Finance

How To Wave Shopify Merchant Fee

Published: February 23, 2024

Learn how to minimize Shopify merchant fees and optimize your finances with our expert finance tips. Save money and increase profits today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Shopify Merchant Fee and Ways to Reduce It

If you're a business owner utilizing Shopify as your e-commerce platform, you're likely familiar with the convenience it offers for setting up and managing your online store. However, one aspect that may cause concern is the Shopify merchant fee. Understanding this fee and discovering ways to reduce it can significantly impact your bottom line.

Shopify, like many other e-commerce platforms, charges a merchant fee for each transaction processed through its system. This fee is a percentage of the total transaction amount, often accompanied by a fixed fee. While this is a standard practice in the industry, it's essential for merchants to explore strategies to minimize this cost without compromising the quality of service provided to customers.

In this comprehensive guide, we will delve into the intricacies of the Shopify merchant fee, providing insights into how it is calculated and the various methods you can employ to reduce it. By the end of this article, you'll be equipped with the knowledge and strategies to optimize your use of Shopify while minimizing the impact of the merchant fee on your business's profitability. Let's embark on this journey to unravel the nuances of the Shopify merchant fee and discover practical ways to mitigate its financial impact.

Understanding the Shopify Merchant Fee

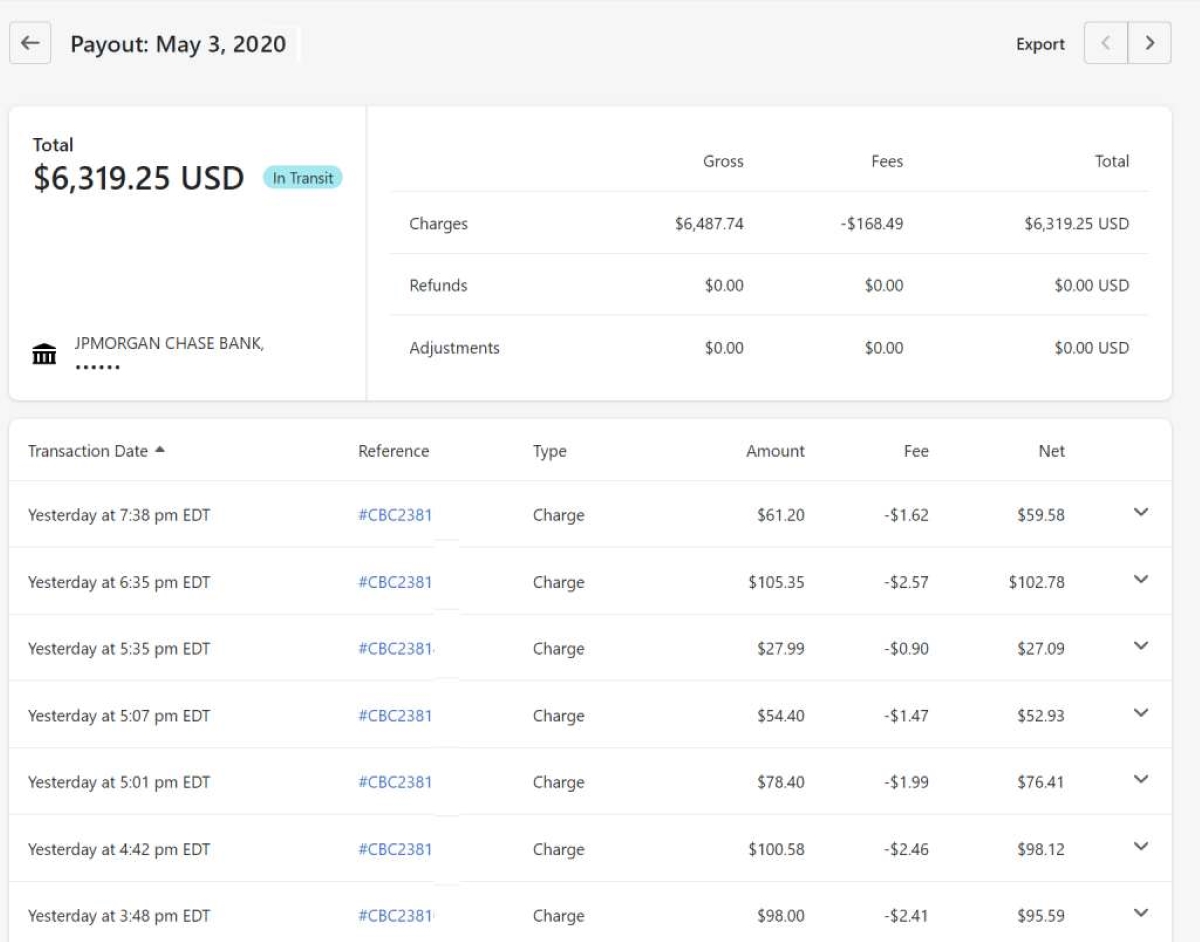

Before delving into strategies to reduce the Shopify merchant fee, it’s crucial to grasp the fundamental components and calculations involved. The Shopify merchant fee comprises a combination of a percentage fee and a fixed fee for each transaction processed through the platform.

The percentage fee, typically ranging from 2.4% to 2.9%, is calculated based on the total transaction amount. This means that for every sale made on your Shopify store, a percentage of the sale value is allocated as the merchant fee. In addition to the percentage fee, a fixed fee, usually around $0.30, is applied to each transaction, irrespective of the sale amount.

It’s important to recognize that these fees are inherent to the operation of an e-commerce business and are essential for leveraging the capabilities provided by Shopify. However, the cumulative impact of these fees on your revenue can be significant, especially for businesses with a high volume of transactions.

Furthermore, understanding the implications of the merchant fee on your profitability is vital for making informed decisions regarding pricing strategies and cost management. By comprehending the mechanics of the Shopify merchant fee, you can strategically navigate its impact and implement measures to mitigate its financial burden.

As we proceed, we will explore actionable approaches to reduce the Shopify merchant fee, empowering you to optimize your e-commerce operations while maximizing your revenue potential.

Ways to Reduce Shopify Merchant Fee

While the Shopify merchant fee is a standard component of conducting online transactions, there are several effective strategies to minimize its impact on your business’s finances. By implementing these tactics, you can optimize your revenue and enhance the profitability of your e-commerce operations.

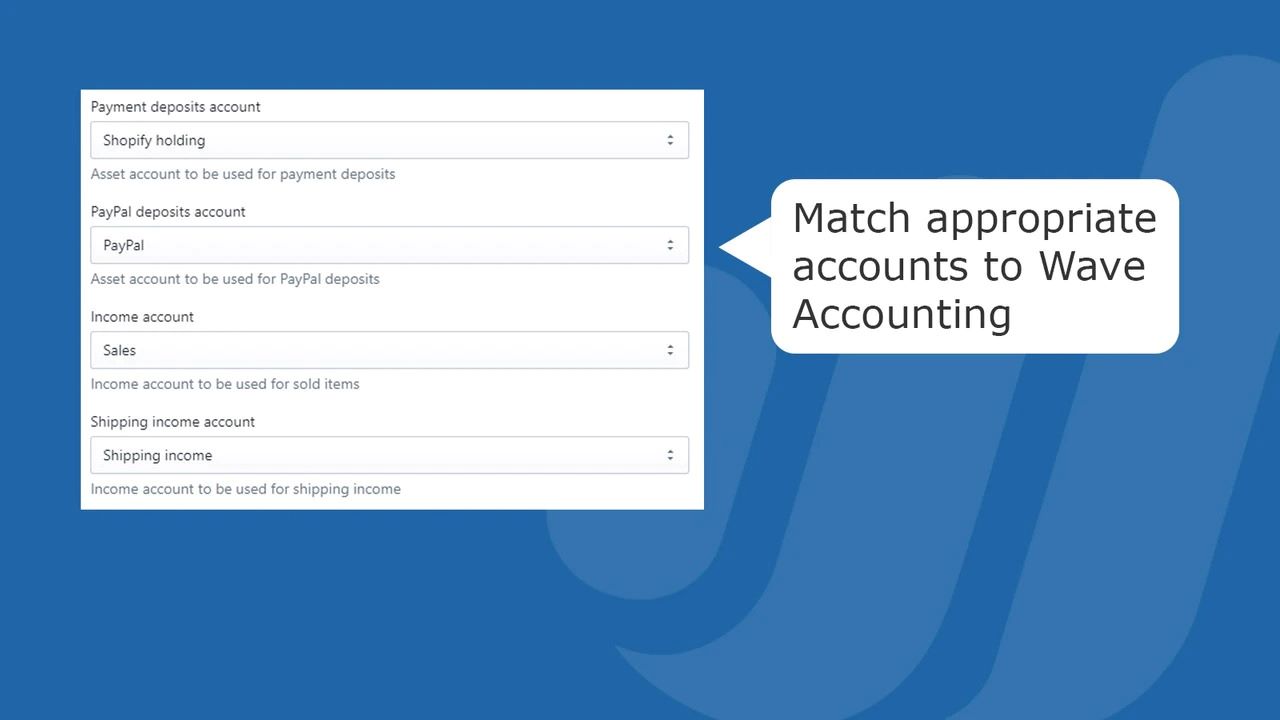

1. Optimize Payment Processing Solutions: Explore alternative payment processors and compare their fee structures with Shopify’s rates. Depending on your sales volume and average transaction value, you may discover more cost-effective solutions that align with your business needs.

2. Encourage Direct Bank Transfers: Encouraging customers to utilize direct bank transfers or ACH payments can reduce the reliance on credit card transactions, which typically incur higher processing fees. Offering incentives, such as discounts for bank transfer payments, can incentivize customers to choose this cost-efficient payment method.

3. Leverage Shopify Payments: Utilize Shopify Payments as your primary payment gateway. Shopify offers competitive rates for transactions processed through its native payment solution, potentially reducing the overall merchant fee compared to using third-party payment gateways.

4. Implement Dynamic Pricing Strategies: Incorporate dynamic pricing models that account for the impact of transaction fees on your margins. By strategically adjusting prices based on transaction methods and costs, you can offset the impact of the merchant fee without compromising your competitiveness in the market.

5. Opt for Annual Plans: Consider opting for Shopify’s annual plans, which often include reduced transaction fees compared to monthly plans. While this approach requires upfront investment, it can lead to substantial savings over time, particularly for businesses with consistent sales volume.

6. Streamline Operations to Reduce Chargebacks: Implement robust customer service and fulfillment processes to minimize the occurrence of chargebacks and disputes. By proactively addressing customer concerns and ensuring efficient order fulfillment, you can reduce the risk of incurring additional fees associated with chargebacks.

By integrating these proactive measures into your e-commerce strategy, you can effectively mitigate the impact of the Shopify merchant fee, fostering a more sustainable and lucrative online business presence.

Negotiating with Shopify

When exploring avenues to reduce the Shopify merchant fee, it’s essential to consider the possibility of negotiating directly with Shopify. While the standard fee structure is transparent and non-negotiable for most merchants, certain circumstances may warrant discussions aimed at securing more favorable terms.

Evaluating Sales Volume: If your business demonstrates a substantial sales volume or exhibits potential for significant growth, you may be in a favorable position to negotiate with Shopify. By showcasing your business’s potential and the value it brings to the platform, you can initiate constructive conversations regarding the possibility of tailored fee arrangements.

Highlighting Loyalty and Long-Term Commitment: Emphasize your commitment to Shopify as a long-term partner and the value of maintaining a mutually beneficial relationship. Expressing loyalty to the platform and your dedication to its growth can serve as compelling factors in negotiations, potentially leading to concessions in the merchant fee structure.

Seeking Customized Solutions: Engage in open dialogue with Shopify to explore the potential for customized solutions tailored to your business’s unique needs. While the standard fee structure applies to most merchants, demonstrating specific requirements or innovative approaches to collaboration can prompt Shopify to consider personalized arrangements that align with your objectives.

Utilizing Professional Advocacy: In certain cases, enlisting the support of professional negotiators or consultants with expertise in e-commerce fee negotiations can bolster your position when engaging with Shopify. These professionals can leverage their industry insights and negotiation skills to advocate for more favorable fee terms on your behalf.

It’s important to approach negotiations with Shopify diplomatically and constructively, emphasizing the mutual benefits of reaching a favorable agreement. While not all negotiations may result in immediate fee reductions, initiating these discussions can lay the groundwork for potential adjustments in the future as your business evolves and strengthens its partnership with Shopify.

Conclusion

As an e-commerce entrepreneur leveraging the capabilities of Shopify, navigating the complexities of the merchant fee is a pivotal aspect of optimizing your business’s financial performance. By gaining a comprehensive understanding of the Shopify merchant fee and implementing strategic approaches to reduce its impact, you can fortify your profitability and enhance the sustainability of your online enterprise.

Throughout this guide, we’ve explored the intricacies of the Shopify merchant fee, delving into its composition and the factors influencing its financial implications. By recognizing the interplay between transaction volume, payment methods, and fee structures, you can proactively devise tailored strategies to mitigate the impact of the merchant fee on your revenue streams.

Moreover, the implementation of proactive measures, such as optimizing payment processing solutions, encouraging cost-effective payment methods, and exploring negotiations with Shopify, empowers you to exert greater control over your e-commerce expenditure while maximizing the value derived from the platform.

It’s imperative to approach the management of the Shopify merchant fee as an ongoing endeavor, continually evaluating and refining your strategies to align with evolving market dynamics and business requirements. By remaining vigilant and adaptive in your approach, you can sustainably reduce the financial burden associated with transaction fees, ultimately bolstering your bottom line and fostering long-term business prosperity.

Armed with the insights and strategies outlined in this guide, you are equipped to navigate the realm of e-commerce fees with confidence and resourcefulness. As you embark on this journey, remember that the effective management of the Shopify merchant fee is not solely a financial endeavor but a strategic imperative that can elevate the competitiveness and resilience of your online business.