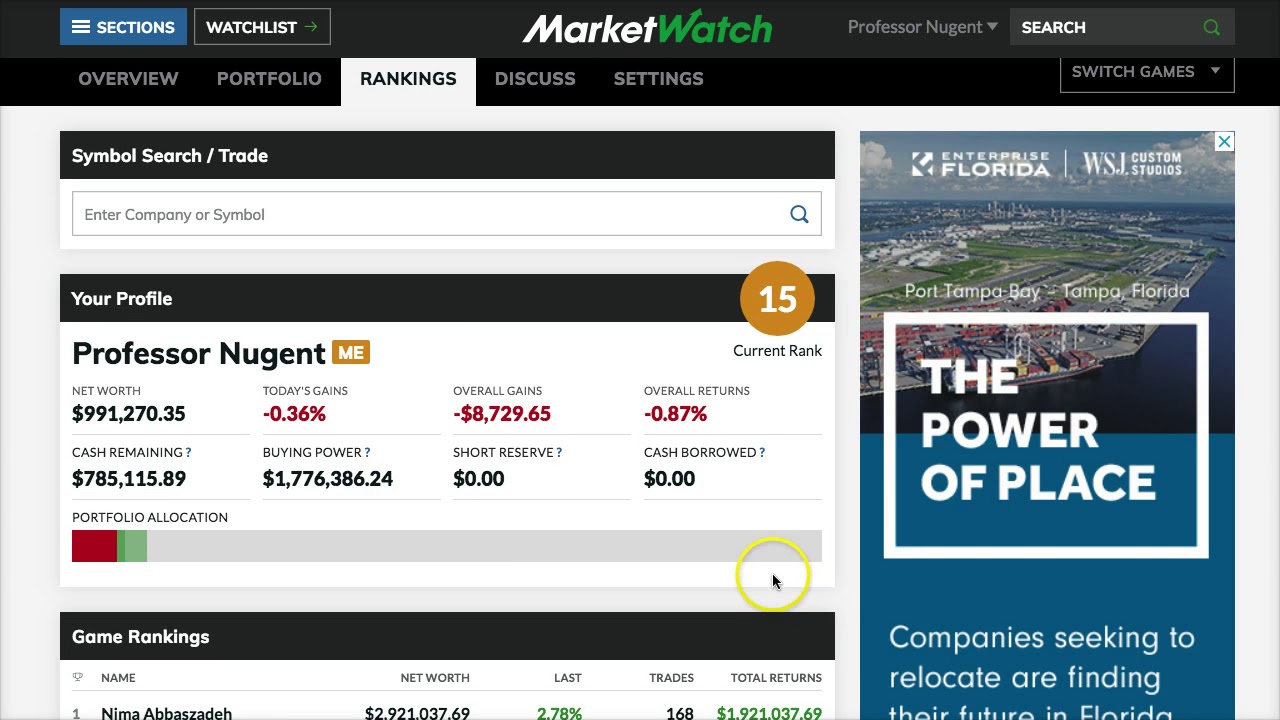

Finance

How To Sell Bonds

Published: November 3, 2023

Learn how to sell bonds and maximize your finance opportunities. Get expert tips and strategies for successful bond selling.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of bonds! Whether you are an individual investor or a financial institution, understanding how to sell bonds is a crucial skill in the finance industry. Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. As an investor, selling bonds can provide you with an opportunity to earn a return on your investment or generate liquidity when needed.

In this comprehensive guide, we will walk you through the process of selling bonds, from understanding the key characteristics of bonds to successfully closing a bond sale. By the end of this article, you will have a solid understanding of how to navigate the bond market and maximize the value of your bond holdings.

Before we dive into the details, it’s important to note that selling bonds involves a certain level of risk and complexity. Market conditions, interest rates, and investor sentiment can all influence the demand for bonds and their selling price. Therefore, it is essential to conduct thorough research and seek professional advice when engaging in bond sales.

Now, let’s explore the world of bonds and discover the strategies for successfully selling them!

Understanding Bonds

Before you can effectively sell bonds, it’s important to have a clear understanding of what bonds are and how they function. Essentially, a bond is a fixed-income security that represents a loan made by an investor to the issuer of the bond. The issuer can be a government entity, municipality, or corporation.

When you purchase a bond, you are essentially lending money to the issuer in exchange for regular interest payments over a predetermined period of time. At the end of the bond’s term, known as the maturity date, the issuer repays the principal amount to the investor. Bonds are typically considered safer investments compared to stocks, as they offer fixed returns and are backed by the issuer’s creditworthiness.

Bonds come in various types, including government bonds, corporate bonds, municipal bonds, and agency bonds. Government bonds are issued by national governments to fund public projects or meet financial obligations. Corporate bonds are issued by corporations to finance business growth or meet financial needs. Municipal bonds are issued by local governments to fund public projects such as schools or infrastructure. Agency bonds are issued by government-affiliated entities, such as Fannie Mae or Freddie Mac, to support specific industries or sectors.

When evaluating bonds, it’s important to consider key characteristics such as the coupon rate, maturity date, credit rating, and yield. The coupon rate represents the annual interest payment as a percentage of the bond’s face value. The maturity date indicates when the bond will be repaid in full. Credit ratings, provided by credit rating agencies, assess the issuer’s ability to meet its financial obligations. Yield refers to the total return an investor can expect to earn from a bond, taking into account both interest payments and any potential changes in its market value.

Understanding the different types of bonds and their characteristics will help you make informed decisions when selling bonds. It’s crucial to analyze market conditions, evaluate the creditworthiness of the issuer, and assess the potential risks and rewards associated with each bond you own or intend to sell.

Evaluating Bond Characteristics

When selling bonds, it is essential to carefully evaluate their characteristics to determine their market value and appeal to potential buyers. There are several key factors to consider:

- Coupon Rate: The coupon rate is the annual interest rate paid by the issuer to the bondholder. Typically, bonds with higher coupon rates offer higher yields and are more attractive to investors. However, if prevailing interest rates rise, a bond with a lower coupon rate may become less appealing.

- Maturity Date: The maturity date of a bond is the date on which the issuer must repay the bond’s principal amount to the bondholder. Bonds with longer maturities tend to carry higher interest rates but also involve greater risk. Investors who prefer stable income may opt for shorter-term bonds with lower interest rates.

- Credit Rating: Credit rating agencies assess the creditworthiness of bond issuers based on their financial stability and ability to meet their debt obligations. Higher-rated bonds are considered less risky and often have lower interest rates. Conversely, bonds with lower credit ratings may offer higher yields to compensate for the increased risk.

- Yield to Maturity: The yield to maturity (YTM) represents the total return an investor can expect to earn if the bond is held until maturity, accounting for both interest payments and any changes in market value. Comparing YTMs can help gauge the relative attractiveness of different bonds.

- Liquidity: Liquidity refers to how easily a bond can be bought or sold in the market. Bonds that are actively traded and have a large volume of buyers and sellers tend to be more liquid. Higher liquidity makes it easier to sell bonds quickly and at a fair price.

When evaluating bond characteristics, it’s essential to conduct thorough research on the issuer’s financial health, industry and market conditions, and any potential regulatory or economic risks. Assessing these factors will help you determine the fair value of your bonds and position them effectively in the market.

Moreover, it’s crucial to keep in mind that bond prices and yields move inversely. As market interest rates fluctuate, the value of existing bonds will adjust to align with the prevailing rates. Understanding these dynamics will enable you to make informed decisions when selling your bonds and maximize your potential returns.

Determining the Bond Selling Price

When selling bonds, one of the critical steps is determining the appropriate selling price. The selling price should reflect the current market conditions, the specific characteristics of the bond, and the desired return for the seller. Here are some key factors to consider when establishing the bond selling price:

- Market Interest Rates: The prevailing interest rates in the market have a significant impact on the selling price of bonds. As interest rates rise, the price of existing bonds tends to decrease. Conversely, when interest rates fall, bond prices typically rise. It’s important to monitor the market and assess the direction of interest rates when determining the selling price of your bonds.

- Bond’s Yield to Maturity: The yield to maturity (YTM) of the bond is a crucial factor to consider when determining the selling price. YTM represents the total return an investor can expect to earn if they hold the bond until maturity. Comparing the bond’s YTM to prevailing market yields can give you an indication of whether the bond is priced attractively or not.

- Credit Quality: The credit quality of the bond issuer plays a significant role in determining the selling price. Bonds with higher credit ratings are deemed less risky and typically trade at lower yields. On the other hand, bonds with lower credit ratings may have higher yields to compensate for the additional risk associated with the investment.

- Time until Maturity: The remaining time until the bond reaches maturity affects its selling price. Investors generally seek higher yields for longer-term bonds due to the increased risk associated with holding the investment for an extended period.

- Market Demand: The demand for the type of bond you are selling can impact its selling price. Bonds in high demand will likely command a higher price, while those with lower demand may need to be priced more attractively to entice buyers.

When determining the bond-selling price, it’s important to strike a balance between maximizing the desired return and offering a competitive price to attract potential buyers. Conducting thorough market research, seeking advice from financial professionals, and staying informed about macroeconomic factors can aid in setting an appropriate selling price and maximizing the value of your bond sale.

Additionally, keep in mind that transaction costs such as brokerage fees and taxes should also be factored into the selling price calculation. These costs can vary, so it’s crucial to consider them to ensure a fair and profitable bond sale.

Setting Up a Bond Sale

Once you have determined the selling price for your bonds, it’s time to set up the bond sale. This involves several key steps to ensure a smooth and successful transaction:

- Choose a Sales Method: There are several methods you can use to sell your bonds. You can work with a broker or financial advisor who will help facilitate the sale on your behalf. Alternatively, you can sell your bonds directly by utilizing an online trading platform or contacting potential buyers directly.

- Prepare the Necessary Documentation: To proceed with the bond sale, you will need to prepare the necessary documentation. This typically includes the bond certificate or confirmation statement, legal agreements, and any other relevant paperwork required by the specific selling method or regulatory requirements.

- Ensure Compliance with Regulatory Requirements: Selling bonds may involve adhering to specific regulatory requirements. Ensure that you are familiar with the regulations governing bond sales in your jurisdiction and fulfill any necessary obligations to remain in compliance.

- Secure a Custodian: If you decide to work with a broker or financial institution, you will need to identify a custodian to hold and safeguard your bonds during the sales process. A custodian ensures secure custody of your assets and facilitates the transfer of ownership upon completion of the sale.

- Set a Timeline: Establish a timeline for the bond sale, taking into consideration factors such as market conditions, liquidity, and any specific requirements or preferences you may have. Having a clear timeline will help you stay organized and manage the sale effectively.

- Consider Financing Options: In some cases, investors may require financing to purchase the bonds. If this is the case, explore financing options such as margin loans or leveraging credit facilities to make the purchase more attractive to potential buyers.

It’s important to note that the process of setting up a bond sale may vary depending on the type of bond, applicable regulations, and market conditions. Seeking guidance from professionals who specialize in bond transactions can be invaluable in navigating these complexities and ensuring a successful sale.

Once you have completed the setup process, you are ready to move forward with marketing and promoting your bonds to potential buyers. Effective marketing strategies and communication will play a crucial role in generating interest and demand for your bonds, as we will explore in the next section.

Marketing and Promoting Bonds

Once you have set up your bond sale, it’s time to focus on marketing and promoting your bonds to attract potential buyers. Effective marketing strategies can help generate interest and increase demand for your bonds. Here are some key strategies to consider:

- Targeted Outreach: Identify your target audience and tailor your marketing efforts to reach those potential buyers. Research and understand their preferences, investment goals, and risk tolerance to craft compelling messages that resonate with them.

- Engaging Content: Create informative and engaging content to highlight the key features and benefits of your bonds. This can include written articles, videos, infographics, and other visual materials that effectively communicate the value proposition of your bonds.

- Online Presence: Establish a strong online presence through a dedicated website or landing page for your bond offering. Optimize the website with relevant keywords and ensure that it provides comprehensive information about the bonds, including the terms, credit rating, and potential returns.

- Social Media and Email Marketing: Leverage social media platforms and email marketing campaigns to reach a wider audience. Share regular updates, educational content, and news related to your bonds to maintain engagement and build credibility.

- Networking and Relationship Building: Attend industry conferences, seminars, and networking events to connect with potential buyers, financial advisors, and institutional investors. Building relationships and establishing a strong network can help generate referrals and expand your reach.

- Public Relations: Generate media coverage by issuing press releases, engaging with journalists, and participating in interviews or panel discussions. Positive media exposure can enhance your credibility and create awareness about your bond offering.

In addition to these strategies, it’s crucial to emphasize the unique selling points of your bonds. Highlight any distinctive features, such as tax advantages, additional security measures, or social or environmental impact, that may attract the attention of socially responsible investors.

Remember to comply with applicable regulations regarding marketing and promoting securities. Be transparent and provide accurate information about the risks associated with the bonds to ensure ethical business practices and maintain investor trust.

By implementing these marketing strategies, you can effectively reach your target audience, increase visibility for your bond offering, and create a positive impression that motivates potential buyers to take action.

Negotiating the Sale

Once you have generated interest and potential buyers for your bonds, the next step is to negotiate the terms of the sale. Negotiating the sale involves finding a mutually acceptable agreement between you and the buyer on factors such as the selling price, quantity of bonds, and any additional terms or conditions. Here are some key considerations when negotiating the sale:

- Price Negotiation: Start the negotiation process by considering the market conditions, prevailing interest rates, and the demand for your bonds. Keep in mind your desired return and the buyer’s willingness to pay. Be open to offers and consider potential counteroffers until a satisfactory price is reached.

- Quantity of Bonds: Determine the quantity of bonds the buyer is interested in purchasing. Assess whether selling the entire bond holdings or a partial amount aligns with your investment objectives. Be prepared to negotiate the quantity based on the buyer’s requirements and your selling goals.

- Additional Terms and Conditions: Discuss any additional terms or conditions that may impact the sale. This can include factors such as settlement and payment terms, any special rights or restrictions associated with the bonds, or other relevant contractual obligations that need to be addressed.

- Flexibility: It’s important to approach the negotiation process with a certain level of flexibility. Be willing to listen to the buyer’s perspective and consider their needs and preferences. Finding common ground and being open to reasonable requests can help facilitate a smoother negotiation process.

- Legal and Regulatory Considerations: Ensure that the negotiation process adheres to all legal and regulatory requirements. Seek advice from legal professionals or a qualified financial advisor to ensure compliance with applicable laws and regulations governing bond sales.

- Communication and Documentation: Keep clear and open lines of communication with the buyer throughout the negotiation process. Ensure that all agreements, terms, and conditions are documented appropriately to avoid any future disputes or misunderstandings.

Remember, negotiation is a give-and-take process. It’s essential to strike a balance between your objectives as the seller and the buyer’s requirements. Building a positive rapport, being collaborative, and maintaining a professional approach will greatly contribute to a successful negotiation and a satisfactory outcome for both parties.

Once the negotiation is complete and an agreement is reached, move on to the final step of closing the bond sale, which we will explore in the next section.

Closing the Bond Sale

After successfully negotiating the terms of the bond sale, it’s time to move forward with the closing process. Closing the bond sale involves finalizing the transaction, transferring ownership of the bonds, and ensuring all necessary paperwork and legal requirements are fulfilled. Here are the key steps involved in closing the bond sale:

- Verification of Legal and Regulatory Requirements: Ensure that all legal and regulatory requirements for the bond sale are met. This may include obtaining necessary approvals, completing any disclosure obligations, and complying with applicable securities laws.

- Execution of Purchase Agreement: Prepare and execute a purchase agreement that outlines the terms and conditions of the bond sale. The agreement should include details such as the selling price, quantity of bonds, payment terms, and any additional provisions agreed upon during the negotiation process.

- Transfer of Ownership: Transfer the ownership of the bonds from the seller to the buyer. This typically involves updating the bond registry to reflect the change in ownership and ensuring that all necessary documentation is provided to the buyer and any relevant custodians or financial intermediaries.

- Payment Settlement: Arrange for the settlement of payment. This may involve coordinating with the buyer’s financial institution or custodian to ensure funds are transferred to the seller’s designated account in accordance with the agreed-upon payment terms.

- Confirmation of Transaction: Obtain confirmation from both parties that the transaction has been successfully completed. This can be in the form of written confirmation, electronic notifications, or any other agreed-upon method of verifying the closure of the bond sale.

- Recordkeeping and Documentation: Maintain thorough records of the bond sale transaction, including copies of the purchase agreement, payment receipts, and any other relevant documents. These records are essential for future reference, audits, or any potential legal requirements.

- Post-Sale Communication: Follow up with the buyer to ensure a smooth transition and address any questions or concerns that may arise after the bond sale. Providing exceptional customer service and ongoing support can help build strong relationships and potentially lead to future business opportunities.

It’s important to consult with professionals such as legal experts, financial advisors, or qualified bond brokers throughout the closing process. These professionals can ensure that all necessary legal and regulatory obligations are met, and the bond sale is finalized in a legally compliant and efficient manner.

By carefully following these steps, you can successfully close the bond sale, transfer ownership, and complete the transaction with confidence and professionalism.

Conclusion

Selling bonds requires a thorough understanding of the market, bond characteristics, and effective sales strategies. By following the steps outlined in this comprehensive guide, you can navigate the bond-selling process successfully and maximize the value of your bond holdings.

First, understanding the fundamentals of bonds is essential. Knowing the different types of bonds, their characteristics, and how they function will help you make informed decisions when selling them.

Evaluating bond characteristics, such as coupon rates, maturity dates, credit ratings, and yields, is crucial in determining the selling price. Consider market conditions, interest rates, and liquidity when setting the bond selling price.

Setting up a bond sale involves choosing a sales method, preparing necessary documentation, ensuring compliance with regulations, securing a custodian, and establishing a timeline. These steps lay the foundation for a successful bond sale.

Marketing and promoting your bonds are integral to attracting potential buyers. Targeted outreach, engaging content, online presence, social media and email marketing, networking, and public relations are key strategies you can employ to generate interest and demand for your bonds.

Negotiating the sale involves finding a mutually acceptable agreement on the selling price, quantity of bonds, and any additional terms and conditions. Flexibility, effective communication, and legal compliance are paramount in ensuring a successful negotiation process.

Finally, closing the bond sale requires verifying legal and regulatory requirements, executing a purchase agreement, transferring ownership, settling payments, confirming the transaction, recordkeeping, and maintaining post-sale communication.

By following these comprehensive steps, you can effectively sell your bonds and achieve your desired objectives. Remember to stay informed about market conditions, seek professional advice as needed, and approach the process with a strategic mindset. Selling bonds can be a rewarding endeavor, providing you with liquidity or returns on your investment. With careful planning and execution, you can navigate the bond market with confidence and achieve success in your bond-selling endeavors.