Home>Finance>The Ultimate Guide On How To Save A Million Dollars

Finance

The Ultimate Guide On How To Save A Million Dollars

Modified: September 6, 2023

Discover how you can save a million dollars. With our easy to understand guide, you will be well on your way to becoming a millionaire.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Just like any other dream, thinking about how to save a million dollars can be intimidating. A lot of people share this desire, probably more than you know. You could continue daydreaming as much as you want, or you could take that first step.

However, once you set your mind to it, you should know, you are already halfway there! This guide will teach you all you need to know about how to save a million dollars.

The first thing you ought to do is plan. How badly do you want your first million? And when are you looking to have it by? What can you do to achieve it? Exactly how much should you save and how long would it take you?

You see, having solid answers to these questions is important because this would serve as the foundation of your whole journey. Don’t forget to consider your current income, expenses and savings rate.

At this point, you might have already realized that it would be a lot better to resort to bigger savings, wiser expenses, and an earlier, much sooner start. All the answers are within you, and our insightful guide hopes to answer any questions you might have.

Setting Your Plan To Saving A Million Dollars

“Why do you want to have 1 million dollars?”. Your reason could be several things – from wanting to afford a house and car, to aspiring to travel around the world, to seeking financial freedom.

Whatever your reason might be, make sure to have a clear vision of it. If at any point you feel things are getting too hard, refer back to the reason you started in the first place. Nobody said that learning how to save a million dollars was going to be easy – we said it was possible.

Once you have decided where you are going, you ask yourself when you plan to get there. This determines how much you have to keep aside and for how long. Moreover, your answer here would heavily affect the things that you plan to do in order to save your first million.

To wrap up your first step, you must have clear answers to 4 questions: why you want to save a million dollars, when you want to achieve it, how much you plan to put in savings and for how long.

Now, you are ready to embark on the second step.

Saving Your First Million

A good way to start saving a million dollars is by starting with what you already have. It pertains to your current income, and how much you are putting into savings and investments from it.

You might have started saving some already, which is good. However, it would be better if you do it wisely. Mindlessly putting money aside will probably not get you very close to saving a million dollars.

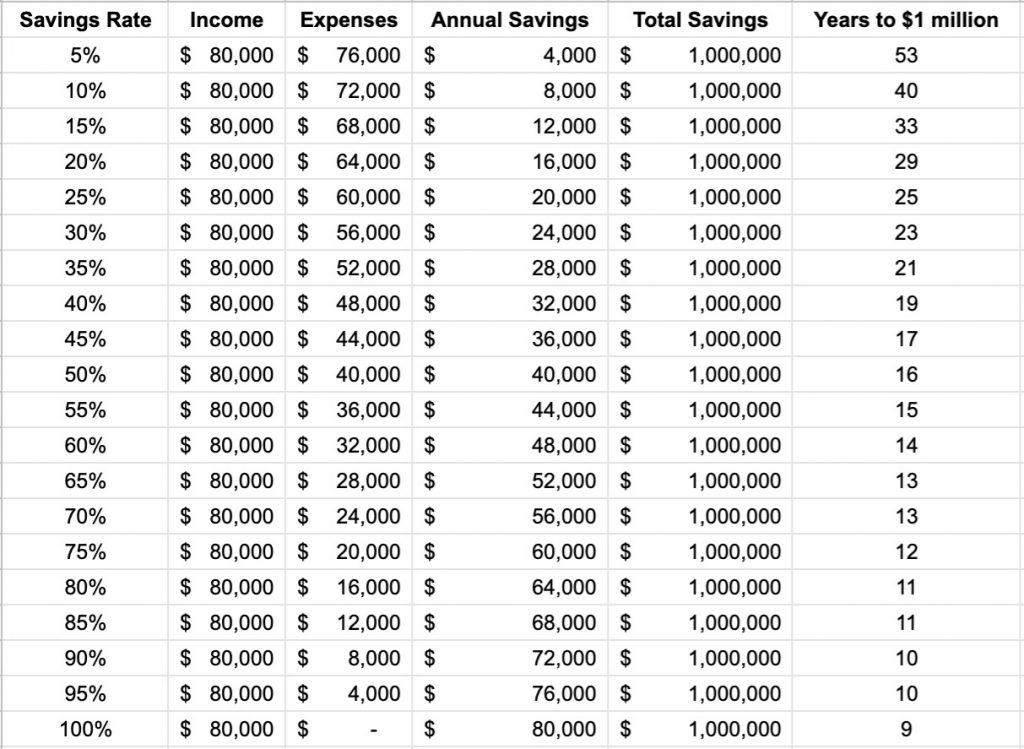

Instead, you could make use of a money-saving chart. Lay down your income, expenses, savings rate, expected monthly and annual savings from that percentage.

After this, compute the number of years it would take you to reach 1 million dollars from the figures you have input. This method will give you a clear and tangible vision for your goal and could steer you away from unnecessary heartache.

See this sample chart based on an income of $50,000.

Looking at this chart, you will see that it started with having 5% of an income down placed into one’s savings. That would take you up to 48 years to reach your million-dollar goal.

However, you might have answered differently when we asked you when you wanted to save your million by. Still, you should not be disheartened just yet.

Go over to the last row of the table, where the savings rate is raised to 100%. Yes, this is actually possible.

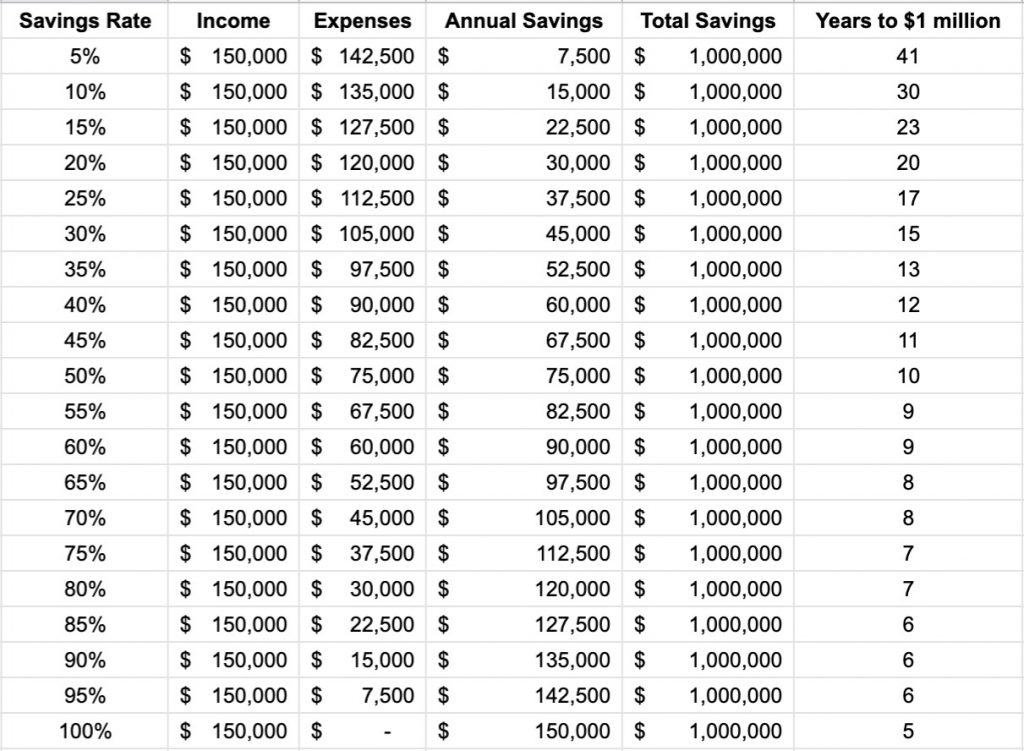

Also, take note that having your computations pre- and post-tax makes a huge difference. Take a look at the next table with $100,000 total income after taxes for another reference.

With an income of $50,000, the earliest you could reach 1 million is after 13 years. On the other hand, with a total revenue of $100,000, you could get you there in 8 years.

Note the 5-year difference. Of course, that number of years still has a lot of room to decrease if you are willing to increase the other side of the equation, which is your income. You could also try adjusting the variables and add your age as another factor to consider.

Where To Save Your Money

Being able to save certain amounts of money is one thing, but knowing where the right place to put them in is another. The bank may be the most famous option for this, and you have probably already saved some in one by now.

While there is nothing wrong with that, you also have to know that there is little to no room for your money to grow there.

Still, there are numerous ways for you to make your savings grow. One of them is putting your savings in the right places. Places, with an ‘s,’ as it is wiser to put it in more investments than one. Investing in bonds or businesses and trading stocks are just a few.

You should only move onto the next part if you now have a better grasp of managing your finances at present.

How To Earn A Million Dollars

Saving and earning are two different things. However, they are connected nonetheless. You could not expect to save much if your revenue is not enough to cover the rates that you have set. Likewise, an increase in your income should also incur the same raise in your saving rates.

Using the money that you have stored in the first stages of your journey, you could venture into money-growing activities that could expand your resources even while you are sound asleep.

When thinking about how to save a million dollars, it will do you good to realise you should pay some attention to your income. Try looking into other methods of earning some money – a side hustle, if you will.

Plan For Retirement Early

Planning your retirement as earlier as possible could be more beneficial than you realize. Refer to the 401k plan for instance.

The 401(k) plan is a retirement account that is sponsored by a company, but to which employees can contribute as well. What makes it even better is how employers may match your contributions.

You could choose between two different types of 401k plans – the traditional 401(k) and the Roth 401(k). The main difference between them is that the latter’s contributions are made pre-tax. Take a look at this article for a better understanding of the 401(k) plan.

Enrolment to this plan means that an employee’s subsidy would come from the automatic withholding from their payroll. They are entitled to choose the amount that they desire, with the opportunity to get a matching amount from the employer depending on the company’s policy.

Invest As Early As You Can, With As Much As You Can

When it comes to investments, time is crucial. Values rise and fall by the minute, but you could not experience any of its benefits unless you get your mind and hands onto it. You could educate yourself with the many books on investing out there. Choose those that best suit your goals and match your ideal returns, experience, knowledge, and style.

Equip yourself with tools as part of your continuous education. The right investment growth calculator and/or stock market calculator would not only provide you with numerical calculations but also with figures that could help you with your plan and goals.

Photo from Unsplash

Probably, the easiest type of investing that you could do is taking advantage of compound interest. Say, you are in your 20s, but you believe that you are ‘too young’ to save or think that it is ‘too early’ for you to consider your retirement.

You planned to put off investing until you’re 30. If you saved $300 monthly until you reach 60, you could have $440,445 for your retirement.

Big money, yes, but not as big as how if you started earlier. The same monthly rate could get you up to $1,000,000, given an 8% return during those years. Just see how much difference 10 years can make.

Having an investment growth calculator is like taking a peek into your investment’s future. Still, your figures are dependent on your input and the added value of where you put them.

Treat Yourself As An Asset

To start, set your goals SMART – Specific, Measurable, Attainable, Relevant and Timely. Nothing will get you there faster than a feasibly designed plan.

You have now learned how to use your money wisely, now give your time some loving as well. All 86,400 seconds of your day is at your disposal. Divide it into self-rewarding activities if you must.

Read up some educational books, explore your creative side, and attend seminars and workshops. Engage in activities that improve you, both mentally and spiritually. Soon enough, you would see that the credentials that you built would serve as magnets to money which you have been chasing.

Among the doors that could open, are potential business opportunities. People are capable of more than they are willing to work on, and you could discover your own potential. Remember, all the big companies that you could name today, started small some years back.

Grow Your Million

You made it! Wherever you are in your journey now, whether you are still at the planning stage or just a few hundred-thousands shy of your goal, congratulations! Once you decide to take action, you are already on your way. You’ve stopped thinking about how to save a million dollars but you’ve put plans into action. But what happens after the ring bells when your money reaches 1 million dollars?

Grow it.

Aiming to be a one-day millionaire only puts all your hard work in vain at the end. When you finally got your hands onto you first 1 million dollars, here are some things you could do:

SAVE. This four-letter word never gets old. It might as well be married to money. If you are wondering why you should still do this when you landed your first million, then please feel free to go back to the first part of this article – where you were wondering how to save a million dollars.

INVEST. Either stick to what you are already doing or look into something that proposes higher returns. This time, you are more experienced and capable of wiser decisions than you were when you started this journey.

Likewise, treat yourself in ways that are also enhancing and upgrading. If your business requires you to travel or transport items most of the time, invest in a suitable car. If you are more of a stay-at-home entrepreneur, invest in upgrading your equipment where necessary.

Most importantly, invest in the betterment of your skills and knowledge.

REPEAT. Master these two steps, and you can smoothly repeat the process of earning millions and millions.

The process is endless, but the rewards are priceless.