Finance

How To Reinvest Dividends With Schwab

Published: January 3, 2024

Learn how to reinvest dividends with Schwab and maximize your financial gains. Get expert advice and start growing your wealth with our comprehensive finance solutions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of dividends and investment growth! If you’re looking to make your money work harder for you, understanding dividends and how to reinvest them can be a game-changer. Whether you are just starting your investment journey or are a seasoned investor, reinvesting dividends can lead to substantial long-term gains.

Dividends are a fascinating aspect of investing, representing a distribution of a company’s profits to its shareholders. When you invest in dividend-paying stocks, you have the opportunity to receive a portion of the company’s earnings regularly. Rather than keeping these dividends as cash, reinvesting them allows you to purchase additional shares of the stock and compound your gains.

Reinvesting dividends is an effective strategy that can significantly boost your investment returns over time. By reinvesting, you can take advantage of compounding – the process of generating earnings on your initial investment as well as on the reinvested dividends. This compounding effect can accelerate the growth of your portfolio and potentially provide you with a higher total return in the long run.

In this article, we will explore the benefits of reinvesting dividends and guide you through the process of reinvesting dividends with Schwab, a well-known and reputable financial institution. Whether you’re a Schwab customer or considering opening an account with them, you’ll learn how to leverage their dividend reinvestment program to enhance your investment strategy.

So, if you’re ready to uncover the power of reinvesting dividends and discover how Schwab can help you achieve your financial goals, let’s dive right in!

Understanding Dividends

Before diving into the world of dividend reinvestment, it’s crucial to have a solid understanding of what dividends are and how they work.

Dividends are payments made by companies to their shareholders as a way to distribute a portion of their profits. When you invest in a dividend-paying company, you become a part-owner of that company and are entitled to a share of the company’s earnings.

Dividends are typically paid out on a regular basis, often quarterly, although some companies may pay dividends monthly or annually. The amount of the dividend is determined by the company’s board of directors and is usually expressed as a fixed amount per share or as a percentage of the stock’s current price, known as the dividend yield.

Dividend-paying stocks are popular among income-seeking investors who rely on the regular income generated from these payments. Additionally, dividends can be an attractive feature for long-term investors as they provide a tangible return on investment.

It’s important to note that not all stocks pay dividends. Some companies, especially in the technology sector, prefer to reinvest their profits back into the business to fund growth and innovation rather than distributing them to shareholders. These stocks are known as non-dividend-paying stocks.

Dividends can be a significant source of income for investors, especially in retirement or for those looking to supplement their regular earnings. However, instead of pocketing the dividends as cash, you can choose to reinvest them.

Now that we have a solid understanding of dividends, let’s explore the concept of reinvesting dividends and how it can amplify your investment returns.

What is Reinvesting Dividends?

Reinvesting dividends is a strategy where instead of receiving dividend payouts in cash, you use them to purchase additional shares of the dividend-paying stock or mutual fund. Essentially, it’s the process of reinvesting the dividends back into the same investment that generated them.

By reinvesting dividends, you can take advantage of the power of compounding. Compounding is the ability of an investment to generate earnings not only on the initial investment but also on the reinvested earnings. It’s like a snowball effect, where your investment grows progressively larger over time.

Let’s illustrate this with an example. Suppose you invest $10,000 in a dividend-paying stock with a dividend yield of 3% per year. In the first year, you would receive $300 in dividends. If you reinvest these dividends to buy more shares of the same stock, your investment would now be worth $10,300.

In the second year, assuming the stock’s dividend yield remains the same, you would receive $309 in dividends (3% of $10,300). By reinvesting these dividends, your investment would grow to $10,609. This compounding effect continues to amplify your returns as the number of shares increases over time.

Reinvesting dividends can be a powerful wealth-building strategy, particularly when practiced over the long term. Through compounding, your investment returns can accelerate, potentially generating substantial wealth over time.

It’s worth noting that dividend reinvestment can be a particularly advantageous strategy in a tax-advantaged account, such as an Individual Retirement Account (IRA) or a 401(k) plan. In these accounts, you can reinvest dividends without incurring taxes on them until you withdraw the funds in retirement.

Reinvesting dividends is a simple yet effective way to put your money to work and optimize the growth of your investment portfolio. In the next section, we will explore the various benefits of reinvesting dividends that make it such a compelling strategy for investors.

Benefits of Reinvesting Dividends

Reinvesting dividends can offer several compelling benefits for investors. Let’s explore some of the key advantages of this strategy:

- Compound Growth: By reinvesting dividends, you harness the power of compounding. This allows your investment to grow exponentially over time as you earn not only on your initial investment but also on the reinvested dividends. The longer you reinvest dividends, the greater the compounding effect, potentially leading to significant wealth accumulation.

- Increased Share Ownership: Reinvesting dividends allows you to acquire additional shares of the dividend-paying stock or mutual fund. As you accumulate more shares, you increase your ownership stake in the company, providing a greater potential for future dividend payments and capital appreciation.

- Lower Transaction Costs: When you reinvest dividends, you typically do so through a dividend reinvestment program (DRIP) offered by your brokerage or mutual fund provider. These programs often allow you to reinvest dividends commission-free or at a lower cost than purchasing additional shares separately. This can result in savings on transaction fees and improve your overall investment returns.

- Automatic and Convenient: Reinvesting dividends can be an automated process, meaning you don’t have to manually reinvest the funds or make decisions about when to reinvest. Once you set it up, your dividends will be automatically reinvested, making it a hassle-free way to grow your investment.

- Diversification: Reinvesting dividends can help diversify your investment portfolio. As dividends are typically paid by established and stable companies, reinvesting dividends can provide exposure to a diversified range of quality stocks across various sectors. This diversification can help reduce risk and enhance the stability of your portfolio.

It’s important to note that while reinvesting dividends can be a lucrative strategy, it may not be suitable for every investor. It’s essential to consider your personal investment goals, risk tolerance, and overall investment strategy when deciding whether to reinvest dividends or take them as cash.

Now that we understand the benefits of reinvesting dividends, let’s explore how you can reinvest dividends with Schwab, a popular investment platform.

Reinvesting Dividends with Schwab

Schwab, one of the leading investment platforms, offers a convenient and user-friendly way to reinvest dividends. With their Dividend Reinvestment Program (DRIP), Schwab provides investors with the opportunity to automatically reinvest dividends from eligible stocks, mutual funds, and exchange-traded funds (ETFs).

The Schwab DRIP is designed to help investors maximize their investment potential by harnessing the power of compounding. By reinvesting dividends, you can acquire additional shares of the same security, allowing your investment to grow over time.

Here are some key features of the Schwab Dividend Reinvestment Program:

- Automatic Dividend Reinvestment: With Schwab’s DRIP, you can set up automatic dividend reinvestment for eligible securities in your account. Once enrolled, any eligible dividends will be automatically reinvested in additional shares of the same security.

- No Transaction Fees: Schwab does not charge any transaction fees or commissions for dividend reinvestment. This means that you can reinvest your dividends without incurring any additional costs, helping to maximize your investment returns.

- Wide Range of Eligible Securities: The Schwab DRIP covers a broad selection of eligible securities, including individual stocks, mutual funds, and ETFs. This allows you to reinvest dividends from a diverse range of investments within your Schwab account.

- Flexibility and Control: Schwab provides investors with the flexibility to choose which securities they want to reinvest dividends from. You can selectively enroll or unenroll specific securities from the Dividend Reinvestment Program according to your investment preferences.

- Dividend Reinvestment Order Types: Schwab offers various order types for dividend reinvestment, including market orders and limit orders. This allows you to have control over the price at which the dividend is reinvested and can be particularly beneficial for securities with higher price volatility.

Reinvesting dividends with Schwab is a straightforward process that can be done online through their intuitive platform. To get started, you’ll need to have a Schwab brokerage account and ensure that the securities you own are eligible for dividend reinvestment.

Next, you can enroll in the Dividend Reinvestment Program for each eligible security in your account. Schwab provides clear instructions and guidance on how to enroll in the program through their website or by contacting their customer service.

Once you have successfully enrolled in the DRIP, any future dividends from your eligible securities will be automatically reinvested according to your chosen preferences.

Now that we understand how to reinvest dividends with Schwab, let’s explore the step-by-step process of setting up dividend reinvestment in your Schwab account.

Steps to Reinvest Dividends with Schwab

Reinvesting dividends with Schwab is a simple and straightforward process. Here are the steps to set up dividend reinvestment in your Schwab account:

- Open a Schwab brokerage account: If you don’t already have a Schwab account, you’ll need to open one. Visit the Schwab website and follow the instructions to open a brokerage account. You may need to provide some personal information and complete the necessary documentation.

- Deposit funds into your account: Once your Schwab account is open, you’ll need to deposit funds into your account to invest. You can transfer funds from your bank account into your Schwab brokerage account through various methods, including electronic funds transfer, wire transfer, or by mailing a check.

- Research and select dividend-paying securities: Before you can start reinvesting dividends, you’ll need to identify dividend-paying stocks, mutual funds, or ETFs that you want to invest in. Schwab provides an extensive range of investment options to choose from. Conduct research, analyze performance data, and select securities that align with your investment goals and risk tolerance.

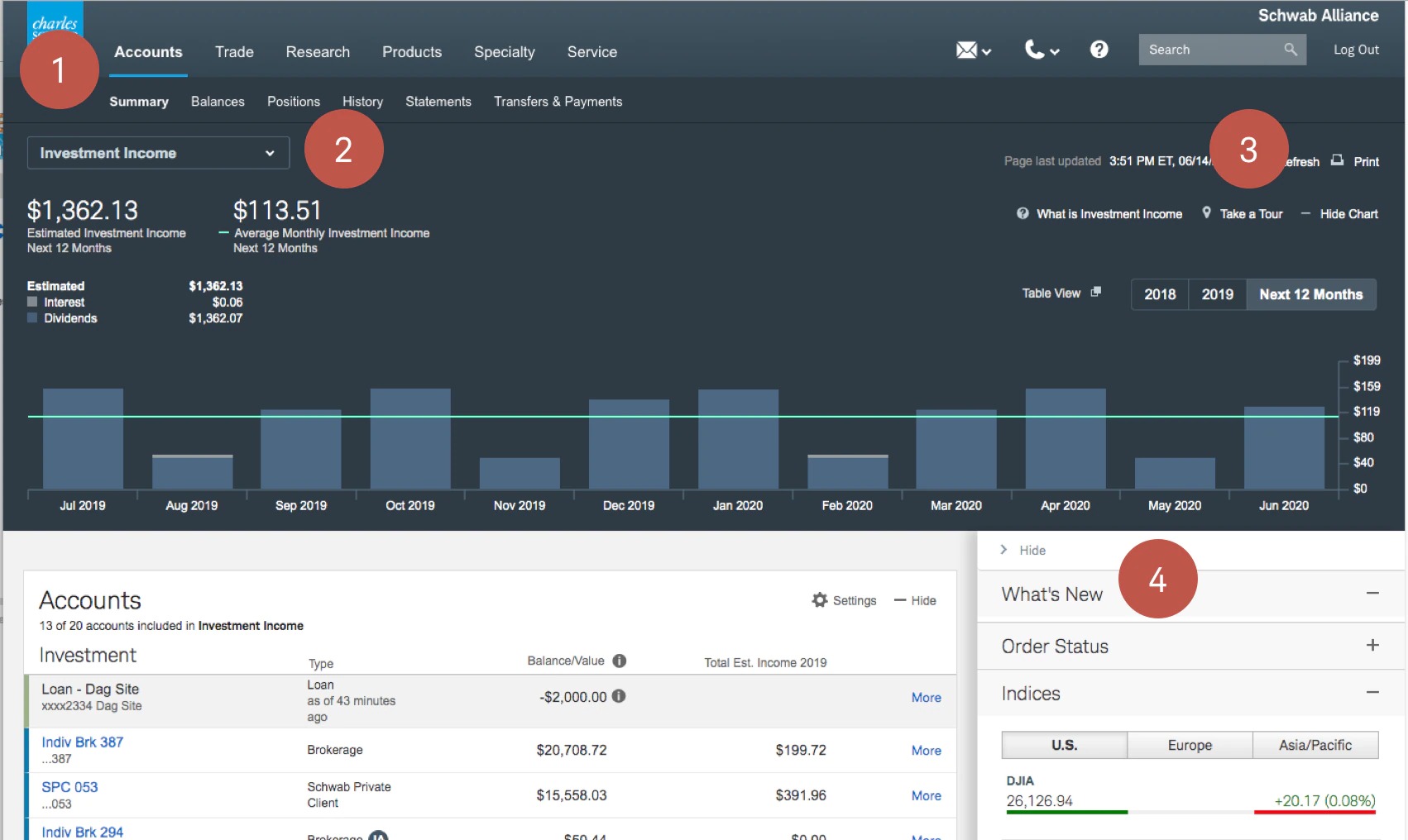

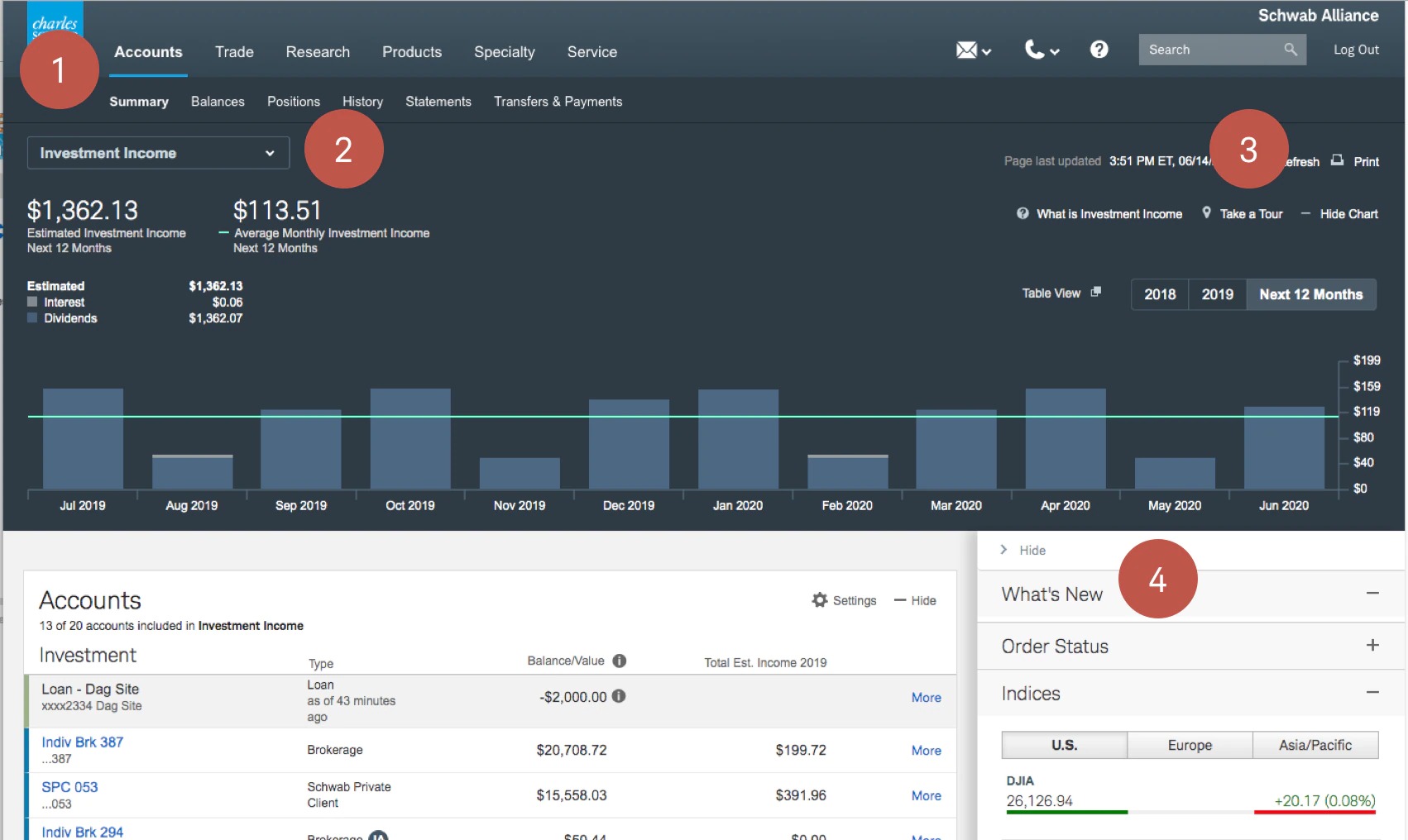

- Enroll in the Schwab Dividend Reinvestment Program: Once you have identified the securities for dividend reinvestment, you need to enroll in the Schwab Dividend Reinvestment Program for each eligible security. Log in to your Schwab account, navigate to the account settings or preferences section, and locate the Dividend Reinvestment Program options. Follow the instructions to enroll in the program for each specific security you want to reinvest dividends from.

- Set up dividend reinvestment preferences: After enrolling in the Dividend Reinvestment Program, you’ll have the opportunity to set up your dividend reinvestment preferences. Specify whether you want to reinvest dividends for all eligible securities or select specific securities. You can also choose the order type for reinvesting dividends, such as market orders or limit orders.

- Monitor and track your dividend reinvestment: Once you have completed the enrollment and set up your preferences, Schwab will automatically reinvest eligible dividends for your chosen securities. You can monitor and track your dividend reinvestment activity through your Schwab account. Schwab provides detailed transaction history and account statements that show the reinvestment of dividends and the resulting changes in your investment holdings.

By following these steps, you can easily set up dividend reinvestment in your Schwab account and start harnessing the power of compounding to maximize your investment returns. Remember to regularly review and evaluate your investment strategy to ensure it aligns with your financial goals and risk tolerance.

Now that you know how to reinvest dividends with Schwab, let’s explore some tips to optimize your dividend reinvestment strategy.

Tips for Dividend Reinvestment

When it comes to dividend reinvestment, there are a few key tips to keep in mind to optimize your strategy and maximize your returns. Consider the following tips for dividend reinvestment:

- Choose quality dividend-paying securities: Not all dividend-paying stocks are created equal. Research and select high-quality companies with a history of consistent and reliable dividend payments. Look for companies with strong financials, solid growth prospects, and a sustainable dividend payout ratio.

- Diversify your dividend investments: It’s important to diversify your dividend investments across different sectors, industries, and asset classes. This helps reduce the risk of relying too heavily on a single security or sector and provides a more balanced and stable portfolio.

- Reinvest dividends during market downturns: Market downturns can present excellent buying opportunities. Consider reinvesting dividends during market downturns when stock prices may be lower. This allows you to acquire more shares at a discounted price, potentially increasing your long-term returns.

- Regularly review and evaluate your portfolio: Monitor the performance of your dividend-paying securities and regularly review your portfolio. Assess if the companies are still meeting your investment criteria and reevaluate your dividend reinvestment strategy if needed.

- Consider tax implications: Be aware of the tax implications of dividend reinvestment. Dividends are typically subject to taxation, even if they are reinvested. Depending on your tax situation, it may be more advantageous to reinvest dividends within a tax-advantaged account, such as an IRA or 401(k), to defer taxes until withdrawal.

- Keep reinvestment costs in check: While Schwab offers commission-free dividend reinvestment, it’s essential to be mindful of any costs associated with reinvesting dividends. If you hold investments outside of Schwab, be aware of any transaction fees or commissions that may be incurred when reinvesting dividends.

- Stay focused on your long-term goals: Dividend reinvestment should align with your long-term investment goals. Maintain a disciplined approach and stay focused on your investment strategy, even during market fluctuations. Dividend reinvestment is a strategy designed to enhance long-term wealth accumulation.

By taking these tips into consideration and adjusting your dividend reinvestment strategy accordingly, you can make the most of your investment portfolio and potentially achieve higher returns over time.

Now that we’ve covered the tips for dividend reinvestment, let’s conclude our discussion.

Conclusion

Reinvesting dividends can be a powerful strategy to enhance your investment returns and accelerate the growth of your portfolio. By automatically reinvesting dividends, you can take advantage of the compounding effect and acquire additional shares of dividend-paying securities over time.

Schwab, with its Dividend Reinvestment Program (DRIP), offers investors a seamless and cost-effective way to reinvest dividends. Through their platform, you can set up automatic dividend reinvestment, benefit from commission-free transactions, and have control over your reinvestment preferences.

When reinvesting dividends, it’s crucial to select high-quality dividend-paying securities, diversify your investments, and stay focused on your long-term goals. Regularly evaluating and monitoring your portfolio will help ensure that your dividend reinvestment strategy aligns with your investment objectives.

Remember to consider the tax implications of dividend reinvestment and be mindful of any costs or fees associated with the process. Schwab’s platform provides transparency and flexibility, allowing you to make informed decisions and optimize your dividend reinvestment strategy.

By following the steps outlined in this guide and implementing the tips provided, you can harness the power of dividend reinvestment and potentially achieve significant long-term wealth accumulation.

So, whether you’re a beginner investor looking to start your dividend reinvestment journey or an experienced investor seeking to enhance your portfolio, Schwab and the strategy of reinvesting dividends can be valuable tools on your path to financial success.

Start exploring the world of dividend reinvestment today and take control of your future financial growth with Schwab.