Home>Finance>How To Set Up An Irrevocable Life Insurance Trust

Finance

How To Set Up An Irrevocable Life Insurance Trust

Modified: February 21, 2024

Learn how to set up an irrevocable life insurance trust to secure your financial future and protect your loved ones. Expert tips and guidance for managing finances in a smarter way.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an Irrevocable Life Insurance Trust?

- Benefits of Setting Up an Irrevocable Life Insurance Trust

- Factors to Consider Before Setting Up an Irrevocable Life Insurance Trust

- Step-by-Step Guide to Setting Up an Irrevocable Life Insurance Trust

- Funding the Irrevocable Life Insurance Trust

- Managing the Irrevocable Life Insurance Trust

- Tax Implications of an Irrevocable Life Insurance Trust

- Pros and Cons of an Irrevocable Life Insurance Trust

- Conclusion

Introduction

Life insurance is an essential tool for protecting your loved ones financially in the event of your passing. However, for individuals with significant assets and estate planning goals, a standard life insurance policy may not be sufficient. This is where an irrevocable life insurance trust (ILIT) comes into play.

An irrevocable life insurance trust is a legal entity that owns a life insurance policy on behalf of the insured individual. The purpose of setting up an ILIT is to remove the life insurance policy from the insured’s estate, thus potentially reducing estate taxes and facilitating the efficient transfer of assets to beneficiaries.

In this article, we will explore the ins and outs of setting up an irrevocable life insurance trust. We will discuss the benefits of an ILIT, the factors to consider before establishing one, and provide a step-by-step guide on how to create and manage an ILIT. Additionally, we will touch upon the tax implications of an ILIT and weigh the pros and cons to help you make an informed decision.

Whether you have a substantial estate or simply want to ensure that your loved ones are well taken care of when you’re no longer around, understanding how to set up an irrevocable life insurance trust is key to effective estate planning.

What is an Irrevocable Life Insurance Trust?

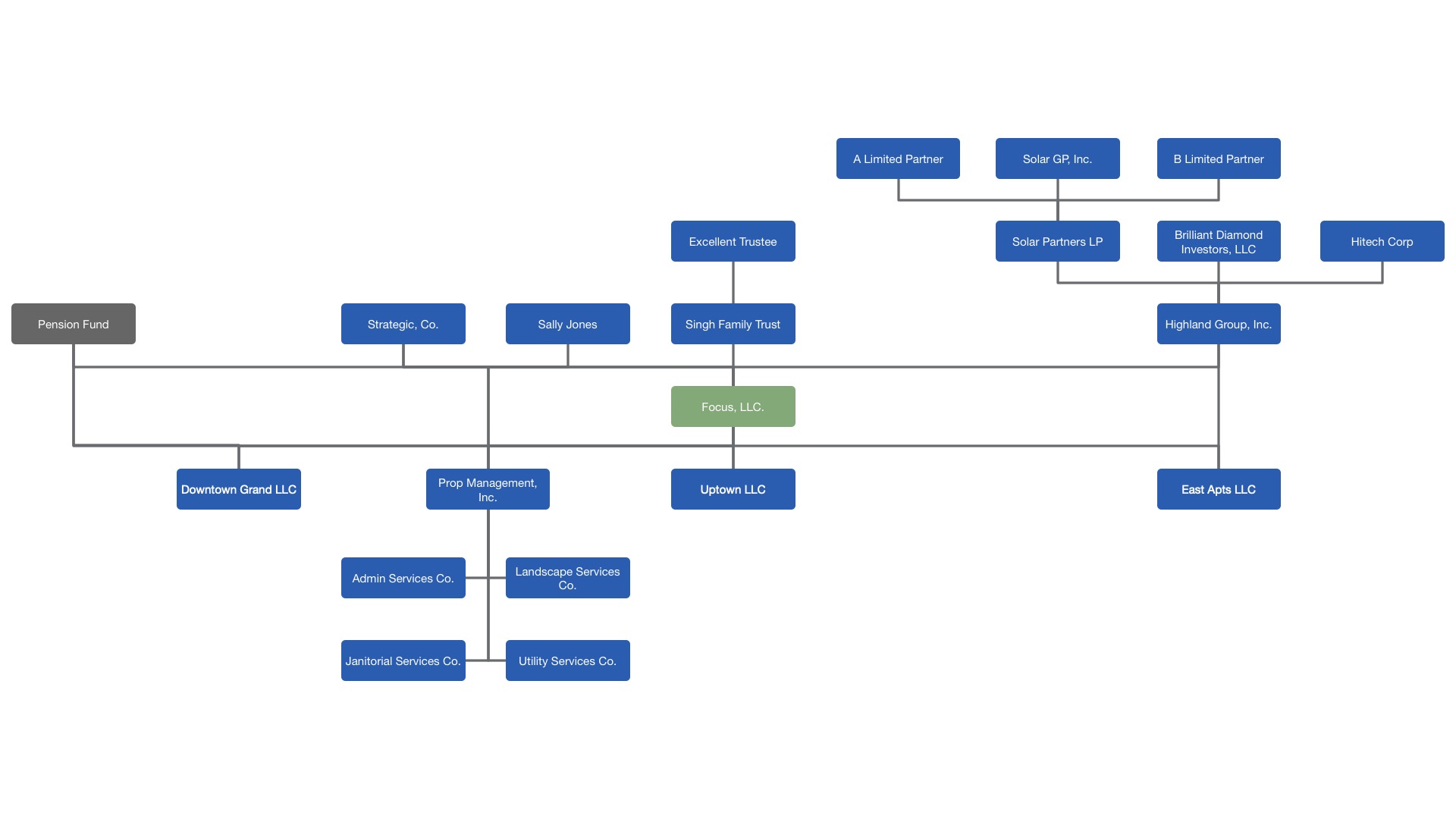

An irrevocable life insurance trust (ILIT) is a legal arrangement in which a person, known as the grantor, establishes a trust for the purpose of owning a life insurance policy. The main objective of an ILIT is to remove the life insurance proceeds from the grantor’s taxable estate, thereby potentially reducing estate taxes and ensuring efficient wealth transfer to beneficiaries.

When an individual establishes an ILIT, they transfer ownership of the life insurance policy to the trust. The trust, in turn, becomes the policy’s owner and beneficiary. This means that the proceeds from the life insurance policy are paid directly to the trust upon the insured’s death, rather than being included in the insured’s estate. The trustee, who is responsible for managing the trust, then distributes the proceeds to the trust’s beneficiaries according to the terms outlined in the trust agreement.

One of the key features of an ILIT is its irrevocability. Once the trust is established, the grantor relinquishes control over the trust assets and cannot make changes to the terms or beneficiaries without the approval of the trustee and the trust’s beneficiaries. This ensures that the trust and its assets are protected and that the intentions of the grantor are carried out.

It’s important to note that the policy premiums for an ILIT are typically paid by the grantor through annual gifts to the trust. These gifts are subject to certain limitations determined by the Internal Revenue Service (IRS) and may be subject to gift tax. However, by transferring the life insurance policy to the trust and paying the premiums through gifts, the value of the policy is removed from the grantor’s estate, potentially reducing the estate tax burden.

Overall, an irrevocable life insurance trust offers individuals a powerful estate planning tool that can help protect their assets, minimize estate taxes, and ensure a smooth wealth transfer to their chosen beneficiaries.

Benefits of Setting Up an Irrevocable Life Insurance Trust

Setting up an irrevocable life insurance trust (ILIT) can provide numerous benefits for individuals seeking to protect their assets and optimize their estate planning strategies. Let’s explore some of the key advantages of establishing an ILIT:

1. Estate Tax Reduction: One of the primary benefits of an ILIT is the potential to reduce estate taxes. By transferring ownership of a life insurance policy to the trust, the value of the policy is effectively removed from the insured’s estate. As a result, the proceeds from the policy are not subject to estate taxes upon the insured’s death. This can lead to significant tax savings, allowing more of your assets to be passed to your beneficiaries.

2. Asset Protection: Assets held within an ILIT are protected from creditors, lawsuits, and other potential claims. Since the trust owns the life insurance policy, the proceeds are shielded from the beneficiary’s creditors. This can be particularly beneficial if one of your beneficiaries faces financial difficulties or has a high-risk profession.

3. Medicaid Planning: An ILIT can be an effective tool for Medicaid planning. By placing assets in the trust, individuals may be able to qualify for Medicaid benefits while still preserving the life insurance policy for the benefit of their beneficiaries. It’s important to consult with a knowledgeable attorney to ensure compliance with Medicaid rules and regulations.

4. Control and Flexibility: Although an ILIT is an irrevocable trust, the grantor can still maintain a certain level of control and flexibility. Through careful drafting, the trust agreement can outline specific instructions for how the trust is managed and how the proceeds should be distributed to beneficiaries. This ensures that your wishes are carried out and allows for customization to suit your unique needs.

5. Privacy: Unlike a will, which becomes a public document upon your passing, an ILIT provides a level of privacy. The trust agreement and its provisions remain confidential, preserving your family’s financial privacy and protecting sensitive information from becoming publicly accessible.

6. Efficient Wealth Transfer: An ILIT allows for the seamless transfer of wealth to your chosen beneficiaries. By bypassing probate, which can be time-consuming and expensive, the proceeds from the life insurance policy are distributed directly to the trust and subsequently to the beneficiaries, avoiding delays and potential disputes.

Overall, an irrevocable life insurance trust offers a range of benefits for individuals looking to protect their assets, reduce estate taxes, maintain control over wealth distribution, and ensure an efficient and effective estate plan. It is essential to seek guidance from a financial advisor and an experienced estate planning attorney to determine if an ILIT is suitable for your specific circumstances.

Factors to Consider Before Setting Up an Irrevocable Life Insurance Trust

While an irrevocable life insurance trust (ILIT) offers numerous benefits, it’s important to carefully consider several factors before deciding to establish one. These considerations will help ensure that an ILIT aligns with your financial goals and estate planning needs. Let’s delve into the key factors to contemplate:

1. Financial Implications: It’s crucial to evaluate the financial implications of setting up an ILIT. Consider the cost of the life insurance policy premiums, which will be funded through annual gifts to the trust. Analyze your cash flow and assess whether you have the ability to consistently make those gifts without negatively impacting your overall financial well-being.

2. Estate Planning Goals: Clearly define your estate planning goals and assess whether an ILIT aligns with them. Determine if wealth preservation, reducing estate taxes, and/or providing for your loved ones in a specific manner are important to you. An ILIT may be suitable if your primary objective is to maximize the financial benefits and control over the life insurance proceeds.

3. Time Horizon: Consider your time horizon and how long you anticipate needing life insurance coverage. An ILIT is generally a long-term commitment, as once the policy has been transferred to the trust, it is challenging to cancel or modify. If you anticipate a shorter time horizon for your life insurance needs, an ILIT may not be the most appropriate option.

4. Trustee Selection: The choice of trustee is vital when establishing an ILIT, as the trustee will have the responsibility of managing the trust and distributing the life insurance proceeds to beneficiaries. Select an individual or institution that you have confidence in, ensuring they have the necessary knowledge, expertise, and integrity to handle trust administration.

5. Gift Tax Considerations: Understand the potential gift tax consequences associated with establishing an ILIT. When making annual gifts to the trust to cover the life insurance premiums, consider the gift tax exemptions and limitations set by the Internal Revenue Service (IRS). Consulting with a tax professional or estate planning attorney can help navigate the complexities of gift taxes and minimize potential tax liabilities.

6. Future Changes: Since an ILIT is an irrevocable trust, it’s important to consider any future changes in circumstances that may impact the trust. Once established, it may be challenging to modify the trust or change beneficiaries without the consent of all parties involved. Ensure that the terms of the trust and the beneficiaries named align with your long-term intentions.

Understanding these factors and evaluating their significance in your specific situation is crucial when deciding whether to establish an irrevocable life insurance trust. Seeking guidance from a qualified financial advisor and estate planning attorney will help ensure that your overall estate plan aligns with your goals and maximizes the benefits for you and your loved ones.

Step-by-Step Guide to Setting Up an Irrevocable Life Insurance Trust

Setting up an irrevocable life insurance trust (ILIT) requires careful planning and adherence to specific legal and financial requirements. Follow this step-by-step guide to help you navigate the process:

Step 1: Define Your Objectives: Clarify your estate planning goals and determine how an ILIT can help you achieve them. Consider factors such as reducing estate taxes, protecting assets, and ensuring a seamless wealth transfer to your beneficiaries.

Step 2: Select a Trustee: Choose a trustee who will be responsible for managing the ILIT and carrying out your instructions. This can be an individual, such as a family member or close friend, or a corporate trustee, such as a bank or trust company.

Step 3: Consult with an Attorney: Seek guidance from an experienced estate planning attorney who specializes in ILITs. They will help draft the necessary legal documents, including the trust agreement, to ensure compliance with state laws and your specific requirements.

Step 4: Transfer Ownership of the Life Insurance Policy: Assign ownership of your existing life insurance policy to the ILIT. This typically involves executing an assignment of ownership form, which transfers the policy to the trust. Make sure to follow the policy guidelines and consult with your insurance provider throughout the process.

Step 5: Fund the Trust: To ensure the ILIT has the necessary funds to pay the life insurance premiums, make annual gifts to the trust. These gifts, subject to gift tax limitations, will be used to cover the premiums. Consult with a tax professional to ensure compliance with gift tax regulations.

Step 6: Create the Trust Agreement: Work with your attorney to draft the ILIT trust agreement. This document outlines the terms and conditions of the trust, including the powers and responsibilities of the trustee, the beneficiaries, and the distribution of assets.

Step 7: Obtain Life Insurance Policy Appraisal: Obtain an independent appraisal of the life insurance policy’s value to ensure accurate assessment and to comply with IRS guidelines. This appraisal will help determine the value of the policy, which is crucial for estate tax calculations.

Step 8: Sign and Execute the Trust Agreement: Review the ILIT trust agreement thoroughly and sign it in the presence of a notary public. Ensure that all required parties, such as the grantor, trustee, and beneficiaries, sign the document as well.

Step 9: Notify Beneficiaries: Inform the named beneficiaries about their inclusion in the ILIT. Provide them with relevant details about the trust, your intentions, and how the life insurance proceeds will be distributed upon your passing.

Step 10: Review and Periodically Update the Trust: Regularly review and update the ILIT to ensure it remains consistent with your wishes and financial circumstances. Life events such as births, deaths, marriages, or divorces may require amendments to the trust to reflect changes in beneficiaries or trustee appointments.

Establishing an irrevocable life insurance trust requires careful planning and the guidance of experienced professionals. By following this step-by-step guide and consulting with an estate planning attorney, you can create an ILIT that aligns with your goals and provides financial security for your loved ones.

Funding the Irrevocable Life Insurance Trust

Funding an irrevocable life insurance trust (ILIT) is a critical step in ensuring the trust has the necessary financial resources to pay for the life insurance premiums and fulfill its intended purpose. Here are some key considerations when it comes to funding an ILIT:

1. Annual Gifts: The most common method of funding an ILIT is through annual gifts from the grantor. These gifts are used to cover the premiums of the life insurance policy held within the trust. The gift tax exemption allows you to make tax-free gifts up to a certain amount each year, subject to the applicable limits set by the Internal Revenue Service (IRS).

2. Crummey Withdrawal Rights: To make annual gifts to the ILIT, the trust agreement should include Crummey withdrawal rights. These rights allow beneficiaries to withdraw their portion of the gifted funds for a limited time, typically 30 or 60 days. By providing this withdrawal opportunity, the gift qualifies for the annual gift tax exclusion.

3. Utilizing Existing Assets: In some cases, grantors may choose to fund the ILIT by transferring existing assets into the trust instead of making cash gifts. This can include investments, real estate, or other valuable assets. However, it’s essential to carefully assess the potential tax implications and consult with a tax professional or estate planning attorney to ensure compliance with applicable laws.

4. Loans to the Trust: Another option for funding an ILIT is for the grantor to provide a loan to the trust. The trust then uses the loan proceeds to pay the life insurance premiums. This approach allows the trust to obtain the necessary funds without relying on annual gifts or liquidating other assets. However, it’s crucial to structure the loan properly to comply with IRS rules and avoid triggering unfavorable tax consequences.

5. Life Insurance Policy Loans: If the ILIT already owns a life insurance policy, the trust can take out a loan against the cash value of the policy to cover the premiums. This strategy can be used if the policy has acquired sufficient cash value over time. However, it’s important to consider the long-term impact on the policy’s death benefit and the interest costs associated with the loan.

6. Irrevocable Life Insurance Trust Seed Money: In some cases, grantors may choose to provide an initial lump sum of cash into the ILIT, known as seed money, at the time of establishing the trust. This seed money can help cover initial premiums or expenses, ensuring the trust is adequately funded until the annual gifting or other funding sources are established.

When it comes to funding an irrevocable life insurance trust, it’s essential to work closely with a financial advisor and an experienced estate planning attorney. They can guide you through the process, help you understand the tax implications, and ensure that the funding strategy aligns with your specific circumstances and goals.

Managing the Irrevocable Life Insurance Trust

Managing an irrevocable life insurance trust (ILIT) is crucial to ensure that it continues to serve its intended purpose and remains in compliance with legal and financial requirements. Proper management involves various responsibilities that should be carried out by the trustee and other key parties involved. Here are important considerations for managing an ILIT:

1. Trustee’s Role: The trustee plays a critical role in managing the ILIT. Their responsibilities include overseeing the trust’s administration, ensuring compliance with the trust agreement, making decisions about investments, collecting premiums, and ultimately distributing the life insurance proceeds to beneficiaries upon the insured’s death.

2. Communication with Beneficiaries: It is essential for the trustee to maintain clear and open communication with the trust beneficiaries. Keeping them informed about the trust’s progress, any changes in the life insurance policy, and the timing of potential future distributions helps build trust and transparency.

3. Premium Payments: The trustee is responsible for ensuring that the ILIT has sufficient funds to pay the life insurance premiums. This involves managing cash flow, monitoring the account balance, and making timely premium payments to the insurance provider. Failure to keep up with premium payments could result in the policy lapsing and the intended benefits being compromised.

4. Investment Management: Depending on the trust agreement, the trustee may have the authority to make investment decisions to help grow the ILIT’s assets. Careful consideration should be given to risk tolerance, time horizon, diversification, and the need for liquidity to balance the growth potential with preservation of the trust’s principal.

5. Policy Review: Regular review of the life insurance policy is essential to ensure that it continues to meet the trust’s objectives. The trustee should assess factors such as policy performance, costs, and changes in beneficiaries or circumstances that may necessitate policy adjustments or providing additional coverage.

6. Record-Keeping: The trustee should maintain accurate and up-to-date records of all transactions, premiums, distributions, and other relevant documents related to the ILIT. This includes keeping copies of the trust agreement, the life insurance policy, receipts for premium payments, and any correspondence with beneficiaries or professionals involved in trust management.

7. Periodic Reviews: Conducting periodic reviews of the ILIT with the assistance of a financial advisor and estate planning attorney can help ensure that the trust remains aligned with your goals and objectives. These reviews can identify any necessary updates or adjustments to the trust agreement, beneficiaries, or investment strategies.

8. Trustee Succession Planning: It’s crucial to have a plan in place to address trustee succession. The trustee should consider designate a successor trustee who will step into the role in the event of the original trustee’s incapacity or death. This ensures a seamless transition in trust management and continuity in carrying out the trust’s intentions.

Proactive and diligent management of an irrevocable life insurance trust is essential to preserve its intended benefits and ensure efficient asset distribution. Working closely with a qualified financial advisor and estate planning attorney will help navigate the complexities of trust management and ensure that the trust continues to serve your intended purposes.

Tax Implications of an Irrevocable Life Insurance Trust

Establishing an irrevocable life insurance trust (ILIT) can have various tax implications, both for the grantor and the beneficiaries. Understanding these tax considerations is crucial when implementing and managing an ILIT. Here are key tax implications to consider:

1. Estate Tax: Transferring a life insurance policy to an ILIT removes its value from the grantor’s taxable estate. As a result, the proceeds from the policy are generally not subject to estate taxes upon the insured’s death. This can result in significant estate tax savings, allowing more of the estate to be distributed to beneficiaries.

2. Gift Tax: Making annual gifts to fund the ILIT may trigger gift tax implications. The grantor can make tax-free gifts up to a certain annual exclusion limit determined by the Internal Revenue Service (IRS). However, any gift amounts exceeding this limit may be subject to gift tax. It’s important to consult with a tax professional to understand the applicable gift tax rules and utilize available gift tax exemptions.

3. Crummey Withdrawal Rights: The inclusion of Crummey withdrawal rights in the ILIT allows beneficiaries to withdraw their portion of annual gifts for a limited time. These withdrawal rights make the gifts qualify for the annual gift tax exclusion. However, it’s crucial to ensure that the withdrawals are not excessive and should be carried out within the permissible withdrawal timeframe to avoid potential gift tax consequences.

4. Generation-Skipping Transfer (GST) Tax: The GST tax is designed to prevent tax avoidance through the transfer of wealth across multiple generations. With an ILIT, it’s possible to structure the trust as a generation-skipping trust, thereby avoiding GST tax. By distributing the life insurance proceeds directly to grandchildren or future generations, the trust can potentially minimize taxes on transfers to skip beneficiaries.

5. Income Tax: Generally, income earned on the assets held within the ILIT is not subject to income tax at the trust level. Instead, the beneficiaries may be responsible for reporting and paying taxes on distributed income. However, if the trust generates income that remains undistributed, it may be subject to the compressed income tax rates applicable to trusts.

6. Policy Loans: If the ILIT takes out policy loans against the cash value of the life insurance policy, it’s important to be aware that these loans are generally not taxable. The borrowed funds are considered loans rather than income and do not trigger income tax consequences to the trust or the beneficiaries.

7. Irrevocable Life Insurance Trust Termination: Terminating an ILIT before the insured’s death can have potential tax consequences. For example, surrendering or transferring a life insurance policy held within the trust may result in income tax liability if the cash value exceeds the policy’s tax cost basis. It’s crucial to consult with a tax professional and seek guidance before considering the termination of an ILIT.

Understanding and managing the tax implications of an irrevocable life insurance trust is vital in maximizing its benefits and avoiding unintended tax liabilities. Working with a knowledgeable estate planning attorney and a tax professional will help ensure compliance with tax regulations and optimize the tax advantages associated with an ILIT.

Pros and Cons of an Irrevocable Life Insurance Trust

An irrevocable life insurance trust (ILIT) offers several advantages for estate planning purposes, but it’s essential to consider both the pros and cons before deciding to establish one. Let’s explore the positive aspects and potential drawbacks of an ILIT:

Pros:

- Estate Tax Reduction: One of the primary benefits of an ILIT is the potential to reduce estate taxes. By transferring the life insurance policy to the trust, the policy’s value is removed from the grantor’s taxable estate, potentially resulting in significant tax savings.

- Asset Protection: Assets held within an ILIT are protected from creditors, lawsuits, and other claims. This ensures that the life insurance proceeds are safeguarded for the beneficiaries and not subject to potential financial risks.

- Control and Customization: With an ILIT, the grantor can maintain control over how the trust is managed and distribute the life insurance proceeds. The trust agreement can be customized to meet the grantor’s specific wishes and provide flexibility in shaping the distribution of assets.

- Wealth Transfer: An ILIT allows for a seamless and efficient transfer of wealth to beneficiaries. By bypassing probate, the life insurance proceeds are distributed directly to the trust and subsequently to the beneficiaries, avoiding delays, costs, and potential disputes.

- Privacy: Unlike a will, which becomes a public document, an ILIT provides a level of privacy. The trust agreement and its provisions remain confidential, ensuring the financial affairs of the grantor and the beneficiaries are protected.

- Medicaid Planning: An ILIT can be utilized as part of Medicaid planning strategies. By placing assets in the trust, individuals may be able to qualify for Medicaid benefits while still preserving the life insurance policy for the benefit of their beneficiaries.

Cons:

- Irrevocability: Once an ILIT is established, it is difficult to change or revoke. The grantor loses control and cannot make changes to the trust agreement or beneficiaries without the approval of the trustee and beneficiaries. This lack of flexibility may not align with certain individuals’ changing circumstances or evolving estate planning goals.

- Complexity and Cost: Establishing and maintaining an ILIT can be complex and involve legal and administrative expenses. Assistance from a qualified estate planning attorney and ongoing trustee fees should be factored into the decision-making process.

- Gifting Limitations: Contributions to an ILIT are typically made through annual gifts, subject to gift tax limitations. If the grantor wishes to make substantial premium payments, these gifts may exceed the gift tax exemption and trigger potential tax liabilities.

- Loss of Access to Cash Value: Transferring a life insurance policy to an ILIT means the grantor no longer has direct access to the policy’s cash value. This cash value becomes the asset of the trust and can only be accessed or used as outlined in the trust agreement.

- Complicated Administration: Managing an ILIT requires adherence to legal and financial requirements, including premium payments, tax filings, and ongoing communication with beneficiaries. The trustee must fulfill these responsibilities diligently to ensure the trust’s effectiveness and compliance.

Considering the pros and cons of an irrevocable life insurance trust is essential to make an informed decision about whether it aligns with your estate planning goals. Consult with a financial advisor and an experienced estate planning attorney to evaluate your specific circumstances and ensure that an ILIT is suitable for your needs.

Conclusion

An irrevocable life insurance trust (ILIT) can be a powerful tool in estate planning, providing individuals with the opportunity to protect their assets, reduce estate taxes, and ensure a seamless transfer of wealth to their chosen beneficiaries. By transferring ownership of a life insurance policy to an ILIT, the policy’s value is removed from the taxable estate, potentially resulting in significant tax savings and asset protection.

While an ILIT offers numerous advantages, it’s important to carefully consider the factors involved, such as financial implications, estate planning goals, and gift tax considerations. Working with qualified professionals, including financial advisors and estate planning attorneys, can help navigate the complexities and ensure that the trust is aligned with your objectives and financial circumstances.

The step-by-step guide provided in this article outlines the process of setting up an ILIT, from defining your objectives to signing and executing the trust agreement. Funding the trust through annual gifts or other means, managing the trust’s assets, and maintaining proper communication with beneficiaries are vital aspects of ILIT administration.

It’s crucial to be aware of the tax implications associated with an ILIT, including estate tax reduction, gift tax considerations, and potential income tax responsibilities. Understanding these tax implications is essential in optimizing the benefits, complying with tax laws, and avoiding unintended tax liabilities.

While an ILIT offers numerous benefits, it’s important to recognize that it also has its limitations and considerations. Irrevocability, complexity, and possible loss of access to cash value are factors that should be carefully evaluated based on your personal circumstances and estate planning goals.

In conclusion, an irrevocable life insurance trust can be a valuable tool for individuals seeking to protect their assets, minimize estate taxes, and efficiently transfer wealth to their chosen beneficiaries. By thoroughly understanding the advantages, disadvantages, and important considerations, you can confidently make informed decisions about whether an ILIT is right for you. Remember to seek guidance from qualified professionals to tailor the trust to your unique needs and ensure that it aligns with your long-term objectives.