Home>Finance>Are Preferred Dividends Not Declared When Preferred Stock Is Cumulative?

Finance

Are Preferred Dividends Not Declared When Preferred Stock Is Cumulative?

Modified: January 5, 2024

Discover the answer to whether preferred dividends are declared in cumulative preferred stock through this guide from a finance expert.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where stocks, bonds, and dividends rule the game. When it comes to investing in stocks, preferred stock is an option that offers certain advantages compared to common stock. Preferred stockholders have the guarantee of receiving dividends before common stockholders, along with other potential benefits.

But what happens with preferred dividends when a company issues cumulative preferred stock? Are these dividends still paid out, even when they are not declared by the company? Let’s dive into the fascinating world of cumulative preferred stock and understand how it affects the payment of preferred dividends.

Before delving into the technicalities, it’s important to have a clear understanding of what cumulative preferred stock entails. Cumulative preferred stock is a type of preferred stock that entitles the shareholder to receive unpaid or omitted dividends from previous periods when the company has the financial capacity to do so.

Preferred dividends, as the name suggests, are the dividends paid to preferred shareholders before common shareholders. These dividends are typically fixed at a predetermined rate and represent a share of the company’s profits.

Now, let’s address the burning question: Are preferred dividends still paid out when a company issues cumulative preferred stock, even if they are not declared by the company? The answer is not as straightforward as it may seem.

When a company issues cumulative preferred stock, it creates a contractual obligation to pay dividends to the preferred shareholders. However, the company has the discretion to declare or not declare these dividends. While not declaring preferred dividends may seem detrimental to the preferred shareholders, there are valid reasons behind this decision.

So, why would a company choose not to declare preferred dividends? Stay tuned as we delve deeper into the treatment of preferred dividends in cumulative preferred stock and explore the reasons behind this financial strategy.

Explanation of Cumulative Preferred Stock

Cumulative preferred stock is a type of preferred stock that holds a unique characteristic – it provides a guarantee to preferred shareholders that if a company is unable to pay dividends in a given year, those dividends will accrue and must be paid in the future when the company has sufficient funds.

When a company issues cumulative preferred stock, it creates a contractual obligation to its preferred shareholders. This means that if the company does not pay the preferred dividends in any given year, the unpaid dividends accumulate and become a liability for the company. This liability is known as “dividends in arrears.”

Once the company has the financial capacity, it must first fulfill its obligation to pay any accumulated unpaid dividends to the cumulative preferred shareholders before distributing dividends to common stockholders. This feature makes cumulative preferred stock a more attractive investment option for shareholders who prioritize a consistent income stream.

For example, let’s say a company issues cumulative preferred stock with a 5% dividend rate and fails to pay the preferred dividends for three consecutive years due to financial constraints. In the fourth year, when the company has recovered financially, it must first pay the accumulated dividends for the previous three years to the cumulative preferred shareholders before considering any dividend distribution to common shareholders.

It is important to note that cumulative preferred stock does not guarantee the payment of dividends. It only ensures that if dividends are not paid in a particular year, they will accrue and must be paid in the future when financial conditions permit.

Now that we have a clearer understanding of cumulative preferred stock, let’s explore how preferred dividends are treated in the context of cumulative preferred stock.

Understanding Preferred Dividends

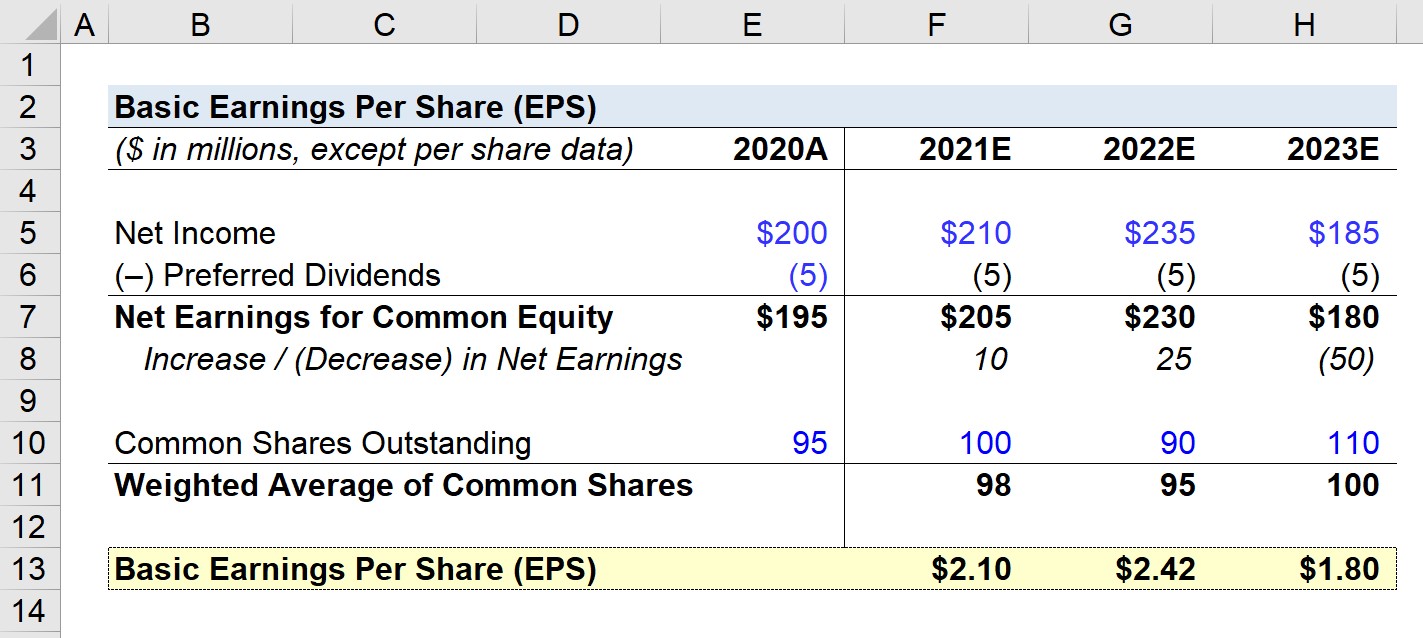

Preferred dividends are the dividends paid to preferred shareholders, who hold preferred stock in a company. Preferred dividends are typically fixed at a predetermined rate, which is specified in the terms and conditions of the preferred stock.

Preferred stockholders have certain advantages over common stockholders when it comes to receiving dividends. The primary advantage is that preferred stockholders receive their dividends before any dividends are distributed to common stockholders. This preference gives preferred stockholders a higher priority in terms of receiving a share of the company’s profits.

The rate of preferred dividends is usually expressed as a percentage of the face value or the par value of the preferred stock. For example, if a company issues cumulative preferred stock with a 7% dividend rate and the face value of each share is $100, preferred shareholders would receive $7 in dividends per share annually.

It’s important to note that the payment of preferred dividends is not guaranteed, especially in the case of cumulative preferred stock. The company has the discretion to declare or not declare these dividends in any given year, based on various factors such as financial performance, cash flow, and profitability.

Preferred dividends are paid out of a company’s profits and are usually stated as a fixed dollar amount or a percentage of the preferred stock’s face value. As long as the company has sufficient profits available for distribution, preferred dividends are paid to the preferred stockholders.

However, if the company is facing financial difficulties or has negative retained earnings, it may choose not to declare or pay preferred dividends. This is where the concept of cumulative preferred stock comes into play, as it provides a mechanism for unpaid dividends to accrue and be paid in the future when the company has the financial capacity to do so.

Now that we have a solid understanding of preferred dividends, let’s explore how these dividends are treated in the specific context of cumulative preferred stock.

Treatment of Preferred Dividends in Cumulative Preferred Stock

In the case of cumulative preferred stock, preferred dividends that are not declared by the company accumulate and become a liability for the company. These accumulated unpaid dividends are commonly referred to as “dividends in arrears.”

When a company has the financial capacity to pay dividends, it must first fulfill its obligation to the cumulative preferred shareholders by paying any accumulated dividends in arrears before distributing dividends to common stockholders. This means that preferred shareholders will receive their current dividends, as well as any unpaid dividends from previous periods.

For example, let’s assume a company has cumulative preferred stock with a 6% dividend rate and fails to pay dividends for two consecutive years due to financial difficulties. In the third year, when the company has recovered financially and decides to pay dividends, it must first pay the dividends for the third year to the cumulative preferred shareholders. Additionally, it must also pay the accumulated unpaid dividends for the previous two years.

In some cases, cumulative preferred stockholders may be entitled to receive a higher dividend rate if the company is unable to pay dividends in a specific year. This higher dividend rate, known as a “catch-up” provision, allows the preferred shareholders to receive the unpaid dividends from previous years before the common shareholders receive any dividends.

It’s important to note that the decision of whether to declare or not declare preferred dividends is at the discretion of the company’s board of directors. They consider various factors, such as the company’s financial performance, cash flow, and profitability, when making this decision.

By allowing preferred dividends to accumulate in the case of cumulative preferred stock, companies can retain flexibility in managing their cash flow during periods of financial uncertainty. This strategy can help ensure the long-term stability and viability of the company.

Now that we understand how preferred dividends are treated in cumulative preferred stock, let’s explore the reasons why a company may choose not to declare preferred dividends, despite having the option to do so.

Reasons for Not Declaring Preferred Dividends

While it may seem counterintuitive for a company to choose not to declare preferred dividends, there are valid reasons behind this decision. Companies may decide not to declare preferred dividends for several reasons, including:

- Financial Difficulties: If a company is facing financial challenges, it may not have sufficient profits or cash flow to pay dividends to preferred shareholders. In such cases, the company may choose to preserve its cash for other operational needs or to reinvest in the business to improve its financial position.

- Profitability Concerns: If the company is not generating enough profits or experiencing a decline in profitability, the board of directors may decide to conserve financial resources and forgo declaring preferred dividends. This strategic decision is often made with the aim of safeguarding the long-term financial health and sustainability of the company.

- Legal Restrictions: Sometimes, external factors such as legal restrictions or regulatory requirements may prevent a company from paying preferred dividends. For example, if the company is in violation of debt covenants or is subject to legal proceedings, it may be prohibited from making dividend payments.

- Investment Opportunities: In some cases, a company may choose to reinvest its profits into expansion projects or new business initiatives rather than paying preferred dividends. This decision aims to enhance the company’s future growth potential and generate higher returns for shareholders in the long run.

- Preserving Relationship with Creditors: If a company has outstanding debts or obligations to creditors, it may prioritize meeting these financial commitments over paying dividends to shareholders. Failing to honor financial obligations can damage the company’s reputation and have adverse effects on its ability to secure future financing.

It’s important to note that when a company decides not to declare preferred dividends, these unpaid dividends accumulate as dividends in arrears. This means that when the company has the financial capacity in the future, it must fulfill its obligation to the cumulative preferred shareholders by paying the accumulated unpaid dividends.

By not declaring preferred dividends, companies can navigate through challenging financial circumstances, preserve cash flow, maintain profitability, and take advantage of growth opportunities. While this decision may disappoint preferred shareholders in the short term, it is often made in the best interest of the overall financial health and success of the company.

Now that we’ve explored the reasons behind not declaring preferred dividends, let’s delve into the implications of this decision for shareholders.

Implications for Shareholders

The decision of whether or not to declare preferred dividends has implications for both preferred shareholders and common shareholders. Let’s explore these implications:

Preferred Shareholders: Preferred shareholders are the primary beneficiaries of preferred dividends. When preferred dividends are declared and paid, it provides them with a consistent income stream and a priority claim on the company’s profits. However, in the case of cumulative preferred stock, if the company chooses not to declare preferred dividends, preferred shareholders may experience a delay in receiving their dividends. The accumulation of unpaid dividends, known as dividends in arrears, creates a future financial liability for the company, entitling preferred shareholders to the unpaid dividends when the company has the financial capacity to fulfill its obligation. Preferred shareholders should carefully assess the financial stability and track record of the company before investing in cumulative preferred stock.

Common Shareholders: The decision to not declare preferred dividends can have both positive and negative implications for common shareholders. On the positive side, by not paying preferred dividends, the company can retain more cash for operational needs, debt reduction, or investment in growth opportunities. This can potentially lead to higher capital appreciation for common shareholders if the company’s strategic decisions yield positive results. However, common shareholders need to be aware that the non-payment of preferred dividends may signal financial difficulties or lower profitability. It’s important for common shareholders to closely monitor the financial health and performance of the company to gauge the potential impact of the decision on the overall value of their investment.

Investor Confidence: The decision of not declaring preferred dividends can influence investor confidence in the company. Preferred shareholders may become apprehensive or frustrated if dividends are not being paid as expected. Common shareholders, on the other hand, may interpret this decision as a prudent measure by the company to prioritize financial stability and long-term growth. Overall, the company’s communication with its shareholders and transparent reporting of financial performance are critical to maintaining investor confidence.

Legal Obligations: Companies that issue cumulative preferred stock have a legal obligation to pay the accumulated unpaid dividends when they have the financial capacity. Failing to meet this obligation can result in legal repercussions and damage the company’s reputation. Therefore, companies must carefully consider their financial position and ensure compliance with contractual obligations before deciding to not declare preferred dividends.

Ultimately, the implications of not declaring preferred dividends depend on the specific circumstances of the company and the preferences of its shareholders. By evaluating the financial condition, profitability, and growth potential of the company, shareholders can make informed investment decisions and understand the potential impact of the company’s dividend policies.

Now, let’s dive into a case study to better understand the treatment of preferred dividends in cumulative preferred stock.

Case Study: Company XYZ’s Cumulative Preferred Stock

Let’s take a closer look at a hypothetical case study involving Company XYZ and its cumulative preferred stock. Company XYZ is a well-established manufacturing company that has issued cumulative preferred stock with a dividend rate of 8%.

In the first year of the stock’s issuance, Company XYZ declares and pays the preferred dividends to its cumulative preferred shareholders. However, in the second year, the company faces financial difficulties due to a decline in sales and increased production costs. As a result, the board of directors decides not to declare preferred dividends for that year.

By not declaring preferred dividends, Company XYZ accumulates unpaid dividends, known as dividends in arrears. These dividends in arrears must be paid to the cumulative preferred shareholders when the company has the financial capacity to do so.

In the third year, Company XYZ’s financial condition improves, and the board of directors decides to resume paying dividends to both common and preferred shareholders. However, before distributing dividends to common shareholders, the company must first pay the accumulated unpaid dividends from the previous year to the cumulative preferred shareholders.

The payout to the cumulative preferred shareholders consists of two parts: the current dividend for the third year and the accumulated dividends in arrears from the second year. This ensures that preferred shareholders receive both the current dividend and their fair share of the unpaid dividends from previous periods.

The accumulation of unpaid dividends may have implications for both preferred and common shareholders of Company XYZ. Preferred shareholders can expect to receive their dividends in full, including any unpaid dividends from the previous year. Common shareholders, while not directly impacted by the non-payment of preferred dividends, may benefit from the company’s improved financial position and potential growth opportunities resulting from the retained cash.

It is important for shareholders to closely monitor the financial performance and dividend policies of Company XYZ. By assessing the company’s ability to fulfill its obligations and its potential for future growth, shareholders can make informed investment decisions based on the specific circumstances of the company.

This case study highlights the importance of understanding how cumulative preferred stock operates and the potential implications for both preferred and common shareholders when preferred dividends are not declared. Each company’s situation may differ, and investors should carefully consider their investment objectives and risk tolerance before investing in cumulative preferred stock.

Now let’s summarize our findings in the concluding section.

Conclusion

Cumulative preferred stock offers preferred shareholders the assurance that if dividends are not declared in any given year, they will accrue and must be paid in the future when the company has the financial capacity to do so. This unique characteristic of cumulative preferred stock provides a level of security for preferred shareholders in terms of their dividend payments.

While the decision to not declare preferred dividends may disappoint preferred shareholders in the short term, there are valid reasons behind this strategic choice. Companies may choose to not declare preferred dividends due to financial difficulties, profitability concerns, legal restrictions, investment opportunities, or to preserve relationships with creditors.

The treatment of preferred dividends in cumulative preferred stock means that when the company has the financial capacity to pay dividends, it must first fulfill its obligation to the cumulative preferred shareholders by paying any accumulated dividends in arrears. This ensures that preferred shareholders receive both the current dividend and any unpaid dividends from previous periods.

Implications for shareholders vary depending on their investment objectives and risk tolerance. Preferred shareholders may experience delays in receiving their dividends but have the assurance that the accumulated unpaid dividends will be paid out in the future. Common shareholders may benefit from the retained cash and potential growth opportunities resulting from the non-payment of preferred dividends.

Investors should closely monitor a company’s financial performance, dividend policies, and overall financial health before investing in cumulative preferred stock. Understanding the specific circumstances of the company and its ability to fulfill its obligations is crucial in making informed investment decisions.

By exploring the intricacies of cumulative preferred stock, understanding the treatment of preferred dividends, and considering the reasons behind not declaring preferred dividends, investors can navigate the world of finance with a deeper understanding of this particular aspect of stock ownership.

Remember, investing in stocks involves risks, and it is always recommended to consult with a financial advisor or do thorough research before making any investment decisions.