Finance

Negative Butterfly Definition

Published: December 29, 2023

Discover the negative butterfly definition in finance and learn how it impacts markets and investment strategies. Gain valuable insights into this phenomenon and its potential implications.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Negative Butterfly Definition: A Guide to Financial Terminology

Welcome to our finance blog! In this post, we will explore the concept of Negative Butterfly Definition, an important term in the world of finance. If you’ve come across this term and wondered what it means, you’re in the right place! We’ll break down the definition of Negative Butterfly and explain its significance in simple terms.

Key Takeaways:

- Negative Butterfly is a term used in finance to describe a scenario where the prices of options with shorter expiration dates decrease more quickly compared to options with longer expiration dates.

- This phenomenon can occur when market participants expect increased volatility in the near future.

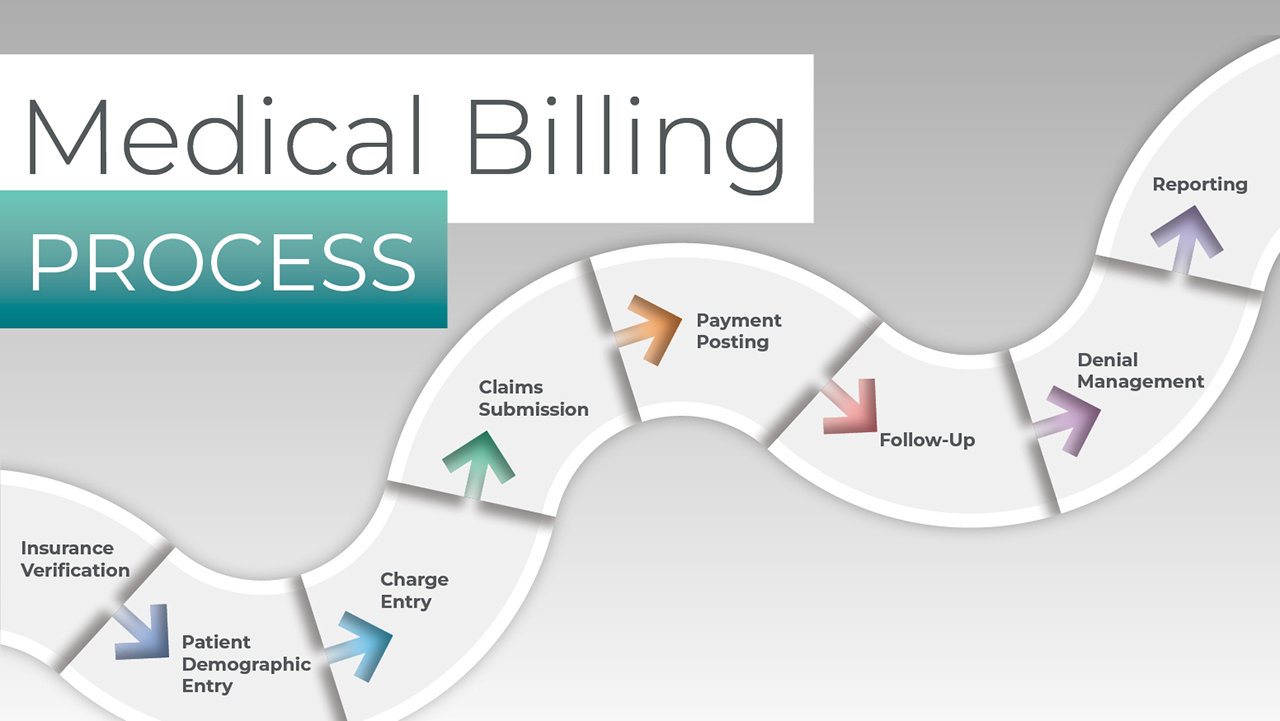

Now, let’s delve deeper into the concept of Negative Butterfly Definition. To understand it better, let’s first look at the basics of butterfly spreads in the options market. A butterfly spread involves buying one option with a certain strike price, selling two options with a higher and lower strike price, and buying another option with an even higher (or lower) strike price.

The profit or loss in a butterfly spread largely depends on the difference between the strike price and the actual stock price at expiration. In a typical butterfly spread, the maximum profit is achieved when the actual stock price perfectly matches the middle strike price. However, in a Negative Butterfly scenario, there is a twist in the expected outcome.

In the Negative Butterfly Definition, the options with shorter expiration dates are more sensitive to changes in volatility compared to options with longer expiration dates. This means that if volatility increases, the value of options with shorter expiration dates will decline at a higher rate, resulting in a potential loss for the investor.

So why does this happen? It primarily occurs when market participants expect a significant increase in volatility, leading them to demand higher premiums for options with shorter expiration dates. As a result, the price of these options decreases more rapidly.

Here are two key takeaways to remember:

- Negative Butterfly refers to a scenario where options with shorter expiration dates decrease in value more quickly compared to options with longer expiration dates.

- This phenomenon is driven by market expectations of increased volatility.

It’s essential for investors and traders to understand Negative Butterfly and its implications. By recognizing this pattern, they can better navigate the options market and make informed decisions. Managing risk effectively in options trading requires a comprehensive understanding of various concepts and terminologies, including Negative Butterfly.

Now that you have learned about Negative Butterfly Definition, you are one step closer to becoming a more knowledgeable investor. Stay tuned for more finance insights and educational content on our blog!