Finance

How To Close The Dividends Account

Published: January 2, 2024

Learn how to close your dividends account and manage your finances effectively with our step-by-step guide. Achieve financial stability and maximize your returns

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where managing your investment portfolio is crucial for financial success. One important aspect of managing your investments is understanding and dealing with dividends. Dividends are payments made by a company to its shareholders as a reward for their investment in the company’s stock.

While dividends can provide a steady stream of income and contribute to the growth of your wealth, there may come a time when you need to close your dividends account. This can be due to various reasons, such as consolidating your investment accounts, simplifying your finances, or investing in other opportunities.

In this article, we will take a closer look at dividends accounts, explore the reasons why you might consider closing one, and provide a step-by-step guide to help you navigate the process. Additionally, we will discuss the important factors you need to consider before closing your dividends account and the potential implications of doing so.

Whether you are a seasoned investor or just starting out, understanding how to close a dividends account is essential knowledge that can help you effectively manage your investment portfolio. So, let’s dive in and explore the ins and outs of closing a dividends account.

Understanding Dividends Account

Before we delve into the process of closing a dividends account, it’s important to have a clear understanding of what exactly a dividends account is. A dividends account is a specialized account that holds the dividends you receive from the stocks you own in a particular company.

Dividends are typically paid out by companies that are profitable and have a surplus of earnings. They are a way for companies to distribute a portion of their profits to their shareholders. Dividends can be paid in the form of cash, additional shares of stock, or other assets.

When you invest in a company’s stock, you become a shareholder and are eligible to receive a portion of the company’s earnings in the form of dividends. These dividends are directly deposited into your dividends account.

Dividends accounts are often managed by brokerage firms or financial institutions. The account serves as a record of all the dividends you have received, allowing you to keep track of your earnings from your investments.

It’s important to note that dividends accounts are separate from your regular brokerage or investment accounts. While your regular account holds your stocks and other securities, the dividends account specifically focuses on tracking and managing the dividends you receive.

Dividends can be a valuable source of income and can significantly contribute to the growth of your investment portfolio. However, there may come a time when you need to close your dividends account. The next section will delve into the reasons why you might consider closing your dividends account.

Reasons for Closing Dividends Account

While dividends can be a valuable source of income, there are several reasons why you might consider closing your dividends account:

- Consolidating Accounts: If you have multiple investment accounts, it may be more convenient for you to consolidate them into one. Closing your dividends account and transferring the dividends to your primary investment account can streamline your financial management.

- Simplifying Finances: Managing multiple accounts can be complex and time-consuming. If you find yourself overwhelmed with keeping track of various dividends accounts, closing them and simplifying your finances can provide peace of mind and make financial management more manageable.

- Investing in Other Opportunities: If you have identified other investment opportunities that you believe will yield higher returns, you may choose to close your dividends account and reallocate the funds to these new investment prospects.

- Changing Investment Strategy: As your financial goals and investment strategy evolve over time, you may decide to shift your focus away from dividend-paying stocks. In such cases, closing your dividends account can align your investment strategy with your current objectives.

- Addressing Account Fees: Some brokerage firms or financial institutions may charge fees for maintaining a dividends account. If the fees outweigh the benefits of keeping the account open, closing it can help you avoid unnecessary expenses.

While these are common reasons for closing a dividends account, it’s important to carefully evaluate your specific circumstances and consult with a financial advisor if needed. Assessing the pros and cons of closing your dividends account will ensure that you make an informed decision that aligns with your financial goals.

Now that we have explored the reasons behind potentially closing your dividends account, let’s move on to the next section, where we will provide a step-by-step guide on how to close a dividends account.

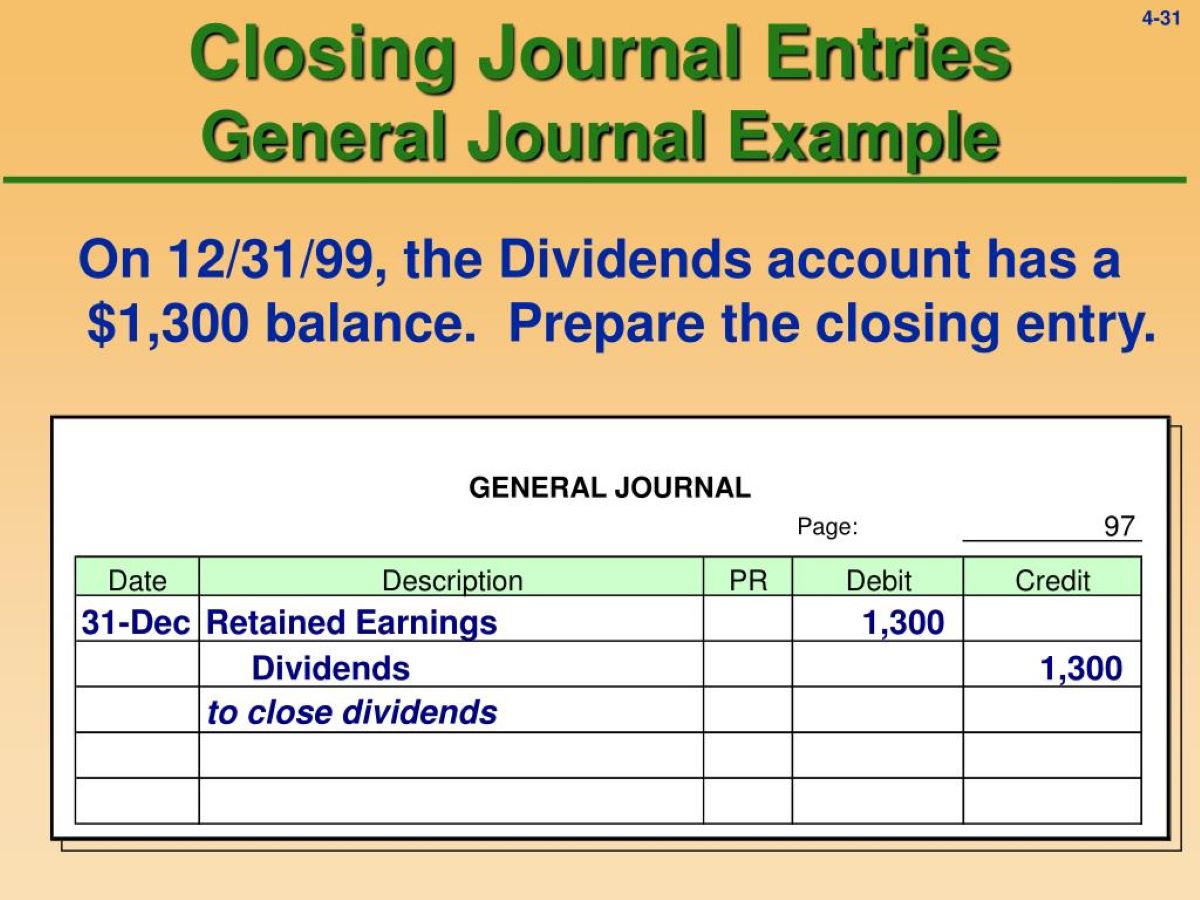

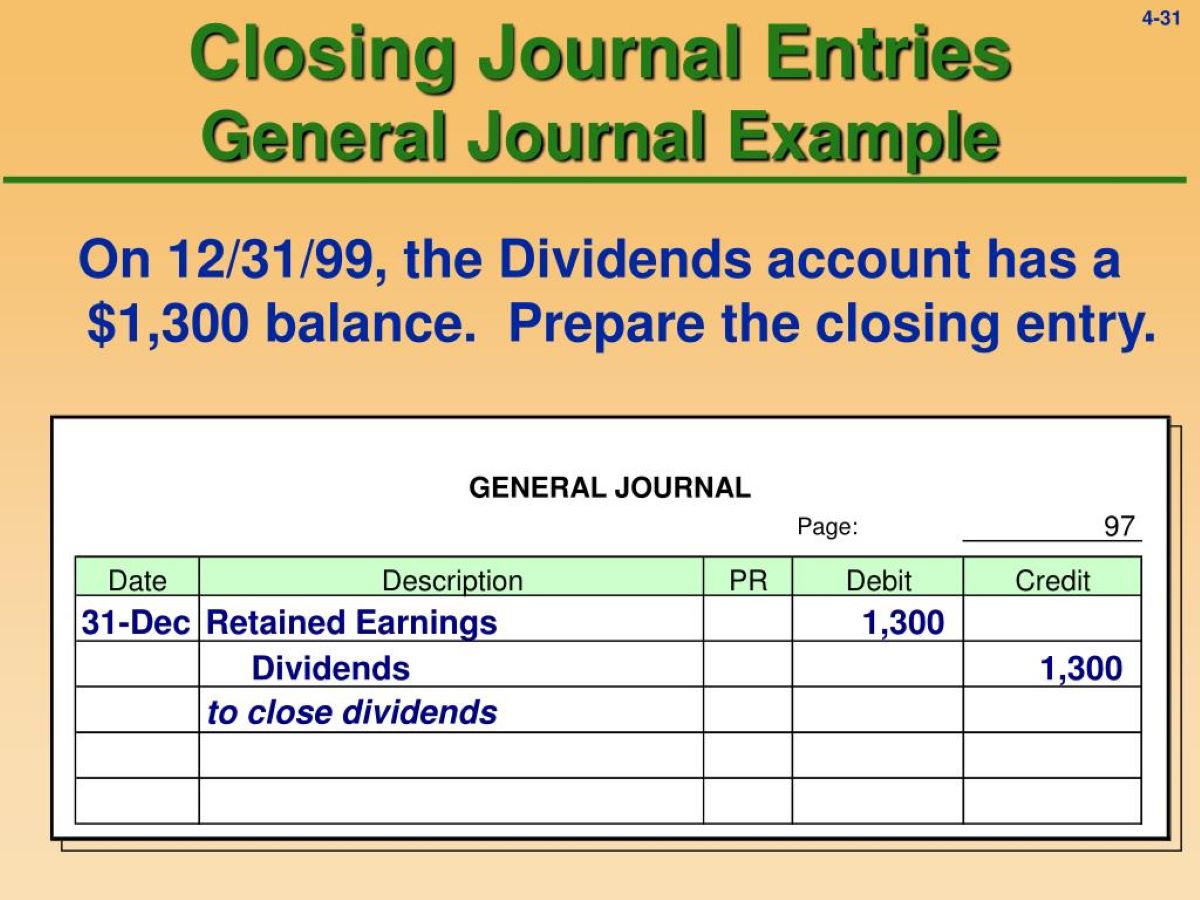

Step-by-Step Guide to Closing Dividends Account

If you have decided to close your dividends account, follow these steps to ensure a smooth transition:

- Evaluate your investments: Before closing your dividends account, review your overall investment portfolio and assess the impact of transferring or closing the account. Make sure you have a clear understanding of the potential tax implications and any fees associated with closing the account.

- Notify your financial institution: Contact your brokerage firm or financial institution and inform them of your intention to close the dividends account. They will provide you with the necessary instructions and documentation required to initiate the account closure process.

- Prepare the required documentation: Gather all the required paperwork, including account closure forms, identification documents, and any other documents specified by your financial institution. Ensure that you complete the forms accurately and provide any additional information requested.

- Transfer remaining funds: If you have any remaining funds in your dividends account, decide how you want to handle them. You may choose to transfer the funds to your primary investment account, have them disbursed to your bank account, or reinvest them in other securities. Follow the instructions provided by your financial institution to complete the transfer.

- Close the account: Once you have completed the necessary paperwork and transferred any remaining funds, your financial institution will process the closure of your dividends account. They will confirm the closure with you and provide any final statements or documentation for your records.

- Review and update your investment strategy: Take this opportunity to review and update your investment strategy. Consider consulting with a financial advisor to ensure that your investment portfolio aligns with your financial goals and risk tolerance.

It’s important to note that the specific steps involved in closing a dividends account may vary depending on your financial institution and the account itself. Therefore, it’s crucial to follow the instructions provided by your financial institution and seek clarification if needed to ensure a seamless account closure process.

Now that you have a clear understanding of how to close a dividends account, let’s move on to the next section, where we will discuss important considerations before closing your dividends account.

Considerations before Closing Dividends Account

Before you proceed with closing your dividends account, it’s important to consider the following factors:

- Tax Implications: Closing a dividends account may have tax implications. Depending on your jurisdiction and the specific details of your investments, you may incur capital gains taxes or other tax obligations. It’s recommended to consult with a tax professional to understand the potential tax consequences of closing your account.

- Unrealized Gains: Take into account any unrealized gains in your dividends account. If you decide to close the account, you may realize these gains, which might be subject to taxes or impact your overall investment strategy. Consider the potential impact on your investment portfolio before making a decision.

- Dividend Reinvestment: If you have been reinvesting your dividends in additional shares of stock, closing your dividends account means you will no longer have the option to automatically reinvest your dividends. Consider if you want to manually reinvest the dividends or redirect them to a different investment strategy.

- Future Dividend Income: Closing your dividends account means forfeiting future dividend income from the stocks you held in that account. Evaluate the impact of this loss of income and assess if you have alternative investments or income sources that can compensate for it.

- Account Maintenance Fees: Review any account maintenance fees associated with your dividends account. If the fees are high or outweigh the benefits of keeping the account open, closing it may save you money in the long run.

- Long-Term Investment Goals: Consider your long-term investment goals and how closing your dividends account aligns with them. If dividend income is an essential component of your investment strategy, explore other avenues to continue investing in dividend-paying stocks or funds.

It’s crucial to evaluate these considerations in light of your individual financial goals and investment strategy. Taking the time to understand the implications of closing your dividends account will help you make an informed decision that is in line with your overall financial objectives.

In the next section, we will discuss the potential implications of closing your dividends account, so let’s continue exploring this topic further.

Potential Implications of Closing Dividends Account

When considering closing your dividends account, it’s important to be aware of the potential implications that this decision may have on your overall investment portfolio:

- Loss of Dividend Income: By closing your dividends account, you will no longer receive regular dividend payments from the stocks held in that account. This loss of income can impact your overall cash flow and may require you to explore alternative sources of income.

- Reduced Investment Diversification: If your dividends account contains a significant portion of your diversified investments, closing it can result in a reduced level of diversification in your investment portfolio. This may increase your exposure to risks associated with other types of investments in your portfolio.

- Change in Investment Strategy: Closing your dividends account may require you to adjust your investment strategy. If you relied heavily on dividend income for your investment goals, you may need to reassess and potentially modify your strategy to compensate for the loss of dividend payments.

- Tax Implications: Closing your dividends account can have tax implications, particularly if you have unrealized gains or are subject to capital gains taxes. Consult with a tax professional to understand the potential tax consequences specific to your situation.

- Opportunity Cost: Consider the potential opportunity cost of closing your dividends account. If you believe that the stocks in your dividends account will continue to generate solid dividend income in the future, closing the account may mean missing out on potential future earnings.

- Reinvestment Options: Closing your dividends account may require you to explore other options for reinvesting your funds. You could consider allocating your funds towards other income-generating assets or reinvesting them in different investment vehicles that align with your financial goals.

These potential implications highlight the importance of carefully evaluating the impact of closing your dividends account on your overall financial plan. It’s advisable to consult with a financial advisor who can provide personalized guidance based on your specific circumstances.

Now that we have explored the potential implications, it’s time to wrap up our discussion on closing dividends accounts.

Conclusion

Closing a dividends account is a decision that should be approached with careful consideration and analysis of your financial goals. While dividends accounts can provide a steady stream of income and contribute to the growth of your investment portfolio, there may be valid reasons for closing such an account.

In this article, we have explored the fundamentals of dividends accounts, reasons why you might consider closing one, and provided a step-by-step guide to help you navigate the process. We have also discussed the important factors to consider before closing your dividends account, as well as the potential implications of doing so.

When contemplating closing a dividends account, it’s crucial to assess the impact on your investment portfolio, tax implications, and long-term financial goals. Consulting with a financial advisor can provide valuable insights and guidance personalized to your situation.

Remember that closing a dividends account is not a decision to be taken lightly. Evaluate the pros and cons, assess the potential implications, and consider alternative investment strategies to ensure that your overall financial plan remains on track.

Managing your investment portfolio requires careful attention to various aspects, and closing a dividends account is just one part of the process. By staying informed and making well-informed decisions, you can navigate the ever-changing landscape of finance and strive towards achieving your financial goals.

So, whether you choose to close your dividends account or continue to enjoy the benefits of dividend income, may your investments flourish, and your financial future be bright!