Home>Finance>How Will A Life Insurance Beneficiary Designation Naming A Spouse Be Changed By Divorce?

Finance

How Will A Life Insurance Beneficiary Designation Naming A Spouse Be Changed By Divorce?

Published: October 15, 2023

Discover how divorce can impact the beneficiary designation of a spouse in a life insurance policy. Learn how to navigate these changes in your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Life Insurance Beneficiary Designations

- Naming a Spouse as the Beneficiary in a Life Insurance Policy

- Impact of Divorce on Life Insurance Beneficiary Designation

- Automatic Revocation of Ex-Spouse as the Beneficiary

- Challenges and Complexities in Changing Beneficiary Designations

- Importance of Updating Beneficiary Designations After Divorce

- Seeking Legal Advice for Modifying Beneficiary Designations

- Conclusion

Introduction

Life insurance is a crucial financial tool that provides a financial safety net for your loved ones in the event of your untimely passing. One important aspect of a life insurance policy is designating a beneficiary – the person or entity who will receive the death benefit upon your death. Typically, people choose their spouse as the primary beneficiary, ensuring that their partner is financially protected after they’re gone.

However, life doesn’t always follow a straight path, and marriages can sometimes end in divorce. This raises the question of what happens to the life insurance beneficiary designation when a couple goes through a divorce. How does the divorce affect the designation of the ex-spouse as the beneficiary? In this article, we will explore the impact of divorce on life insurance beneficiary designations and highlight the importance of updating these designations post-divorce.

Understanding how divorce affects life insurance policies is crucial, as failing to update a beneficiary designation can have significant legal and financial consequences. It’s essential to be aware of your rights and obligations and take the necessary steps to protect yourself and your loved ones.

Understanding Life Insurance Beneficiary Designations

Before delving into the impact of divorce on life insurance beneficiary designations, it’s important to have a clear understanding of what beneficiary designations entail. When you purchase a life insurance policy, you have the opportunity to name one or more beneficiaries who will receive the death benefit in the event of your passing.

The primary beneficiary is the person or entity you designate to receive the death benefit. This is typically a spouse, child, or another family member. You also have the option to name contingent beneficiaries who would receive the death benefit if the primary beneficiary predeceases you.

Life insurance policies allow flexibility in choosing beneficiaries. You can allocate the death benefit in various ways, such as a specific percentage for each beneficiary or assigning equal shares to multiple beneficiaries. Additionally, you can update beneficiary designations at any time, ensuring that your policy reflects your changing circumstances and wishes.

It’s important to note that life insurance beneficiary designations override the instructions in your will. This means that even if your will specifies a different distribution of assets, the life insurance policy’s beneficiary designation will determine who receives the death benefit.

Life insurance beneficiary designations are a crucial aspect of your financial planning. They ensure that the funds are distributed as per your wishes and can provide financial stability and support for your loved ones in a difficult time.

Naming a Spouse as the Beneficiary in a Life Insurance Policy

When it comes to life insurance, many people choose to name their spouse as the primary beneficiary. This is a common choice, as it ensures that the surviving spouse is financially protected and can maintain their lifestyle after the insured’s passing.

By naming a spouse as the beneficiary, the life insurance proceeds can provide financial support for various needs. They can help cover funeral expenses, pay off outstanding debts, replace the lost income of the deceased, and ensure that the surviving spouse can continue to meet their financial obligations and maintain their quality of life.

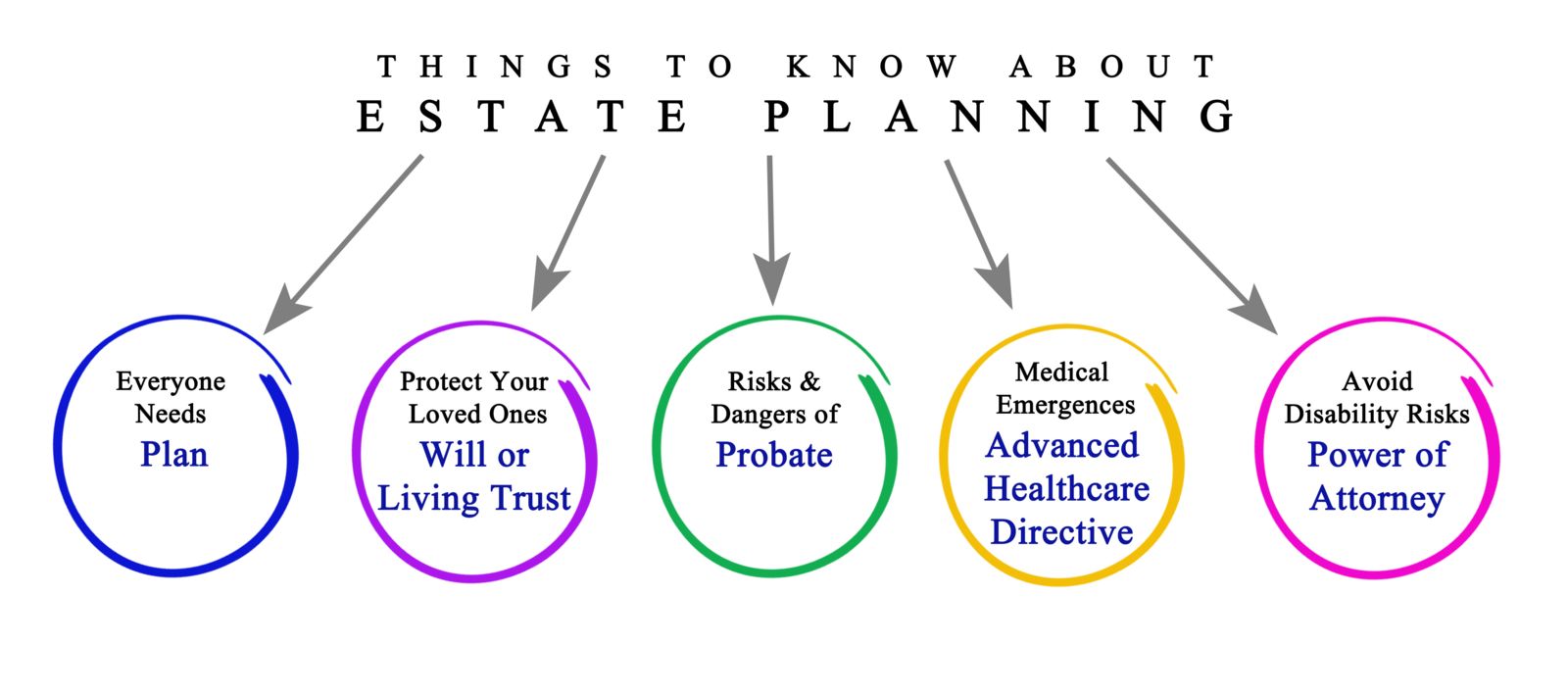

Furthermore, by designating a spouse as the primary beneficiary, the death benefit is typically paid out directly and avoids the probate process. This means that the funds are readily available to the surviving spouse without any delays or complications.

It’s important to note that life insurance beneficiary designations are separate from the division of assets in a divorce. Even if there is a divorce settlement that outlines the distribution of the estate, the beneficiary designation remains valid until it is changed officially.

It’s essential for individuals considering divorce or going through the process to understand the legal implications of maintaining a spouse as the beneficiary during this time. Additionally, they should be aware of the steps required to make changes to the beneficiary designation after the divorce is finalized.

Impact of Divorce on Life Insurance Beneficiary Designation

A divorce can have a significant impact on the life insurance beneficiary designation that names a spouse as the primary beneficiary. In many jurisdictions, the law recognizes that the dynamics of a relationship change after a divorce, and certain provisions come into effect to protect the interests of the parties involved.

One of the key provisions that affect life insurance beneficiary designations is automatic revocation. In many jurisdictions, divorce automatically revokes the designation of the former spouse as the beneficiary. This means that if you do not update your beneficiary designation after a divorce, your ex-spouse will no longer be entitled to receive the death benefit.

Automatic revocation is designed to prevent unintended consequences and ensure that the life insurance proceeds go to individuals who are currently aligned with your wishes and financial circumstances. It recognizes the changed relationship status and prioritizes the need to update beneficiary designations to reflect the reality of the situation.

It’s important to note that automatic revocation does not apply to every jurisdiction and may vary depending on local laws and the specific terms of your divorce settlement. Therefore, it’s crucial to consult a legal professional to understand the rules and regulations that apply to your situation.

In some cases, divorce decrees may explicitly mention the life insurance beneficiary designation and provide instructions on how it should be handled. These instructions may include requirements for maintaining the ex-spouse as the beneficiary for a certain period or until specific conditions are met.

Although automatic revocation helps in many situations, it’s essential to update beneficiary designations promptly after a divorce to avoid any potential legal disputes or unintended consequences. By updating the designation, you can ensure that the death benefit is directed to the person or entity that aligns with your current wishes and financial circumstances.

Automatic Revocation of Ex-Spouse as the Beneficiary

One of the significant impacts of divorce on life insurance beneficiary designations is the automatic revocation of the ex-spouse as the beneficiary. This revocation typically occurs upon the finalization of the divorce and helps ensure that the life insurance proceeds are distributed according to the current intentions of the policyholder.

Automatic revocation is a legal provision that recognizes the changed dynamics of a relationship after a divorce. It acknowledges that individuals may want to remove their ex-spouse as the beneficiary and redirect the death benefit to someone else, such as a new spouse, children, or other family members.

By automatically revoking the ex-spouse as the designated beneficiary, the law aims to prevent any unintended consequences and ensure that the life insurance proceeds are distributed in line with the policyholder’s current wishes and circumstances.

It’s important to note that automatic revocation may not be applicable in all jurisdictions or under specific circumstances. Some jurisdictions may have specific rules that require the policyholder to take active steps to remove the ex-spouse as the beneficiary, even after the divorce. Thus, it’s crucial to consult with a legal professional to understand the laws and regulations that apply in your particular case.

It’s also worth mentioning that automatic revocation does not affect contingent beneficiaries named in the policy. If the policyholder has named alternate or secondary beneficiaries, they will typically move up in line to receive the death benefit in place of the ex-spouse.

In cases where the ex-spouse was named as the only beneficiary and automatic revocation comes into effect, the death benefit may be paid to the estate of the policyholder. This means that the funds will be subject to probate and distributed according to the applicable laws and any existing will or estate plan.

To avoid any potential complications and ensure that the life insurance proceeds are distributed as intended, it’s imperative to update beneficiary designations promptly after a divorce. By doing so, you can ensure that the death benefit goes to the individuals or entities that align with your current wishes and financial circumstances.

Challenges and Complexities in Changing Beneficiary Designations

While updating beneficiary designations after a divorce is a straightforward process in theory, there can be challenges and complexities that arise. It’s essential to navigate these potential hurdles to ensure that the beneficiary designation reflects your current wishes and protects the financial interests of your loved ones.

One challenge is the identification and location of all relevant life insurance policies. During a divorce, individuals may have multiple insurance policies that need to be taken into consideration. It’s crucial to gather all policy documents and review them to determine the beneficiary designations on each policy. This can be a time-consuming process, especially if the policies were obtained at different times or under different circumstances.

Additionally, individuals may face challenges if the ex-spouse is not cooperative or willing to cooperate in updating the beneficiary designation. The ex-spouse may refuse to sign the necessary paperwork or communicate their intentions regarding the life insurance policy. In such cases, it may be necessary to seek legal intervention to ensure that the beneficiary designation is updated appropriately.

Furthermore, if the divorce settlement includes provisions regarding life insurance beneficiary designations, there can be additional complexities and requirements to fulfill. It’s important to review the settlement agreement carefully and understand any specific instructions or conditions related to the life insurance policy. Failure to comply with these requirements can result in legal consequences or disputes.

Another challenge that individuals may face is the emotional aspect of changing beneficiary designations after a divorce. It can be difficult to address the reality that an ex-spouse is no longer the intended recipient of the death benefit, especially if the policy was initially taken out to provide financial support for them. However, it’s crucial to separate emotional considerations from financial and practical ones to ensure that the designated beneficiaries are aligned with your current circumstances and wishes.

Seeking guidance from a financial advisor or attorney who specializes in estate planning and divorce can help navigate these challenges and complexities. They can provide valuable advice on the legal requirements, assist in locating and updating the necessary policies, and ensure that the beneficiary designations are in line with your current financial goals.

It’s important to remember that updating beneficiary designations is a crucial step in the post-divorce process. By overcoming the challenges and complexities involved, you can protect the financial interests of your loved ones and ensure that the life insurance proceeds are distributed in accordance with your wishes.

Importance of Updating Beneficiary Designations After Divorce

Updating beneficiary designations after a divorce is of utmost importance to ensure that your life insurance proceeds are distributed according to your current wishes and circumstances. Failing to update these designations can lead to unintended consequences and may result in the funds going to someone you no longer want to benefit from the policy.

Here are a few reasons why updating beneficiary designations after divorce is crucial:

- Protects your loved ones: Updating beneficiary designations allows you to protect the financial interests of your loved ones. After a divorce, it’s common for individuals to want to redirect the death benefit to their children, other family members, or new dependents.

- Avoids legal disputes: Failing to update beneficiary designations can lead to legal disputes or challenges. If you pass away without updating the designation, your ex-spouse may argue that they are still entitled to the death benefit, leading to delays and potential litigation. By proactively updating the designation, you can minimize the risk of such disputes.

- Aligns with your intentions: After a divorce, your wishes and priorities may change. Updating beneficiary designations allows you to ensure that the life insurance proceeds are distributed in line with your current intentions and financial goals.

- Avoids unintended consequences: Automatic revocation may not always apply or may be subject to specific conditions in your jurisdiction. By actively updating the beneficiary designations, you can prevent any unintended consequences and ensure that the funds go to the intended recipients.

- Complies with divorce settlement: If your divorce settlement includes provisions regarding life insurance beneficiary designations, updating these designations is necessary to comply with the terms of the settlement. Failure to do so may result in legal consequences or disputes.

- Reflects your changing circumstances: Life events such as divorce often bring about significant changes in your financial situation, relationships, and dependents. Updating beneficiary designations allows you to ensure that the life insurance proceeds align with your current circumstances and can adequately provide for your loved ones.

It’s important to note that updating beneficiary designations is not a one-time task. It’s recommended to review and update your designations periodically, especially after major life events like divorce, marriage, the birth of a child, or the death of a beneficiary.

Seeking guidance from a financial advisor or attorney who specializes in estate planning can help you navigate the complexities of updating beneficiary designations and ensure that your wishes are appropriately reflected in your life insurance policies.

By taking the necessary steps to update your beneficiary designations after a divorce, you can have peace of mind knowing that your loved ones will be protected and financially supported in the event of your passing.

Seeking Legal Advice for Modifying Beneficiary Designations

Modifying beneficiary designations after a divorce is a critical step in protecting your financial interests and ensuring that your life insurance proceeds are distributed according to your wishes. To navigate the legal complexities involved in this process, it is highly recommended to seek legal advice from a qualified attorney who specializes in family law and estate planning.

Here are a few reasons why seeking legal advice is important when modifying beneficiary designations:

- Understanding your rights and obligations: The laws surrounding beneficiary designations and divorces can vary depending on your jurisdiction. By consulting with a knowledgeable attorney, you can gain a clear understanding of your rights and obligations in updating the designations.

- Interpreting divorce settlement provisions: If your divorce settlement includes provisions regarding life insurance beneficiary designations, an attorney can help you interpret these provisions and ensure that you comply with their requirements. They can also guide you in understanding any conditions or stipulations related to the modifications.

- Reviewing insurance policies and documents: A skilled attorney can assist you in gathering and reviewing all relevant insurance policies and documents. They can help you identify the policies that require beneficiary updates and ensure that no policies are overlooked during the process.

- Navigating legal complexities: Modifying beneficiary designations involves adhering to legal processes and requirements. An attorney can guide you through these complexities, ensuring that you follow the necessary steps and that all legal formalities are met.

- Providing guidance on documentation: Your attorney can help you complete the required documentation for modifying the beneficiary designations. They can ensure that the paperwork is accurately completed and in compliance with the applicable laws and regulations.

- Offering protection against legal disputes: If there is any disagreement or potential dispute regarding the beneficiary designations, an attorney can provide legal advocacy to protect your interests. They can help resolve conflicts and ensure that the modifications are upheld in accordance with the law.

It’s important to choose an attorney who specializes in family law, divorce, and estate planning. They will have the expertise and experience to provide you with the necessary guidance and support throughout the process. Additionally, they can work in collaboration with your financial advisor to ensure that your beneficiary designations align with your overall financial goals and estate planning objectives.

By seeking legal advice, you can navigate the legal complexities involved in modifying beneficiary designations after a divorce with confidence. An attorney will help ensure that your wishes are correctly reflected in your life insurance policies and that your loved ones are protected in the event of your passing.

Conclusion

Updating beneficiary designations after a divorce is a crucial step in protecting your loved ones and ensuring that your life insurance proceeds are distributed according to your current wishes. Divorce has a significant impact on beneficiary designations, triggering automatic revocation of the ex-spouse as the beneficiary in many jurisdictions. However, it’s important to understand the specific laws and regulations that apply in your jurisdiction and to consult with a legal professional for guidance.

By updating beneficiary designations, you can safeguard the financial interests of your loved ones and prevent any unintended consequences. It allows you to ensure that your life insurance proceeds go to individuals or entities that align with your current circumstances and intentions.

Modifying beneficiary designations can come with challenges and complexities, including the identification of all relevant policies, cooperation from the ex-spouse, and compliance with divorce settlement provisions. Seeking legal advice from an attorney who specializes in family law and estate planning can help you navigate these challenges and ensure that you meet all legal requirements.

Remember, updating beneficiary designations is not a one-time task. Life events such as divorce, marriage, or the birth of a child may necessitate further updates. Regularly reviewing and updating your designations, with the assistance of a legal professional, will help ensure that they align with your evolving financial goals and family structure.

Ultimately, the importance of updating life insurance beneficiary designations after a divorce cannot be overstated. By taking proactive measures and seeking legal advice, you can have peace of mind, knowing that your loved ones will be protected and financially supported in the event of your passing.