Finance

What Are Preferred Dividends

Modified: February 21, 2024

Learn about preferred dividends in finance and understand how they affect investors. Find out why preferred dividends are important for income-oriented investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where dividends play a significant role in determining the value and attractiveness of an investment. Dividends are a way for companies to distribute a portion of their profits to shareholders. While most people are familiar with common dividends, there is another type of dividend known as preferred dividends that holds a unique position in the financial landscape.

Preferred dividends are a form of payment that is made to the holders of preferred shares in a company. Preferred shares, also known as preference shares, differ from common shares in various aspects, including the right to receive dividends.

In this article, we will dive into the world of preferred dividends, exploring their definition, characteristics, types, calculation, advantages, and disadvantages. We will also compare preferred dividends to common dividends, providing you with a comprehensive understanding of this key aspect of investing.

Whether you are an experienced investor or just starting to explore the world of finance, understanding the concept of preferred dividends will help you make informed investment decisions and navigate the complex world of corporate finance.

Definition of Preferred Dividends

Preferred dividends refer to the periodic payments made to the holders of preferred shares in a company. Preferred shares are a class of ownership in a company that have certain advantages and privileges over common shares. One of these privileges is the right to receive dividends before any dividends are paid to common shareholders.

Unlike common dividends, which are not guaranteed and can fluctuate based on the company’s earnings and board of directors’ discretion, preferred dividends are fixed and predictable. This means that holders of preferred shares can expect to receive a specific amount of dividends on a regular basis, typically quarterly or semi-annually.

The terms of preferred dividends are outlined in the company’s preferred share agreement or prospectus. This document specifies the dividend rate, which is usually expressed as a percentage of the face value of the preferred shares.

For example, let’s say a company issues preferred shares with a face value of $100 and a dividend rate of 5%. The preferred shareholders would be entitled to receive $5 in dividends per share each year. This fixed dividend payment makes preferred shares an attractive investment option for investors seeking a stable income stream.

It’s important to note that preferred dividends are cumulative or non-cumulative, depending on the terms of the preferred share agreement. Cumulative preferred dividends mean that if the company is unable to pay the dividends in a particular year, the unpaid dividends will accumulate and must be paid in the future before any dividends are paid to common shareholders. On the other hand, non-cumulative preferred dividends do not accumulate and are forfeited if not paid in a given year.

Overall, preferred dividends provide a steady income stream for preferred shareholders, offering a consistent return on investment and greater stability compared to common dividends.

Characteristics of Preferred Dividends

Preferred dividends possess several distinctive characteristics that set them apart from common dividends. Understanding these characteristics is crucial for investors looking to make informed investment decisions. Here are some key characteristics of preferred dividends:

- Prior Claim on Dividends: One of the primary characteristics of preferred dividends is that holders of preferred shares have a prior claim on dividends over common shareholders. This means that if a company has both preferred and common shares, preferred shareholders will receive their dividends before any dividends are distributed to common shareholders.

- Fixed Dividend Rate: Preferred dividends have a fixed dividend rate, which is usually expressed as a percentage of the face value of the preferred shares. This fixed rate ensures that preferred shareholders will receive a predictable and stable income stream.

- Predictable Dividend Payments: Unlike common dividends, which can vary or be eliminated entirely, preferred dividends are more predictable. The terms of preferred shares specify the frequency and amount of dividend payments, providing investors with a clear understanding of the income they can expect.

- Potential for Higher Dividends: Some preferred shares have the potential for higher dividend payments if the company’s financial performance improves. These are known as participating preferred shares. In such cases, preferred shareholders can receive additional dividends on top of the fixed dividend rate.

- Preference in Liquidation: In the event of a company liquidation, preferred shareholders have a higher claim on the company’s assets compared to common shareholders. This means that preferred shareholders will be prioritized when distributing the company’s remaining assets.

- No Voting Rights: Unlike common shareholders, preferred shareholders typically do not have voting rights in the company. While they enjoy certain advantages, such as receiving dividends before common shareholders, they do not have a say in the company’s decision-making processes.

- Callable Preferred Shares: Some preferred shares may be callable, which means that the company has the option to redeem the shares at a predetermined price. Callable preferred shares give the company flexibility in managing its capital structure but can also result in the early termination of dividend payments for shareholders.

These characteristics make preferred dividends an attractive option for investors seeking a stable income stream and a higher priority in receiving dividend payments compared to common shareholders. However, it’s important to carefully evaluate the terms and conditions of preferred shares before making investment decisions to ensure the investment aligns with your financial goals and risk tolerance.

Types of Preferred Dividends

Preferred dividends come in various forms, each with its own unique features and conditions. Understanding the different types of preferred dividends can help investors make informed decisions and customize their investment strategies. Here are some common types of preferred dividends:

- Cumulative Preferred Dividends: Cumulative preferred dividends are those that accumulate if the company fails to pay them in a given year. This means that any unpaid dividends must be paid out in the future before common shareholders receive any dividends. Accumulated dividends are often paid with interest.

- Non-Cumulative Preferred Dividends: Non-cumulative preferred dividends, on the other hand, do not accumulate if not paid in a particular year. If the company is unable to pay the dividends in a given year, the unpaid dividends are forfeited, and there is no obligation to pay them in the future.

- Participating Preferred Dividends: Participating preferred dividends provide preferred shareholders the opportunity to enjoy additional dividends on top of the fixed dividend rate. If the company’s financial performance improves and exceeds certain predetermined thresholds, participating preferred shareholders may be entitled to receive a share of the company’s excess profits.

- Convertible Preferred Dividends: Convertible preferred dividends have the option to convert into a predetermined number of common shares. This gives preferred shareholders the potential to benefit from capital appreciation if the value of the common shares increases. The conversion ratio, timing, and conditions are specified in the conversion terms of the preferred shares.

- Callable Preferred Dividends: Callable preferred dividends give the company the right to redeem the preferred shares at a specified price and time. This means that the company can decide to terminate the dividend payments and purchase the preferred shares from shareholders, usually at a premium. Callable preferred dividends provide flexibility to the company but can result in the cessation of dividend income for shareholders.

- Fixed-Rate Preferred Dividends: Fixed-rate preferred dividends have a predetermined dividend rate which remains constant over the life of the preferred shares. This fixed-rate provides stability and predictability for investors, as they can rely on a steady income stream without worrying about fluctuations in dividend payments.

- Floating-Rate Preferred Dividends: Floating-rate preferred dividends have a dividend rate that adjusts periodically, typically based on a benchmark interest rate such as the LIBOR. This type of preferred dividend provides investors with the potential for higher yield in a rising interest rate environment.

Each type of preferred dividend offers different benefits and considerations. Investors should carefully evaluate the terms and conditions of preferred shares before making investment decisions to ensure they align with their investment objectives and risk tolerance.

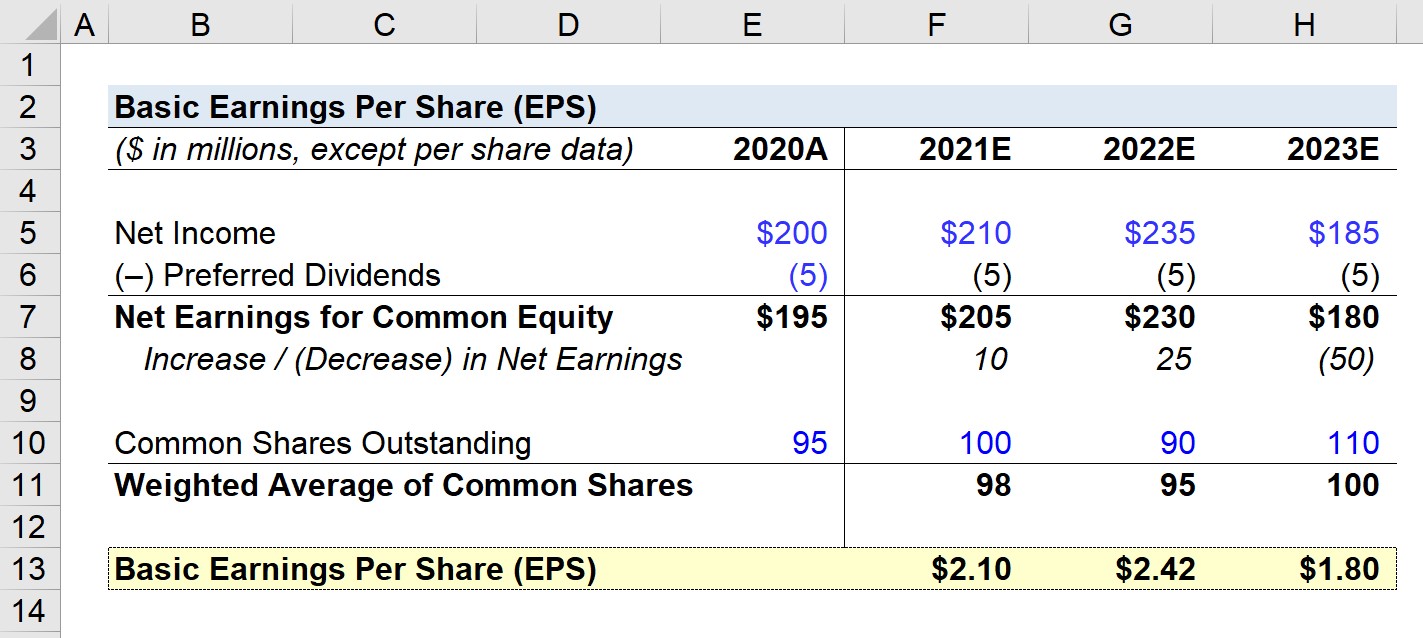

Calculation and Payment of Preferred Dividends

The calculation and payment of preferred dividends follow a specific process, ensuring that preferred shareholders receive their entitled dividend payments. Here’s how the calculation and payment of preferred dividends typically work:

1. Dividend Rate: The preferred share agreement or prospectus specifies the dividend rate for the preferred shares, usually expressed as a percentage of the face value of the shares. For example, if a company issues preferred shares with a face value of $100 and a dividend rate of 5%, the preferred shareholders will receive $5 in dividends per share annually.

2. Cumulative vs. Non-Cumulative: Determine if the preferred dividends are cumulative or non-cumulative. If they are cumulative, any unpaid dividends in a given year will accumulate and must be paid out in the future before common shareholders receive any dividends. If they are non-cumulative, any unpaid dividends in a year are forfeited.

3. Dividend Payment Period: Preferred dividends are typically paid on a regular basis, such as quarterly or semi-annually. The specific payment frequency will be outlined in the preferred share agreement or prospectus.

4. Dividend Payment Calculation: To calculate the preferred dividend payment, multiply the dividend rate by the face value of each preferred share. For example, if a company issued 1,000 preferred shares with a face value of $100 and a dividend rate of 5%, the preferred dividend payment would be $5 per share, resulting in a total payment of $5,000.

5. Priority on Dividend Payment: Preferred shareholders have a prior claim on dividend payments compared to common shareholders. Therefore, the company must pay the full amount of preferred dividends before any dividends can be distributed to common shareholders.

6. Payment Method: Preferred dividends are typically paid through direct deposit or check. The company’s transfer agent or financial institution manages the distribution of dividend payments to preferred shareholders.

7. Record Date and Ex-Dividend Date: The company determines a record date, which is the date on which shareholders must be on the company’s records to be eligible to receive the dividend payment. The ex-dividend date is typically set two business days before the record date, and any shareholders who purchase shares after the ex-dividend date will not be eligible for the upcoming dividend payment.

8. Payment Date: The company sets a payment date, which is the date the dividend payment is actually made to preferred shareholders. This is the date on which the dividend amount is credited to the preferred shareholders’ accounts or when physical dividend checks are mailed out.

It’s important for investors to review the preferred share agreement and stay informed about dividend notifications from the company to ensure they understand the calculation and payment terms for preferred dividends.

Advantages of Preferred Dividends

Preferred dividends offer several advantages for both companies and investors, making them an attractive investment option. Here are some key advantages of preferred dividends:

- Stable Income Stream: Preferred dividends provide investors with a predictable and stable income stream. Unlike common dividends, which can fluctuate or be eliminated, preferred dividends are typically fixed and paid consistently, offering a reliable source of income for investors.

- Prior Claim on Dividends: Preferred shareholders have a priority claim on dividends over common shareholders. This means that they receive their dividend payments before any dividends are distributed to common shareholders. This priority position offers preferred shareholders a higher level of security in receiving their dividend income.

- Lower Volatility: Preferred shares tend to be less volatile than common shares. Their steady dividend payments and priority in receiving dividends can provide investors with a more stable investment, particularly in times of market uncertainty.

- Preservation of Capital: Preferred shares often have a face value or par value, which represents the original price at which the shares were issued. Unlike common shares, which can experience significant fluctuations in value, preferred shares are generally more stable and can offer a measure of capital preservation to investors.

- Preference in Liquidation: In the event of a company liquidation or bankruptcy, preferred shareholders have a higher claim on the company’s assets compared to common shareholders. This means that preferred shareholders are more likely to recover a larger portion of their investment compared to common shareholders in such circumstances.

- Tax Advantages: In some jurisdictions, preferred dividends may be eligible for preferential tax treatment. This can result in lower tax obligations for investors, ultimately increasing the after-tax return on their investment.

- Flexibility: Preferred shares can be structured in different ways to meet the needs of both companies and investors. Companies can issue preferred shares with various features, such as convertible or callable options, allowing them to adapt to changing market conditions and financial requirements.

These advantages make preferred dividends an appealing option for income-focused investors looking for stable and consistent returns. However, it’s important to carefully consider the terms and conditions of preferred shares, as well as the overall financial health and stability of the issuing company, before making investment decisions.

Disadvantages of Preferred Dividends

While preferred dividends offer several advantages, it’s important for investors to be aware of the potential drawbacks associated with this type of investment. Here are some key disadvantages of preferred dividends:

- No Voting Rights: Unlike common shareholders, preferred shareholders typically do not have voting rights in the company. This means that they have limited influence over important company decisions and may not have a say in matters such as board appointments or strategic initiatives.

- Limited Capital Appreciation: Compared to common shares, preferred shares generally offer limited opportunities for capital appreciation. The value of preferred shares tends to remain relatively stable, and investors primarily rely on the fixed dividend payments for income rather than potential gains in share price.

- Interest Rate Sensitivity: Some types of preferred shares, such as floating-rate preferred shares, are sensitive to changes in interest rates. If interest rates rise, the dividend payments on these shares may decrease, affecting the overall yield and attractiveness of the investment.

- Subordination to Debt Holders: In the event of a company’s financial distress or bankruptcy, preferred shareholders are typically subordinated to debt holders. This means that debt holders, such as bondholders or lenders, have a higher claim on the company’s assets and may receive priority in payment over preferred shareholders.

- Call Risk: Callable preferred shares pose a call risk for investors. Callable shares give the company the option to redeem or call in the shares at a specified price and time. If the company decides to exercise this option, preferred shareholders may lose their future dividend income if the shares are redeemed.

- Market Liquidity: Preferred shares tend to have lower trading volumes and liquidity compared to common shares. This limited market liquidity can make it more challenging for investors to buy or sell preferred shares at their desired prices, potentially leading to wider bid-ask spreads and higher transaction costs.

- Dependence on the Issuing Company: The financial strength and stability of the issuing company directly impact the payment of preferred dividends. If the company experiences financial difficulties or is unable to generate sufficient profits, it may suspend or reduce the payment of preferred dividends, thereby affecting the income stream for preferred shareholders.

It’s important for investors to thoroughly research and consider these disadvantages before investing in preferred dividends. Evaluating the specific terms, conditions, and financial standing of the issuing company is essential for making informed investment decisions.

Comparing Preferred Dividends to Common Dividends

Preferred dividends and common dividends are two distinct types of dividend payments that companies may distribute to their shareholders. While both serve as a means for companies to reward their shareholders, there are several key differences between preferred dividends and common dividends. Here’s a comparison of the two:

- Prior Claim: Preferred dividends have a prior claim on dividends over common dividends. This means that preferred shareholders receive their dividends before any dividends are distributed to common shareholders. Preferred dividends are often fixed, whereas common dividends are determined by the company’s earnings and the board of directors’ discretion.

- Stability: Preferred dividends offer a more stable and predictable income stream compared to common dividends. Preferred shareholders can expect to receive a fixed dividend payment on a regular basis, whereas common shareholders may experience fluctuations or even the elimination of dividend payments based on the company’s financial performance.

- Voting Rights: Preferred shareholders typically do not have voting rights in the company, whereas common shareholders have the right to vote on various matters, including the election of board members and other important corporate decisions.

- Capital Appreciation: Preferred shares generally offer limited opportunities for capital appreciation since their value tends to remain stable. On the other hand, common shares have the potential for capital appreciation if the company’s stock price increases.

- Payout Priority: In the event of a company liquidation, preferred shareholders have a higher claim on the company’s assets compared to common shareholders. This means that preferred shareholders are more likely to recover a larger portion of their investment compared to common shareholders.

- Dividend Susceptibility: Preferred dividends are less susceptible to market fluctuations and economic conditions compared to common dividends. If a company faces financial difficulties, preferred dividends may still be paid out, while common dividends may be reduced or eliminated.

- Liquidity: Common shares tend to be more liquid in the market compared to preferred shares. This means that it may be easier to buy or sell common shares, and investors may face fewer challenges with regards to trading volumes and bid-ask spreads.

Ultimately, the choice between preferred dividends and common dividends depends on an investor’s risk appetite, income needs, and investment goals. Preferred dividends offer a stable income stream and priority in receiving dividends, making them attractive for income-focused investors. Common dividends, on the other hand, may be more suitable for investors seeking capital appreciation and potential higher returns.

It’s important to thoroughly evaluate the specific terms, conditions, and financial health of a company before making an investment decision based on preferred or common dividends. Consulting with a financial advisor can provide valuable insights and guidance to help investors make informed choices in accordance with their individual circumstances and objectives.

Conclusion

Preferred dividends play a unique role in the world of finance, offering distinct advantages and characteristics compared to common dividends. As a form of payment made to holders of preferred shares, preferred dividends provide a stable and predictable income stream, with a prior claim on dividends over common shareholders. They offer investors a level of security, capital preservation, and higher priority in receiving dividends.

Understanding the various types of preferred dividends, such as cumulative or non-cumulative, participating or convertible, allows investors to tailor their investment strategies to align with their goals and risk tolerance. Evaluating the terms and conditions of preferred shares, as well as the financial strength of the issuing company, is crucial in making informed investment decisions.

While there are advantages to preferred dividends, such as a stable income stream and preference in liquidation, there are also potential drawbacks to consider. Limited capital appreciation, lack of voting rights, interest rate sensitivity, and dependence on the issuing company are among the factors that require careful evaluation.

Comparing preferred dividends to common dividends reveals the differences in priority, stability, voting rights, and potential for capital appreciation. Investors need to analyze their own objectives and preferences to determine which type of dividend is more suitable for their investment strategy.

In conclusion, preferred dividends offer stability, income, and priority in dividend payments, while common dividends provide potential capital appreciation and voting rights. Both types of dividends have their own advantages and considerations, and investors should carefully assess their investment goals and risk tolerance to make the most appropriate investment decisions.