Finance

How To Fill In Minimum Payment As Entry Level

Modified: February 26, 2024

Learn how to manage minimum payments and improve your financial skills as an entry-level individual. Discover essential tips and strategies to handle your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of Minimum Payments for Entry-Level Individuals

Entering the realm of personal finance can be both exciting and daunting, especially for those who are just starting their careers. As an entry-level individual, managing finances effectively is crucial for building a strong foundation for future financial stability. One aspect that holds significant weight in this journey is understanding and fulfilling minimum payments. In this article, we will delve into the significance of minimum payments, explore how they are calculated, and provide strategies for meeting them effectively. By the end, you will have a comprehensive understanding of how to navigate the world of minimum payments as an entry-level individual, setting the stage for a secure financial future.

Navigating the world of personal finance can be overwhelming, especially when faced with unfamiliar terms and concepts. However, understanding the basics is essential for making informed decisions and establishing healthy financial habits. One such fundamental concept is the minimum payment, which plays a pivotal role in managing various forms of debt, including credit card balances, student loans, and other financial obligations.

For entry-level individuals, the concept of minimum payments can be particularly crucial, as it sets the tone for responsible financial management early in one's career. By grasping the significance of minimum payments and learning how to fulfill them efficiently, individuals can lay the groundwork for a solid financial future. Throughout this article, we will explore the nuances of minimum payments, providing actionable insights to empower entry-level individuals in their financial journey.

Understanding Minimum Payments

Grasping the Essentials of Minimum Payments

Minimum payments represent the lowest amount that an individual must pay each billing cycle to maintain their account in good standing. While it may seem like a routine financial obligation, understanding the intricacies of minimum payments is crucial for making informed decisions and avoiding potential pitfalls.

When it comes to credit cards, the minimum payment is typically calculated as a percentage of the outstanding balance, subject to a minimum amount. This percentage can vary among different credit card issuers, often ranging from 1% to 3% of the total balance. Additionally, the minimum payment may encompass the interest accrued for that billing cycle, along with a portion of the principal balance.

For individuals carrying student loan debt, minimum payments are determined based on the terms of the loan agreement. These payments are designed to ensure that borrowers make consistent progress towards repaying their loans within a specified timeframe. Understanding the minimum payment requirements for student loans is essential for maintaining good standing and avoiding potential repercussions, such as late fees or negative impacts on credit scores.

One common misconception regarding minimum payments is the notion that consistently paying only the minimum amount due is a sustainable approach to managing debt. In reality, relying solely on minimum payments can lead to prolonged debt repayment periods and substantial interest accrual, ultimately impeding one’s financial progress. Therefore, while meeting the minimum payment requirement is essential, striving to pay more than the minimum whenever possible can significantly expedite debt repayment and reduce overall interest costs.

By comprehending the significance of minimum payments and the implications of different financial obligations, entry-level individuals can make informed decisions to maintain their financial health. In the subsequent sections, we will explore how minimum payments are calculated and provide effective strategies for meeting these obligations, empowering individuals to navigate their financial journey with confidence and prudence.

Calculating Minimum Payments

Unraveling the Formulas Behind Minimum Payments

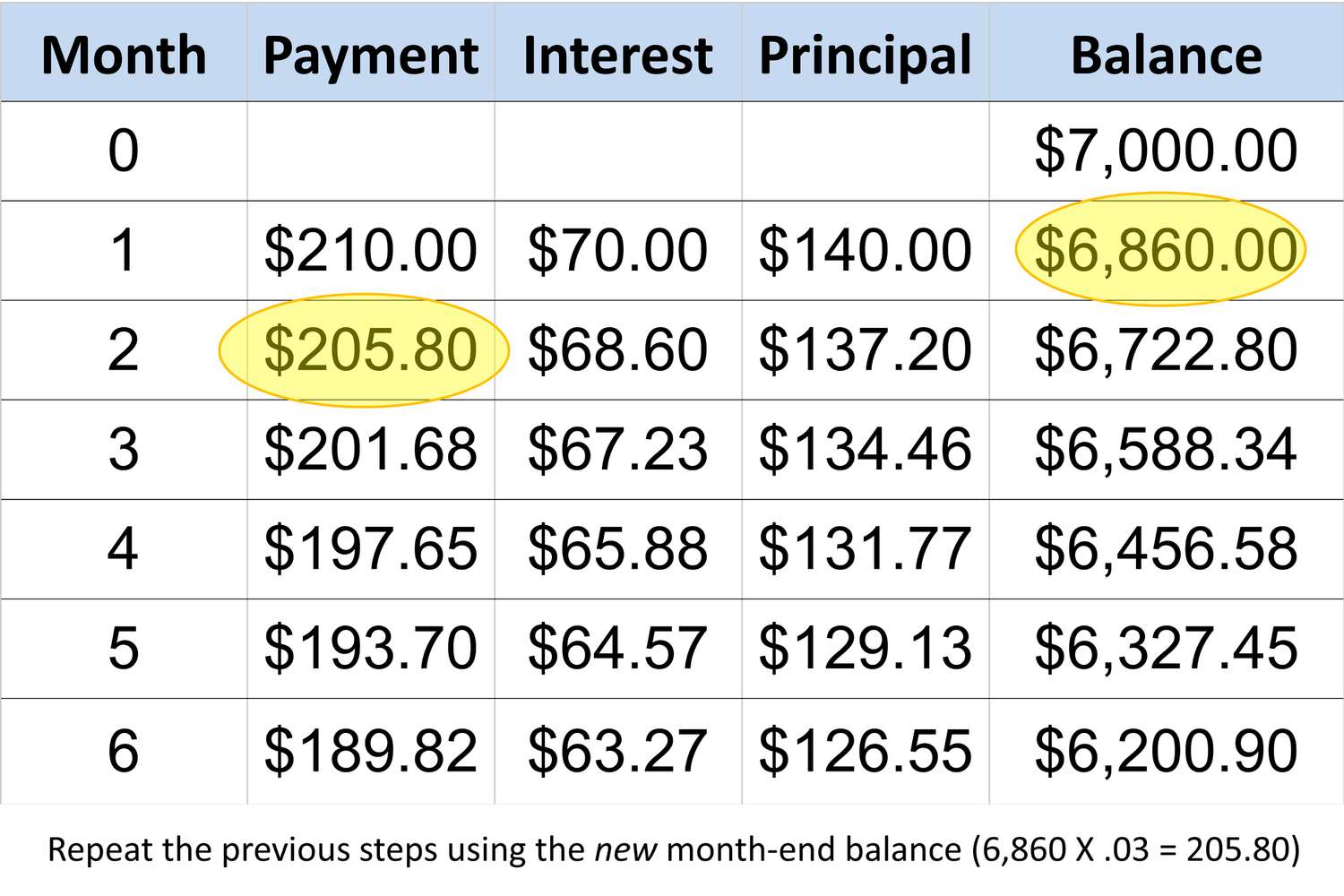

Understanding how minimum payments are calculated is essential for individuals striving to manage their financial obligations effectively. When it comes to credit cards, minimum payments are often determined using a specific formula that considers various factors, including the outstanding balance and the terms of the credit card agreement.

The most common method for calculating the minimum payment on a credit card involves applying a percentage to the total balance. This percentage, typically ranging from 1% to 3%, accounts for the minimum amount that cardholders must pay each billing cycle. In addition to this percentage, credit card issuers may set a minimum dollar amount to ensure that the minimum payment covers at least a specified portion of the principal balance and accrued interest.

For example, if a credit card issuer sets the minimum payment at 2% of the outstanding balance with a minimum of $25, an individual carrying a $1,500 balance would be required to pay $30 (2% of $1,500), meeting the minimum dollar threshold. It is important to note that failing to meet the minimum payment requirement can result in late fees, increased interest rates, and negative impacts on credit scores, emphasizing the significance of fulfilling this obligation in a timely manner.

When it comes to student loans, the calculation of minimum payments is predetermined by the terms of the loan agreement. Typically, student loan servicers provide clear documentation outlining the minimum monthly payment based on the loan balance, interest rate, and repayment term. Understanding these calculations is crucial for borrowers to budget effectively and ensure consistent compliance with their repayment obligations.

By grasping the formulas used to calculate minimum payments for credit cards and student loans, entry-level individuals can gain insight into their financial commitments and make informed decisions to fulfill these obligations responsibly. In the subsequent section, we will explore effective strategies for meeting minimum payments, empowering individuals to navigate their financial responsibilities with confidence and prudence.

Strategies for Meeting Minimum Payments

Navigating Financial Responsibilities with Prudence

Meeting minimum payments is a fundamental aspect of responsible financial management, particularly for entry-level individuals striving to establish a strong foundation for their financial future. To effectively meet these obligations and maintain good standing with creditors, it is essential to employ strategic approaches that align with one’s financial capabilities and goals.

1. Budgeting Wisely: Creating a comprehensive budget that prioritizes minimum payments for all financial obligations is paramount. By allocating sufficient funds to cover minimum payments within the budget, individuals can ensure that these obligations are met consistently, thereby avoiding potential repercussions such as late fees and negative impacts on credit scores.

2. Prioritizing High-Interest Debt: When faced with multiple sources of debt, prioritizing high-interest balances can yield significant long-term savings. By allocating additional funds to pay more than the minimum on high-interest accounts, individuals can expedite debt repayment and minimize overall interest costs, ultimately enhancing their financial well-being.

3. Exploring Income-Boosting Opportunities: For individuals seeking to meet minimum payments more comfortably, exploring opportunities to increase income can provide valuable support. This may involve taking on additional part-time work, freelancing, or leveraging skills and talents to generate supplementary income dedicated to fulfilling financial obligations.

4. Communicating with Creditors: In cases where meeting minimum payments becomes challenging due to unforeseen circumstances, such as job loss or medical emergencies, proactive communication with creditors can be beneficial. Many creditors offer hardship programs or alternative payment arrangements to support individuals facing temporary financial setbacks.

5. Avoiding New Debt Accumulation: While striving to meet minimum payments, it is crucial to avoid accumulating new debt whenever possible. By exercising restraint in credit card usage and making informed purchasing decisions, individuals can prevent exacerbating their financial obligations, thereby maintaining greater control over their overall financial health.

By implementing these strategies, entry-level individuals can navigate their financial responsibilities with prudence and foresight, fostering a solid financial foundation for the future. Embracing proactive financial management practices and seeking opportunities for growth and stability can empower individuals to fulfill their minimum payment obligations while progressing towards their broader financial goals.

Conclusion

Nurturing Financial Health and Responsibility

As an entry-level individual venturing into the realm of personal finance, understanding and meeting minimum payments are integral components of establishing a robust financial foundation. By delving into the nuances of minimum payments, individuals can equip themselves with the knowledge and strategies necessary to navigate their financial responsibilities with confidence and prudence.

Throughout this exploration, we have uncovered the significance of minimum payments, unraveling the formulas used to calculate them for credit cards and student loans. We have also delved into effective strategies for meeting minimum payments, emphasizing the importance of budgeting wisely, prioritizing high-interest debt, exploring income-boosting opportunities, communicating with creditors, and avoiding new debt accumulation.

By embracing these insights and strategies, entry-level individuals can cultivate responsible financial habits, setting the stage for long-term stability and growth. Nurturing financial health through informed decision-making, proactive management, and a commitment to meeting minimum payment obligations paves the way for a secure and prosperous financial future.

Ultimately, the journey toward financial well-being is a continuous evolution, shaped by informed choices, resilience in the face of challenges, and a proactive approach to managing financial obligations. By leveraging the knowledge and strategies presented in this article, entry-level individuals can embark on their financial journey with clarity and determination, empowered to navigate the complexities of minimum payments and build a solid foundation for their future aspirations.