Finance

How To Find Change In Net Working Capital

Published: December 19, 2023

Looking for ways to find the change in net working capital in finance? Discover effective techniques and strategies in this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Net Working Capital

- Importance of Change in Net Working Capital

- Determining Change in Net Working Capital

- Analyzing Accounts Receivable and Payable

- Evaluating Inventory Changes

- Tracking Cash Flow Changes

- Calculating Change in Net Working Capital

- Interpreting Change in Net Working Capital

- Conclusion

Introduction

Understanding and effectively managing working capital is crucial for any business, regardless of its size or industry. Working capital represents the funds available to a company for day-to-day operations. It is primarily derived from the company’s current assets (such as cash, accounts receivable, and inventory) and is used to cover short-term liabilities (such as accounts payable and operating expenses).

One essential aspect of working capital is net working capital, which is the difference between current assets and current liabilities. It serves as a measure of a company’s short-term liquidity and financial health. A positive net working capital indicates that a company has sufficient funds to meet its short-term obligations, while a negative net working capital indicates potential financial difficulties.

In order to effectively manage working capital, it is important to understand the concept of change in net working capital. Change in net working capital refers to the difference between the net working capital of two consecutive accounting periods. This measurement provides valuable insights into a company’s efficiency in managing its current assets and liabilities over time.

Determining and analyzing the change in net working capital is crucial for businesses as it helps identify trends, evaluate financial performance, and make informed decisions. This article aims to provide a comprehensive guide on how to find and interpret change in net working capital, with a focus on key factors such as accounts receivable, accounts payable, inventory, and cash flow.

By mastering the concept of change in net working capital, businesses can gain valuable insights into their financial well-being, improve cash flow management, and make informed decisions to optimize their working capital levels.

Understanding Net Working Capital

Net working capital is a critical financial metric that showcases a company’s ability to meet its short-term financial obligations. Calculating net working capital involves subtracting the current liabilities from the current assets. The resulting number represents the amount of capital that a business has readily available to cover its day-to-day operational expenses.

A positive net working capital indicates that a company has more current assets than current liabilities. This surplus provides a cushion for meeting financial obligations, such as paying suppliers, funding inventory purchases, and covering operating expenses. It also indicates that a business has sufficient liquidity to operate without relying too heavily on external financing sources.

On the other hand, a negative net working capital indicates that a company has more current liabilities than current assets. This deficiency may pose challenges in meeting short-term obligations and suggests potential cash flow difficulties. Businesses with negative net working capital may need to rely on external financing, such as loans or credit lines, to cover their expenses.

Proper management of net working capital is vital for business sustainability and growth. It ensures that a company has enough working capital to support its daily operations while maintaining a healthy financial position. Monitoring net working capital regularly allows businesses to identify potential liquidity issues, take corrective measures, and optimize their cash flow management strategies.

It is worth noting that the ideal net working capital level varies across industries. Some industries, such as retail or manufacturing, may require higher levels of working capital due to inventory investments and longer cash conversion cycles. Conversely, service-based businesses may have lower working capital needs due to shorter sales cycles and minimal inventory requirements.

Overall, understanding net working capital is essential for businesses as it provides insights into their liquidity, financial health, and ability to meet short-term obligations. By effectively managing net working capital, companies can enhance their operational efficiency, strengthen their financial position, and make informed decisions to drive sustainable growth.

Importance of Change in Net Working Capital

The change in net working capital is a crucial indicator of a company’s financial performance and operational efficiency. It measures the fluctuation in a company’s liquidity position over a specific period of time. Understanding and analyzing the change in net working capital is vital for several reasons:

- Assessing Financial Health: The change in net working capital provides valuable insights into a company’s financial health. A positive change indicates an increase in liquidity, which suggests that a business has improved its ability to meet short-term obligations. Conversely, a negative change indicates potential cash flow issues and a need for further analysis and corrective actions.

- Identifying Trends and Patterns: Monitoring the change in net working capital over time helps identify trends and patterns in a company’s working capital management. Consistently positive changes indicate effective management of current assets and liabilities, while consistent negative changes may signal underlying inefficiencies in cash flow management or operational practices.

- Evaluating Efficiency: Analyzing the change in net working capital allows businesses to evaluate their efficiency in managing current assets and liabilities. For example, a decrease in accounts receivable or an increase in accounts payable may indicate improved cash collection or better vendor payment terms, respectively, resulting in more favorable cash flow and working capital position.

- Making Informed Decisions: The change in net working capital serves as a valuable tool for decision-making. By understanding the factors contributing to the change, businesses can make informed decisions regarding inventory management, credit policies, vendor negotiations, and financing strategies to optimize their working capital levels.

- Enhancing Cash Flow Management: Analyzing the change in net working capital helps businesses identify opportunities to enhance their cash flow management. By focusing on managing current assets (such as accounts receivable and inventory) and current liabilities (such as accounts payable), companies can improve cash conversion cycles, reduce reliance on external financing, and maintain a healthy liquidity position.

In summary, the change in net working capital is a crucial metric for evaluating a company’s financial health, identifying trends, evaluating efficiency, making informed decisions, and enhancing cash flow management. By closely monitoring and analyzing the change in net working capital, businesses can optimize their working capital levels, improve operational efficiency, and ensure long-term sustainability and growth.

Determining Change in Net Working Capital

Determining the change in net working capital involves calculating the difference between the net working capital of two consecutive accounting periods. This calculation provides valuable insights into how a company’s liquidity position has changed over time. To determine the change in net working capital, the following key factors need to be considered:

- Accounts Receivable: Start by calculating the change in accounts receivable, which represents the money owed to the company by its customers. Compare the accounts receivable balance at the end of the current period with the accounts receivable balance at the end of the previous period. A decrease in accounts receivable indicates improved cash collection and contributes to a positive change in net working capital.

- Accounts Payable: Next, calculate the change in accounts payable, which represents the money owed by the company to its suppliers or creditors. Compare the accounts payable balance at the end of the current period with the accounts payable balance at the end of the previous period. An increase in accounts payable indicates extended vendor payment terms and contributes to a positive change in net working capital.

- Inventory: Evaluate the change in inventory, which represents the value of goods held by the company for sale. Compare the inventory balance at the end of the current period with the inventory balance at the end of the previous period. A decrease in inventory indicates efficient inventory management and contributes to a positive change in net working capital.

- Other Current Assets and Liabilities: Consider the change in other current assets and liabilities, such as prepaid expenses, accrued liabilities, and short-term investments. Calculate the change in each of these categories and include them in the overall calculation of the change in net working capital.

By combining the changes in accounts receivable, accounts payable, inventory, and other current assets and liabilities, businesses can determine the overall change in net working capital. This calculation provides a clear picture of how a company’s liquidity position has shifted between two accounting periods.

It is important to note that the change in net working capital calculation should be based on consistent accounting periods to ensure accurate comparisons. Additionally, any non-cash items or extraordinary transactions should be excluded from the calculation to focus solely on the change in working capital related to day-to-day operations.

By effectively determining the change in net working capital, businesses can gain valuable insights into their working capital management practices, identify areas for improvement, and make informed decisions to optimize their financial performance.

Analyzing Accounts Receivable and Payable

When analyzing the change in net working capital, it is important to closely examine the accounts receivable and accounts payable components. These two factors have a significant impact on a company’s cash flow and overall financial health. Here’s how to analyze accounts receivable and payable:

Accounts Receivable:

Accounts receivable represents the amount of money owed to a company by its customers for goods or services provided on credit. Analyzing accounts receivable helps businesses understand their cash collection efficiency and identify any potential issues. It involves assessing the following:

- Average Collection Period: Calculate the average number of days it takes for a company to collect payment from its customers. Compare this period with previous accounting periods to determine any changes. A decrease in the average collection period indicates improved cash collection efficiency and contributes to a positive change in net working capital.

- Bad Debt Ratio: Evaluate the proportion of accounts receivable that is considered uncollectible or at high risk of non-payment. A decrease in the bad debt ratio indicates effective credit management practices and contributes to a positive change in net working capital.

- Credit Policies: Review the company’s credit policies, including credit terms, credit limits, and customer evaluation processes. Assess if any changes or adjustments to these policies have influenced the accounts receivable balance and the overall change in net working capital.

Accounts Payable:

Accounts payable represents the money owed by the company to suppliers, vendors, or creditors. Analyzing accounts payable helps businesses manage their cash flow and vendor relationships effectively. Consider the following when analyzing accounts payable:

- Payment Terms: Examine the payment terms negotiated with suppliers or vendors. Assess if any changes in payment terms have affected the accounts payable balance and the overall change in net working capital. Longer payment terms contribute to a positive change in net working capital by allowing more time to use cash for other business purposes.

- Vendor Relationships: Evaluate the relationships with suppliers or vendors. Assess if there have been any changes in pricing, discounts, or incentives offered by vendors that have influenced the company’s accounts payable balance and the overall change in net working capital.

- Efficiency of Payment Process: Review the company’s payment process to ensure timely and accurate payments to suppliers. Inefficient payment processes can result in late payment penalties, strain vendor relationships, and potentially impact the change in net working capital.

By thoroughly analyzing accounts receivable and payable, businesses can gain insights into their cash flow management, customer creditworthiness, relationships with suppliers, and overall financial health. This analysis helps identify areas for improvement, optimize working capital, and make informed decisions to enhance the company’s financial performance.

Evaluating Inventory Changes

Inventory is a critical component of a company’s working capital and can significantly impact the change in net working capital. Managing inventory effectively is essential to maintain optimal cash flow and operational efficiency. When evaluating inventory changes, consider the following factors:

- Inventory Turnover: Calculate the inventory turnover ratio, which measures how efficiently a company manages its inventory. The ratio is obtained by dividing the cost of goods sold by the average inventory value. Comparing inventory turnover ratios across different accounting periods can help identify trends and indicate if inventory management practices are improving or deteriorating.

- Obsolete or Slow-Moving Inventory: Identify any obsolete or slow-moving inventory items that may be tying up valuable working capital. Obsolete inventory is inventory that is no longer in demand or usable, while slow-moving inventory consists of items with low turnover rates. Analyzing the change in obsolete or slow-moving inventory can highlight the effectiveness of inventory management strategies and shed light on potential financial risks.

- Demand Forecasting: Evaluate the company’s ability to accurately forecast demand and adjust inventory levels accordingly. Maintaining an optimal balance of inventory prevents overstocking or understocking situations that can negatively impact cash flow and overall working capital. Effective demand forecasting minimizes carrying costs and ensures that inventory turnover remains efficient.

- Supplier Relations: Assess the company’s relationships with suppliers to determine if any changes have affected inventory levels and the overall change in net working capital. Collaborative relationships with suppliers can facilitate favorable pricing terms, inventory management support, and faster delivery times, resulting in improved working capital management.

- Inventory Valuation: Analyze the method used to value inventory, such as the First-In, First-Out (FIFO) or the Last-In, First-Out (LIFO) method. Different inventory valuation methods can have varying impacts on the balance sheet and the change in net working capital. Understanding the effects of inventory valuation methods is crucial for accurate financial reporting and analysis.

By evaluating inventory changes, businesses can identify opportunities to optimize inventory management practices, minimize carrying costs, and improve working capital efficiency. Efficient inventory management ensures that the right products are available at the right time, prevents overstocking or understocking situations, and helps maintain a healthy balance between cash flow and liquidity.

Tracking Cash Flow Changes

Cash flow is a fundamental aspect of a company’s financial performance and plays a crucial role in determining the change in net working capital. Monitoring and tracking cash flow changes allow businesses to identify trends, assess liquidity, and make informed decisions regarding working capital management. When tracking cash flow changes, consider the following factors:

- Operating Activities: Evaluate the cash flow generated from the core operations of the business. Analyze the change in cash flow from sales, accounts receivable collections, and day-to-day expenses. Positive cash flow from operating activities contributes to a positive change in net working capital.

- Investing Activities: Assess the change in cash flow resulting from investing activities such as capital expenditures, acquisitions, or investments in marketable securities. Significant cash outflows from investing activities may impact the change in net working capital, as it affects the company’s overall liquidity position.

- Financing Activities: Track the change in cash flow related to financing activities, including equity or debt financing, dividend payments, and loan repayments. Changes in financing activities can influence the overall cash flow position and subsequently impact the change in net working capital.

- Working Capital Ratio: Calculate the working capital ratio, which compares current assets to current liabilities. Monitoring changes in the working capital ratio helps track the overall liquidity position and identifies any significant shifts that may impact the change in net working capital.

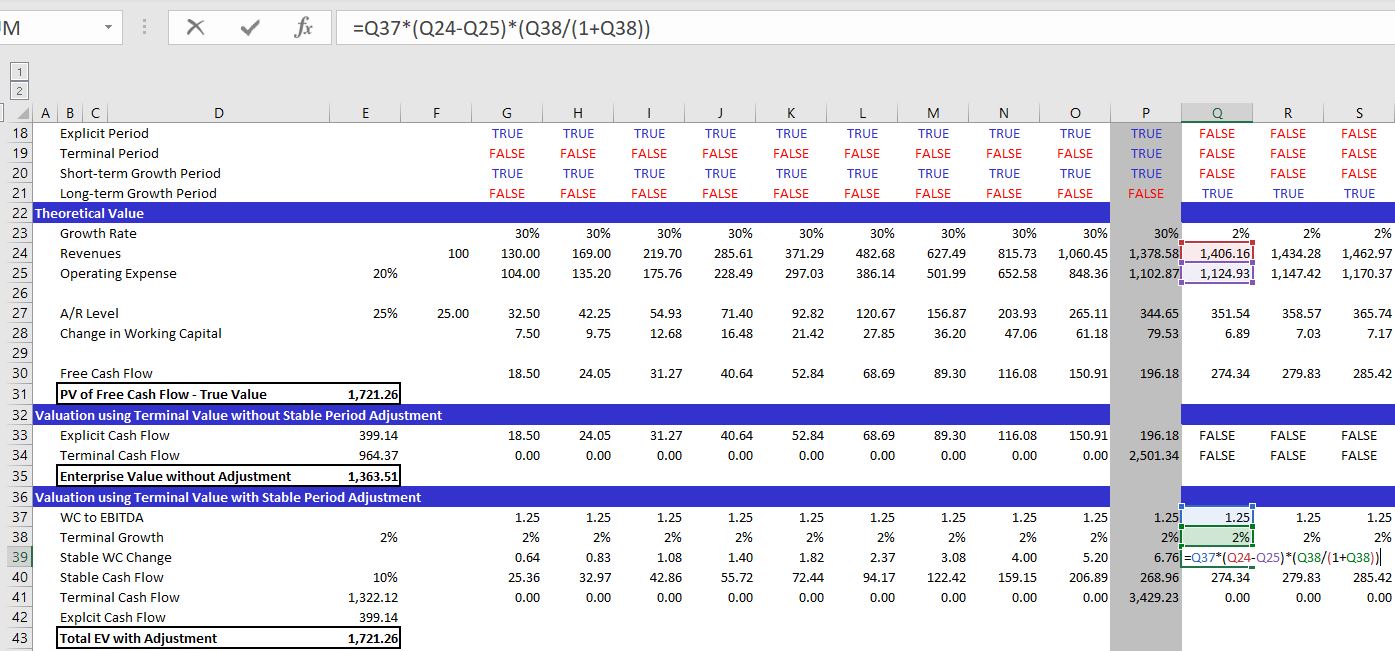

- Cash Conversion Cycle: Evaluate the cash conversion cycle, which includes the time it takes to convert inventory into sales, accounts receivable collections, and payment of accounts payable. Analyzing changes in the cash conversion cycle helps identify opportunities to optimize working capital management and improve cash flow.

Tracking cash flow changes enables businesses to understand the sources and uses of cash, identify areas of improvement, and make informed decisions to optimize working capital. By closely monitoring cash flow, businesses can proactively manage their financial resources, enhance liquidity, and effectively respond to changes in the business environment.

It is important to note that cash flow changes should be evaluated in conjunction with other financial metrics and factors influencing the change in net working capital. This comprehensive analysis provides a holistic view of a company’s financial performance and enables businesses to develop effective strategies to maintain a healthy working capital position.

Calculating Change in Net Working Capital

The change in net working capital is calculated by comparing the net working capital of two consecutive accounting periods. This calculation provides insight into how a company’s liquidity position has changed over time. To calculate the change in net working capital, follow these steps:

- Identify Current Assets: Determine the total value of current assets at the end of the current accounting period. Current assets typically include cash, accounts receivable, inventory, and other short-term assets.

- Identify Current Liabilities: Determine the total value of current liabilities at the end of the current accounting period. Current liabilities generally include accounts payable, accrued expenses, and short-term debt.

- Calculate Net Working Capital: Subtract the total value of current liabilities from the total value of current assets. The resulting number represents the net working capital for the current accounting period.

- Repeat for Previous Period: Repeat steps 1-3 for the previous accounting period to calculate the net working capital for that period.

- Calculate Change: Subtract the net working capital of the previous period from the net working capital of the current period. The resulting number represents the change in net working capital.

The formula for calculating the change in net working capital can be summarized as follows:

Change in Net Working Capital = Net Working Capital (Current Period) – Net Working Capital (Previous Period)

A positive change in net working capital indicates an increase in liquidity and is generally viewed as favorable. It suggests that a company has improved its ability to meet short-term obligations. Conversely, a negative change in net working capital indicates potential cash flow issues and may require further analysis and corrective actions.

It is important to note that the change in net working capital should be calculated consistently using the same accounting period and methodology to ensure accurate comparisons. Additionally, any non-cash items or extraordinary transactions should be excluded from the calculation to focus solely on changes related to day-to-day working capital management.

By calculating the change in net working capital, businesses can gain a clear understanding of their liquidity position and make informed decisions regarding working capital management, cash flow optimization, and overall financial performance.

Interpreting Change in Net Working Capital

The change in net working capital provides valuable insights into a company’s financial performance and working capital management. Interpreting the change in net working capital involves analyzing the magnitude and direction of the change and understanding its implications. Here are some key considerations when interpreting the change in net working capital:

- Magnitude of Change: Evaluate the magnitude of the change in net working capital. A significant change, whether positive or negative, indicates a potential shift in a company’s liquidity position and warrants closer examination. A larger change suggests a greater impact on a company’s ability to meet short-term obligations.

- Direction of Change: Consider the direction of the change in net working capital. A positive change indicates an increase in liquidity and suggests improved working capital management. It may be the result of factors such as efficient cash collection, extended payment terms, or effective inventory management. Conversely, a negative change suggests potential cash flow challenges and may indicate issues with accounts receivable, inventory management, or increased liabilities.

- Trends and Patterns: Analyze the change in net working capital over multiple accounting periods to identify trends and patterns. Consistent positive changes may indicate effective working capital management practices, while consistent negative changes may highlight underlying inefficiencies or financial risks. Understanding long-term trends helps businesses make strategic decisions to optimize working capital, manage cash flow, and improve profitability.

- Industry Comparison: Compare the change in net working capital to industry benchmarks or peers. This analysis helps contextualize the results and provides insights into a company’s relative performance. If the change in net working capital significantly deviates from industry norms, it may indicate the need for further investigation or adjustments in working capital management strategies.

- Relationship with Other Metrics: Consider the relationship between the change in net working capital and other financial metrics. Evaluate how the change aligns with changes in revenue, profitability, and cash flow. A healthy balance between these metrics suggests effective working capital management and operational efficiency. On the other hand, significant discrepancies may indicate areas of concern that require attention.

Interpreting the change in net working capital provides businesses with valuable insights to understand their liquidity position and make informed decisions. A positive change signifies improved financial health and suggests efficient working capital management. Conversely, a negative change calls for a closer examination of cash flow and working capital management practices. By analyzing the change in net working capital, businesses can identify areas for improvement, optimize their cash flow, and maintain a healthy working capital position for sustained growth.

Conclusion

Managing net working capital is a fundamental aspect of financial management for businesses of all sizes and industries. The change in net working capital provides valuable insights into a company’s liquidity position, working capital management practices, and overall financial health. By understanding and interpreting the change in net working capital, businesses can make informed decisions to optimize their working capital levels and enhance their financial performance.

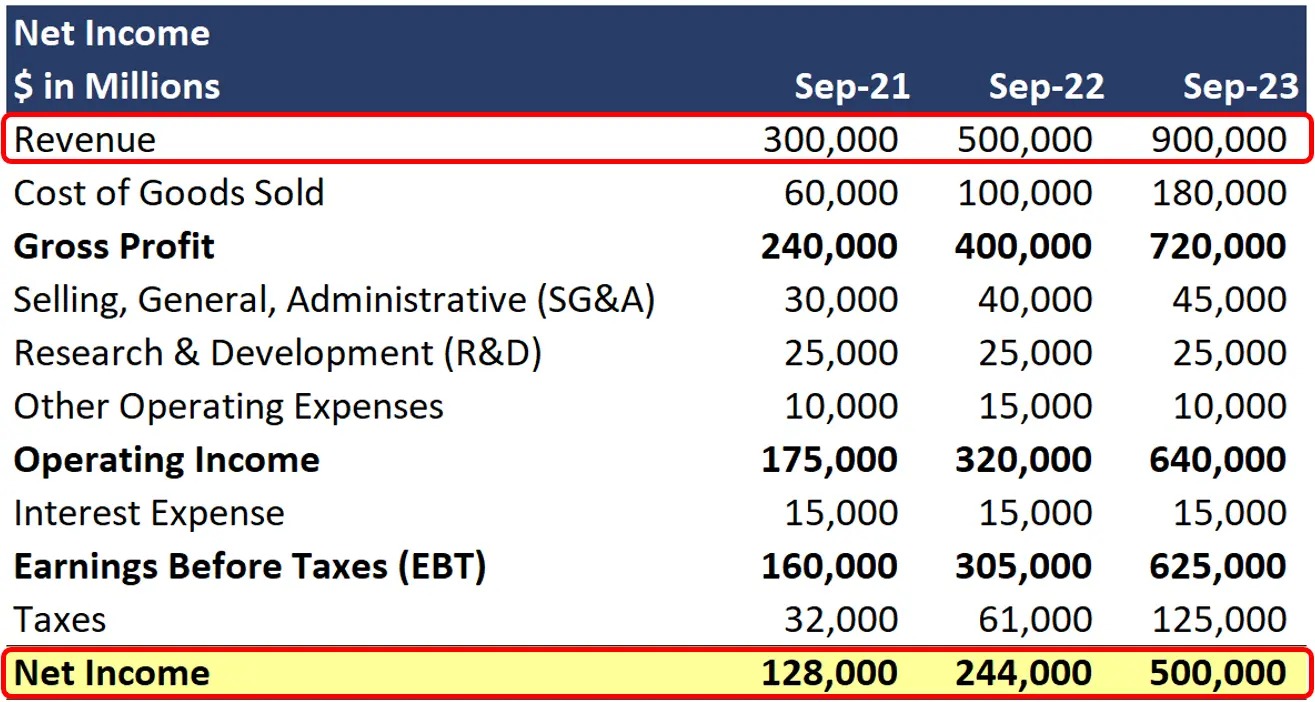

Throughout this article, we have discussed the importance of understanding net working capital and its components, such as accounts receivable, accounts payable, inventory, and cash flow. We have explored how to determine and calculate the change in net working capital, and the significance of analyzing this change. Understanding the interpretation of the change in net working capital allows businesses to identify areas for improvement, track trends, and make data-driven decisions to optimize their working capital management strategies.

Proper management of net working capital ensures that a business has a healthy cash flow and sufficient liquidity to meet short-term obligations. It also facilitates effective inventory management, optimized credit policies, and improved cash collection practices. By monitoring and reacting to changes in net working capital, businesses can maximize their operational efficiency, strengthen financial stability, and support long-term growth.

It is important to note that the change in net working capital should not be considered in isolation. It is advisable to analyze it in conjunction with other financial metrics to gain a comprehensive understanding of a company’s financial performance and working capital dynamics. Comparisons to industry benchmarks and peers also provide valuable insights into a company’s relative performance and areas for improvement.

In conclusion, understanding and effectively managing the change in net working capital is crucial for businesses. By regularly monitoring and evaluating changes in working capital, businesses can make informed decisions to optimize liquidity, enhance cash flow management, and drive long-term success. By implementing sound working capital management practices, businesses can better weather economic downturns, navigate market uncertainties, and position themselves for sustainable growth.