Finance

How To Find Net Sales On A Balance Sheet

Published: December 27, 2023

Learn how to find net sales on a balance sheet in the field of finance. Master the art of calculating net sales for accurate financial analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how to find net sales on a balance sheet. In the world of finance, understanding the concept of net sales is crucial for individuals and businesses alike. Net sales is a key metric that represents the total revenue generated by a company after deducting any sales returns, allowances, and discounts. It is an important indicator of a company’s performance and financial health.

Net sales play a significant role in financial analysis, as it provides insights into a company’s ability to generate revenue from its core operations. This metric is particularly useful for investors, creditors, and other stakeholders who want to assess a company’s profitability and revenue-generating capabilities.

When analyzing a company’s balance sheet, the section related to net sales reveals important information about the company’s sales performance and the impact of various factors on its revenue. By understanding how to find net sales on a balance sheet, you can gain valuable insights into a company’s financial position and make informed decisions about investing, lending, or partnering with the company.

In this guide, we will delve into the concept of net sales, explore its components, and provide step-by-step instructions on how to calculate it from a balance sheet. Whether you are a finance professional, a business owner, or an individual interested in understanding financial statements, this guide will equip you with the knowledge you need to effectively analyze net sales on a balance sheet.

So, let’s dive in and unravel the mysteries of net sales on a balance sheet, and discover how it can be a crucial tool for assessing a company’s financial performance and stability.

Definition of Net Sales

Net sales, also referred to as net revenue or net sales revenue, is a financial metric that represents the total amount of revenue generated by a company through the sale of goods or services. It is an important figure that reflects the true earnings of a company after accounting for various deductions and adjustments.

Net sales take into consideration the impact of sales returns, allowances, and discounts, which are subtracted from gross sales to arrive at the final net sales figure. This metric provides a more accurate representation of a company’s revenue, as it accounts for any sales that are reversed or reduced due to customer refunds, product returns, or allowances granted to customers.

Net sales are typically reported on a company’s income statement, which outlines its financial performance over a specific period of time. By analyzing the net sales figure, investors, creditors, and other stakeholders can assess a company’s ability to generate revenue and understand its profitability. It is important to note that net sales do not include other sources of income such as interest or investment income, which are typically reported separately.

Net sales are a critical metric for evaluating the operational efficiency and financial performance of a company. It provides insights into the effectiveness of a company’s sales and marketing strategies, as well as its ability to attract and retain customers. Companies with high net sales figures often indicate strong market demand for their products or services and a competitive advantage over their industry peers.

Understanding the concept of net sales is essential for financial analysis and decision-making. By assessing this metric, investors can evaluate a company’s revenue growth and compare it to industry benchmarks, while creditors can assess a company’s ability to generate cash flow and repay its debts. Additionally, business owners can use net sales as a performance indicator and identify areas for improvement in their sales and marketing efforts.

In the next section, we will explore the components that make up net sales and provide a deeper understanding of how this metric is derived from a company’s financial statements.

Components of Net Sales

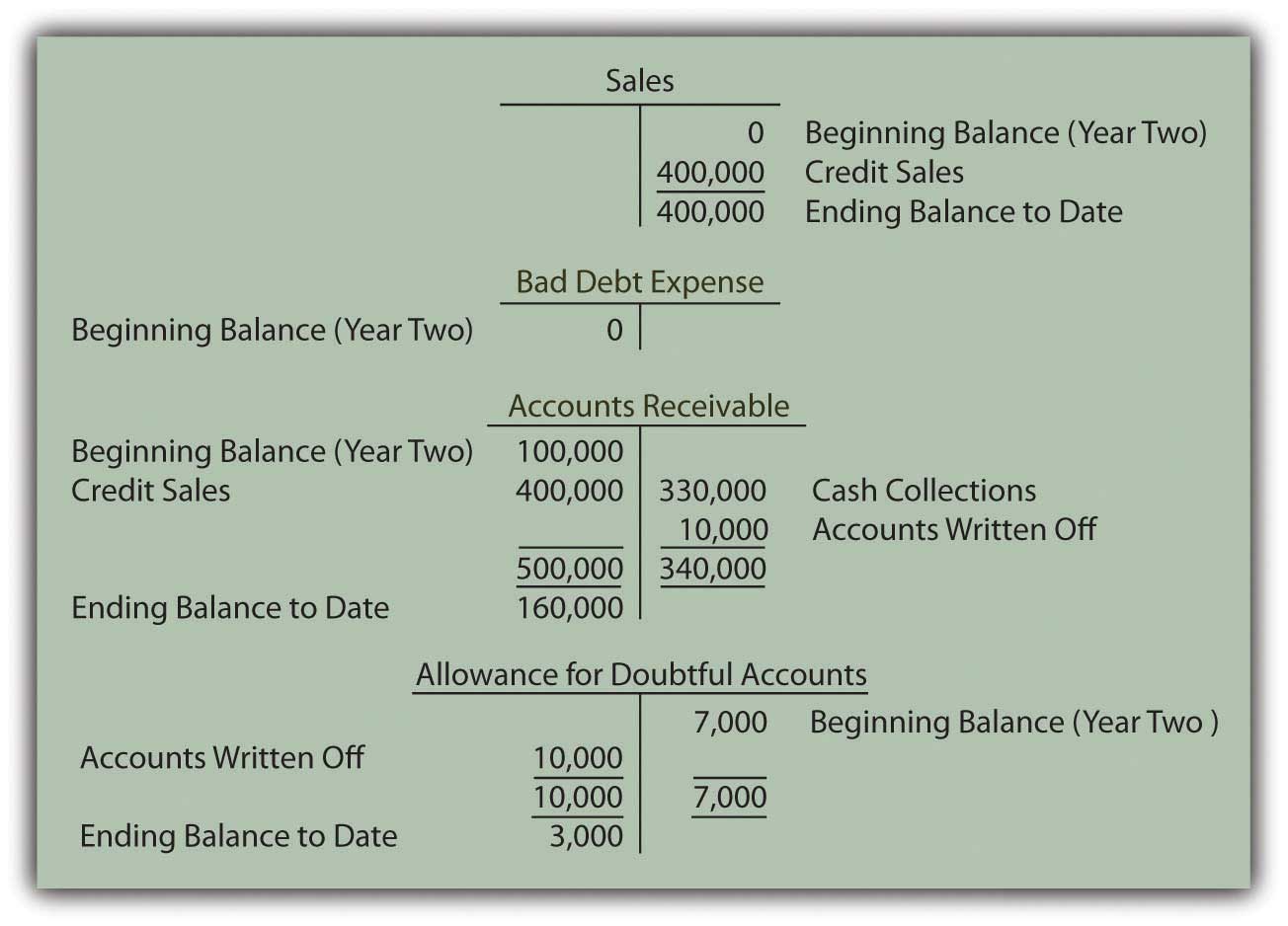

To understand how to find net sales on a balance sheet, it’s important to grasp the various components that make up this metric. Net sales are derived by adjusting gross sales for three key factors: sales returns and allowances, sales discounts, and cost of goods sold.

Gross Sales: Gross sales, also known as gross revenue or gross sales revenue, represent the total value of all sales made by a company within a given period. It includes revenue generated from the sale of goods or services, before any deductions. Gross sales are typically recorded when a transaction occurs, and they form the starting point for calculating net sales.

Sales Returns and Allowances: Sales returns and allowances occur when customers return products or request refunds for various reasons, such as receiving defective or unsatisfactory goods. These returns reduce the overall revenue generated by a company and are subtracted from gross sales to determine net sales. Similarly, sales allowances represent the discounts or adjustments given to customers for issues such as damaged products or pricing discrepancies. These allowances are also subtracted from gross sales to calculate net sales.

Sales Discounts: Sales discounts are incentives offered to customers to encourage prompt payment or bulk purchases. These discounts are usually expressed as a percentage of the total purchase price and are deducted from gross sales to arrive at net sales. Sales discounts incentivize customers to pay their invoices early, which can help companies improve their cash flow and reduce the risk of bad debts.

Cost of Goods Sold: The cost of goods sold (COGS) is the direct cost incurred by a company to produce or acquire the goods or services that were sold. This includes the cost of raw materials, labor, and overhead expenses associated with the production process. To calculate net sales, the COGS is subtracted from the adjusted gross sales figure. This adjustment accounts for the expenses directly related to the production and sale of goods or services, resulting in the final net sales amount.

By understanding these components, individuals can get a complete picture of the factors that impact a company’s net sales figure. Each component plays a critical role in determining the overall revenue and profitability of the business. A deep analysis of these factors can provide valuable insights into a company’s sales performance and help identify areas where improvements can be made.

In the next section, we will explore how to calculate net sales from the various components, providing a step-by-step guide to interpreting the information on a balance sheet.

Gross Sales

Gross sales, often referred to as gross revenue or gross sales revenue, serve as the starting point for calculating net sales on a balance sheet. Gross sales represent the total value of all sales made by a company within a specific period, before any deductions or adjustments are made.

When a sale is made, the revenue generated from that transaction is recorded as part of the gross sales figure. This includes revenue from the sale of goods or services, as well as any other income directly related to the core business operations of the company.

It’s important to note that gross sales include both cash and credit sales. Cash sales refer to transactions where payment is received immediately, while credit sales involve providing goods or services to customers on credit, allowing them to pay at a later date.

Gross sales provide a valuable insight into the overall performance of a company’s sales efforts. It indicates the total volume of sales achieved by the company and reflects the demand for its products or services in the market. Analyzing gross sales over time can help to identify sales trends, seasonality effects, and patterns in consumer behavior.

However, it’s crucial to understand that gross sales alone do not reflect the true profitability or financial health of a company. Gross sales do not account for any returns, allowances, or discounts, and do not consider the costs associated with producing or delivering the goods or services sold.

While gross sales are an important metric for evaluating the sales performance of a company, it is the net sales figure that provides a more accurate representation of the company’s revenue. To arrive at net sales, gross sales must be adjusted for elements like sales returns and allowances, sales discounts, and the cost of goods sold.

In the next section, we will explore the impact of sales returns and allowances on the calculation of net sales, shedding light on their significance in determining a company’s true revenue.

Sales Returns and Allowances

Sales returns and allowances are an important component to consider when calculating net sales on a balance sheet. They represent the transactions where customers return products or receive allowances for various reasons, such as receiving defective or unsatisfactory goods.

Sales returns occur when customers return purchased products due to defects, damages, or other issues. These returns reduce the overall revenue generated by a company. Similarly, sales allowances are granted to customers as a result of issues such as pricing discrepancies or damaged goods. These allowances also reduce the total revenue earned.

Including sales returns and allowances in the calculation of net sales is crucial to accurately reflect a company’s true revenue. By deducting these amounts, the net sales figure reflects the actual revenue received from customers after accounting for sales reversals or reductions.

It’s important to note that sales returns and allowances are typically recorded as separate line items on a company’s income statement or profit and loss statement. These line items help provide transparency in understanding the deductions made from gross sales to arrive at net sales.

Monitoring sales returns and allowances can provide valuable insights into a company’s customer experience and product quality. Frequent or excessive returns may be indicative of product defects or customer dissatisfaction, which can impact a company’s reputation and bottom line. For this reason, companies should strive to identify and address the root causes of returns and resolve customer issues promptly to minimize their impact.

In some cases, companies may choose to provide incentives or alternative solutions to dissatisfied customers instead of accepting returns. This approach helps retain customer loyalty and reduces the number of returns, which can positively impact net sales figures and overall profitability.

Overall, sales returns and allowances play a significant role in calculating net sales and provide valuable insights into a company’s revenue stream. Analyzing trends in sales returns and allowances can help businesses identify areas for improvement in product quality, customer service, and overall customer satisfaction.

Next, we will examine the impact of sales discounts on net sales and explore how they factor into the calculation of a company’s true revenue.

Sales Discounts

Sales discounts are another important component to consider when calculating net sales on a balance sheet. Sales discounts are incentives offered to customers to encourage prompt payment or bulk purchases. These discounts are typically expressed as a percentage of the total purchase price and are deducted from gross sales to arrive at net sales.

The purpose of offering sales discounts is to incentivize customers to settle their invoices early or purchase in larger quantities. By providing these incentives, companies can improve their cash flow by receiving payments sooner and reduce the risk of bad debts.

While sales discounts can be advantageous for companies in terms of improving liquidity, it’s essential to weigh the potential impact on net sales. The amount of sales discounts granted represents a reduction in revenue earned by the company. Therefore, it is subtracted from the gross sales figure to reflect the true revenue received after accounting for these discounts.

It’s important to note that not all customers take advantage of sales discounts. Some customers may not qualify for the discount due to specific terms and conditions, or they may choose not to pay early and forego the discount. Therefore, the deduction for sales discounts from gross sales is only applicable to customers who meet the eligibility criteria and choose to take advantage of the offer.

Sales discounts provide an incentive for customers to maintain a positive relationship with the company and can help strengthen customer loyalty. Offering discounts can also attract new customers who are price-sensitive and value cost savings.

However, it’s crucial for companies to carefully consider the impact of sales discounts on their financial performance and profitability. While offering discounts can increase sales volume in the short term, it may result in lower profit margins if not managed effectively. Balancing the benefits of improved cash flow and increased customer satisfaction with the potential impact on net sales and profitability is crucial.

Monitoring the utilization of sales discounts and analyzing their impact on net sales can provide insights into customer behavior and preferences. This information can help companies refine their pricing strategies, identify opportunities to optimize discounts, and evaluate the overall effectiveness of their sales incentive programs.

Next, we will explore the final component of net sales calculation – the cost of goods sold (COGS) – and its significance in determining the true revenue of a company.

Cost of Goods Sold

The cost of goods sold (COGS) is a critical component when calculating net sales on a balance sheet. It represents the direct expenses a company incurs in producing or acquiring the goods or services that were sold to customers.

The COGS includes factors such as the cost of raw materials, direct labor, and any other direct expenses associated with the production or acquisition of goods or services. It does not include other indirect costs, such as administrative expenses or overhead costs, which are typically recorded separately.

By subtracting the COGS from the adjusted gross sales figure, companies can determine their net sales. This adjustment accounts for the expenses directly attributed to the production and sale of goods or services, providing a more accurate reflection of the company’s revenue.

The COGS is an important metric for evaluating a company’s profitability and cost management. It helps companies analyze the relationship between their sales revenue and the costs involved in producing or acquiring the items sold. By closely monitoring the COGS and identifying ways to optimize it, companies can enhance their profitability and overall financial performance.

A high COGS relative to net sales may indicate inefficiencies in the production process, excessive material or labor costs, or pricing strategies that should be reconsidered. Conversely, a low COGS percentage may suggest effective cost control measures, efficient operations, or economies of scale that lead to higher profit margins.

It’s essential to regularly review and analyze the COGS to identify any potential cost-saving opportunities or areas for improvement. This can involve streamlining the supply chain, negotiating better terms with suppliers, implementing lean manufacturing principles, or exploring alternative sourcing options.

In addition, accurately tracking and categorizing the COGS is crucial for financial reporting and tax purposes. The COGS is typically reported on a company’s income statement or profit and loss statement, providing clarity on the expenses directly associated with generating sales revenue.

Understanding the COGS allows businesses to gain better insights into their true profitability and make informed decisions regarding pricing, product mix, and resource allocation. By effectively managing the COGS, companies can optimize their net sales and improve their overall financial performance.

In the next section, we will delve into the step-by-step process of calculating net sales using the components discussed thus far, providing practical insights to effectively analyze a company’s balance sheet.

Calculating Net Sales

Calculating net sales involves a step-by-step process that takes into account the various components we have discussed: gross sales, sales returns and allowances, sales discounts, and the cost of goods sold (COGS).

The first step is to start with the gross sales figure, which represents the total revenue generated by the company from the sale of goods or services within a specific period. This figure can be obtained from the company’s income statement or revenue reports.

Next, subtract the sales returns and allowances from the gross sales. Sales returns are transactions where customers return products, while allowances represent discounts or adjustments granted to customers. These deductions are made to reflect the reduction in gross sales due to customer reversals.

After accounting for sales returns and allowances, subtract any sales discounts offered to customers. Sales discounts are incentives given to customers to encourage prompt payment or bulk purchases. Deducting these discounts provides a more accurate representation of the net revenue received by the company.

Finally, subtract the COGS from the adjusted gross sales figure. The COGS represents the direct expenses incurred in producing or acquiring the goods or services sold. This deduction accounts for the costs associated with generating the revenue and provides the final net sales figure.

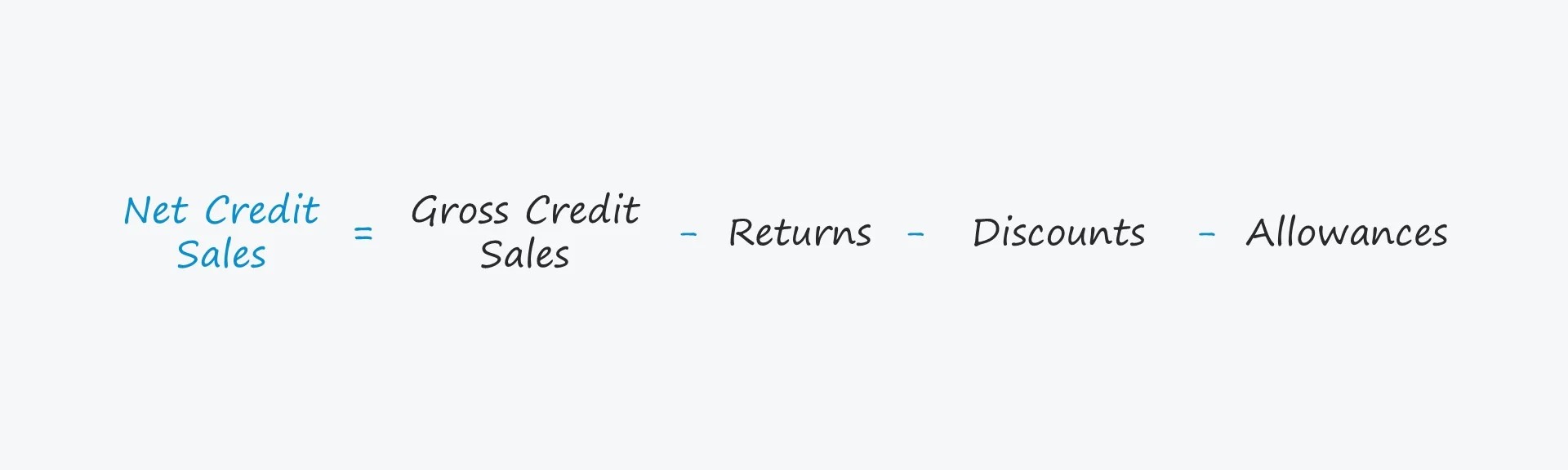

The formula for calculating net sales can be summarized as follows:

Net Sales = Gross Sales – Sales Returns and Allowances – Sales Discounts – COGS

Net sales provide a more accurate reflection of a company’s revenue by considering the deductions and adjustments that impact the final amount received from customers. This metric is a crucial indicator of a company’s sales performance, profitability, and financial health.

It’s important to note that net sales figures should be monitored and analyzed over time, compared to industry benchmarks, and evaluated in the context of the company’s overall financial goals. Understanding the factors that contribute to net sales can help identify areas for improvement, optimize pricing strategies, and enhance sales and marketing efforts.

In the next section, we will explore the significance of net sales on a balance sheet and its importance in understanding a company’s financial position.

Importance of Net Sales on a Balance Sheet

Net sales play a crucial role on a balance sheet, as they provide valuable insights into a company’s financial position, performance, and overall health. Understanding the importance of net sales is essential for investors, creditors, and other stakeholders looking to assess the profitability and revenue-generating capabilities of a company.

Here are key reasons why net sales are significant on a balance sheet:

1. Profitability Assessment: Net sales are a key measure of a company’s profitability. By calculating net sales, investors and stakeholders can evaluate the effectiveness of a company’s sales and marketing strategies, as well as its ability to generate profit from its core operations. Higher net sales indicate better revenue generation and potentially higher profit margins.

2. Financial Performance Evaluation: Net sales provide a comprehensive view of a company’s financial performance. By analyzing net sales over time and comparing them to industry benchmarks, investors can assess the growth trajectory and market competitiveness of the company. Positive trends in net sales indicate a healthy business that is attracting customers and meeting market demand.

3. Cash Flow Analysis: Net sales are closely tied to a company’s cash flow. Generating higher net sales can lead to increased cash inflows, while lower net sales can impact a company’s liquidity. Understanding the net sales figure allows investors and creditors to evaluate a company’s ability to generate cash flow, manage working capital, and meet financial obligations.

4. Industry Comparison: Net sales serve as a benchmark for comparing a company’s performance to its industry peers. Investors and analysts often use net sales figures to assess the market position, market share, and competitiveness of a company within its sector. By comparing net sales across similar companies, stakeholders gain insights into relative market performance and identify potential investment opportunities.

5. Decision-Making Guide: Net sales figures are vital for making informed investment, lending, or partnership decisions. Investors and creditors utilize net sales data to evaluate the financial stability and growth potential of a company. Additionally, business owners can leverage net sales figures to identify areas for improvement, develop sales strategies, and allocate resources effectively.

6. Compliance and Reporting: Net sales figures are crucial for financial reporting and compliance with accounting standards. Companies must accurately report net sales on their financial statements to provide transparency and ensure compliance with regulatory requirements. Properly disclosing net sales figures ensures fair representation of a company’s revenue and financial position.

In summary, net sales on a balance sheet provide key insights into a company’s profitability, financial performance, and market competitiveness. By analyzing net sales, stakeholders can make informed decisions, assess risk, and gain a comprehensive understanding of a company’s revenue-generating capabilities.

Next, we will conclude our guide and recap the key points covered in this article.

Conclusion

Understanding how to find net sales on a balance sheet is crucial for anyone involved in finance or business. Net sales serve as a key metric for evaluating a company’s revenue, profitability, and financial health. By considering the various components of net sales, including gross sales, sales returns and allowances, sales discounts, and the cost of goods sold, stakeholders can gain a comprehensive understanding of a company’s true revenue and financial performance.

Net sales not only provide insights into a company’s sales performance but also help evaluate its ability to generate cash flow, manage costs, and meet financial obligations. They play a vital role in assessing profitability, comparing performance to industry benchmarks, and making informed investment or lending decisions.

By monitoring net sales over time and analyzing trends, investors can assess a company’s growth potential, market competitiveness, and overall financial stability. Business owners can leverage net sales figures to improve sales strategies, optimize pricing, and identify areas for improvement. Net sales also play a significant role in financial reporting, ensuring accurate representation of a company’s revenue on its balance sheet.

In conclusion, net sales on a balance sheet are a crucial aspect of financial analysis and decision-making. By understanding how to calculate net sales and interpret the information presented, individuals can gain valuable insights into a company’s financial position and performance. Whether you are an investor, creditor, or business owner, understanding net sales allows for better evaluation of a company’s revenue generation and overall financial health.

We hope this comprehensive guide has offered you valuable insights into the concept of net sales and its significance on a balance sheet. Armed with this knowledge, you are well-equipped to assess and analyze net sales figures effectively.