’s time to dive into researching the various Spirit Credit options available. Understanding the different types of credit cards offered by Spirit Credit will help you choose the one that best suits your financial goals and lifestyle.

Spirit Credit offers a range of credit cards tailored to different needs, including cashback cards, rewards cards, low-interest cards, and cards specifically designed for those looking to build or rebuild their credit. Take the time to explore each option and consider the following factors:

- Rewards Program: If you are someone who frequently uses their credit card for everyday expenses, you might want to consider a rewards card. Spirit Credit offers rewards programs that allow you to earn points or cashback on eligible purchases, which can be redeemed for a variety of benefits like travel, merchandise, or statement credits.

- Interest Rates: If you anticipate carrying a balance on your credit card, it’s important to pay attention to the interest rates offered by Spirit Credit. Look for cards with low introductory rates or competitive ongoing rates to minimize the amount of interest you will be charged.

- Fees: Take note of any annual fees, late payment fees, or other charges associated with each credit card option. Understanding the fees upfront will help you make an informed decision and avoid any surprises down the line.

- Credit Building Options: If you have a limited or less-than-perfect credit history, Spirit Credit offers credit-building cards designed to help you establish or improve your credit score. These cards often come with lower credit limits and tools to track and monitor your progress.

While researching Spirit Credit options, take advantage of online resources, comparison websites, and customer reviews. This will provide valuable insights and feedback from current cardholders, helping you make an informed decision.

Consider your financial goals, spending habits, and credit situation when evaluating the different options. Remember, choosing the right Spirit Credit card can provide you with long-term benefits and financial flexibility.

Once you have narrowed down your options, make a note of the specific card(s) you are interested in, as they will be needed in the next step of the application process.

Step 3: Fill out Spirit Credit Application

Now that you have done your research and have a clear understanding of the Spirit Credit options available, it’s time to fill out the credit card application. The application process can be done online through the Spirit Credit website or in person at a local branch. Follow these steps to ensure a smooth and accurate application:

- Access the Application: Visit the Spirit Credit website or go to a local branch to obtain the credit card application. If applying online, ensure that you have a stable internet connection and a device that can access the website.

- Personal Information: Start by providing your personal information, including your full name, date of birth, social security number, and contact details. Double-check the accuracy of the information before proceeding.

- Employment and Income Details: Enter your employment information, including your employer’s name, address, and contact information. Provide details about your job title, duration of employment, and monthly income. If you are self-employed, you may need to submit additional documentation to verify your income.

- Financial Information: Fill in the fields regarding your financial situation, including your current mortgage or rent payments, outstanding debts, and monthly expenses. Be truthful and accurate in disclosing this information as it will help Spirit Credit assess your ability to manage credit.

- Spirit Credit Card Selection: Indicate your preferred Spirit Credit card option, based on the research you conducted in the previous step. Select the specific card and any additional features or benefits you wish to apply for.

- Terms and Conditions: Carefully read through the terms and conditions of the credit card agreement. Understand the interest rates, fees, and any other important terms associated with the card. If you have any questions, don’t hesitate to reach out to a Spirit Credit representative for clarification.

- Review and Submit: Take a moment to review all the information you entered before submitting the application. Ensure that all details are accurate and complete. Once you are satisfied, click the submit button to send your application for review.

Remember to keep a copy of your completed application for your records. This will allow you to refer back to the information provided and have a record of the application submission.

Whether you apply online or in-person, the Spirit Credit application process is designed to be user-friendly and efficient. By accurately completing the application form, you increase your chances of a successful application outcome.

Step 4: Submit Application and Supporting Documents

After completing the Spirit Credit card application, it’s time to submit your application and any required supporting documents. This step is crucial to ensure that your application is processed promptly and accurately. Here’s what you need to do:

- Review Your Application: Before submitting, take a final look at your application to ensure that all information provided is correct and complete. Verify that you have selected the desired Spirit Credit card option and any additional features you want.

- Compile Supporting Documents: Gather all the documents that need to be submitted along with your application. These can include copies of your identification document, proof of address, income verification, and any other documentation requested by Spirit Credit.

- Make Copies: It’s crucial to keep copies of all documents you submit for your records. Make photocopies or scan the documents to create digital copies that you can refer to if needed.

- Submit Online or In-Person: If you submitted your application online, follow the instructions provided to upload the supporting documents. Ensure that the documents are clear and legible. If applying in person at a Spirit Credit branch, bring all the necessary documents with you and hand them over to the representative assisting you.

- Confirmation: After submitting your application and supporting documents, you will receive a confirmation notification. This may be via email, SMS, or an in-person acknowledgement at the branch. Ensure that you receive this confirmation to have peace of mind that your application has been successfully submitted.

Remember, timely submission of your application and supporting documents is crucial to maintaining a smooth application process. Delays in submitting documents may result in prolonging the approval process or even rejection of your application.

If you have any uncertainties or need further assistance, don’t hesitate to reach out to a Spirit Credit representative. They will be able to guide you through the submission process and provide any necessary clarification on the documents required.

Now that you have submitted your Spirit Credit application, it’s time to move on to the next step and follow up on the status of your application.

Step 5: Follow up on Application Status

Once you have submitted your Spirit Credit application and supporting documents, it’s important to stay informed about the status of your application. This step ensures that you are aware of any updates or additional requirements that may be needed for a successful approval. Here’s what you need to do:

- Confirmation: After submitting your application, you should receive a confirmation of receipt. This may come in the form of an email, SMS, or a reference number. Keep this confirmation handy as it may be needed for future reference or inquiries.

- Wait Patiently: The processing time for credit card applications can vary depending on the volume of applications received and the verification process. It’s important to be patient and allow sufficient time for Spirit Credit to review your application. For most applications, you can expect a response within a few business days to a couple of weeks.

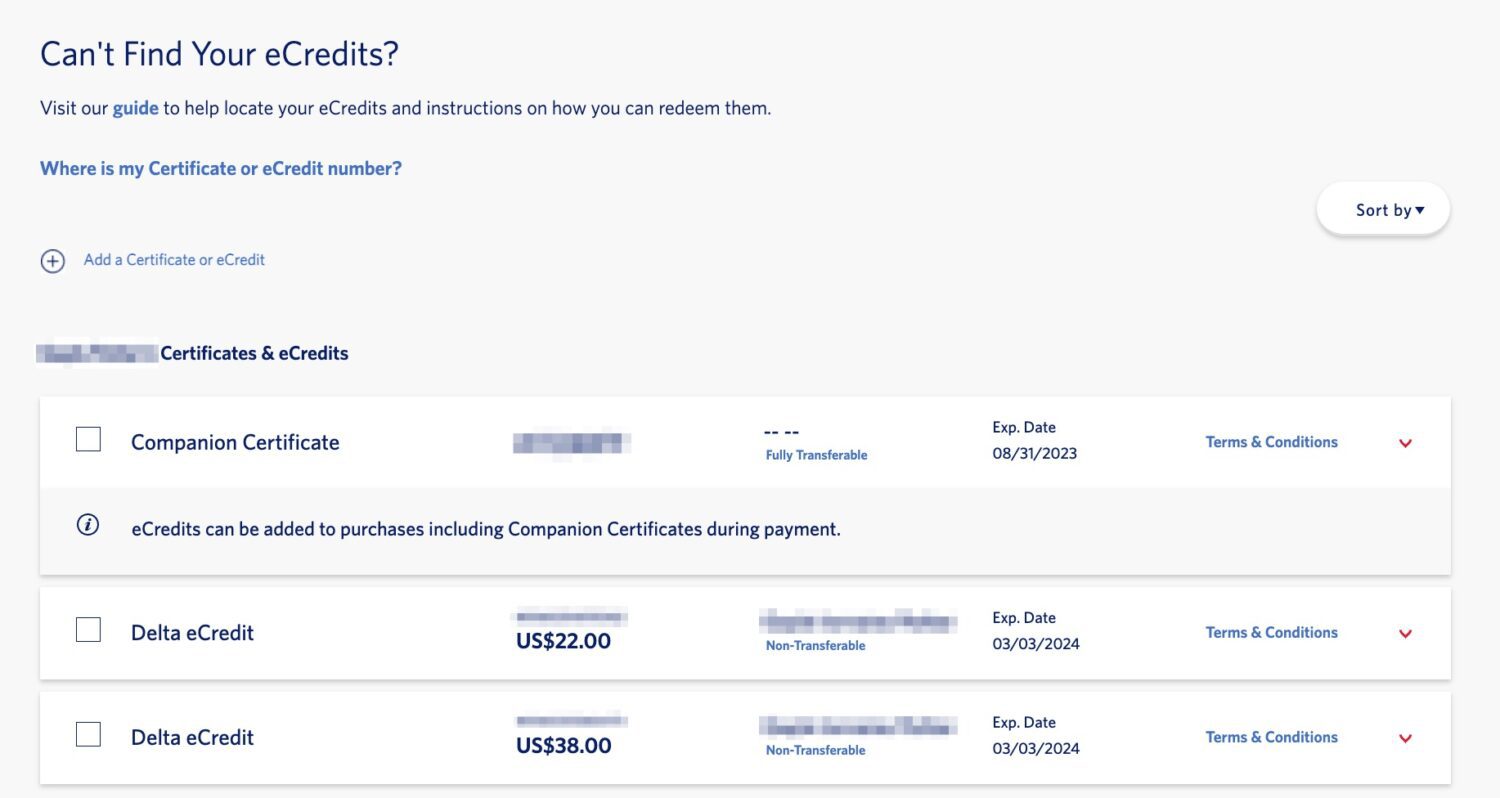

- Check Application Status: Spirit Credit often provides an online portal or a dedicated customer service line to check your application status. Visit the Spirit Credit website and log in to your account using the provided credentials to track the progress of your application. Alternatively, contact the customer service team via phone or email to inquire about the status.

- Provide Additional Information: In some cases, Spirit Credit may require additional information or documentation to complete the evaluation of your application. If you receive a request for more information, promptly provide the requested documents or details to expedite the process. Failure to respond within the given timeframe may result in a delayed or rejected application.

- Stay Informed: Check your email, phone, or any other communication channels regularly for updates from Spirit Credit. They may reach out to you if there are any updates or clarifications needed regarding your application. Keep an eye on your spam or junk folder as well, to ensure you don’t miss any important notifications.

Following up on your application status is crucial as it allows you to proactively address any potential issues or provide any requested information in a timely manner. It also gives you peace of mind knowing that your application is progressing through the evaluation process.

Remember, if you have any questions or concerns during the application review period, don’t hesitate to reach out to Spirit Credit customer service. They are there to assist you and provide updates on your application status.

Once your Spirit Credit application is approved, it’s time to move on to the next step of the process – receiving your Spirit Credit card and activating it.

Step 6: Receive Spirit Credit Approval

Congratulations! You’ve reached an exciting milestone in the Spirit Credit application process – receiving your approval. This step confirms that your application has met the necessary criteria and that you have been deemed eligible for a Spirit Credit card. Here’s what you can expect:

- Notification: Spirit Credit will notify you of your approval status through various means, such as email, SMS, or a physical letter. Keep an eye on your designated communication channels to ensure you don’t miss any important updates.

- Terms and Conditions: Upon approval, you will receive a detailed document outlining the terms and conditions of your Spirit Credit card. Review this document thoroughly to understand your credit limit, interest rates, fees, and any additional features or benefits associated with your card.

- Delivery of Your Spirit Credit Card: Once your application is approved, Spirit Credit will proceed with issuing and delivering your physical credit card. Depending on your location, it may take a few business days to receive it via mail. Take note of the estimated delivery timeframe provided by Spirit Credit.

- Verify Card Activation: Upon receiving your Spirit Credit card, you will need to verify the activation process. This usually involves contacting the provided activation line or visiting the Spirit Credit website to activate your card. Follow the instructions provided and ensure your card is activated within the specified time frame.

It’s important to understand the terms and conditions of your Spirit Credit card to make the most of the benefits and avoid any surprises. Familiarize yourself with the credit limit, payment due dates, interest rates, and any promotional offers associated with your card.

Upon receiving your activated Spirit Credit card, take a moment to verify that all the information on the card is correct. Check the name, card number, expiration date, and security code to ensure accuracy. If you notice any discrepancies or issues, contact Spirit Credit immediately for resolution.

Once your Spirit Credit card is activated, you can start using it to make purchases, earn rewards, and enjoy the benefits provided by Spirit Credit. Remember to manage your credit responsibly, make timely payments, and keep track of your expenses to maintain a healthy credit profile.

Now that you have received your Spirit Credit approval, it’s time to put your new card to use and enjoy the financial flexibility it offers.

Step 7: Activate and Use Spirit Credit

Now that you have received your Spirit Credit card and completed the activation process, it’s time to put your new card to use and enjoy the benefits it offers. Follow these steps to activate and make the most of your Spirit Credit:

- Activate Your Card: As mentioned in the previous step, activate your Spirit Credit card by following the designated activation process. This may involve calling a specified activation line or visiting the Spirit Credit website. By activating your card, you confirm that you have received it and can begin using it.

- Set Up Online Access: Take advantage of Spirit Credit’s online banking services by setting up an online account. This will allow you to conveniently manage your credit card, view transactions, make payments, and monitor your statement online. Follow the instructions provided by Spirit Credit to create your online account.

- Familiarize Yourself with Card Features: Review the features and benefits of your Spirit Credit card. Take note of any rewards programs, cashback offers, travel perks, or exclusive discounts that are associated with your card. Understanding these features will help you maximize the benefits of your Spirit Credit card.

- Make Responsible Purchases: Use your Spirit Credit card for everyday purchases, online shopping, and other expenses as needed. However, it’s important to maintain responsible usage and avoid overspending beyond your means. Keep track of your purchases and always ensure you can comfortably repay the amount within the billing cycle.

- Pay on Time: Timely payment is crucial to maintain a positive credit history and avoid unnecessary interest charges. Review your monthly statement to understand the minimum payment required and the due date. Set up reminders or automate payments to ensure you never miss a payment.

- Monitor Your Credit: Regularly review your credit card statements to identify any unauthorized charges or errors. Monitoring your credit activity can help you detect any fraudulent activity early on and take appropriate action. Additionally, keeping an eye on your credit utilization can help you maintain a healthy credit score.

- Take Advantage of Benefits: Explore the various benefits and perks offered by Spirit Credit. This may include cashback rewards, travel insurance, extended warranty protection, or access to exclusive events. Familiarize yourself with these benefits and utilize them to enhance your overall credit card experience.

Remember, using your Spirit Credit card responsibly and within your means is crucial to maintaining a positive credit profile. Avoid accumulating unnecessary debt and aim to pay off your balance in full each month to avoid interest charges.

By activating and responsibly using your Spirit Credit card, you can build a positive credit history, earn rewards, and unlock the financial flexibility that comes with it. Enjoy the convenience and advantages that your Spirit Credit card provides!

Conclusion

Congratulations! You’ve successfully navigated the process of applying for and obtaining a Spirit Credit card. By following the steps outlined in this guide, you have gathered the necessary documents, researched the available options, completed the application, submitted supporting documents, followed up on your application status, received approval, and activated your card. Now, you are ready to fully enjoy the benefits and convenience that come with being a Spirit Credit cardholder.

Remember, with Spirit Credit, you have access to a range of credit card options tailored to different needs including cashback rewards, low-interest rates, and credit-building opportunities. Choose the card that aligns with your financial goals and spending habits.

Utilize your Spirit Credit card responsibly by making timely payments, staying within your credit limit, and monitoring your spending. Take advantage of the features and benefits offered by Spirit Credit, such as rewards programs and exclusive discounts, to maximize the value of your card.

Maintaining a healthy credit profile is crucial for your financial well-being. By using your Spirit Credit card responsibly and developing good credit habits, you can establish a positive credit history and open doors to future financial opportunities.

Lastly, always stay informed about any updates or changes to the terms and conditions of your Spirit Credit card. Keeping a close eye on your statements and regularly reviewing your account activity will help you detect and address any issues promptly.

Thank you for trusting our guide to navigate the Spirit Credit application process. We hope this comprehensive overview has provided you with valuable insights and tips to make your experience seamless and successful. Enjoy the benefits of your Spirit Credit card and make the most of your financial journey!