Home>Finance>Account In Trust: Definition, Types, Benefits, How To Set One Up

Finance

Account In Trust: Definition, Types, Benefits, How To Set One Up

Published: September 26, 2023

Discover the definition, types, and benefits of an Account in Trust in the world of finance. Learn how to set one up and secure your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Account in Trust: Definition, Types, Benefits, How To Set One Up

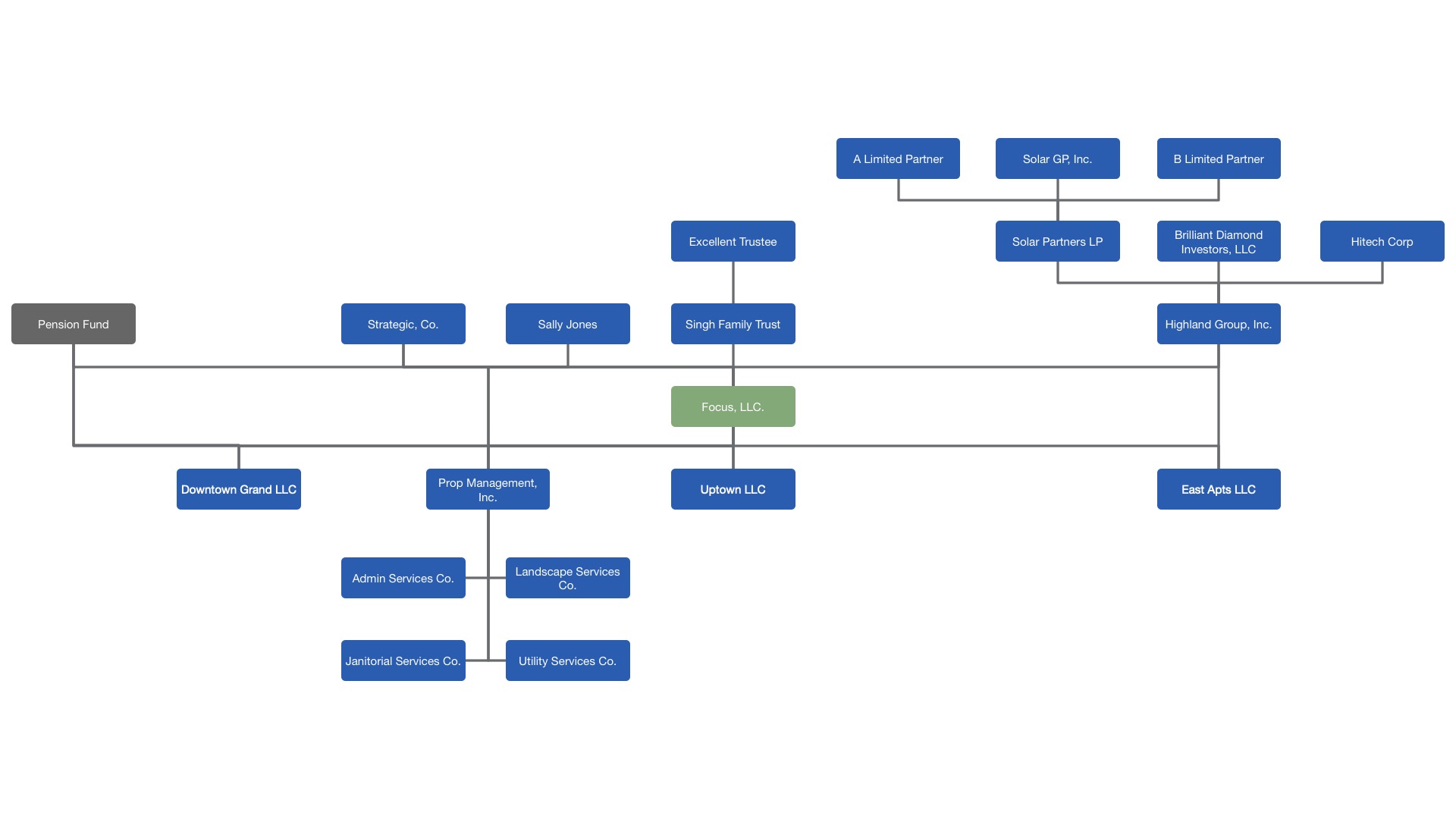

Are you looking to establish a secure and efficient way to manage your finances? An account in trust may be the solution you’ve been seeking. A trust account is a legally recognized arrangement that allows an individual or entity, known as the grantor, to transfer assets to a trustee who manages them on behalf of one or more beneficiaries. In this blog post, we will delve into the details of account in trust, its types, benefits, and how to set one up.

Key Takeaways:

- An account in trust is a legal arrangement that allows assets to be managed by a trustee on behalf of beneficiaries.

- Setting up a trust account can provide benefits such as asset protection, tax advantages, and estate planning opportunities.

What is an Account in Trust?

An account in trust, also known as a trust account, is a financial instrument that enables individuals or entities to transfer assets into a trust managed by a trustee. The trustee will administer the assets and distribute them to the beneficiaries according to the terms outlined in the trust agreement. Trusts are established for a variety of reasons, including asset protection, tax planning, and estate management.

Types of Trusts

There are different types of trust accounts, each designed to serve specific purposes. Here are some commonly established trust types:

- Revocable Living Trust: This trust allows the grantor to maintain control over the assets and make changes to the trust terms during their lifetime.

- Irrevocable Trust: Once established, an irrevocable trust cannot be modified or revoked without the consent of the beneficiaries. This type of trust offers greater asset protection.

- Charitable Remainder Trust: This trust allows the grantor to donate assets to a charity of their choice while retaining an income stream from those assets during their lifetime.

- Special Needs Trust: A special needs trust is designed to provide financial support for individuals with disabilities without jeopardizing their eligibility for government assistance programs.

- Testamentary Trust: Created through a Will, a testamentary trust comes into effect upon the grantor’s death and is often used for estate planning purposes.

Benefits of Trust Accounts

Setting up an account in trust offers several benefits, depending on your specific financial goals and circumstances. Some key advantages include:

- Asset Protection: Trusts can provide a shield for assets against creditor claims, lawsuits, and other potential risks.

- Tax Advantages: Certain trusts offer tax benefits by minimizing estate taxes, income taxes, and capital gains taxes.

- Estate Planning Opportunities: Trusts allow for efficient distribution of assets, privacy, and control over how assets are passed on to beneficiaries.

- Probate Avoidance: Assets held in trust can bypass the probate process, saving time, and reducing costs.

How to Set Up an Account in Trust

Establishing a trust account involves several essential steps:

- Define Your Goals: Determine the purpose of creating the trust account and the intended beneficiaries.

- Choose the Trust Type: Select the most suitable trust type based on your objectives.

- Select a Trustee: Appoint a reliable trustee who will manage the assets and fulfill the duties outlined in the trust agreement.

- Create the Trust Agreement: Consult with an attorney to draft a comprehensive trust agreement that outlines the terms, conditions, and instructions for the trustee.

- Transfer Assets: Transfer the desired assets into the trust account, ensuring all legal requirements are met.

- Review and Update: Regularly review and update the trust account as necessary to reflect any changes in your circumstances or wishes.

By following these steps and seeking professional guidance, you can establish an account in trust that aligns with your financial objectives and provides the desired benefits for you and your beneficiaries.

Are you ready to take control of your financial future with an account in trust? Start exploring the various trust types and consult with a trusted financial advisor or attorney to guide you through the process. Embrace the advantages of asset protection, tax planning, and efficient estate management that a trust account can bring to your financial endeavors.