Finance

How To Find APR In Excel

Published: March 2, 2024

Learn how to calculate Annual Percentage Rate (APR) in Excel with our step-by-step guide. Master finance formulas and boost your financial skills today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of APR in Financial Decision-Making

When it comes to managing personal finances or evaluating potential loans and credit offers, having a clear understanding of the Annual Percentage Rate (APR) is crucial. The APR represents the true cost of borrowing, encompassing not only the interest rate but also any additional fees and charges associated with the loan or credit product. This comprehensive metric provides individuals with valuable insights into the overall affordability and long-term implications of various financial arrangements.

By delving into the realm of APR, individuals can make informed decisions, ensuring that they select the most favorable borrowing options and avoid potential pitfalls. Whether it's assessing mortgage offers, comparing credit card terms, or exploring personal loan opportunities, the APR serves as a fundamental tool for evaluating the true cost of borrowing. In this article, we will explore how to leverage the power of Microsoft Excel to calculate APR efficiently, empowering individuals to make well-informed financial choices.

Understanding the intricacies of APR and mastering the utilization of Excel for APR calculations can significantly enhance financial literacy and decision-making prowess. With this knowledge at hand, individuals can navigate the complex landscape of borrowing with confidence and precision, ultimately securing the most advantageous financial outcomes. Let's delve into the world of APR and Excel to unlock the potential for informed and empowered financial decision-making.

Understanding APR

Deciphering the Annual Percentage Rate (APR)

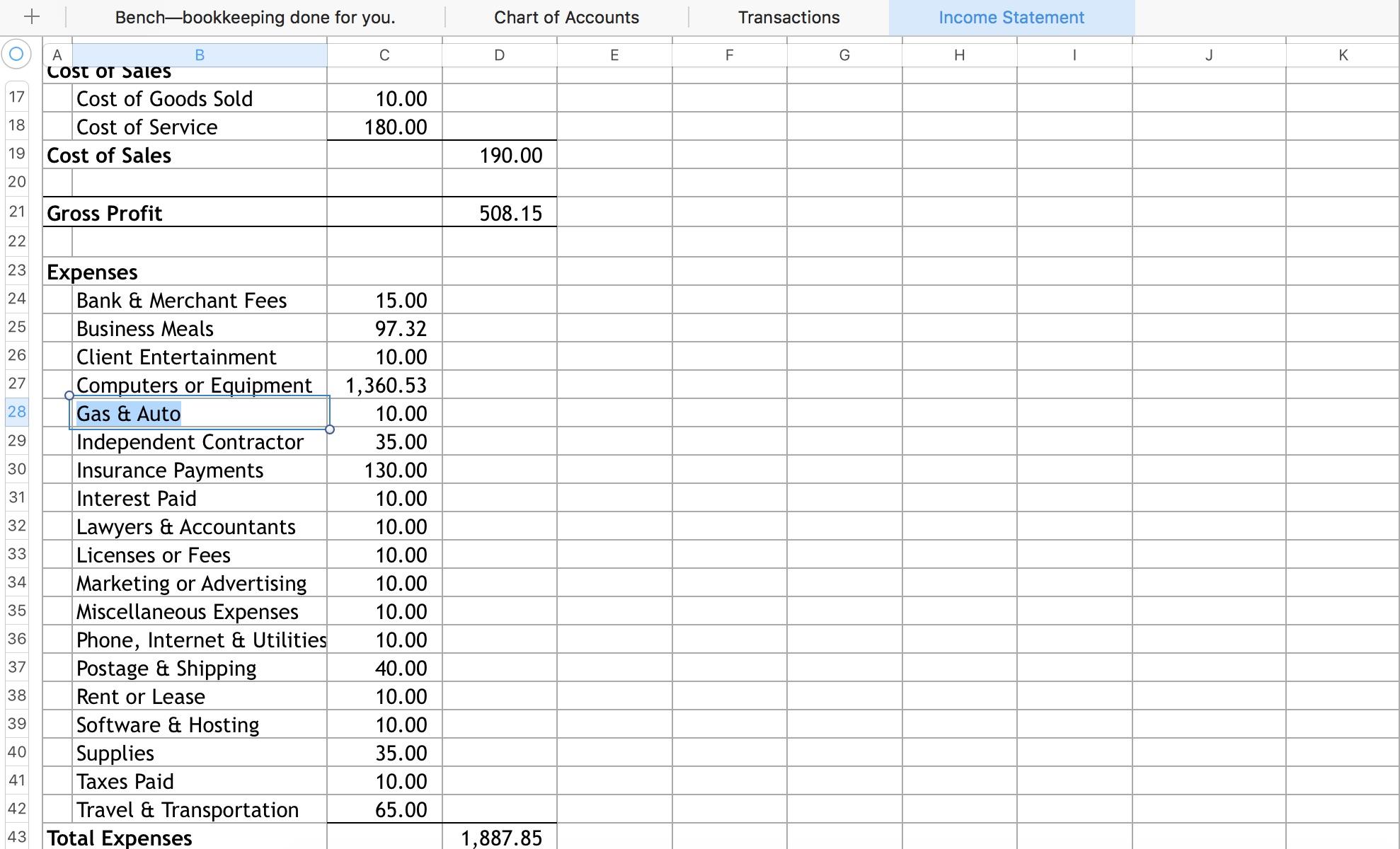

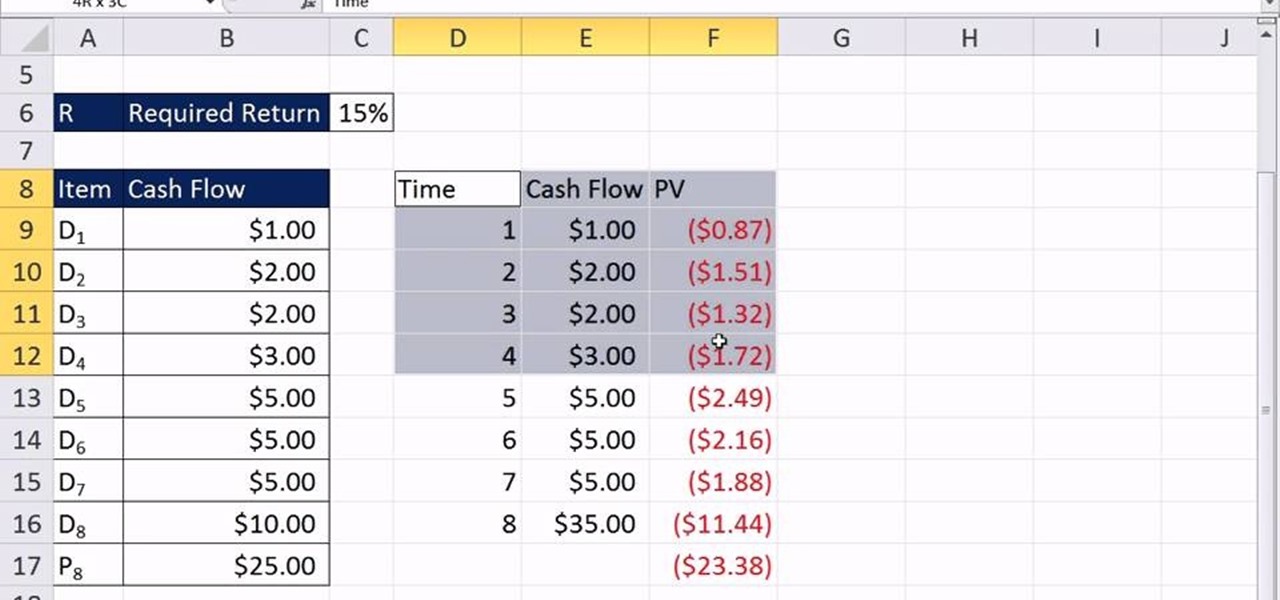

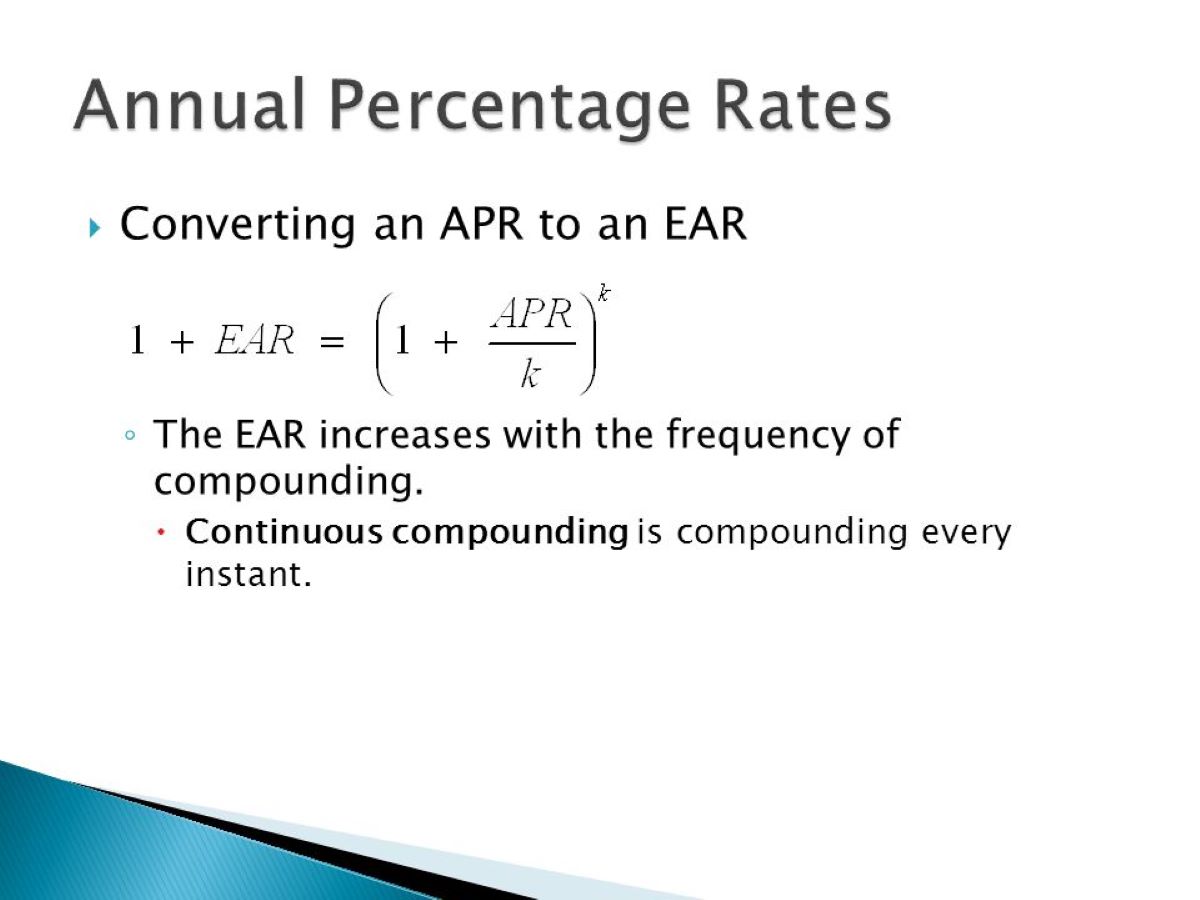

At its core, the Annual Percentage Rate (APR) encapsulates the total cost of borrowing money over a year, incorporating not only the interest rate but also any additional fees and charges imposed by the lender. This comprehensive metric provides a standardized platform for comparing the true cost of various financial products, ranging from mortgages and car loans to credit cards and personal loans.

Unlike the nominal interest rate, which solely reflects the cost of borrowing expressed as a percentage of the principal amount, the APR paints a more holistic picture. By encompassing additional expenses such as origination fees, points, and mortgage insurance, the APR offers a comprehensive view of the actual cost of financing. This enables consumers to make well-informed decisions by considering the complete financial implications of a loan or credit offer.

For example, when comparing mortgage offers, the APR accounts for not only the interest rate but also the lender fees and closing costs, providing a more accurate representation of the total cost of borrowing. Similarly, in the realm of credit cards, the APR reflects the annualized cost of credit, including annual fees, balance transfer charges, and other relevant expenses.

Understanding the significance of APR empowers individuals to make informed financial choices, enabling them to assess the true affordability of borrowing options. By grasping the nuances of APR and its role in financial decision-making, individuals can navigate the complex landscape of loans and credit with confidence and clarity, ultimately securing the most advantageous terms for their unique financial needs.

Using Excel to Find APR

Harnessing the Power of Excel for APR Calculations

Microsoft Excel, renowned for its versatility and robust functionality, serves as a valuable tool for conducting various financial calculations, including the determination of the Annual Percentage Rate (APR). Leveraging Excel’s built-in functions and formula capabilities, individuals can streamline the process of computing APR, facilitating efficient and accurate analyses of borrowing costs.

By harnessing Excel’s financial functions, such as the RATE function, individuals can swiftly compute the APR for different types of loans and credit arrangements. This empowers users to gain a comprehensive understanding of the true cost of borrowing, enabling them to make well-informed financial decisions based on precise and reliable calculations.

Excel’s intuitive interface and formula-driven approach simplify the task of determining APR, making it accessible to a broad spectrum of users, from financial professionals to individuals managing their personal finances. The ability to input relevant loan details and swiftly obtain the APR enhances the efficiency and accuracy of financial analyses, ultimately facilitating informed decision-making.

Moreover, Excel’s flexibility allows for scenario-based APR calculations, enabling users to assess the impact of varying loan terms and conditions on the overall cost of borrowing. This dynamic capability empowers individuals to conduct thorough comparative analyses, identifying the most advantageous borrowing options tailored to their specific financial requirements.

By harnessing Excel as a powerful tool for APR calculations, individuals can elevate their financial acumen and decision-making prowess, gaining a deeper understanding of the true cost of borrowing across diverse financial products. This proficiency in APR computation equips individuals with the insights needed to navigate the complex terrain of loans and credit, ensuring that they secure the most favorable terms aligned with their financial goals and preferences.

Step-by-Step Guide

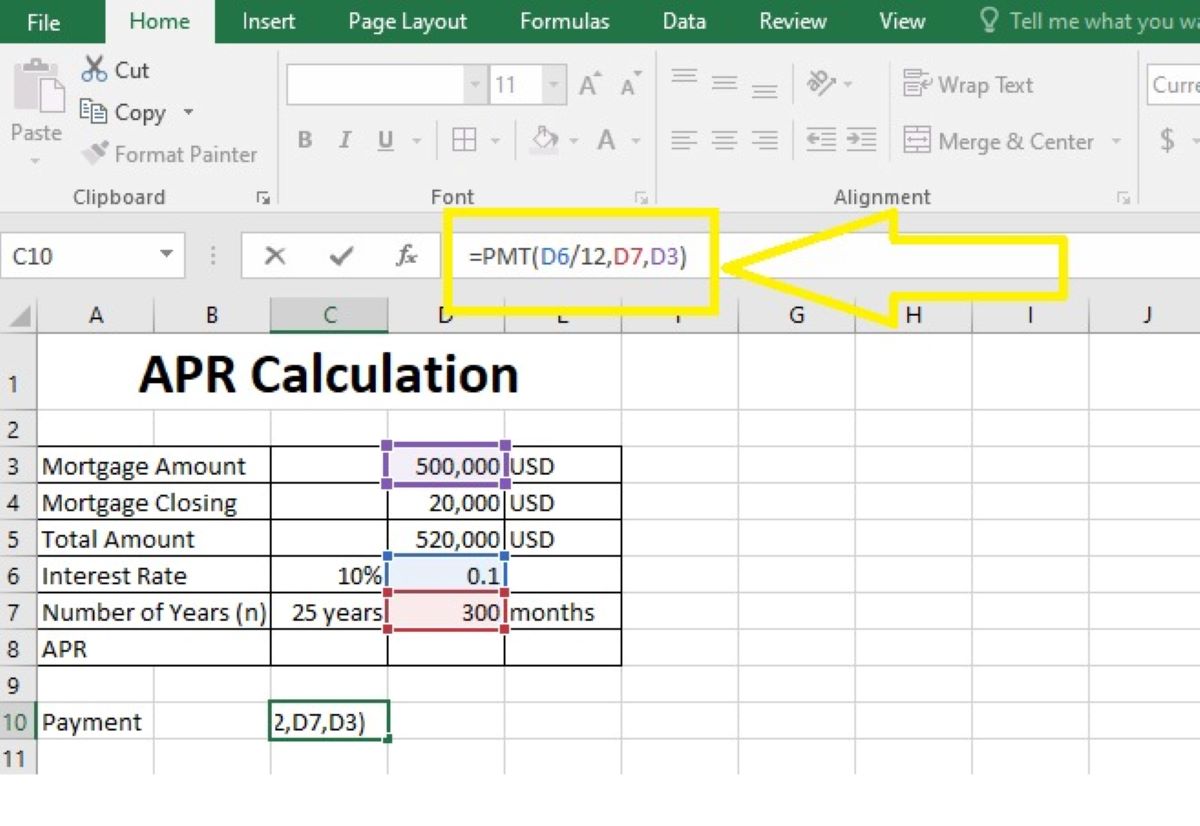

Navigating the Process of Calculating APR Using Excel

Embarking on the journey of computing the Annual Percentage Rate (APR) using Microsoft Excel entails a systematic and user-friendly process, empowering individuals to gain valuable insights into the true cost of borrowing. Below is a comprehensive step-by-step guide to assist in navigating the APR calculation process with proficiency and precision.

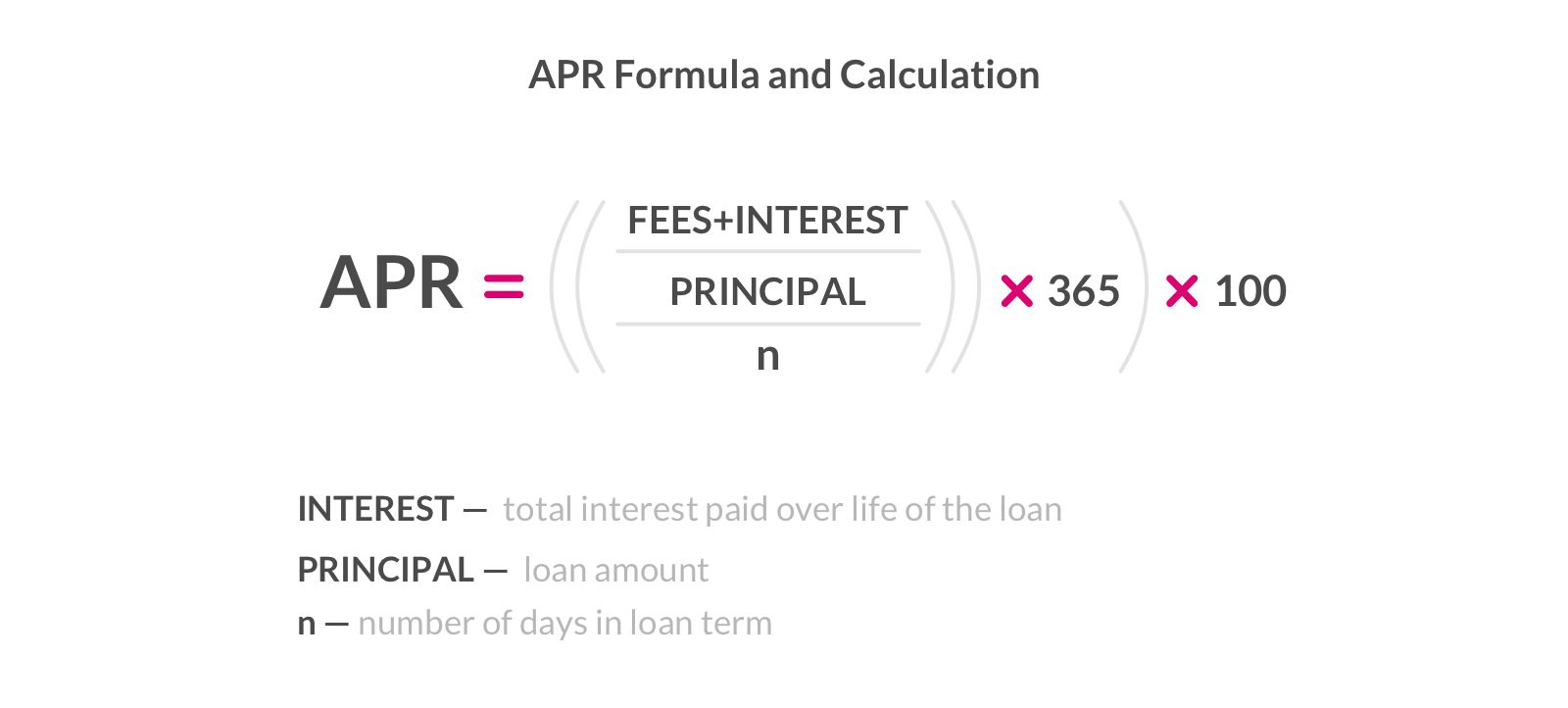

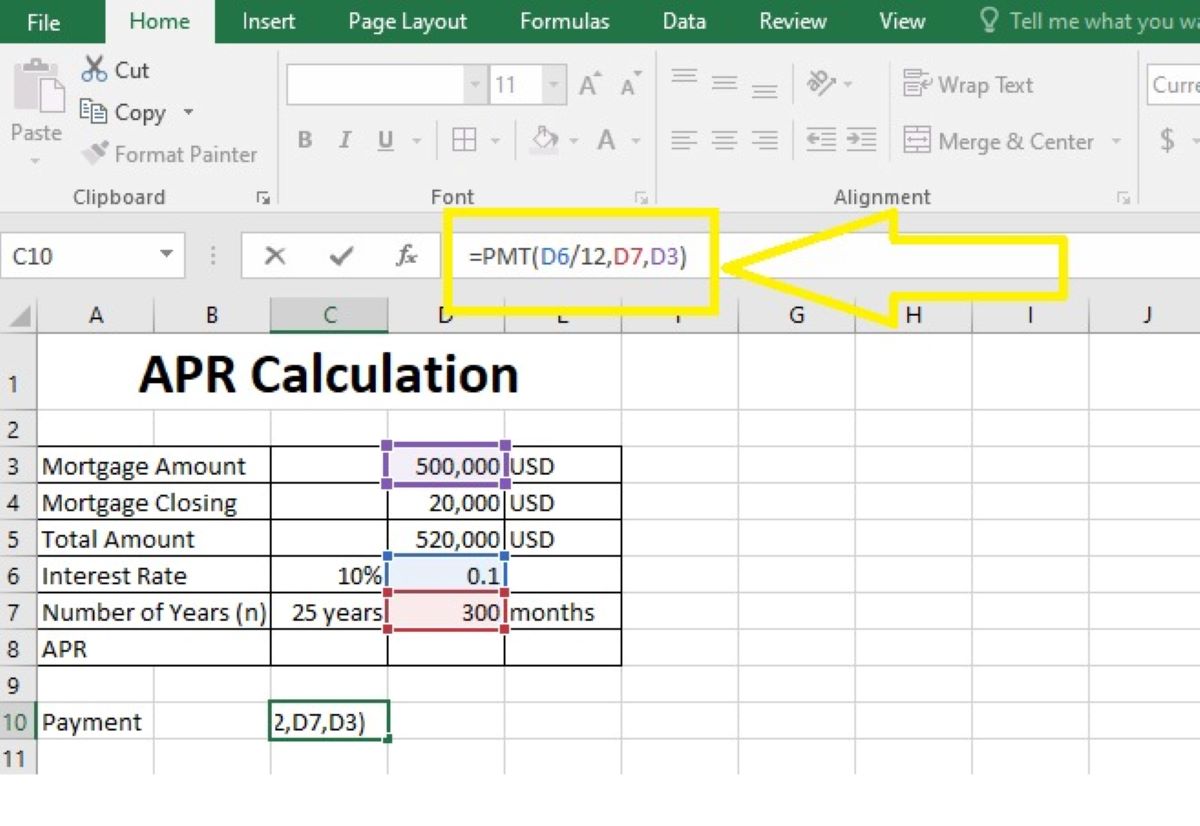

- Input Relevant Loan Details: Begin by entering the pertinent loan information into an Excel spreadsheet, including the loan amount, term, and any associated fees or charges. This serves as the foundational data for the APR calculation process.

- Utilize the RATE Function: Leverage Excel’s RATE function to compute the periodic interest rate, which forms the basis for determining the APR. By inputting the number of periods and the periodic payment, individuals can swiftly obtain the periodic interest rate using this built-in financial function.

- Convert Periodic Rate to APR: Once the periodic interest rate is determined, convert it to the Annual Percentage Rate (APR) by multiplying it by the number of periods in a year. This transformation yields the comprehensive APR, encapsulating the total cost of borrowing over a year.

- Consider Additional Fees and Charges: Factor in any additional fees or charges associated with the loan, such as origination fees or closing costs, to obtain a more comprehensive and accurate representation of the true cost of borrowing reflected in the APR.

- Validate the APR Calculation: Verify the accuracy of the APR calculation by cross-referencing it with other loan cost disclosures and utilizing Excel’s auditing tools to ensure precision and reliability.

By following this systematic guide, individuals can proficiently navigate the process of computing APR using Excel, harnessing the platform’s robust capabilities to obtain a comprehensive understanding of the true cost of borrowing across various financial arrangements. This proficiency in APR calculation empowers individuals to make well-informed financial decisions, ensuring that they secure the most advantageous borrowing options aligned with their unique financial objectives and preferences.

Conclusion

Elevating Financial Literacy and Decision-Making with APR and Excel

As we conclude our exploration of the Annual Percentage Rate (APR) and its computation using Microsoft Excel, it becomes evident that these financial tools hold immense potential for empowering individuals to make informed and strategic decisions in the realm of borrowing and lending. Understanding the significance of APR as a comprehensive metric for evaluating the true cost of borrowing is pivotal in navigating the complex landscape of financial products, from mortgages and car loans to credit cards and personal loans.

By delving into the intricacies of APR and mastering the utilization of Excel for APR calculations, individuals can enhance their financial literacy and decision-making prowess. The ability to discern the complete cost of borrowing, encompassing not only the interest rate but also additional fees and charges, equips individuals with the insights needed to select the most advantageous borrowing options aligned with their unique financial goals and circumstances.

Moreover, harnessing Excel’s robust capabilities for APR calculations streamlines the process of obtaining precise and reliable insights into the true cost of borrowing, fostering efficiency and accuracy in financial analyses. The step-by-step guide presented in this article serves as a valuable resource for individuals seeking to navigate the APR calculation process with proficiency and confidence, ultimately facilitating well-informed decision-making.

As individuals embrace the knowledge and proficiency gained from understanding APR and utilizing Excel for APR computations, they are poised to approach borrowing and lending with clarity and precision. This enhanced financial acumen enables individuals to secure the most favorable borrowing terms, aligning with their long-term financial objectives and ensuring optimal affordability and financial well-being.

In essence, the synergy between APR and Excel empowers individuals to transcend the complexities of financial decision-making, fostering a landscape where informed choices pave the way for sustainable financial success. By embracing the insights and tools presented in this article, individuals can embark on their financial journeys with confidence, leveraging the power of APR and Excel to navigate the terrain of borrowing and lending with acumen and assurance.