Finance

How To Find Revised Statement Balance

Published: March 2, 2024

Learn how to find your revised statement balance and manage your finances effectively with our expert tips and guidance. Master the art of financial management today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

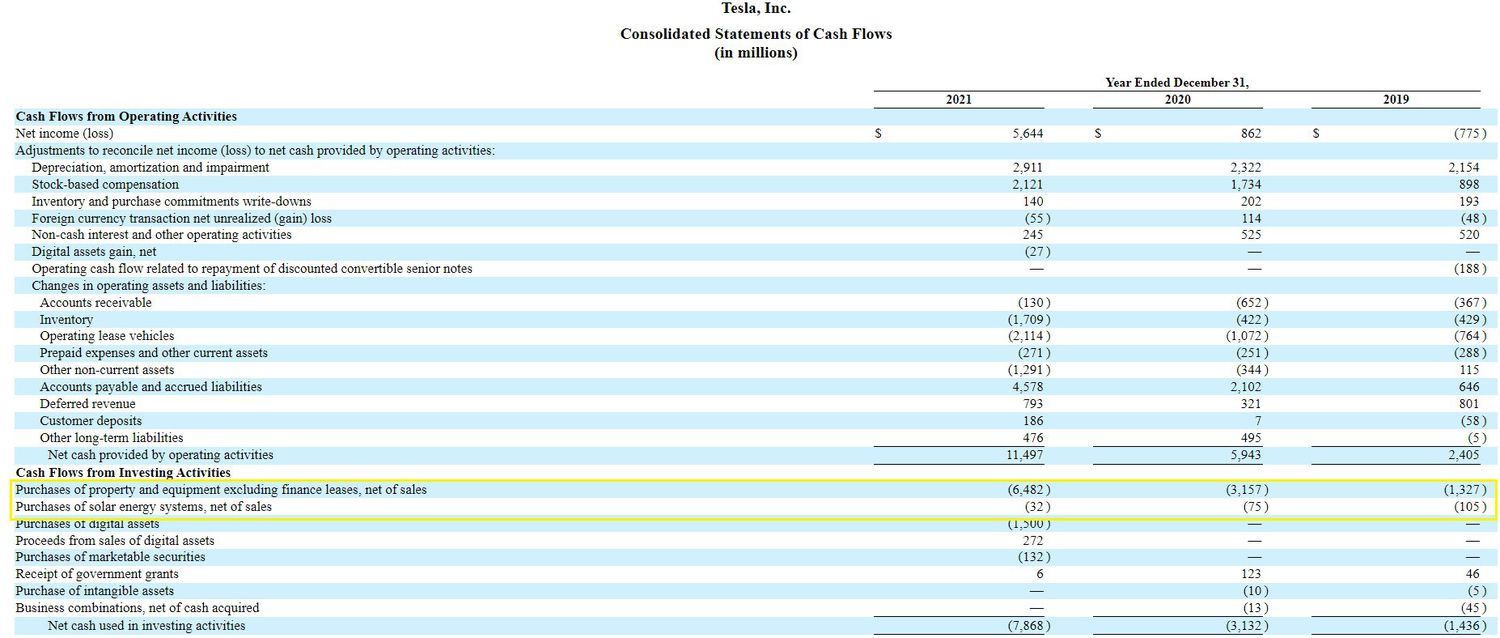

Understanding your financial statements is crucial for managing your personal or business finances effectively. One key element of financial statements is the statement balance, which reflects the total amount of funds in an account at a specific point in time. However, there are instances when the statement balance may need to be revised due to various factors such as errors, discrepancies, or adjustments. In this article, we will delve into the process of finding a revised statement balance, providing you with the knowledge and tools to navigate this aspect of financial management with confidence.

The statement balance serves as a snapshot of your financial position, capturing the funds available in an account at the end of a specified period, typically a month. This balance is essential for reconciling accounts, tracking expenses, and assessing overall financial health. However, discrepancies or errors may arise, necessitating the revision of the statement balance to ensure accuracy and reliability.

Whether you're a business owner, an accounting professional, or an individual managing personal finances, the ability to identify and address revised statement balances is a valuable skill. By understanding the process of locating and verifying revised statement balances, you can maintain financial accuracy, make informed decisions, and uphold the integrity of your financial records.

In the following sections, we will explore the concept of the statement balance in greater detail, examine the reasons for revisions, and provide actionable steps for locating the revised statement balance. By gaining proficiency in this area, you can enhance your financial acumen and streamline the management of your financial accounts.

Let's delve into the intricacies of statement balances and equip ourselves with the knowledge to navigate the process of finding revised balances effectively. Understanding the nuances of financial statements empowers you to make sound financial decisions and maintain precise financial records, ultimately contributing to your financial well-being and success.

Understanding the Statement Balance

Before delving into the intricacies of finding a revised statement balance, it’s essential to grasp the fundamental concept of the statement balance itself. The statement balance represents the total amount of funds in a financial account at a specific point in time, typically at the end of a billing cycle or accounting period. This balance serves as a critical indicator of the account’s financial standing, providing insight into available funds, outstanding transactions, and overall account activity.

When you receive a statement from your financial institution, whether it’s a bank statement, credit card statement, or investment account statement, it includes the statement balance as of the statement date. This balance reflects the net amount of funds in the account after factoring in deposits, withdrawals, purchases, payments, and any applicable fees or interest charges. Understanding the statement balance is essential for assessing your financial position, reconciling accounts, and monitoring cash flow.

Moreover, the statement balance forms the basis for financial decision-making, budgeting, and financial planning. Whether you’re managing personal finances or overseeing business accounts, the accuracy of the statement balance is paramount for making informed choices and maintaining financial stability.

It’s important to note that the statement balance is distinct from the current balance, which represents the real-time amount of funds in the account, accounting for transactions that have occurred since the statement date. Discrepancies between the statement balance and the current balance can arise due to pending transactions, holds, or other factors, underscoring the need for periodic reconciliation and verification.

By comprehending the significance of the statement balance and its role in financial management, you lay the groundwork for effectively navigating the process of finding revised statement balances. Whether you’re conducting personal financial reconciliation or overseeing corporate accounting, a solid understanding of the statement balance is indispensable for maintaining financial accuracy and making informed decisions.

Now that we’ve established a foundational understanding of the statement balance, let’s proceed to explore the process of checking for revisions and locating the revised statement balance, equipping you with the knowledge and strategies to ensure the precision and integrity of your financial records.

Checking for Revisions

Once you’ve grasped the significance of the statement balance, it’s vital to recognize the circumstances that may prompt revisions to this critical financial indicator. Revisions to the statement balance can stem from various factors, including errors in recording transactions, banking discrepancies, or adjustments made by the financial institution. When checking for revisions, it’s essential to be vigilant and thorough in reviewing your financial statements to identify any discrepancies or inconsistencies that may warrant a revised statement balance.

Common scenarios that may necessitate revisions to the statement balance include errors in recording deposits or withdrawals, unauthorized transactions, processing delays, or adjustments for accrued interest or fees. Additionally, if you’ve initiated transactions close to the statement date, such as electronic transfers or bill payments, these transactions may not be reflected in the initial statement, potentially impacting the accuracy of the statement balance.

Furthermore, if you’ve reported discrepancies or unauthorized activity to your financial institution, they may conduct an investigation and subsequently revise the statement balance to rectify the inaccuracies. It’s crucial to stay informed about any ongoing investigations or disputes that may affect the accuracy of your statement balance, as these circumstances can lead to revisions that impact your financial records.

When checking for revisions, meticulously review your financial statements, paying close attention to transaction details, dates, and amounts. Compare the statement balance with your records, including receipts, transaction logs, and digital banking records, to identify any disparities that may indicate the need for a revised statement balance. Additionally, stay attuned to communications from your financial institution regarding updates or corrections to your statement balance, as proactive awareness is key to maintaining financial accuracy.

By being proactive in checking for revisions and remaining vigilant in monitoring your financial statements, you demonstrate a commitment to upholding the precision and integrity of your financial records. This diligence not only safeguards against potential discrepancies but also fosters a comprehensive understanding of your financial standing, empowering you to make informed decisions and take appropriate actions to address any discrepancies or revisions that may arise.

With a keen awareness of the circumstances that may prompt revisions and a proactive approach to reviewing your financial statements, you are well-positioned to navigate the process of locating the revised statement balance with confidence and precision.

Locating the Revised Statement Balance

Once you’ve identified the need for a revised statement balance through diligent review and scrutiny of your financial statements, the next step is to navigate the process of locating this revised balance. This entails engaging with your financial institution, leveraging digital banking tools, and adhering to best practices for verifying and reconciling your financial records.

When a revision to your statement balance is warranted, initiate communication with your financial institution to inquire about the nature of the revision, the specific transactions or adjustments that prompted the change, and the updated statement balance. Whether through online banking platforms, customer service channels, or in-person interactions at a branch, seek clarity and documentation regarding the revised statement balance to ensure comprehensive understanding and accuracy.

Utilize digital banking resources to access updated account information, transaction histories, and revised statements. Many financial institutions offer secure online portals and mobile applications that enable account holders to view real-time balances, monitor transaction activity, and access revised statements promptly. Leveraging these digital tools empowers you to stay informed about any revisions to your statement balance and facilitates seamless reconciliation of your financial records.

When verifying the revised statement balance, cross-reference the updated information with your existing records, including receipts, transaction logs, and any documentation related to the transactions prompting the revision. This meticulous comparison enables you to confirm the accuracy of the revised balance and identify any discrepancies that may require further clarification or resolution.

Adhering to best practices for reconciling your financial records, such as maintaining organized transaction logs, promptly addressing discrepancies, and documenting communications with your financial institution, enhances your ability to navigate the process of locating the revised statement balance effectively. By upholding these practices, you demonstrate a commitment to financial accuracy and accountability, fostering a comprehensive and reliable financial management approach.

Moreover, remaining proactive and engaged in the process of locating the revised statement balance reinforces your financial acumen and empowers you to uphold the integrity of your financial records. This proactive stance not only ensures the accuracy of your financial statements but also cultivates a deeper understanding of your financial standing, enabling you to make informed decisions and manage your finances with confidence.

By engaging with your financial institution, leveraging digital banking resources, and adhering to best practices for reconciling your financial records, you can effectively locate the revised statement balance, affirming the accuracy and reliability of your financial records and reinforcing your financial management prowess.

Conclusion

Understanding the nuances of statement balances and the process of finding revised balances is integral to maintaining financial accuracy and making informed decisions. The statement balance serves as a pivotal indicator of your financial standing, providing a snapshot of available funds and account activity at a specific point in time. However, the potential for revisions to the statement balance underscores the importance of vigilance and proactive engagement in managing your financial records.

By comprehending the significance of the statement balance and its role in financial management, you lay the groundwork for effectively navigating the process of finding revised statement balances. Vigilant scrutiny of your financial statements, proactive communication with your financial institution, and leveraging digital banking resources are essential components of this process, enabling you to locate and verify revised statement balances with precision and confidence.

When checking for revisions, meticulous review of transaction details, comparison with your records, and proactive awareness of potential discrepancies are key elements of maintaining financial accuracy. This diligence not only safeguards against potential discrepancies but also fosters a comprehensive understanding of your financial standing, empowering you to make informed decisions and take appropriate actions to address any revisions that may arise.

Engaging with your financial institution, leveraging digital banking tools, and adhering to best practices for reconciling your financial records are crucial steps in locating the revised statement balance. This proactive stance not only ensures the accuracy of your financial statements but also cultivates a deeper understanding of your financial standing, enabling you to make informed decisions and manage your finances with confidence.

Ultimately, the ability to navigate the process of finding revised statement balances empowers you to maintain precise financial records, make informed decisions, and uphold the integrity of your financial accounts. By honing this skill, whether in personal finance management or business accounting, you fortify your financial acumen and contribute to the stability and reliability of your financial records.

Armed with the knowledge and strategies outlined in this article, you are well-equipped to navigate the complexities of finding revised statement balances, ensuring the accuracy and reliability of your financial records and bolstering your financial management prowess.