Finance

How To Close A Savings Account With A US Bank

Modified: December 30, 2023

Learn how to efficiently close a savings account with a US bank and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Closing a savings account with a US bank may seem like a daunting task, but with the right guidance and understanding of the process, it can be a smooth and hassle-free experience. Whether you are closing your account to switch to a different bank or simply no longer need a savings account, this article will provide you with a step-by-step guide on how to close a savings account with a US bank.

Before proceeding with the closure, it’s crucial to familiarize yourself with the terms and conditions of your account. This will help you understand any potential fees, withdrawal restrictions, or any additional requirements you need to fulfill before closing your account. Additionally, gathering all the necessary information and documents ahead of time will ensure a seamless process.

Once you are prepared, the next step is to contact the bank’s customer service department. This can usually be done by phone, online chat, or visiting a local branch if available. During this interaction, you will need to verify your identity and provide any requested information to authenticate your account.

After your identity has been verified, you will need to withdraw any remaining funds from your savings account. This can usually be done through an ATM withdrawal, transferring the funds to another account, or requesting a cashier’s check.

Once your account balance is zero, you can proceed to submit a closure request. This can typically be done through the bank’s website, customer service, or by filling out a specific form provided by the bank.

Finally, it is essential to confirm the closure of your savings account. This may require contacting customer service or monitoring your account status online. Ensuring that your account is closed will prevent any future fees or unauthorized activity from occurring.

In the following sections, we will discuss each step in detail, providing helpful insights and tips to ensure a successful closure of your savings account with a US bank.

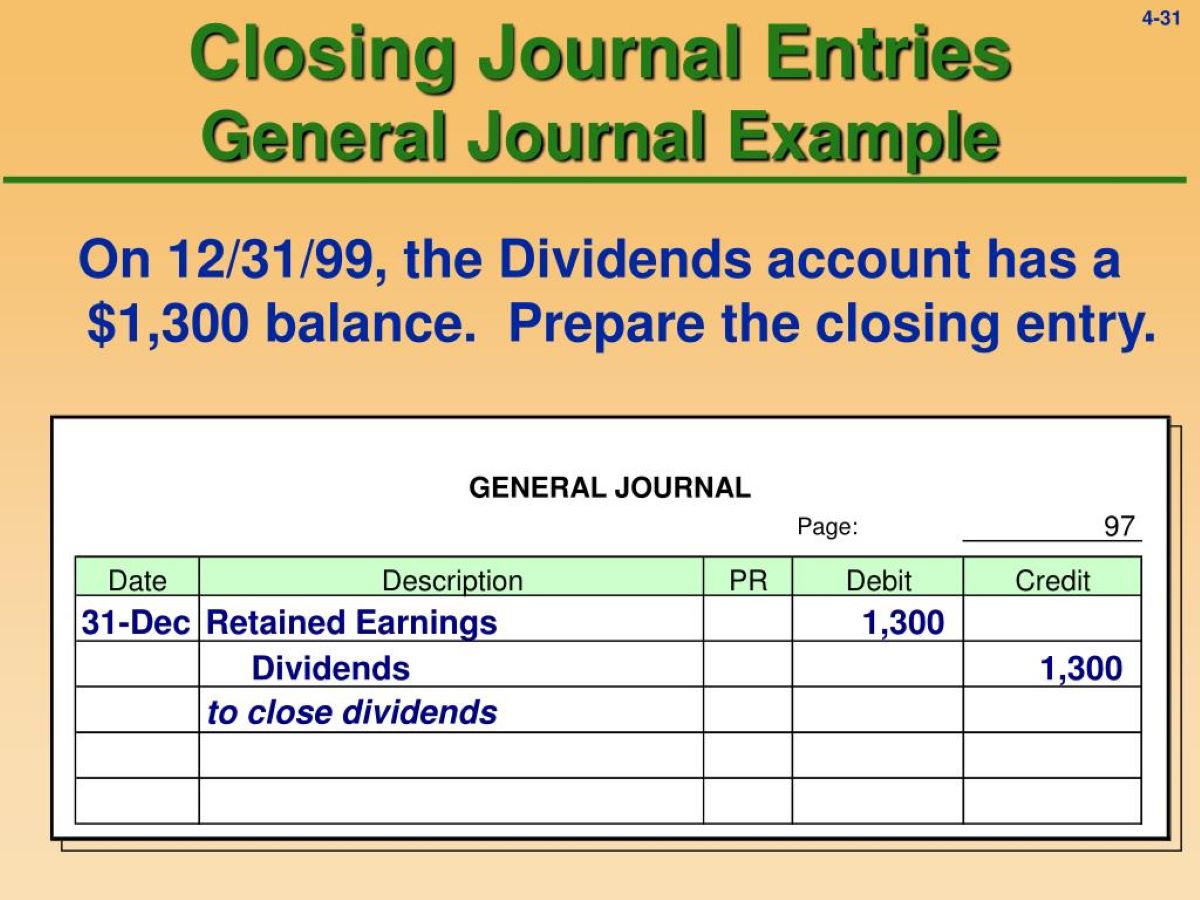

Step 1: Gather necessary information

Before initiating the process to close your savings account with a US bank, it is crucial to gather all the necessary information to ensure a smooth and efficient closure. This will help you avoid any potential complications or delays throughout the process.

The first piece of important information you need to collect is your account number. This can usually be found on your account statement, passbook, or any other banking documents related to your savings account. Make sure to double-check the accuracy of the account number to avoid any mistakes.

Additionally, it is wise to have your contact information readily available, including your current address and phone number. This information may be required during the closure process to verify your identity and ensure that any necessary notifications or updates can be sent to you.

In some cases, you may also need to provide your social security number or taxpayer identification number. This information is typically required for identity verification purposes and to comply with regulatory requirements. If you are unsure whether this information is necessary, you can contact customer service for clarification.

Moreover, it is advisable to review any recent account statements or transaction history to ensure that all transactions are accounted for. This will help you identify any pending transactions, outstanding checks, or automatic bill payments that need to be addressed before closing the account.

Lastly, it is essential to be aware of any outstanding fees or obligations associated with your savings account. This can include monthly maintenance fees, early closure fees, or penalties for not maintaining a minimum balance. Understanding these charges will enable you to plan accordingly and avoid any surprises during the closure process.

By gathering all the necessary information beforehand, you will be well-prepared to proceed with the subsequent steps involved in closing your savings account with a US bank.

Step 2: Review account terms and conditions

Before proceeding with the closure of your savings account with a US bank, it is crucial to review the account terms and conditions. These are the guidelines set forth by the bank regarding account closure procedures, potential fees, and any additional requirements you need to fulfill.

Start by locating the account terms and conditions document provided by your bank. This can typically be found on the bank’s website or in the documentation you received when you opened the account. If you are unable to find it, you can contact customer service for assistance.

Once you have the account terms and conditions document in hand, take the time to read through it carefully. Pay close attention to the sections that outline the process of closing the account. This will help you understand the specific steps you need to take and any documentation that may be required.

Additionally, familiarize yourself with any potential fees associated with account closure. Some banks may charge an early closure fee if you close the account within a certain period of time after opening it. Others may have a maintenance fee that is applicable even after the account is closed. Take note of these fees to avoid any unexpected charges.

Furthermore, be aware of any contractual obligations or minimum balance requirements. Some banks may require you to maintain a minimum balance or fulfill certain conditions to avoid fees or penalties. If you do not meet these requirements, there may be additional charges when closing the account.

Understanding the terms and conditions of your savings account will enable you to navigate the closure process smoothly and avoid any potential roadblocks. If you have any questions or concerns regarding the terms and conditions, it is recommended to reach out to customer service for clarification.

By reviewing the account terms and conditions thoroughly, you will have a clear understanding of what is expected of you and be better prepared for the subsequent steps involved in closing your savings account with a US bank.

Step 3: Contact customer service

Once you have gathered all the necessary information and reviewed the account terms and conditions, the next step to close your savings account with a US bank is to contact the bank’s customer service department. The purpose of this step is to initiate the closure process and receive guidance on the required steps.

Contacting customer service can usually be done through various channels, such as phone, online chat, or by visiting a local branch if available. Choose the method that is most convenient and accessible to you. Keep in mind that some banks may require you to contact their specific account closure department or submit a request through their website.

During your interaction with customer service, they will guide you through the closure process and provide any necessary instructions or documents to initiate the closure. They may also ask you to verify your identity to ensure the security of your account. Be prepared to provide personal information, such as your account number, social security number, or other identifying details.

While speaking with customer service, take the opportunity to ask any questions you may have about the closure process. Seek clarification on any fees, timeframes, or requirements that you are unsure about. This will help you avoid any misunderstandings or surprises during the closure process.

Customer service representatives are trained to assist account holders with closures and will be able to guide you through the necessary steps. They can provide you with any specific forms or documents required for account closure and offer alternatives if you face any challenges along the way.

It is important to keep a record of the interaction with customer service, including the date, time, and the name of the representative you spoke to. This will serve as a reference in case any issues arise later on or if you require further assistance.

By contacting customer service, you will be able to initiate the closure process with the guidance and support of the bank’s representatives. Their expertise will help ensure a smooth transition as you proceed with closing your savings account with a US bank.

Step 4: Verify your identity

Verifying your identity is a crucial step when closing a savings account with a US bank. It ensures the security of your account and helps prevent unauthorized access or closures. Banks have strict protocols in place to protect their customers’ information, so be prepared to provide the necessary documentation and information to verify your identity.

Typically, banks will require you to provide your personal identification, such as your driver’s license or passport, to confirm your identity. They may also ask for additional identification documents, such as a social security card or a utility bill with your name and address. Make sure to have these documents readily available to expedite the verification process.

Some banks may also use security questions or require you to provide specific details related to your account or recent transactions. This is done to further authenticate your identity and ensure that you are the account holder initiating the closure. These questions may include details such as your last deposit amount or the date and amount of a recent withdrawal.

If you are unable to verify your identity through the standard methods, the bank may require you to visit a local branch in person. This allows them to verify your identity through face-to-face interaction. In such cases, make sure to schedule an appointment beforehand to avoid any unnecessary delays or inconveniences.

It is important to note that the verification process may vary from bank to bank, so it is recommended to contact customer service or refer to the bank’s website for specific instructions on how to verify your identity for account closure.

By verifying your identity, you are ensuring that only authorized individuals can access and make changes to your savings account. This step helps protect your personal and financial information, providing you with peace of mind as you proceed with closing your account.

Step 5: Withdraw funds from your account

Before closing your savings account with a US bank, it is essential to withdraw any remaining funds from the account. This step ensures that you have access to your money and prevents any potential issues that may arise after the account closure.

The method of withdrawing funds may vary depending on the bank, but there are typically several options available to account holders.

One common method is to make an ATM withdrawal. If your bank provides ATM services, you can use your debit card to withdraw funds from your savings account. Make sure to check the ATM withdrawal limits and any associated fees that may apply.

Another option is to transfer the funds to another account, either within the same bank or to an account at a different financial institution. Depending on the bank, this can be done through online banking, by visiting a branch, or by contacting customer service. Provide the necessary account information for the receiving bank or account, ensuring accuracy to avoid any delays or errors.

If you prefer a physical form of withdrawal, you can request a cashier’s check from the bank. This is a secure method of receiving your funds in the form of a check made payable to you. You can then deposit or cash the check as needed.

It is important to ensure that your account balance is zero before proceeding with the closure process. Leaving a small amount in the account could lead to complications, such as ongoing maintenance fees or the account remaining open unintentionally.

If you have any pending transactions or outstanding checks, make sure to address them before closing the account. This will help avoid any issues or overdraft charges that may occur due to transactions attempting to process after the account closure.

By withdrawing the remaining funds from your account, you can have peace of mind and avoid any potential complications or fees in the future. Take the necessary steps to transfer or cash out your funds before proceeding to the next step of closing your savings account with a US bank.

Step 6: Submit a closure request

After you have gathered all the necessary information, reviewed the account terms and conditions, contacted customer service, verified your identity, and withdrawn any remaining funds, it is time to submit a closure request for your savings account with a US bank. This formal request informs the bank of your intention to close the account.

The method of submitting a closure request may vary depending on the bank. Some banks allow you to submit the request online through their website, while others may require you to fill out a specific closure form or contact customer service directly. Check the bank’s website or contact their customer service department to determine the appropriate method for submitting your closure request.

When submitting the closure request, be prepared to provide your account information, such as the account number and your personal identification details. This information is necessary for the closure request to be processed accurately.

Additionally, ensure that you follow any specific guidelines or instructions provided by the bank for submitting the closure request. This may include including any required documentation, completing additional forms, or adhering to specific timelines.

Once your closure request is submitted, you may receive a confirmation or reference number. It is important to keep this number for your records, as it can serve as proof that you initiated the account closure process.

Be aware that some banks may take a few business days to process the closure request. During this time, it is advisable to monitor your account closely to ensure that no unauthorized activity occurs. If you notice any unusual transactions or charges, contact customer service immediately.

By submitting a closure request, you are formally notifying the bank of your intention to close your savings account. This step ensures that the closure process is initiated and allows the bank to proceed with the necessary steps to close the account in a timely manner.

Step 7: Confirm account closure

The final step in closing your savings account with a US bank is to confirm that the account has been successfully closed. This step ensures that all necessary procedures have been completed and that you no longer have any ties or obligations to the bank.

After submitting your closure request, it is important to follow up with the bank to confirm the closure. Depending on the bank’s procedure, you may receive a confirmation email, letter, or notification through your online banking portal. This confirmation typically includes details such as the date of closure and any remaining balances or fees.

If you do not receive a confirmation within the expected timeframe, reach out to the bank’s customer service department to inquire about the status of your account closure. They will be able to provide you with an update and address any concerns you may have.

Once you have received confirmation of the account closure, it is crucial to review your bank statements or online banking activity periodically to ensure that no unexpected transactions occur. This will help confirm that the account is indeed closed and that there are no additional charges or activity associated with it.

Additionally, it is recommended to keep the account closure confirmation documentation for your records. This can serve as proof in case any issues arise in the future regarding the closure of your savings account.

If you don’t receive a confirmation or discover any discrepancies or issues after the closure process, contact the bank immediately to address the situation. Their customer service department will be able to assist you and resolve any outstanding matters.

By confirming the account closure, you can have peace of mind knowing that all necessary steps have been taken to officially close your savings account with a US bank. This final confirmation ensures that you are no longer responsible for the account and can move forward with your financial plans.