Finance

How To Calculate The Market Risk Premium

Modified: December 30, 2023

Learn how to calculate the market risk premium in finance and make informed investment decisions. Discover the key factors influencing this crucial financial metric.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is the Market Risk Premium?

- Importance of Calculating the Market Risk Premium

- Components of the Market Risk Premium

- Sources of Market Risk Premium Data

- Approaches to Calculating the Market Risk Premium

- Method 1: Historical Market Risk Premium Calculation

- Method 2: Equity Risk Premium Model

- Method 3: Survey-Based Approach

- Method 4: Country Risk Premium

- Challenges and Limitations in Calculating the Market Risk Premium

- Conclusion

Introduction

When investing in the financial markets, understanding and managing risk is crucial for success. One key aspect of risk assessment is evaluating the market risk premium. The market risk premium is the additional return that investors expect to receive for taking on the risk associated with investing in the overall market compared to risk-free investments.

As an investor, calculating the market risk premium helps you make informed decisions about portfolio allocations and pricing of securities. It provides valuable insights into the expected returns of different asset classes and enables you to evaluate the attractiveness of potential investments.

In this article, we will delve into the concept of the market risk premium and explore different approaches to calculate it. We will also discuss the importance of understanding this premium and the challenges involved in its calculation.

Understanding the market risk premium requires a grasp of several key concepts, including risk-free rates, expected returns, and systematic risk. It also involves familiarity with different data sources and methodologies. By the end of this article, you will have a solid foundation for evaluating the market risk premium and applying it to your investment decision-making.

Before we dive into the details, it is important to note that calculating the market risk premium is not an exact science. Different approaches and data sources can yield varying results. Therefore, the methods outlined in this article are meant to serve as general guidelines, and it is essential to exercise judgment and consider multiple perspectives when using the market risk premium in financial analysis.

What is the Market Risk Premium?

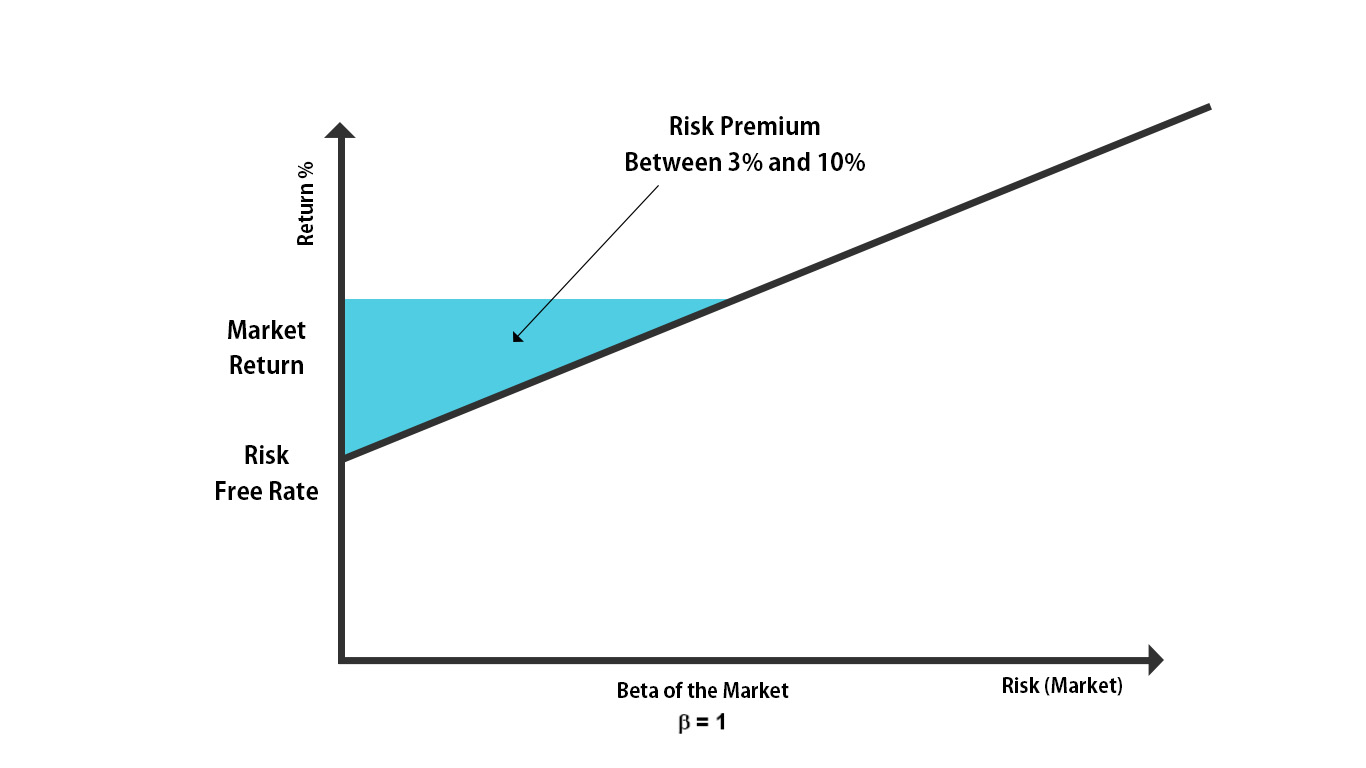

The market risk premium, also known as the equity risk premium, is a concept in finance that represents the additional return investors expect to receive for taking on the risk associated with investing in the overall market compared to risk-free investments. It is a crucial component of modern portfolio theory and helps investors evaluate the expected return of various assets.

The market risk premium is derived from the idea that investing in the stock market involves a level of uncertainty and volatility. While risk-free investments, such as government bonds or treasury bills, offer a guaranteed return, they usually have lower yields. In contrast, equity investments have the potential for higher returns but come with a higher level of risk. The market risk premium quantifies this additional return investors demand for bearing the extra risk.

Mathematically, the market risk premium is calculated as the difference between the expected return of the market and the risk-free rate of return. It represents the compensation investors require for taking on the systematic risk associated with the overall market, beyond what can be obtained by investing in safe assets.

Conceptually, the market risk premium can also be seen as the premium for investing in a diversified portfolio of risky assets. It captures the expectation of a higher return for accepting the volatility and potential losses that come with investing in the market.

The market risk premium is expressed as a percentage or basis points above the risk-free rate. For example, if the risk-free rate is 3% and the expected return on the market is 8%, the market risk premium would be 5%.

It is important to note that the market risk premium is a dynamic concept that can vary over time and across different markets. Economic conditions, geopolitical events, and investor sentiment all influence the perceived level of risk and, consequently, the market risk premium.

Understanding the market risk premium is essential for investors as it provides insights into the potential returns of different asset classes and helps in assessing the risk-reward tradeoff. It enables investors to determine whether the potential returns of an investment are adequate relative to the risk being taken. By incorporating the market risk premium into their analysis, investors can make more informed decisions about portfolio allocations and pricing of securities.

Importance of Calculating the Market Risk Premium

Calculating the market risk premium is of utmost importance in the field of finance and investment. It provides valuable insights and serves several key purposes for investors, portfolio managers, and financial analysts. Let’s explore why calculating the market risk premium is so crucial:

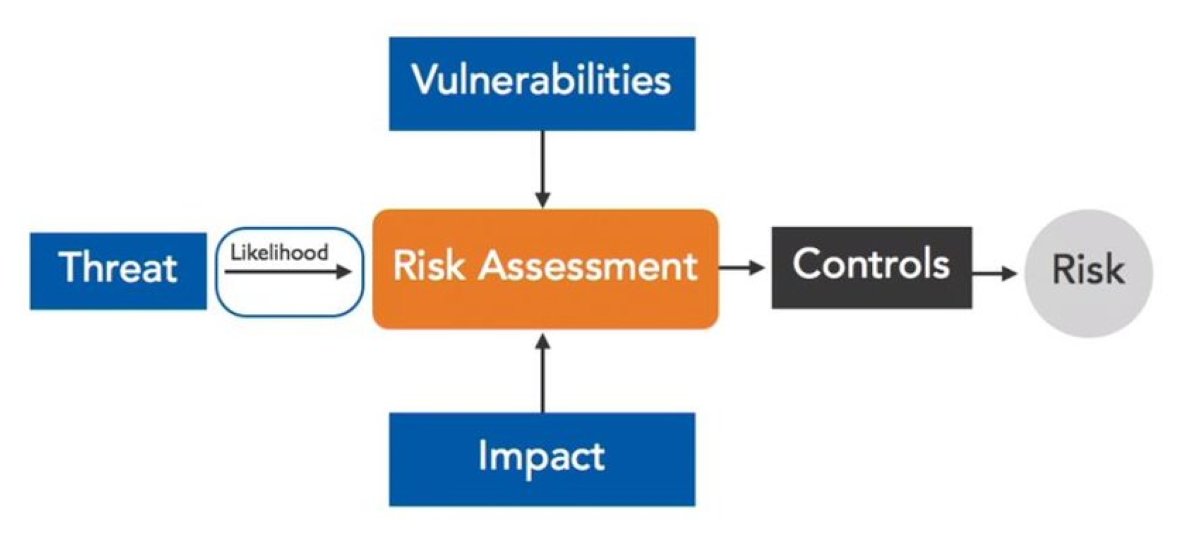

1. Risk Assessment: The market risk premium helps investors assess and quantify the level of risk associated with investing in the overall market. By understanding the premium required for bearing this risk, investors can make informed decisions about the potential returns and volatility of their investments.

2. Asset Pricing: The market risk premium plays a vital role in pricing different financial assets. It serves as a benchmark for determining the expected returns investors demand for investing in specific securities. Asset pricing models, such as the Capital Asset Pricing Model (CAPM), incorporate the market risk premium to calculate the appropriate cost of equity for a company.

3. Portfolio Allocation: Calculating the market risk premium allows investors to assess the relative attractiveness of different asset classes. By comparing the expected returns of various investments with the associated level of risk, investors can make informed decisions about portfolio allocations. They can adjust their investment mix to include assets that offer a suitable risk-reward tradeoff based on the market risk premium.

4. Risk-Adjusted Return: The market risk premium enables investors to evaluate the risk-adjusted return of their investments. By subtracting the risk-free rate from the expected return of a security or portfolio, investors can determine whether the returns compensate them adequately for the risk taken. The risk-adjusted return allows for a more accurate assessment of investment performance.

5. Capital Allocation Decisions: Calculating the market risk premium is essential for making capital allocation decisions within a company. It assists management in determining the required rate of return for evaluating potential projects or acquisitions. By considering the market risk premium, companies can ensure they are earning a sufficient return on their investments to compensate for the level of risk involved.

6. Investor Expectations: The market risk premium provides investors with a gauge for setting realistic expectations about investment returns. It helps manage expectations by providing a reasonable estimate of the potential gains and losses associated with investing in the market over a given time period.

Overall, calculating the market risk premium allows investors and financial professionals to make more informed decisions, adjust portfolio allocations based on risk-reward tradeoffs, and evaluate the performance of investments in a more meaningful way. By incorporating the market risk premium into their analysis, individuals and organizations can better manage risk and maximize returns in the financial markets.

Components of the Market Risk Premium

The market risk premium consists of several components that contribute to its calculation. Understanding these components is key to comprehending how the market risk premium is derived. Let’s explore the main factors that make up the market risk premium:

1. Risk-Free Rate: The risk-free rate is a foundational component of the market risk premium. It represents the hypothetical rate of return an investor would receive from a risk-free investment, typically a government bond or treasury bill. The risk-free rate serves as a benchmark for comparing the returns of other investments and is subtracted from the expected market return to calculate the market risk premium.

2. Expected Market Return: The expected market return, also known as the market rate of return, is the anticipated average return of the overall stock market over a specific time period. It is influenced by factors such as economic conditions, corporate earnings, and investor sentiment. The expected market return serves as the numerator in the market risk premium calculation and provides a measure of the potential returns investors can expect from the market.

3. Systematic Risk: Systematic risk, also referred to as non-diversifiable risk or market risk, represents the risk inherent in the overall market that cannot be eliminated through diversification. It is the component of risk that cannot be diversified away by investing in a portfolio of assets. The market risk premium compensates investors for bearing this systematic risk as they hold diversified portfolios.

4. Beta Coefficient: The beta coefficient measures the sensitivity of a specific security or portfolio to changes in the overall market. A beta of 1 indicates that the security or portfolio moves in tandem with the market, while a beta less than 1 signifies less volatility than the market, and a beta greater than 1 implies greater volatility. The beta coefficient is used in the calculation of the market risk premium through risk-adjusted return models, such as the Capital Asset Pricing Model (CAPM).

5. Investor Risk Appetite: The market risk premium also considers investor risk appetite or risk aversion. This component reflects the willingness of investors to take on additional risk for the potential of higher returns. In periods of economic uncertainty or heightened market volatility, investors may demand a higher market risk premium to compensate them for the perceived increase in risk.

By understanding the components of the market risk premium, investors can gain insights into the factors that impact the premium’s magnitude. Changes in the risk-free rate, expected market return, systematic risk, beta coefficients, and investor risk appetite can all influence the calculation of the market risk premium and, consequently, investment decisions.

Sources of Market Risk Premium Data

Obtaining accurate and reliable market risk premium data is essential for calculating the premium and making informed investment decisions. There are several sources from which market risk premium data can be obtained. Let’s explore some of the common sources:

1. Historical Data: Historical market data is a valuable source for estimating the market risk premium. Historical returns of the stock market can be analyzed to calculate the average annual return over a specific time period. This data can then be compared to the risk-free rate to derive the market risk premium. Historical data provides insights into long-term trends and can be useful for understanding the historical risk and return relationship.

2. Financial Databases: Financial databases such as Bloomberg, Thomson Reuters, and FactSet are widely used by financial professionals to access market data, including market risk premium information. These databases provide comprehensive market data, including historical returns, risk-free rates, and other relevant financial metrics. They offer a convenient and reliable source for obtaining market risk premium data for different asset classes and geographic regions.

3. Research Reports: Research reports from reputable financial institutions and investment banks often include market risk premium data as part of their analysis. These reports provide insights into market trends, expected returns, and risk assessments. They can be a valuable resource for accessing market risk premium data that has been researched and compiled by financial experts.

4. Academic Studies: Academic research and studies in the field of finance often provide valuable insights into market risk premium data. Scholars and researchers conduct empirical studies using historical market data to estimate the market risk premium. These studies contribute to the body of knowledge and can provide useful information for calculating the market risk premium.

5. Professional Associations and Publications: Professional associations and financial publications may publish market risk premium data. Organizations like the CFA Institute, the International Valuation Standards Council (IVSC), and financial magazines often release research papers, publications, and surveys that include market risk premium data. These sources can offer industry-specific perspectives and up-to-date information on the market risk premium.

6. Market Surveys: Some organizations conduct surveys among market participants, such as investors, analysts, and portfolio managers, to gather data on market risk premium expectations. These surveys collect subjective assessments of the market risk premium and provide valuable insights into the sentiment and expectations of market participants. This type of data can be helpful for understanding market dynamics and investor perceptions.

It is important to note that different sources may provide varying estimates of the market risk premium. Factors such as methodology, time period, and sample size can influence the data. Therefore, it is advisable to consider multiple sources and approaches when calculating the market risk premium to gain a more comprehensive understanding and mitigate potential biases.

Approaches to Calculating the Market Risk Premium

Calculating the market risk premium involves various approaches and methodologies. These approaches aim to estimate the additional return investors require for bearing the risk associated with investing in the overall market compared to risk-free investments. Let’s explore some common methods used to calculate the market risk premium:

1. Historical Market Risk Premium Calculation: One approach to calculating the market risk premium is to use historical data. This method involves analyzing historical returns of the stock market over a specific time period and comparing them to the risk-free rate. By subtracting the risk-free rate from the historical market return, an average historical market risk premium can be estimated. However, it is important to consider the limitations of using historical data, as past performance may not necessarily reflect future expectations.

2. Equity Risk Premium Model: The equity risk premium model is based on the Capital Asset Pricing Model (CAPM) and is widely used to calculate the market risk premium. This model incorporates the risk-free rate, beta coefficient, and expected market return to determine the market risk premium. The beta coefficient measures the sensitivity of a security or portfolio to changes in the overall market. By multiplying the beta by the difference between the expected market return and the risk-free rate, the equity risk premium can be calculated.

3. Survey-Based Approach: Another approach to estimating the market risk premium is through surveys of market participants. Surveys collect subjective assessments and expectations of investors, analysts, and portfolio managers regarding the market risk premium. This approach provides insights into investor sentiments and expectations, but it is important to be cautious of potential biases and limitations associated with subjective data.

4. Country Risk Premium: The market risk premium can also be estimated on a country-specific basis. This approach takes into account the specific risks and characteristics of a particular country’s stock market. Factors such as political stability, economic conditions, and regulatory environment can influence the country risk premium. By subtracting the risk-free rate of the country from its expected market return, the country risk premium can be determined.

It is worth noting that calculating the market risk premium can be complex, and different approaches may yield different results. The choice of the calculation method depends on factors such as the availability and reliability of data, the purpose of the analysis, and the preferences of the analyst or investor. It is important to carefully consider the underlying assumptions and limitations of each approach and exercise judgment when interpreting the results.

Ultimately, the calculated market risk premium is a useful tool for understanding the compensation investors demand for taking on the risk associated with the overall market. It serves as a critical input in various financial models, investment analysis, and decision-making processes.

Method 1: Historical Market Risk Premium Calculation

One approach to calculating the market risk premium is by using historical data. This method involves analyzing the historical returns of the stock market over a specific time period and comparing them to the risk-free rate. By subtracting the risk-free rate from the historical market return, an average historical market risk premium can be estimated.

To calculate the historical market risk premium, follow these steps:

- Gather historical data: Collect historical returns of the stock market, usually represented by a market index such as the S&P 500 or the FTSE 100, over a specified period. Make sure to also obtain the corresponding risk-free rate for the same period. The risk-free rate is typically represented by the yield on government bonds or treasury bills.

- Calculate the average market return: Calculate the average annual return of the stock market over the chosen time frame. Add up the annual returns and divide by the number of years considered. This will give you the average historical market return.

- Subtract the risk-free rate: Subtract the risk-free rate from the average market return. The risk-free rate represents the return investors can expect from a risk-free investment such as government bonds or treasury bills. The difference between the average market return and the risk-free rate gives you the historical market risk premium.

It is important to note that historical market data should cover a significant period to capture different market cycles and account for the volatility inherent in the stock market. Additionally, using a diverse set of market data from multiple sources can help ensure the accuracy and reliability of the calculation.

When applying this method, it is essential to recognize the limitations associated with using historical data. Historical returns may not accurately reflect future expectations, as market conditions and investor sentiment can change over time. It is wise to consider additional factors and approaches for a comprehensive analysis of the market risk premium.

The historical market risk premium calculation provides a starting point and baseline for understanding the compensation investors have historically demanded for bearing the risk associated with the overall market. It serves as a useful reference but should be utilized in conjunction with other methods and approaches to gain a more robust and reliable estimation of the market risk premium.

Method 2: Equity Risk Premium Model

The equity risk premium model is a widely used approach to calculate the market risk premium. It is based on the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, beta coefficient, and expected market return to determine the market risk premium.

The steps involved in using the equity risk premium model are as follows:

- Obtain the risk-free rate: Start by identifying the current risk-free rate. Typically, this is the yield on government bonds or treasury bills, which are considered to have no default risk.

- Determine the expected market return: Evaluate the expected return of the overall market. This can be derived from various sources, such as historical market performance, financial forecasts, or market surveys. The expected market return represents the average return investors anticipate from the market over a specific time period.

- Calculate the beta coefficient: The beta coefficient measures the sensitivity of a specific security or portfolio to changes in the overall market. It captures the systematic risk associated with the asset. A beta of 1 indicates that the asset moves in line with the market, while a beta less than 1 suggests lower volatility, and a beta greater than 1 implies higher volatility. Beta coefficients can be obtained from financial databases or calculated using regression analysis.

- Apply the equity risk premium model: Multiply the beta coefficient by the difference between the expected market return and the risk-free rate. The result is the equity risk premium, which represents the additional return investors require for holding a particular asset or portfolio compared to risk-free investments.

The equity risk premium model assumes that investors demand a higher return for accepting the additional risk associated with investing in the market. The model incorporates the concept of systematic risk, which cannot be eliminated through diversification, and provides a quantitative estimate of the market risk premium.

It is important to note that the equity risk premium model has its limitations. It relies on various assumptions, such as the efficiency and stability of the market and the accuracy of the beta coefficient. Additionally, the model’s results may vary depending on the specific inputs used, such as the risk-free rate and the expected market return. It is advisable to consider multiple sources and approaches when calculating the market risk premium to ensure a more comprehensive and reliable estimation.

The equity risk premium model is a valuable tool for investors and financial analysts to assess the additional return required for investing in the overall market. It can aid in decision-making processes such as pricing financial assets and determining the appropriate risk-adjusted return on investments.

Method 3: Survey-Based Approach

The survey-based approach is another method used to estimate the market risk premium. This approach involves collecting subjective assessments and expectations of market participants, such as investors, analysts, and portfolio managers, regarding the market risk premium. Surveys can provide valuable insights into investor sentiment and expectations, which are then used to gauge the market risk premium.

The steps involved in utilizing the survey-based approach are as follows:

- Design and conduct surveys: Develop a survey questionnaire that includes questions about the participants’ views on the future returns of the overall market and their risk perceptions. The survey can be administered through online platforms, professional networks, or specialized survey companies. It is crucial to target a diverse group of market participants to capture a broad range of perspectives.

- Collect and analyze survey data: Collect the responses and analyze the data to extract insights. Calculate the average or median responses for each question related to the market risk premium. Pay attention to potential biases and outliers in the data. Consider the sample size and the representativeness of the survey participants to ensure the reliability and validity of the data.

- Estimate the market risk premium: Based on the survey responses, estimate the market risk premium by subtracting the risk-free rate from the average or median expected market return provided by the participants. This estimation represents the market participants’ collective view on the additional return required for bearing the risk associated with investing in the overall market.

The survey-based approach offers insights into investor sentiment and expectations, which can be valuable inputs for estimating the market risk premium. However, it is essential to recognize that survey-based data is subjective and may be influenced by various factors such as biases, opinions, and changing market conditions. It is advisable to use data from multiple surveys and cross-validate the results with other methodologies to ensure a robust estimation.

This approach is particularly useful when historical data may not accurately reflect current market conditions or when there is a lack of reliable financial data. It allows market participants to directly express their views on the market risk premium and incorporates their perception of risk and expected returns.

While the survey-based approach provides a valuable perspective, it is important to interpret the results with caution and consider other factors such as economic conditions, market dynamics, and other calculation methodologies. Using a combination of different approaches can lead to a more comprehensive understanding of the market risk premium.

Method 4: Country Risk Premium

In addition to calculating the overall market risk premium, analysts may also consider estimating the country risk premium. This method involves determining the additional return that investors demand for investing in a specific country’s stock market compared to risk-free investments in that country.

The country risk premium takes into account the specific risks associated with investing in a particular country, such as political instability, economic factors, regulatory environment, and currency risk. Estimating the country risk premium can be helpful for investors looking to evaluate the risk-reward tradeoff of investing in a specific country.

The following steps outline the process of estimating the country risk premium:

- Identify the risk-free rate: Determine the risk-free rate specific to the country of interest. This is typically represented by the yield on government bonds or treasury bills issued by that country.

- Determine the expected market return: Evaluate the expected return of the stock market in the country. This can be estimated based on market projections, historical data, or expert opinions. The expected market return represents the average return investors anticipate from the country’s stock market over a certain period.

- Calculate the country risk premium: Subtract the risk-free rate from the expected market return. This difference represents the country risk premium that investors demand for investing in the country’s stock market specifically. It quantifies the additional return required to compensate for the risks associated with investing in that country.

It is important to note that country risk premiums can vary significantly depending on the country and prevailing market conditions. Countries with political instability, economic uncertainty, or weak regulatory frameworks tend to have higher country risk premiums. Conversely, countries with stable political systems, strong economies, and investor-friendly policies generally have lower country risk premiums.

Estimating the country risk premium requires a careful assessment of the specific risks associated with investing in a particular country. Accurate and up-to-date information on economic indicators, political developments, and regulatory changes is necessary to make informed calculations.

By incorporating the country risk premium, investors can evaluate the attractiveness of investing in specific countries and adjust their portfolio allocations accordingly. It helps them weigh the potential returns against the perceived risks associated with investing in a particular country’s stock market.

However, it is important to consider that estimating the country risk premium involves some degree of subjectivity and uncertainty. The results may be influenced by individual perspectives, biases, and changing market conditions. It is advisable to use multiple sources of information and cross-validate the estimations when assessing the country risk premium.

Challenges and Limitations in Calculating the Market Risk Premium

While calculating the market risk premium provides valuable insights for investors, it is important to recognize the challenges and limitations associated with this process. Here are some of the key challenges and limitations in calculating the market risk premium:

1. Data Reliability and Availability: Obtaining reliable and accurate data for calculating the market risk premium can be a challenge. Historical market data, risk-free rates, and other relevant financial metrics may differ depending on the data source, leading to potential discrepancies in the calculated premium. Moreover, obtaining comprehensive and long-term data for different asset classes and geographic regions may not always be readily available.

2. Assumptions and Models: Different methodologies and models used to calculate the market risk premium rely on various assumptions and simplifications. For example, the equity risk premium model assumes a linear relationship between risk and return, and the Capital Asset Pricing Model (CAPM) assumes that investors are rational and markets are efficient. These assumptions may not hold true in real-world scenarios, which can impact the accuracy and reliability of the calculated market risk premium.

3. Subjectivity and Bias: Market risk premium calculations can be influenced by subjective factors such as investor sentiment, opinions, and biases. Surveys and subjective assessments may vary among market participants, leading to different estimations of the premium. Additionally, the perceived level of risk and the market risk premium can be subject to confirmation bias or overconfidence, potentially impacting decision-making processes.

4. Changing Market Conditions: Market conditions are dynamic and ever-changing, which makes estimating the market risk premium challenging. Economic factors, geopolitical events, and shifts in investor sentiment can significantly impact the expected returns and risk perceptions. The market risk premium derived from historical data may not accurately reflect current and future market expectations, as historical trends might not necessarily repeat themselves.

5. Diversification Assumptions: Calculating the market risk premium assumes that investors hold fully diversified portfolios. However, it may not accurately reflect the risk and return characteristics of investors with different levels of diversification. The market risk premium derived from a diversified portfolio may not align with the expectations and requirements of investors with concentrated holdings or specific investment strategies.

6. Global and Country-Specific Factors: Estimating the market risk premium for different regions and countries can be challenging due to varying economic, political, and regulatory factors. Country risk premiums can be influenced by country-specific risks, such as regulatory changes, political instability, and currency fluctuations. These factors add complexity to the calculation and require a comprehensive understanding of the unique dynamics of each market.

Despite these challenges and limitations, calculating the market risk premium remains a valuable tool for investors and financial analysts. It provides a framework for understanding the compensation investors demand for bearing market risk and serves as a starting point for making informed investment decisions. It is essential to approach the calculation with awareness of these limitations and supplement it with other analytical methods and expert judgment to gain a more comprehensive view.

Conclusion

The market risk premium is a fundamental concept in finance, representing the additional return investors demand for taking on the risk associated with investing in the overall market compared to risk-free investments. Calculating the market risk premium is crucial for investors, portfolio managers, and financial analysts, as it provides valuable insights into expected returns, risk assessment, and the pricing of securities.

There are various approaches to calculating the market risk premium, including historical analysis, equity risk premium models, survey-based approaches, and country-specific risk premiums. Each method has its strengths and limitations, and it is prudent to consider multiple perspectives and approaches to ensure a more comprehensive understanding of the market risk premium.

It is important to acknowledge the challenges and limitations in calculating the market risk premium, such as data availability, subjectivity, changing market conditions, model assumptions, and country-specific factors. These factors may introduce uncertainty and impact the accuracy of the calculations. Therefore, it is recommended to exercise caution, use reliable data sources, and critically evaluate the results when calculating and interpreting the market risk premium.

Despite these challenges, the market risk premium remains a vital tool for investors and financial professionals. It assists in assessing the risk-reward tradeoff of investments, making informed portfolio allocation decisions, and pricing financial assets. By incorporating the market risk premium into investment analysis and decision-making processes, individuals and organizations can better manage risk and optimize returns.

As the financial markets continue to evolve, it is crucial to stay updated with the latest market trends, economic indicators, and risk factors. Regularly re-evaluating and recalculating the market risk premium will ensure that investment strategies align with current market conditions.

In conclusion, understanding and calculating the market risk premium is essential for navigating the complexities of the financial markets and making informed investment decisions. While it may involve challenges and limitations, incorporating the market risk premium into financial analysis allows investors to evaluate risk, assess returns, and optimize their investment portfolios.