Finance

How To Find Cash On A Balance Sheet

Modified: February 21, 2024

Learn how to uncover hidden cash in a company's balance sheet with our comprehensive finance guide. Maximize your financial insights and boost your bottom line.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When assessing a company’s financial health, one of the key areas to scrutinize is its balance sheet. It provides a snapshot of the company’s financial position, including its assets, liabilities, and equity. One crucial component to look for on the balance sheet is cash. Cash is the lifeblood of any business, and understanding its availability and utilization is vital for investors and stakeholders.

In this article, we will delve into the topic of finding cash on a balance sheet. We will explore various methods to evaluate and analyze the cash position of a company. By understanding how cash flows through a balance sheet, investors can gain valuable insights into a company’s financial stability, liquidity, and investment potential.

We will cover different sections of the balance sheet, including operating activities, investing activities, and financing activities. Additionally, we will discuss the impact of non-operating and non-cash items on a company’s cash position. Finally, we will explore the use of financial ratios to further assess a company’s cash flows.

Whether you are a seasoned investor, a financial analyst, or someone seeking to understand the financial health of a company, this comprehensive guide will provide you with valuable tools and knowledge to navigate the world of cash on a balance sheet.

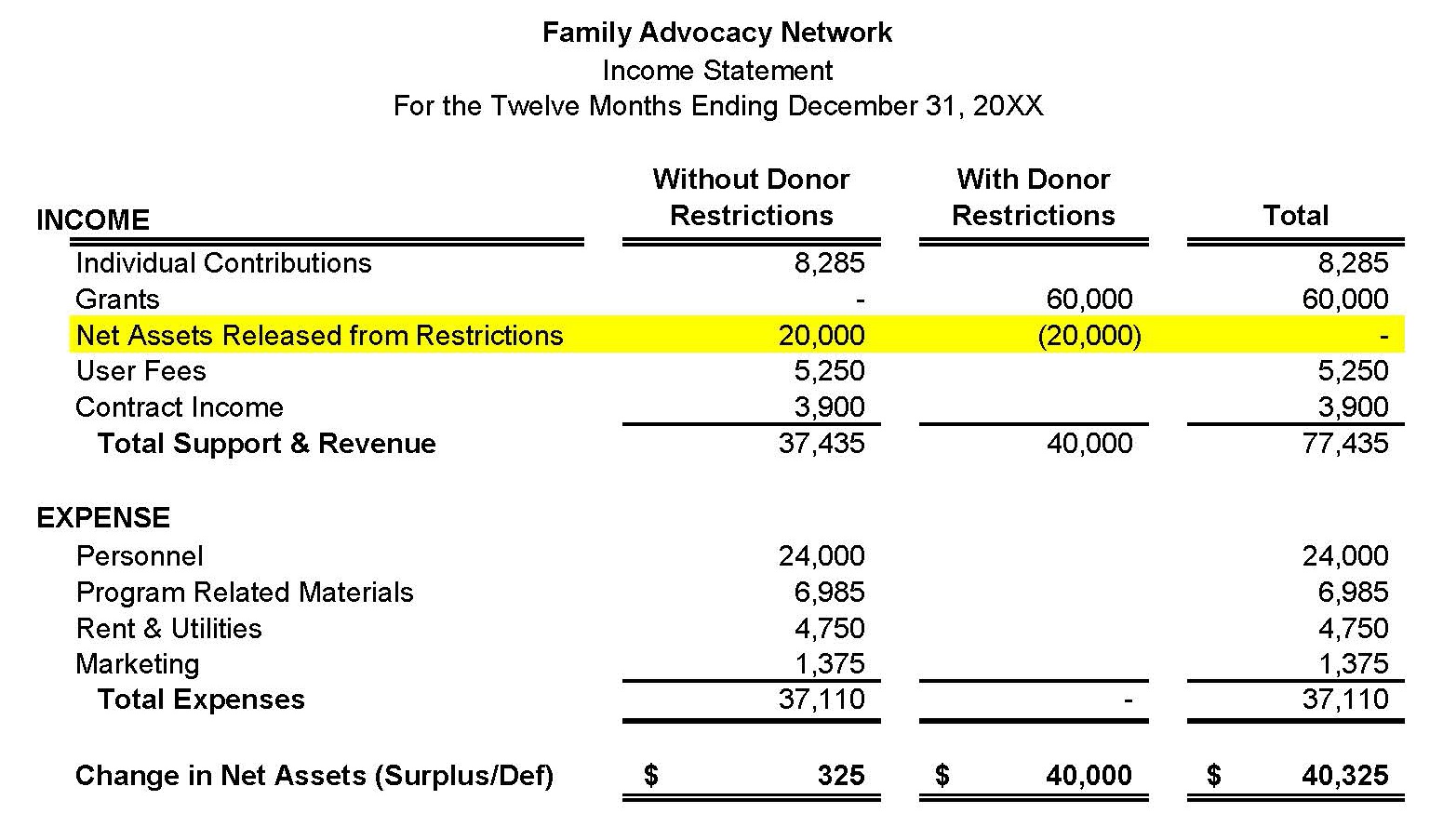

Understanding Cash on a Balance Sheet

When analyzing a balance sheet, it is important to have a clear understanding of what cash represents. Cash refers to the amount of money a company has on hand or in its bank accounts at a given point in time. It includes physical currency, such as bills and coins, as well as demand deposits and short-term investments that can be readily converted into cash.

Cash plays a critical role in a company’s operations. It enables the company to meet its day-to-day expenses, invest in growth opportunities, repay debts, and distribute dividends to shareholders. Therefore, monitoring a company’s cash position is crucial to assess its liquidity, financial stability, and ability to withstand economic downturns.

On a balance sheet, cash is typically listed as a current asset under the “Assets” section. It is usually reported at the top of the current asset section, as it is the most liquid asset. This means that it can be easily converted into cash within a short period, typically within a year.

However, it’s important to note that not all items categorized as “cash” are actual physical currency. Companies often include equivalents that have high liquidity, such as money market funds, treasury bills, and short-term investments, as part of their cash balance. These equivalents are easily convertible to cash and are highly stable, providing additional flexibility and security to companies.

While cash is an essential indicator of a company’s financial health, it should be evaluated in conjunction with other components of the balance sheet, such as receivables, payables, and inventory. Analyzing these elements provides a more comprehensive view of a company’s working capital management and overall financial position.

Now that we have a foundational understanding of what cash represents on a balance sheet, let’s explore how to evaluate and analyze the cash position of a company.

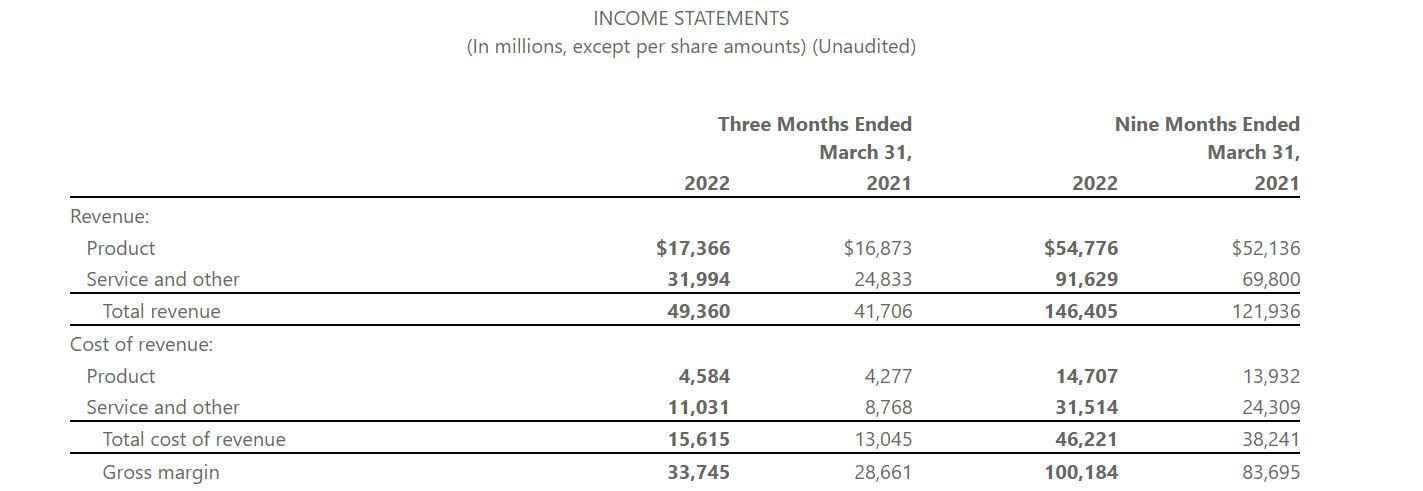

Evaluating Operating Activities

Operating activities are the core revenue-generating activities of a company. They involve the day-to-day operations and transactions necessary for running the business. When evaluating a company’s cash position, it is crucial to analyze the operating activities section of the cash flow statement, which provides insights into cash generated or used from the company’s core operations.

Positive cash flow from operating activities indicates that the company is generating cash from its primary business activities, such as sales of goods or services. This is a favorable sign, as it demonstrates the company’s ability to generate sufficient cash to support its operations and meet its financial obligations.

Conversely, negative cash flow from operating activities could indicate that the company is facing challenges in generating enough cash to sustain its operations. This could be a cause for concern, as it suggests that the company may be relying on external sources of funding or experiencing cash outflows that outweigh its inflows from core operations.

To evaluate the cash flow from operating activities, investors can focus on key components such as:

- Net Income: This represents the company’s profit after deducting all expenses and taxes. Positive net income indicates that the company is generating a profit, but it does not necessarily mean it has sufficient cash flow. It is essential to assess the quality of earnings and how they translate into cash flow.

- Depreciation and Amortization: These non-cash expenses represent the gradual decrease in the value of assets over time. While they do not impact cash directly, they affect the company’s profitability and can have an indirect impact on cash flow.

- Changes in Working Capital: Working capital is the difference between current assets (such as cash, inventory, and accounts receivable) and current liabilities (such as accounts payable and accrued expenses). Changes in working capital can have a significant impact on cash flow. Positive changes indicate an increase in current assets or a decrease in current liabilities, contributing to cash inflows. Conversely, negative changes indicate a decrease in current assets or an increase in current liabilities, leading to cash outflows.

- Non-cash Expenses and Gains: Analyzing non-cash expenses, such as non-cash stock-based compensation or unrealized gains on investments, can provide insights into the company’s cash position. While these expenses do not involve actual cash outflows, they need to be considered to get a comprehensive understanding of the company’s cash flow.

Evaluating the operating activities section can provide valuable information about a company’s ability to generate cash from its core operations. It is essential to look beyond just the net income figure and consider factors that can impact cash flow, such as changes in working capital and non-cash expenses. By analyzing these components, investors can gain insights into a company’s cash-generating capabilities and its ability to sustain its operations over the long term.

Analyzing Investing Activities

Investing activities on a company’s cash flow statement provide insights into the cash inflows and outflows related to investments in long-term assets or securities. These activities involve the acquisition or disposal of fixed assets, investments in other companies, or the purchase/sale of marketable securities.

When analyzing the investing activities section, investors should pay attention to the following key components:

- Purchases and Sales of Property, Plant, and Equipment (PP&E): This includes cash flows related to the purchase or sale of physical assets, such as buildings, machinery, or vehicles. Positive cash flow from the sale of PP&E can indicate the company’s ability to generate returns from its investments.

- Investments in Other Companies: Cash flows from investments in other companies, such as the acquisition of equity securities, can impact a company’s cash position. Positive cash flow from investments may demonstrate that the company is strategically expanding its business or diversifying its revenue streams.

- Purchases and Sales of Marketable Securities: Companies often invest excess cash in marketable securities, such as stocks, bonds, or mutual funds. Cash flows related to the purchase or sale of these securities should be considered when analyzing the company’s cash position. Positive cash flow from the sale of marketable securities may indicate that the company is optimizing its investment portfolio.

Analyzing the investing activities section is important to understand how a company is allocating its capital and whether it is making wise investment decisions. Positive cash flow from investing activities may suggest that the company is investing in growth opportunities or divesting underperforming assets, potentially leading to future cash inflows. On the other hand, negative cash flow from investing activities may indicate heavy capital expenditures or unsuccessful investments, which could put pressure on the company’s cash position.

It is essential to examine the investing activities section in conjunction with other sections of the cash flow statement, such as operating activities and financing activities. This holistic analysis can provide a more comprehensive view of the company’s overall cash flow and help investors assess the company’s investment strategy and potential for future cash generation.

Examining Financing Activities

In addition to operating and investing activities, analyzing the financing activities section of a company’s cash flow statement is crucial for understanding its cash position. Financing activities include cash inflows and outflows related to the company’s capital structure and financing sources.

When examining the financing activities section, investors should focus on the following key components:

- Issuance and Repayment of Debt: Cash flows from the issuance or repayment of debt instruments, such as loans or bonds, can impact a company’s cash position. Positive cash flow from debt issuance may indicate the company’s ability to raise funds to support its operations or growth initiatives. Conversely, cash outflows from debt repayment may reduce the company’s cash reserves.

- Equity Financing: Cash flows from equity financing activities, such as the issuance or repurchase of company stock, are essential to monitor. Positive cash flow from equity issuance may suggest that the company is attracting new investors or has a positive outlook. Cash outflows from stock repurchases may indicate that the company is returning capital to shareholders or believes its stock is undervalued.

- Dividends and Distributions: Cash flow from dividends or distributions to shareholders is an important aspect of financing activities. Positive cash flow from dividends may indicate that the company is rewarding shareholders with a portion of its profits. Investors should consider the sustainability of dividend payments and their impact on the company’s cash reserves.

Understanding the financing activities section is crucial, as it provides insights into how a company is funding its operations and growth, as well as how it manages its capital structure. Positive cash flow from financing activities may suggest that the company has access to external funding sources or has successfully attracted investors. Conversely, negative cash flow from financing activities may indicate that the company is paying off debts or reducing its equity base to strengthen its financial position.

It is important to evaluate the financing activities section in conjunction with the other sections of the cash flow statement. By examining operating activities and investing activities alongside financing activities, investors can gain a comprehensive understanding of a company’s overall cash flow and its financial health. This analysis helps determine whether a company has a sustainable and well-balanced capital structure or if it is relying too heavily on external financing, which could impact its long-term viability.

Assessing Non-operating and Non-cash Items

While evaluating a company’s cash position on the balance sheet, it is essential to consider non-operating and non-cash items that can significantly impact the cash flow. These items do not directly involve the core business operations but can play an important role in understanding a company’s overall financial health and cash management.

Non-operating items refer to transactions that are outside the company’s regular business activities. They can include one-time gains or losses, such as the sale of assets not directly related to the business or the settlement of legal disputes. These items should be carefully assessed as they might have an impact on cash flow, either positive or negative, but do not reflect the company’s ongoing operating performance.

Non-cash items, on the other hand, are transactions that do not involve a cash inflow or outflow but can still affect the company’s financial statements. One common example is depreciation, which represents the gradual decrease in the value of assets over time. While depreciation does not directly impact cash flow, it reduces the company’s reported earnings and taxable income, potentially providing additional cash flow through reduced tax payments.

By analyzing non-operating and non-cash items, investors can gain a more accurate understanding of a company’s underlying cash generation and its ability to sustain its operations. It is important to scrutinize these items and evaluate their impact on the cash flow statement, as they can provide valuable insights into the company’s financial stability and profitability.

When assessing non-operating and non-cash items, consider the following:

- One-time Gains or Losses: Evaluate the nature of these gains or losses and their impact on the company’s cash position. Determine if they are likely to be recurring or if they are exceptional events that may not have a long-term impact.

- Depreciation and Amortization: While these are non-cash expenses, they can indirectly impact cash flow. Consider their magnitude and how they affect the company’s profitability and ability to generate cash.

- Provisions and Write-offs: Assess any provisions, such as for bad debts or warranty claims, and any write-offs of assets. These items can have an impact on cash flow and should be carefully evaluated to understand their implications.

By carefully analyzing non-operating and non-cash items, investors can gain a more comprehensive understanding of a company’s cash position, financial performance, and the underlying drivers of its cash flow. It allows for a more accurate assessment of the company’s true cash-generating capabilities and its ability to weather economic fluctuations.

Utilizing Financial Ratios to Find Cash

In addition to analyzing the specific sections of a company’s balance sheet and cash flow statement, financial ratios can be a helpful tool for assessing a company’s cash position and understanding its financial health. Financial ratios provide valuable insights by comparing different financial variables and indicating the company’s liquidity, solvency, and cash-generating capabilities.

Here are some key ratios that can be utilized to evaluate a company’s cash position:

- Current Ratio: This ratio compares the company’s current assets to its current liabilities. A higher current ratio indicates that the company has sufficient assets to cover its short-term obligations, including the availability of cash or cash equivalents. A current ratio above 1 suggests a healthy cash position.

- Quick Ratio: Also known as the acid-test ratio, this ratio measures the company’s ability to cover its short-term liabilities with its most liquid assets, which typically include cash, cash equivalents, and accounts receivable. A higher quick ratio indicates a stronger cash position and short-term liquidity.

- Cash Ratio: This ratio specifically focuses on the company’s cash and cash equivalents in relation to its current liabilities. It measures the company’s ability to pay off its short-term obligations using only its available cash. A higher cash ratio indicates a stronger cash position and the ability to meet short-term obligations.

- Cash Flow to Debt Ratio: This ratio assesses the company’s ability to generate sufficient cash flow to cover its outstanding debt. It compares the operating cash flow to the total debt obligations. A higher cash flow to debt ratio suggests a healthier cash position and better capacity to service its debt.

- Operating Cash Flow Ratio: This ratio compares the company’s operating cash flow to its net sales. It helps assess the proportion of sales that is converted into cash. A higher operating cash flow ratio indicates a stronger cash position and efficient cash generation from operations.

It’s important to note that financial ratios should be used in conjunction with other financial information and analysis. They provide a snapshot of a company’s cash position and financial health at a specific point in time, but they do not capture the full picture. Factors such as industry norms, market conditions, and future growth prospects should also be considered.

By utilizing financial ratios as part of the analysis, investors can gain valuable insights into a company’s cash position and overall financial health. It helps identify companies with robust cash generation capabilities and aids in making informed investment decisions.

Conclusion

Understanding the cash position of a company is crucial for investors, stakeholders, and anyone interested in assessing its financial health. By analyzing the balance sheet, cash flow statement, and utilizing financial ratios, one can gain valuable insights into a company’s cash generation, liquidity, and financial stability.

Throughout this article, we explored the various components of a balance sheet that contribute to cash on hand. We discussed operating activities and how to evaluate the cash generated from core business operations. We examined investing activities and their impact on the company’s cash flow, considering acquisitions, asset disposals, and investments in other companies. We also examined financing activities, which provide insight into the company’s capital structure and sources of funding.

In addition, we explored the significance of non-operating and non-cash items, such as one-time gains or losses and depreciation, in assessing a company’s cash position. These items, though not directly related to core business operations or involving actual cash inflows or outflows, can influence the overall financial health of the company.

Lastly, we highlighted the importance of utilizing financial ratios to evaluate a company’s cash position. Financial ratios provide a quantitative measure of liquidity, solvency, and cash-generating capabilities. They assist in understanding the company’s ability to meet its short-term obligations, generate cash from operations, and cover its debt obligations.

By carefully analyzing these factors, investors can gain a comprehensive understanding of a company’s cash position and make informed decisions about investing or partnering with the company. It is crucial to assess the various components of the balance sheet in conjunction with each other to obtain a holistic view of the company’s financial health.

Remember, while the balance sheet provides a snapshot of a company’s financial position at a specific point in time, analyzing cash-related components is an ongoing process. It requires monitoring changes in the company’s financial statements, considering industry trends, and assessing the company’s long-term growth prospects.

In conclusion, a thorough analysis of a company’s balance sheet, cash flow statement, and financial ratios allows for a comprehensive assessment of its cash position. This knowledge empowers investors and stakeholders to make informed decisions, evaluate financial stability, and identify potential investment opportunities.