Finance

Why Did My State Farm Car Insurance Go Up?

Published: November 19, 2023

Discover why your State Farm car insurance rates have increased and learn how to manage your finances effectively to save on insurance costs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Car insurance plays a pivotal role in protecting you and your vehicle from financial risks associated with auto accidents. However, you may be perplexed if you notice that your State Farm car insurance rates have increased. Understanding why your rates have gone up can help you make informed decisions about your policy and potentially find ways to reduce your premiums.

Factors such as changes in driving history, coverage, state laws and regulations, and insurance company policies can all contribute to an increase in car insurance rates. Additionally, certain risk factors, such as traffic violations, accidents, age, gender, vehicle type, usage, credit score, and location, can also impact your car insurance premiums.

In this article, we will explore the various factors that can cause your State Farm car insurance rates to go up. By gaining a deeper understanding of these factors, you’ll be better equipped to navigate the complex world of car insurance and make informed decisions about your coverage.

Factors Impacting Car Insurance Rates

Several factors can affect your car insurance rates, and it’s essential to be aware of them to understand why your State Farm car insurance premiums have increased. Let’s take a closer look at these factors:

- Changes in Driving History: Your driving history plays a significant role in determining your car insurance rates. If you’ve recently received a traffic ticket, been involved in an accident, or have accumulated several points on your driving record, it can result in an increase in your premiums.

- Changes in Coverage: Modifying your coverage can impact your car insurance rates. For example, if you’ve added additional coverage options or increased your coverage limits, it can lead to higher premiums. Similarly, decreasing your coverage may result in lower premiums.

- Changes in State Laws and Regulations: State laws and regulations regarding car insurance can change over time. These changes, such as minimum coverage requirements or modifications in the calculation of insurance rates, can have an impact on your premiums.

- Changes in Insurance Company Policies: Insurance companies periodically review and adjust their policies, which can affect your rates. If State Farm has made changes to their underwriting guidelines or rating factors, it could result in an increase in your premiums.

- Increased Risk Factors: Factors that contribute to an increased risk of accidents or insurance claims can also impact your car insurance rates. These risk factors include your driving history, age, gender, type of vehicle, credit score, and even your geographic location.

Understanding the various factors that can cause your car insurance rates to go up is crucial. By being aware of these factors, you can proactively take steps to mitigate potential rate increases or explore alternative insurance options to find the best coverage and rates for your needs.

Changes in Driving History

Your driving history is one of the primary factors that car insurance companies like State Farm consider when determining your insurance rates. Any recent changes in your driving history can result in an increase in your car insurance premiums. Here are some key aspects related to your driving history that can impact your rates:

- Traffic Violations: If you’ve recently received a speeding ticket, a citation for running a red light, or any other traffic violation, it can affect your car insurance rates. Insurance companies view these violations as indicators of risky behavior behind the wheel, increasing the likelihood of accidents or claims.

- Accidents: Being involved in an at-fault accident or even multiple accidents can have a significant impact on your car insurance premiums. At-fault accidents signal to insurance companies that you may be a higher-risk driver, leading to an increase in insurance rates.

- Driving Record: Your overall driving record, including the number of points or violations on your record, can affect your car insurance rates. If you have a history of traffic violations or a considerable number of points on your driving record, it can result in higher premiums.

It’s important to note that insurance companies typically review your driving history periodically. Therefore, even if you had a clean driving record in the past, any recent violations or accidents can lead to an increase in your car insurance rates during the renewal process.

To mitigate the impact of changes in your driving history on your car insurance rates, it’s crucial to practice safe driving habits. Obey traffic laws, avoid distractions while driving, and maintain a vigilant attitude on the road. Over time, your clean driving record can help lower your car insurance premiums.

If you have experienced an increase in your car insurance rates due to changes in your driving history, it may be worth exploring defensive driving courses or traffic school programs. Successfully completing these courses can sometimes help reduce the impact of traffic violations on your car insurance rates.

Changes in Coverage

Modifications to your car insurance coverage can also impact your car insurance rates. Adding or reducing coverage options, adjusting your deductibles, or changing your coverage limits can result in changes to your premiums. Here are a few key aspects of coverage that can affect your car insurance rates:

- Additions to Coverage: If you’ve recently added additional coverage options to your policy, such as comprehensive or collision coverage, it can increase your premiums. These coverage options provide added protection for your vehicle and increase the potential payout for insurance claims, hence the increase in premiums.

- Changes in Deductibles: Adjusting your deductibles can impact your car insurance rates. A deductible is the portion of a claim that you are responsible for paying before the insurance coverage kicks in. If you choose a lower deductible, your premiums will be higher, as the insurance company is taking on a greater portion of the risk.

- Modifications to Coverage Limits: Changing your coverage limits can also lead to changes in your car insurance premiums. Higher coverage limits imply that the insurance company may have to pay out a larger amount in the event of a claim, which can result in higher premiums.

- Added Optional Coverages: Insurance companies offer various optional coverages, such as roadside assistance or rental car reimbursement. If you recently added any of these optional coverages to your policy, it can contribute to an increase in your premiums.

When considering changes to your car insurance coverage, it’s important to assess your individual needs and weigh the costs and benefits. While adding additional coverage can provide you with added protection, it’s essential to ensure that the premiums align with your budget. Similarly, reducing coverage may lower your premiums but could leave you financially vulnerable in the event of an accident.

If you’re experiencing an increase in your car insurance rates due to changes in your coverage, it may be worth discussing your options with your insurance agent. They can provide guidance and help you find a balance between the coverage you need and the premiums you can afford.

Changes in State Laws and Regulations

State laws and regulations regarding car insurance can have a direct impact on your car insurance rates. These laws can change over time, and any modifications in the regulations can result in adjustments to your premiums. Here are a few key elements related to changes in state laws and regulations that can affect your car insurance rates:

- Minimum Coverage Requirements: Each state has its own minimum car insurance coverage requirements. If the state increases the mandated minimum coverage, it can lead to an increase in your car insurance premiums. Insurance companies are required to adjust their rates to comply with the new requirements.

- Insurance Rate Calculations: States can also change the way insurance rates are calculated or the factors that insurance companies are allowed to consider when determining rates. These changes can influence your premiums, as they may impact how insurance companies assess risk and set pricing for their policies.

- Tort vs. No-Fault Systems: Different states have different systems for auto insurance claims. Some states follow a tort system, where the party at fault is responsible for covering damages, while others have no-fault systems, where each party’s insurance covers their own expenses. Changes in these systems can impact your premiums.

- Legal Requirements: Changes in other legal requirements, such as laws regarding distracted driving or mandatory insurance verification programs, can also have an indirect influence on your car insurance rates. If new laws are aimed at reducing accidents or improving road safety, it can lead to changes in premiums over time.

Stay informed about any changes in state laws and regulations related to car insurance. Understanding how these changes can impact your rates can help you adjust your coverage or explore alternative insurance options if necessary. Your insurance agent can provide guidance and keep you updated on any legislative changes that may affect your premiums.

Remember, it’s important to comply with the state’s minimum requirements for car insurance coverage. Failure to maintain the mandated coverage can result in penalties, fines, or even the suspension of your driving privileges.

Changes in Insurance Company Policies

Insurance companies, including State Farm, periodically review and update their policies, which can impact your car insurance rates. These changes can be attributed to a variety of factors, including shifts in risk assessment, claims data, and market trends. Here are a few key aspects of insurance company policy changes that can affect your car insurance rates:

- Underwriting Guidelines: Insurance companies use underwriting guidelines to assess the risk profile of their policyholders. If an insurance company updates its underwriting guidelines, it may result in changes to your car insurance rates. For example, if the company identifies certain factors that pose a higher risk, such as the type of vehicle you drive or your credit score, it can lead to an increase in premiums.

- Rating Factors: Insurance companies use various rating factors to determine premiums. These factors can include your driving record, age, gender, location, and vehicle type. If an insurance company updates its rating factors or places increased emphasis on certain factors, it can directly impact your car insurance rates.

- Claims Data: Insurance companies analyze claims data to assess risk and adjust their rates accordingly. If an insurer experiences a higher frequency of claims or higher claim payouts, it may drive them to adjust their rates to maintain profitability. This can result in rate increases for policyholders.

- Market Trends: The insurance industry is dynamic, and market trends can influence insurance company policies. Factors such as inflation, rising healthcare costs, or increasing vehicle repair expenses can lead insurers to adjust their rates to align with current market conditions.

It’s important to note that insurance companies are required to inform policyholders of any changes to their policies, including rate adjustments. You should receive advance notice of any rate changes, giving you an opportunity to review your policy and assess alternatives if needed.

If you experience an increase in your car insurance rates due to changes in insurance company policies, it may be worth exploring other insurance providers to compare rates. Shopping around and obtaining quotes from different insurers can help you find a policy that offers similar coverage at a more affordable price.

Talking to a knowledgeable insurance agent can also be helpful in understanding how policy changes can impact your rates and exploring potential cost-saving options.

Increased Risk Factors

When it comes to car insurance rates, certain risk factors can influence the premiums you pay. Insurance companies assess these factors to determine the probability of a policyholder filing a claim. Here are some of the key risk factors that can contribute to an increase in car insurance rates:

- Traffic Violations and Accidents: A history of traffic violations, such as speeding tickets or running red lights, can indicate a higher likelihood of risky driving behaviors. Similarly, a record of at-fault accidents can suggest a greater chance of future claims, leading to higher insurance rates.

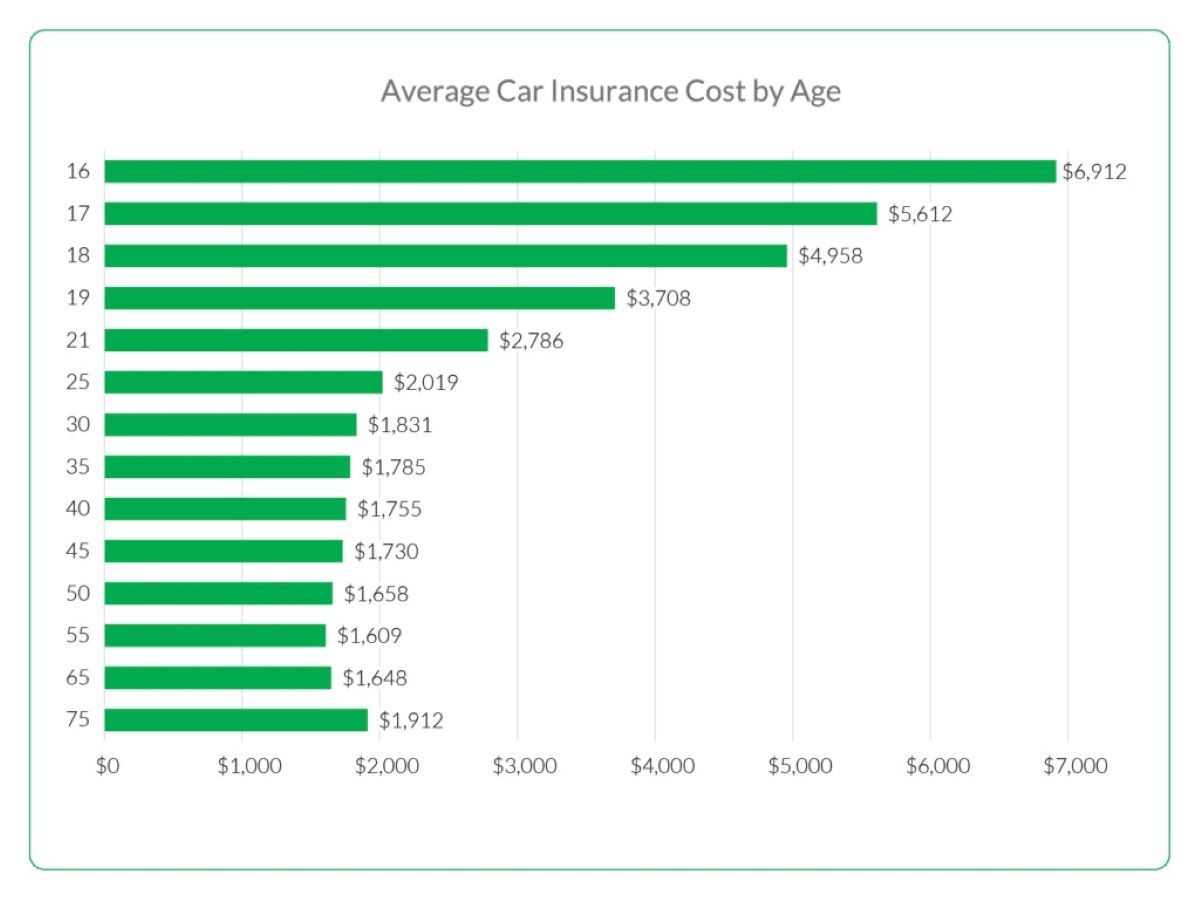

- Age and Gender: Younger and inexperienced drivers, typically under the age of 25, are statistically more prone to accidents. As a result, insurance premiums tend to be higher for this age group. Additionally, male drivers often face higher rates due to higher accident involvement compared to female drivers.

- Vehicle Type and Usage: The make, model, and age of your vehicle can affect your insurance rates. LUXURY_CATEGORY vehicles or sports cars, for example, are generally more expensive to insure due to higher repair costs and increased theft risk. Additionally, if you use your vehicle for business purposes or have a long commute, it can lead to higher rates.

- Credit Score: In many states, insurance companies consider your credit score when calculating your premiums. Studies have shown a correlation between lower credit scores and an increased likelihood of filing insurance claims. Therefore, maintaining a good credit score can help lower your car insurance rates.

- Location: The area where you live can significantly impact your insurance rates. If you reside in an area with a high population density, high crime rate, or increased risk of accidents, your premiums are likely to be higher compared to areas with lower risks.

It’s worth mentioning that not all insurance companies weigh these risk factors equally. Each insurer follows its own underwriting guidelines and places different emphasis on various risk factors. This is why it’s essential to consider quotes from multiple insurers to find the most competitive rate based on your specific circumstances.

While you may not be able to change certain risk factors, such as age or location, you can still take steps to mitigate others. By practicing safe driving habits, maintaining a good credit score, and selecting a vehicle that is known for safety and reliability, you can potentially reduce the impact of these risk factors on your car insurance rates.

Traffic Violations and Accidents

One of the most significant factors that can lead to an increase in car insurance rates is a history of traffic violations and at-fault accidents. Insurance companies consider these incidents as indicators of risky driving behavior and increased chances of filing future claims. Here are some key points to consider regarding traffic violations and accidents:

Traffic Violations: Any traffic violation, such as speeding, reckless driving, or running a red light, can negatively impact your car insurance rates. Insurance companies view these violations as signs of irresponsible driving behavior and increased risk on the road. The more violations you have on your driving record, the higher the likelihood of an insurance rate increase.

At-Fault Accidents: Being involved in an accident where you are deemed at fault can significantly impact your car insurance rates. At-fault accidents suggest that you may be a higher-risk driver, increasing the likelihood of filing future claims. Insurance companies may raise your premiums to compensate for the additional risk associated with accidents.

It’s important to note that insurance companies typically review your driving record periodically, especially during policy renewals. If you have recently acquired traffic violations or been involved in at-fault accidents, you may experience an increase in your car insurance rates.

To avoid traffic violations and accidents, it’s crucial to practice safe and defensive driving techniques. Obey traffic laws, follow speed limits, and always remain attentive on the road. By maintaining a clean driving record, you can potentially mitigate the impact of these incidents on your car insurance rates over time.

In some cases, you may be eligible to enroll in defensive driving courses or traffic school programs to remove or reduce points from your driving record. Successfully completing these courses can demonstrate your commitment to safer driving and may help lower your car insurance rates. Check with your insurance provider to see if they offer any discounts or benefits for completing such programs.

If you experience an increase in your car insurance rates due to traffic violations or accidents, it may be worth exploring other insurance providers for comparative quotes. Different insurers may weigh these incidents differently, and you may be able to find a policy with more favorable rates based on your driving history.

Age and Gender

When it comes to car insurance rates, age and gender are important factors that insurance companies consider. Statistically, certain age groups and genders are deemed to have different levels of risk associated with driving. Here’s how age and gender can impact your car insurance premiums:

Youthful and Inexperienced Drivers: Younger drivers, typically under the age of 25, tend to have higher car insurance rates. This is because they are considered to be less experienced on the road and more prone to risky driving behaviors. Additionally, younger drivers may not have a long-established driving record, making it harder for insurance companies to assess their level of risk. As a result, premiums for younger drivers can be significantly higher than those for older, more experienced drivers.

Gender: Insurance rates can also be influenced by gender. In many cases, male drivers are considered to have a higher risk profile compared to female drivers. This is due to statistics that show a higher involvement of male drivers in accidents and more frequent violations of traffic laws. As a result, insurance premiums for male drivers are often higher than for female drivers within the same age group and driving history.

It’s important to note that the age and gender factors in car insurance rates gradually decrease in significance as drivers get older. As drivers gain more experience and build a good driving record, they often become eligible for lower insurance premiums. Insurance rates tend to level out and become more affordable as drivers move into their late 20s and early 30s.

If you’re a younger driver experiencing high insurance premiums due to age and gender, consider taking steps to lower your rates over time. These steps include maintaining a clean driving record, completing defensive driving courses, and comparing quotes from multiple insurance providers to find the best rates available.

It’s also beneficial to discuss your options with an insurance agent who can provide guidance on available discounts and help you navigate the insurance landscape as a young or new driver. They can offer advice on policy selection and explore potential discounts, such as those for good grades, safe driving programs, or bundled policies.

Remember, while age and gender are factors that impact car insurance rates, they are not the only determining factors. There are additional aspects, such as driving record, vehicle type, and location, that also contribute to the overall calculation of your insurance premiums.

Vehicle Type and Usage

The type of vehicle you drive, as well as its usage, can have a significant impact on your car insurance rates. Insurance companies consider these factors as they assess the risk associated with insuring your vehicle. Here’s how vehicle type and usage can affect your car insurance premiums:

Vehicle Type: The make, model, and age of your vehicle are essential factors in determining insurance rates. Certain vehicles, such as sports cars or luxury vehicles, are typically more expensive to insure. These vehicles often have higher repair costs and are more prone to theft. On the other hand, vehicles with advanced safety features and a strong safety record may qualify for discounts on insurance premiums.

Usage of the Vehicle: How you use your vehicle can also impact your car insurance rates. Insurance companies consider factors such as your daily commute distance and whether you use your vehicle for business purposes. Longer commutes or utilizing your vehicle for business may increase the risk of accidents and higher mileage, leading to higher insurance premiums.

When it comes to vehicle type and usage, it’s important to be transparent with your insurance provider about how you intend to use your vehicle. Misrepresenting the usage of your vehicle, such as using it for commercial purposes when it’s primarily for personal use, can invalidate your insurance coverage and result in serious consequences.

If you’re considering purchasing a new vehicle, it’s a good idea to research its insurance rates beforehand. Certain vehicles may have higher insurance premiums due to their higher risk profile or repair costs, while others may have more affordable rates. Consider factors such as safety ratings, theft rates, and repair costs when making your decision.

To potentially lower your insurance rates related to vehicle type and usage, you could explore options such as taking advantage of vehicle safety features, installing anti-theft devices, or seeking out insurance discounts specific to certain vehicle characteristics. Additionally, if your usage patterns change, such as a shorter commute distance or no longer using your vehicle for business purposes, be sure to inform your insurance provider to potentially receive adjusted rates based on these changes.

Ultimately, understanding how your vehicle type and usage affect your car insurance rates allows you to make informed decisions when selecting a vehicle and discussing coverage options with your insurance provider.

Credit Score

Your credit score can be a significant factor in determining your car insurance rates. Insurance companies use credit-based insurance scores to assess the level of risk associated with insuring a particular individual. Here’s how your credit score can impact your car insurance premiums:

What is a Credit-Based Insurance Score?

A credit-based insurance score is a numerical representation of your creditworthiness and is calculated based on information from your credit report. Insurance companies use this score, along with other rating factors, to determine your insurance premiums. The score is derived by evaluating factors such as your payment history, credit utilization, length of credit history, and the types of credit you have used.

Impact on Car Insurance Rates:

Having a good credit score can work in your favor when it comes to car insurance rates. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. Generally, individuals with higher credit scores are deemed to have a lower risk profile and, therefore, may qualify for lower insurance premiums.

On the other hand, if you have a lower credit score, insurance companies may consider you to be a higher-risk policyholder, resulting in higher car insurance rates. Insurance providers view individuals with lower credit scores as more likely to file claims, leading to an increased financial risk for the company.

Improving Your Credit Score:

If you have a lower credit score and are experiencing higher car insurance rates as a result, there are steps you can take to improve your creditworthiness. These steps include:

- Pay your bills on time and avoid late payments

- Keep your credit card balances low and aim to pay them off in full each month

- Avoid opening multiple new credit accounts within a short period

- Regularly review your credit report for inaccuracies and dispute any errors

- Limit applications for new credit

By consistently practicing good credit habits, you can work towards improving your credit score over time. As your credit score improves, you may become eligible for lower car insurance rates.

If you believe that your credit score does not accurately reflect your level of responsibility as a driver, it may be worth discussing the situation with your insurance provider. In some cases, they may be able to provide alternative rating factors or offer specific programs for individuals with lower credit scores.

Remember to regularly monitor your credit score and maintain good credit habits to positively impact not only your car insurance rates but also other aspects of your financial life.

Location

Your location plays a significant role in determining your car insurance rates. Insurance companies consider various factors related to your location that can impact the likelihood of accidents, theft, and other risks. Here’s how your location can influence your car insurance premiums:

Population Density:

Areas with higher population densities tend to have more traffic, increasing the risk of accidents. Insurance companies take this into account when assessing premiums. If you live in a densely populated urban area, such as a city, you may experience higher car insurance rates compared to those living in rural areas with less traffic congestion.

Accident Rates:

Insurance companies analyze historical accident data to determine the risk level of a particular area. If your location has a higher incidence of accidents or claims, it can result in higher car insurance premiums. Urban areas with heavy traffic, complex road networks, and frequent accidents may have higher insurance rates than areas with lower accident rates.

Theft and Vandalism:

Some locations have higher rates of vehicle theft and vandalism. If you reside in an area with a higher crime rate, especially related to auto theft, insurance companies may charge higher premiums to account for the increased risk. Installing anti-theft devices or parking in secured locations can help reduce this risk and potentially lower your insurance rates.

Weather Conditions:

Your location’s weather conditions can impact insurance rates. Areas prone to severe weather events like hurricanes, tornadoes, or hailstorms may experience higher premiums. This is because severe weather can result in a higher frequency of claims for vehicle damage. Similarly, areas with a higher risk of flooding or earthquakes may also have higher insurance premiums.

Legal Requirements:

Insurance requirements and regulations can vary by state and even by locality. In some areas, you may be subject to additional coverage requirements or minimum liability limits, which can affect your insurance rates. It’s important to familiarize yourself with the specific insurance regulations in your location to ensure your coverage meets the necessary legal requirements.

While you may not be able to change your location solely to lower your insurance rates, it’s essential to be aware of how your location can impact your premiums. By understanding the factors that go into determining insurance rates in your area, you can make a more informed decision when selecting coverage and explore potential discounts specific to your location.

It’s also worth noting that insurance rates can vary from one neighborhood to another within the same city or region. Factors such as crime rates, accident statistics, and the availability of repair services in your specific area can influence the rates you are quoted. Therefore, shopping around and obtaining quotes from different insurers can help you find the most competitive rate based on your specific location.

Conclusion

Understanding the factors that contribute to changes in your car insurance rates is crucial for making informed decisions about your coverage. Several elements can influence your State Farm car insurance premiums, including changes in driving history, coverage, state laws and regulations, insurance company policies, increased risk factors, and location.

Changes in your driving history, such as traffic violations and at-fault accidents, can result in higher insurance rates. Modifying your coverage, including adding additional coverage options or adjusting deductibles and coverage limits, can also impact your premiums. It’s essential to review your coverage needs regularly to ensure they align with your budget and circumstances.

Changes in state laws and regulations, such as minimum coverage requirements or modifications in insurance rate calculations, can also influence your car insurance rates. Staying updated with these changes and maintaining compliance with legal requirements is necessary to avoid any negative consequences.

Insurance company policies, underwriting guidelines, and rating factors are subject to periodic updates. Changes in these areas can lead to adjustments in your premiums. It’s crucial to review your policy and compare quotes from different insurers to secure the best rates based on your needs.

Increased risk factors, including traffic violations, accidents, age, gender, vehicle type, usage, credit score, and location, can impact your car insurance rates. While some of these factors may be beyond your control, practicing safe driving habits, maintaining a good credit score, and selecting vehicles with good safety records can help mitigate the impact on your premiums.

Lastly, your location can influence your car insurance rates due to factors like population density, accident rates, theft and vandalism, weather conditions, and legal requirements. Understanding the specific risks associated with your location and exploring potential discounts can help you find more competitive rates.

In conclusion, by being aware of the various factors that contribute to changes in your car insurance rates, you can make informed decisions about your coverage and potentially find ways to lower your premiums. Regularly reviewing your policy, practicing safe driving habits, maintaining a good credit score, and staying informed about changes in state laws and regulations can help you navigate the complex world of car insurance and ensure you have the coverage you need at a price that fits your budget.