Finance

How To Find Net Credit Sales On Balance Sheet

Modified: February 21, 2024

Learn how to find net credit sales on the balance sheet with this comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Net Credit Sales Definition

- Purpose of Finding Net Credit Sales on the Balance Sheet

- How to Calculate Net Credit Sales

- Step 1: Determine the Total Credit Sales

- Step 2: Identify the Total Sales Returns and Allowances

- Step 3: Calculate the Net Credit Sales

- Example Calculation of Net Credit Sales

- Importance of Finding Net Credit Sales

- Conclusion

Introduction

Welcome to our comprehensive guide on how to find net credit sales on the balance sheet. Understanding net credit sales is essential for businesses as it provides valuable insights into their financial performance and customer creditworthiness. By calculating net credit sales, businesses can assess the effectiveness of their credit policies, analyze trends in sales returns and allowances, and make informed decisions regarding credit terms and collection strategies.

Net credit sales refers to the total amount of sales generated by a company through credit transactions after adjusting for sales returns and allowances. It represents the revenue a company earns from selling its products or services to customers on credit, excluding any returns or discounts. Knowing the net credit sales figure can help businesses evaluate the success of their credit sales operations and identify areas where improvements can be made.

In this guide, we will walk you through the steps to calculate net credit sales, using the information available on the balance sheet. We will also provide an example calculation to illustrate the process. Additionally, we will discuss the significance of finding net credit sales and how it can impact financial decision-making within a company.

Whether you are a business owner, an accountant, or an individual interested in understanding the financial performance of a company, this guide will equip you with the knowledge to find net credit sales on the balance sheet and interpret its implications. Let’s dive in!

Net Credit Sales Definition

Net credit sales is a financial metric that represents the total amount of sales generated by a company through credit transactions after adjusting for sales returns and allowances. It reflects the revenue earned by a business from selling its products or services on credit to customers, minus any returns or allowances granted to customers.

When a company sells its products or services on credit, it allows customers to defer payment for a specific period of time. This helps businesses attract customers who may not have immediate funds to make a purchase. However, it also introduces a level of risk as there is a possibility that customers may default on their payment obligations.

The net credit sales figure is crucial for businesses as it provides insights into the effectiveness of their credit policies and the financial health of their customers. It allows companies to assess the extent to which credit sales are contributing to their overall revenue and profitability. By monitoring net credit sales, businesses can gauge the creditworthiness of their customer base and identify potential risks associated with extending credit.

It is important to note that net credit sales should not be confused with total sales, which include both credit sales and cash sales. Net credit sales specifically focus on transactions where customers make purchases on credit, which involves granting payment terms and allowing customers to pay at a later date. Cash sales, on the other hand, involve immediate payment at the time of purchase, and are not considered as part of net credit sales.

Calculating net credit sales is an essential step in analyzing a company’s financial performance. It helps businesses assess the success of their credit sales operations, identify any sales returns or allowances, and make informed decisions regarding credit terms, customer relationships, and collection strategies. By understanding the net credit sales metric, companies can gain valuable insights into their sales performance and make data-driven decisions to improve profitability and mitigate credit risks.

Purpose of Finding Net Credit Sales on the Balance Sheet

Finding net credit sales on the balance sheet serves several important purposes for businesses. It provides valuable information that aids in assessing financial performance, managing credit risk, and making informed business decisions. Let’s explore the key purposes of calculating net credit sales:

- Evaluating Financial Performance: Net credit sales is a key metric that helps businesses assess their financial performance. By analyzing the amount of revenue generated from credit sales, companies can evaluate the overall effectiveness of their sales and credit policies. Comparing net credit sales over different periods allows businesses to identify trends and understand whether their credit sales are growing or declining.

- Assessing Credit Management: Calculating net credit sales allows businesses to monitor and manage their credit risk effectively. It provides insights into the creditworthiness of customers, helping companies identify any potential issues with late payments, defaults, or delinquencies. This information is crucial for setting credit limits, establishing payment terms, and making decisions about extending credit to customers.

- Identifying Sales Returns and Allowances: In the process of calculating net credit sales, businesses can determine their total sales returns and allowances. Sales returns refer to merchandise or products returned by customers due to defects or dissatisfaction, while allowances are reductions in the selling price granted to customers for various reasons. By identifying and analyzing sales returns and allowances, companies can gain insights into product quality, customer satisfaction, and potential areas for improvement.

- Driving Business Decisions: The net credit sales figure obtained from the balance sheet is a critical piece of information for making informed business decisions. For example, businesses can use this metric to evaluate the creditworthiness of new customers before extending credit to them. It also helps in determining whether existing customers should have their credit limits adjusted or credit terms revised. Additionally, companies can use net credit sales data to optimize collection strategies and improve cash flow.

By finding net credit sales on the balance sheet, businesses gain a deeper understanding of their financial performance, credit management, and customer relationships. This knowledge enables them to make more accurate forecasts, refine their business strategies, and navigate challenges effectively. It also facilitates better decision-making regarding credit policies, collection efforts, and overall profitability.

How to Calculate Net Credit Sales

Calculating net credit sales involves a straightforward process that requires information from the balance sheet. By following these steps, businesses can determine their net credit sales figure:

- Step 1: Determine the Total Credit Sales: Start by identifying the total credit sales for the period you are analyzing. This information can usually be found in the income statement or the sales section of the balance sheet. Credit sales are the sales made to customers on credit, where payment is deferred to a later date.

- Step 2: Identify the Total Sales Returns and Allowances: Next, gather the data on sales returns and allowances for the same period. Sales returns refer to merchandise or products returned by customers due to defects or dissatisfaction, while allowances are reductions in the selling price granted to customers for various reasons. You can find this information in the sales returns and allowances section of the income statement or balance sheet.

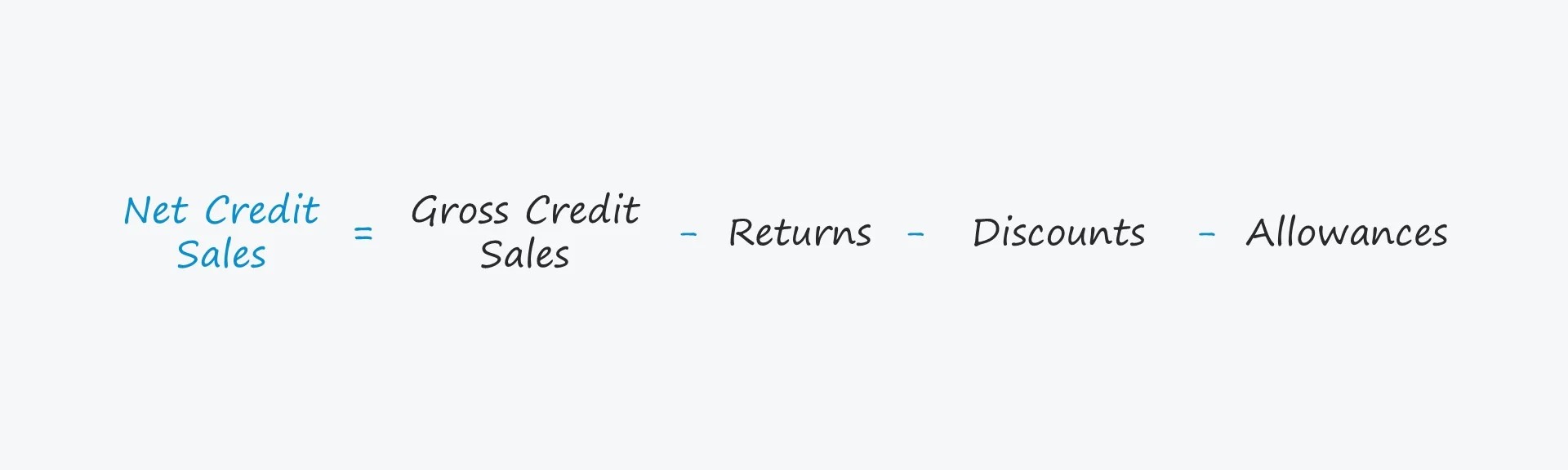

- Step 3: Calculate the Net Credit Sales: To calculate net credit sales, subtract the total sales returns and allowances from the total credit sales. The formula is:

Net Credit Sales = Total Credit Sales – Total Sales Returns and Allowances

The resulting figure represents the revenue generated by the company through credit sales, after adjusting for returns and allowances.

It’s important to note that the net credit sales calculation focuses specifically on credit transactions and does not include cash sales. Cash sales are payments made by customers at the time of the purchase and are not considered part of net credit sales.

Now that we have covered the steps to calculate net credit sales, it’s time to put our knowledge into practice with an example.

Step 1: Determine the Total Credit Sales

The first step in calculating net credit sales is to determine the total credit sales for the period you are analyzing. Credit sales refer to transactions where customers purchase goods or services on credit, meaning they do not make an immediate payment but agree to pay at a later date based on agreed-upon terms.

To find the total credit sales, you need to gather information from the income statement or sales section of the balance sheet. Look for the line item explicitly labeled as “Credit Sales” or “Net Sales” as these figures represent the total amount of sales made on credit.

It’s important to ensure that you are only considering sales made on credit and excluding cash sales. Cash sales are transactions where customers make an immediate payment at the time of purchase and should not be included in the calculation of net credit sales.

If the credit sales figure is not explicitly stated, you may need to calculate it by subtracting cash sales, sales discounts, and sales returns and allowances from the total sales figure. This will give you the net credit sales amount.

Once you have located the total credit sales figure, make note of it as it will be used in the subsequent steps to calculate the net credit sales.

Let’s proceed to the next step, where we will identify the total sales returns and allowances.

Step 2: Identify the Total Sales Returns and Allowances

In the process of calculating net credit sales, the next step is to identify the total sales returns and allowances. Sales returns refer to merchandise or products that customers have returned to the company due to defects, damaged goods, or customer dissatisfaction. Allowances, on the other hand, are reductions in the selling price granted to customers for various reasons, such as pricing errors or customer complaints.

To find the total sales returns and allowances, you need to refer to the income statement or the sales returns and allowances section of the balance sheet. Look for line items specifically labeled as “Sales Returns” or “Allowances.” These figures represent the total monetary value or percentage of sales that have been returned or granted as allowances.

It is important to note that sales returns and allowances should only include transactions related to credit sales. Cash sales should not be considered in this calculation, as they do not impact net credit sales.

Once you locate the total sales returns and allowances figure, make note of it as you will use it in the next step to calculate the net credit sales.

Now that we have identified the total credit sales and total sales returns and allowances, let’s move on to the final step of calculating the net credit sales.

Step 3: Calculate the Net Credit Sales

After determining the total credit sales and identifying the total sales returns and allowances, the final step is to calculate the net credit sales. This step involves subtracting the total sales returns and allowances from the total credit sales.

Using the following formula, you can easily calculate the net credit sales:

Net Credit Sales = Total Credit Sales – Total Sales Returns and Allowances

Subtract the total sales returns and allowances from the total credit sales to obtain the net credit sales figure. This figure represents the amount of revenue generated by the company from credit transactions after taking into account any returns or allowances granted to customers.

The resulting net credit sales figure provides valuable insights into the actual revenue earned by the business from credit sales, excluding any adjustments due to returns or allowances. It helps assess the effectiveness of credit policies, understand the financial impact of sales returns and allowances, and evaluate the success of credit sales operations.

Remember to consider the timeframe for which the calculations are being made, as net credit sales may vary across different periods. It’s good practice to regularly monitor and calculate net credit sales to track trends, make informed business decisions, and manage credit risk effectively.

Now that you know how to calculate net credit sales, let’s move on to an example calculation to illustrate the process.

Example Calculation of Net Credit Sales

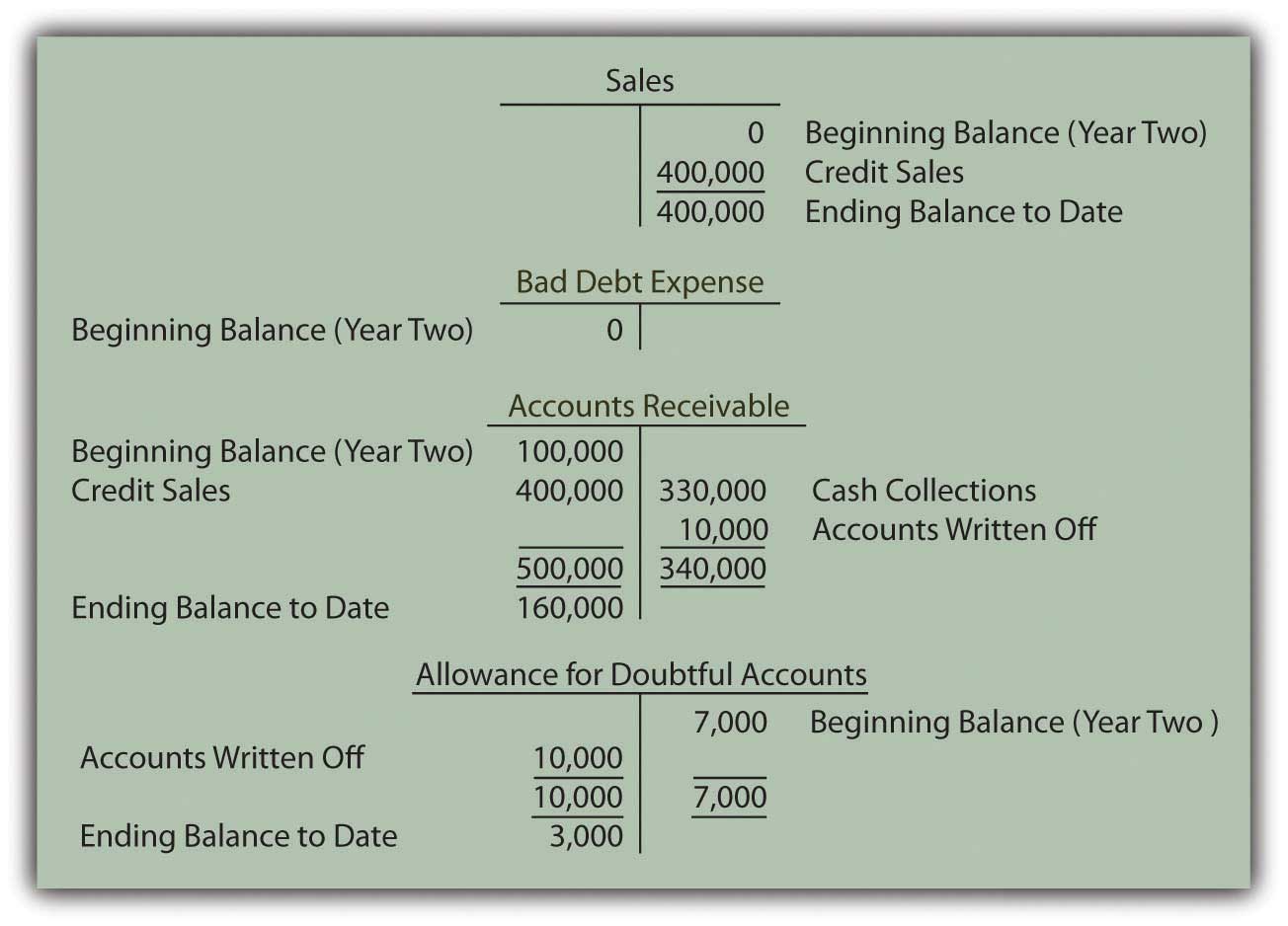

Let’s dive into an example calculation to better understand how to determine net credit sales. Suppose we are analyzing the financial performance of a retail company for the fiscal year 2021. Here are the relevant figures:

- Total Credit Sales: $500,000

- Total Sales Returns: $20,000

- Total Allowances: $10,000

Using these figures, we can calculate the net credit sales as follows:

Net Credit Sales = Total Credit Sales – Total Sales Returns – Total Allowances

Net Credit Sales = $500,000 – $20,000 – $10,000

Net Credit Sales = $470,000

In this example, the net credit sales for the fiscal year 2021 is $470,000. This means that the retail company generated $470,000 in revenue from credit sales after accounting for $20,000 worth of returns and $10,000 in allowances.

Calculating the net credit sales helps the company understand its sales performance, evaluate the effectiveness of its credit policies, and manage credit risks. It provides valuable insights into the financial performance of the business, allowing for better decision-making and strategic planning.

It’s important to note that this is just a simplified example, and in reality, the calculation may involve more intricate details and additional factors specific to the company’s operations and industry. However, by following the same basic principles and using accurate and up-to-date data, businesses can calculate their net credit sales accurately and gain valuable insights into their financial performance.

Understanding the net credit sales figure and its implications helps businesses make informed decisions regarding credit management, sales strategies, and overall profitability.

Now that you have a clear understanding of how to calculate net credit sales, let’s explore the importance of finding net credit sales in the next section.

Importance of Finding Net Credit Sales

Calculating and understanding net credit sales is of paramount importance for businesses, as it provides valuable insights into various aspects of their financial performance and credit management. Let’s explore the significance of finding net credit sales:

- Evaluating Revenue Performance: Net credit sales give businesses a clear picture of the revenue generated from credit sales. It helps assess the extent to which credit transactions contribute to the overall revenue and profitability of the company. Monitoring net credit sales over different periods allows businesses to track trends and identify any fluctuations in sales performance.

- Managing Credit Risk: By knowing the net credit sales figure, businesses can assess the creditworthiness and financial health of their customer base. Monitoring credit sales and understanding the risks associated with extending credit helps companies make informed decisions about credit limits, payment terms, and customer relationships. It enables them to mitigate credit risks and establish effective credit management strategies.

- Evaluating Credit Policies: Net credit sales provide insights into the effectiveness of credit policies implemented by the company. By analyzing the net credit sales figure, businesses can assess whether their credit terms, credit limits, and collection strategies are aligned with their objectives. It helps identify areas where credit policies may need adjustments or improvements to optimize cash flow and minimize bad debt.

- Analyzing Sales Returns and Allowances: Calculating net credit sales involves identifying and accounting for sales returns and allowances. This helps businesses understand the reasons behind customer returns and the impact of allowances on overall sales. Analyzing this data can provide valuable insights into product quality, customer satisfaction, and potential areas for improvement.

- Supporting Financial Decision-making: Net credit sales figures serve as a crucial factor for making informed financial decisions. By understanding the revenue generated through credit sales, businesses can better forecast cash flow, assess their borrowing needs, and evaluate profitability. It also helps them make data-driven decisions regarding credit policies, collection efforts, and overall financial strategies.

Overall, finding net credit sales on the balance sheet is essential for businesses as it allows them to evaluate revenue performance, manage credit risk, assess credit policies, analyze sales returns and allowances, and support financial decision-making. It provides critical insights into the financial health of the business and enables companies to make informed strategic choices to improve profitability and mitigate credit risks.

With a clear understanding of net credit sales, businesses are better equipped to assess their financial performance, make data-driven decisions, and navigate the dynamic landscape of credit sales effectively.

Now, let’s conclude our guide on finding net credit sales.

Conclusion

Understanding how to find net credit sales on the balance sheet is essential for businesses to evaluate their financial performance, manage credit risk, and make informed decisions. Net credit sales represent the revenue generated from credit sales after accounting for sales returns and allowances. By calculating net credit sales, businesses can assess the effectiveness of their credit policies, analyze trends in sales returns and allowances, and make data-driven decisions regarding credit terms and collection strategies.

In this comprehensive guide, we have walked through the process of calculating net credit sales. We started by defining net credit sales and its importance. We then covered the steps involved in determining net credit sales, including identifying total credit sales, total sales returns, and allowances. We also provided an example calculation to illustrate the process.

We highlighted the importance of finding net credit sales, emphasizing its role in evaluating revenue performance, managing credit risk, evaluating credit policies, and supporting financial decision-making. Net credit sales offer businesses valuable insights into their financial health, customer creditworthiness, and overall profitability.

By regularly calculating net credit sales and analyzing the resulting figures, businesses can gain a deeper understanding of their credit sales operations, identify areas for improvement, and make informed decisions to optimize cash flow and mitigate credit risks.

We hope this guide has equipped you with the knowledge and tools to find net credit sales on the balance sheet. Whether you are a business owner, an accountant, or an individual interested in understanding financial performance, understanding net credit sales is essential for effective financial management and decision-making.

Remember, net credit sales not only provide valuable financial insights but also assist businesses in fostering positive customer relationships, implementing effective credit policies, and driving overall business success.

Thank you for joining us on this journey to demystify net credit sales. We hope you found this guide informative and useful!