Home>Finance>Forex Hedge: Definition, Benefits, How It Lowers Risk And Example

Finance

Forex Hedge: Definition, Benefits, How It Lowers Risk And Example

Published: November 27, 2023

Looking to mitigate financial risks in Forex trading? Learn the definition and benefits of Forex hedging, discover how it lowers risk, and gain insight with a practical example.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Power of Forex Hedge: Mitigate Risk and Secure Your Investments

When it comes to navigating the world of finance, managing risk is paramount. One tool that can help you do just that is a Forex Hedge. In this article, we will explore the definition of Forex Hedge, its benefits, understand how it lowers risk, and provide you with a real-life example. By the end, you’ll have a clear understanding of how Forex Hedge can be a game-changer for your financial strategy.

Key Takeaways:

- Forex Hedge is a risk management technique used to protect against adverse currency fluctuations.

- It allows investors to offset potential losses by creating opposite positions on different currency pairs.

What is Forex Hedge?

Forex Hedge is a strategic tool used by investors and traders to mitigate the risk associated with adverse currency fluctuations. It involves opening multiple positions in different currency pairs to offset potential losses in case one position goes against your expectation. In simple terms, it’s like having an insurance policy for your investments in the foreign exchange market.

Benefits of Forex Hedge

Now that we understand what Forex Hedge is, let’s explore its benefits:

- Diversification: By creating multiple positions in different currency pairs, Forex Hedge allows you to diversify your investment portfolio. This reduces your exposure to a single currency and spreads risk across different markets.

- Protection Against Volatility: The forex market is known for its high volatility. Forex Hedge acts as a shield against sudden and unpredictable fluctuations in currency values, protecting your investments from potential losses.

- Ability to Lock-in Profits: Forex Hedge can also be used to secure profits by creating offsetting positions that allow you to lock-in gains. This can be particularly useful when you have positions in highly volatile currency pairs.

- Enhanced Risk Management: By employing Forex Hedge, you gain better control over your investment risk. It provides a level of security and peace of mind, knowing that you have measures in place to minimize potential losses.

How Forex Hedge Lowers Risk

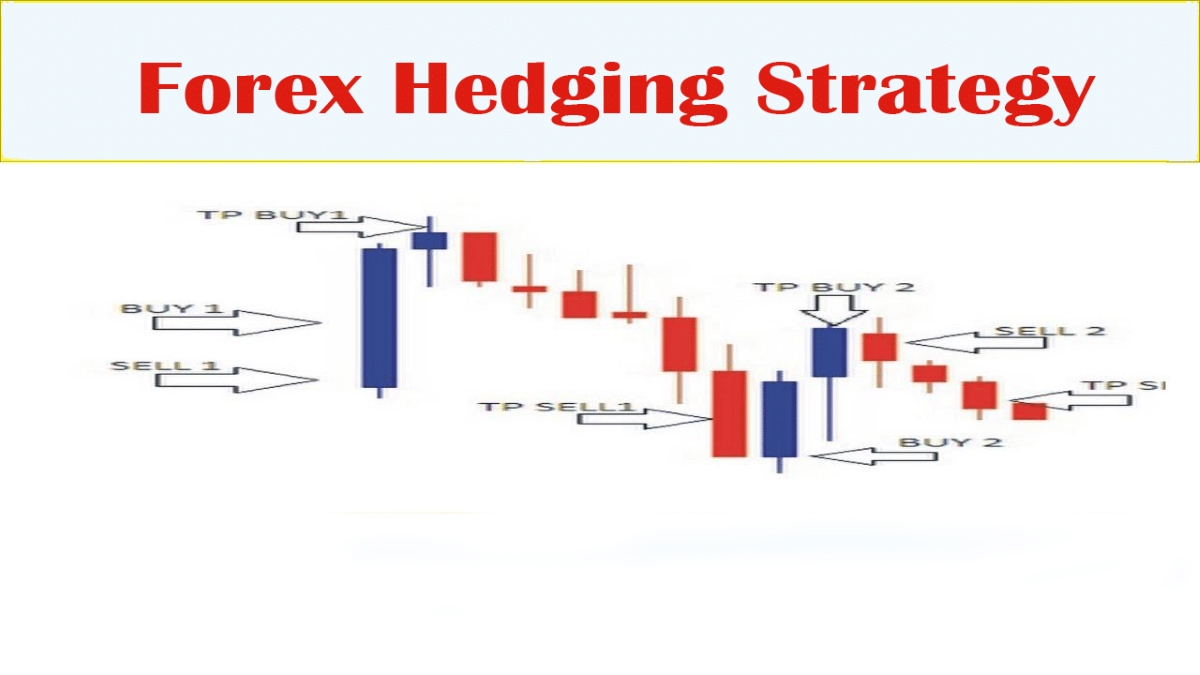

Forex Hedge lowers risk by allowing you to create opposing positions in different currency pairs. Here’s how it works:

Let’s say you are a U.S. investor with a significant investment in the Euro-dollar currency pair. You anticipate a potential drop in the Euro’s value due to economic factors. To protect your investment, you decide to hedge by opening a position in the U.S. dollar-Swiss franc currency pair. Now, if the Euro’s value does decline, your loss in the Euro-dollar pair will be partially offset by the gain in the U.S. dollar-Swiss franc pair. This helps to lower the overall risk and minimize potential losses.

Real-life Example of Forex Hedge

To illustrate how Forex Hedge works, let’s consider an example:

Company ABC, based in the United States, imports goods from Europe and has to make payments in euros. They expect that the euro will appreciate against the U.S. dollar in the near future. To protect themselves from potential losses due to currency fluctuations, Company ABC decides to hedge their position by taking an opposite position in the forex market by selling U.S. dollars and buying euros. If the euro does appreciate as expected, their gain in the forex market will help offset the increased cost of imports.

This real-life example demonstrates how Forex Hedge can be a valuable tool for businesses in managing foreign exchange risk.

In conclusion, a Forex Hedge is a powerful risk management technique that allows investors and businesses to protect themselves against potential losses caused by adverse currency fluctuations. By leveraging the benefits of diversification and securing profits, Forex Hedge empowers you to navigate the volatile world of foreign exchange with confidence. So, why leave your investments vulnerable when you have the power to hedge your risks and pave the way for financial success?