Home>Finance>What Is A Finance Charge? Definition, Regulation, And Example

Finance

What Is A Finance Charge? Definition, Regulation, And Example

Published: November 23, 2023

Learn the definition, regulation, and example of finance charges. Understand how they impact your finances and stay informed about the latest finance trends.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is a Finance Charge? Definition, Regulation, and Example

When it comes to managing your finances, understanding various financial concepts and terms is crucial. One such term that you may come across is the finance charge. But what exactly is a finance charge? In this blog post, we will delve into the definition of a finance charge, its regulation, and provide an example to help you grasp this concept better.

Key Takeaways:

- A finance charge is the fee that lenders charge borrowers for the use of credit.

- Various regulations, such as the Truth in Lending Act, govern the disclosure and calculation of finance charges.

What Is a Finance Charge?

Put simply, a finance charge refers to the fee that lenders charge borrowers for the use of credit. It includes any interest charges, service fees, and other costs associated with borrowing money. Finance charges are typically added to the principal balance and are usually expressed as a percentage of the loan amount or credit balance.

The purpose of a finance charge is to compensate lenders for the risk they take by extending credit. Lenders determine finance charges based on various factors such as the creditworthiness of the borrower, the duration of the loan, and the prevailing interest rates.

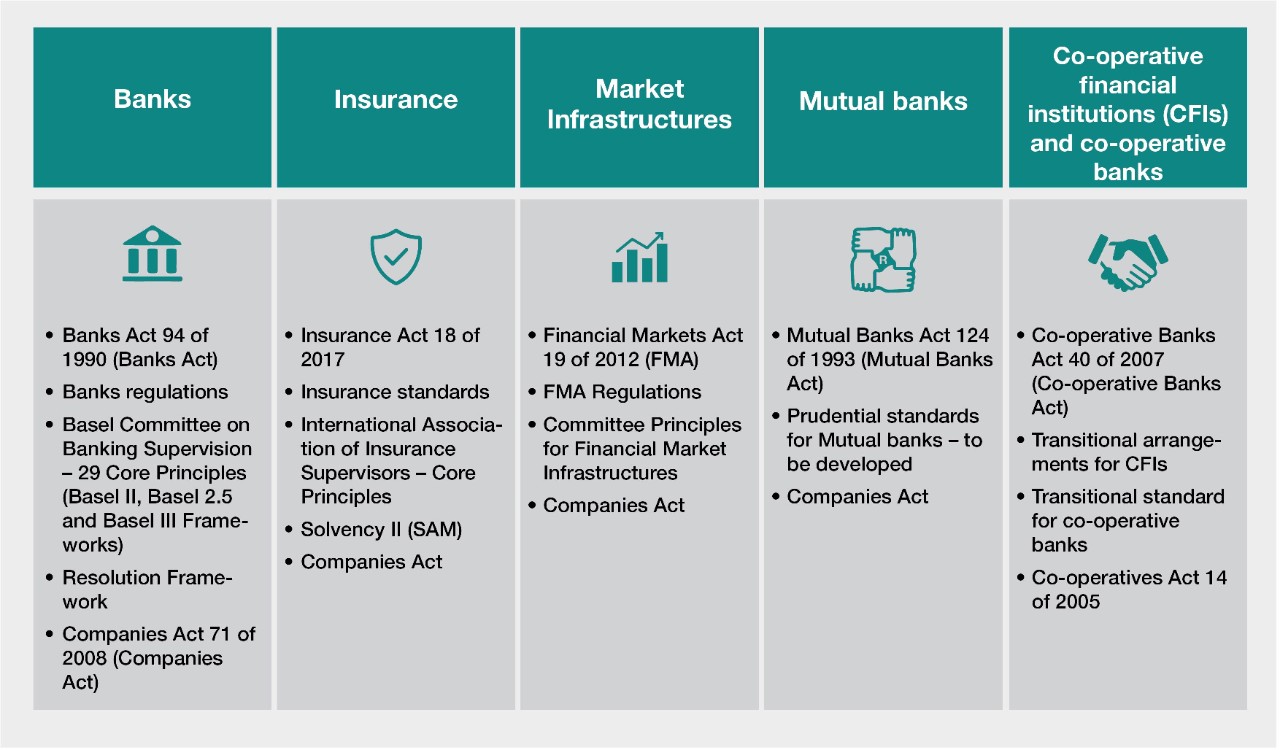

Regulation of Finance Charges

The regulation of finance charges is essential to ensure transparency and protect consumers from deceptive practices. In the United States, the Truth in Lending Act (TILA) is one of the key regulations that governs the disclosure and calculation of finance charges.

Under TILA, lenders are required to disclose the finance charges in a standardized format, allowing borrowers to compare the costs of credit between different lenders. The act also mandates lenders to provide a detailed breakdown of the finance charges, making it easier for borrowers to understand the fees they are being charged.

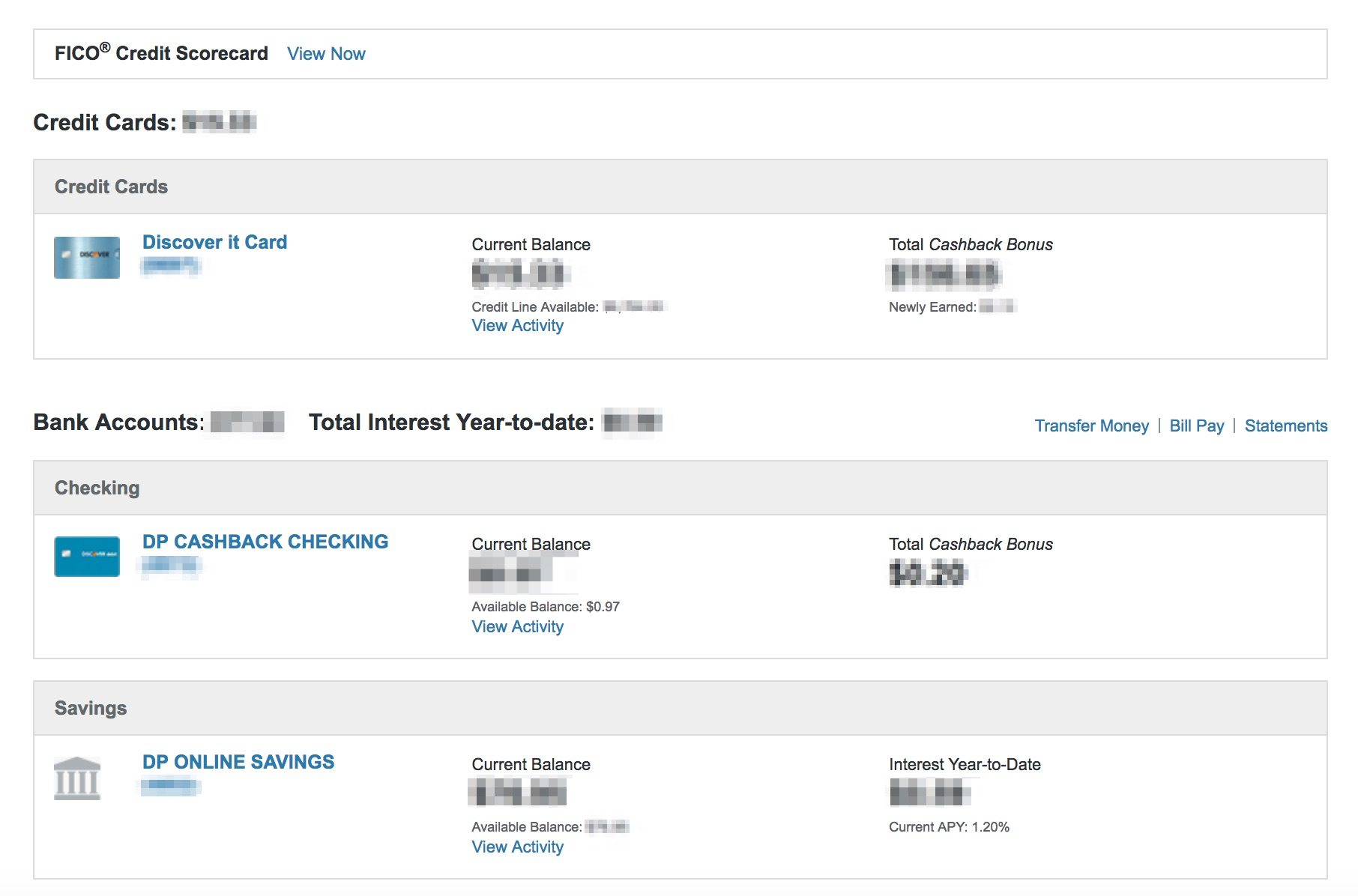

Example of a Finance Charge

Let’s consider an example to illustrate how a finance charge works. Imagine you borrow $10,000 from a bank at an annual interest rate of 10%. The bank also charges an additional service fee of $100 for processing the loan.

To calculate the finance charge, you would first need to determine the interest on the loan. In this case, it would be $10,000 multiplied by 10%, which equals $1,000. Next, you add the service fee of $100 to the interest, resulting in a total finance charge of $1,100.

So, in this scenario, the finance charge is $1,100, which you will need to repay along with the principal amount borrowed.

Conclusion

Understanding what a finance charge is and how it is regulated is crucial for anyone who borrows money or uses credit. By being aware of the fees associated with credit, you can make informed financial decisions and choose lenders that offer transparent terms and conditions.

Remember, finance charges can vary depending on the lender and the terms of the loan, so always review the terms and conditions carefully before borrowing. By having a clear understanding of finance charges, you can navigate the world of credit with confidence.