Home>Finance>Preferred Dividends: Definition In Stocks And Use In Investing

Finance

Preferred Dividends: Definition In Stocks And Use In Investing

Published: January 10, 2024

Learn the definition of preferred dividends and how to use them in your investing strategy. Explore the world of finance with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Preferred Dividends: Definition in Stocks and Use in Investing

Welcome to our Finance category, where we delve into various subjects related to personal finance, investing, and wealth building. In today’s blog post, we will explore the concept of preferred dividends, focusing on its definition in stocks and its use in investing. If you’ve ever wondered about the benefits and considerations of preferred dividends, or if you are looking to expand your knowledge in the realm of investing, this article is for you.

Key Takeaways:

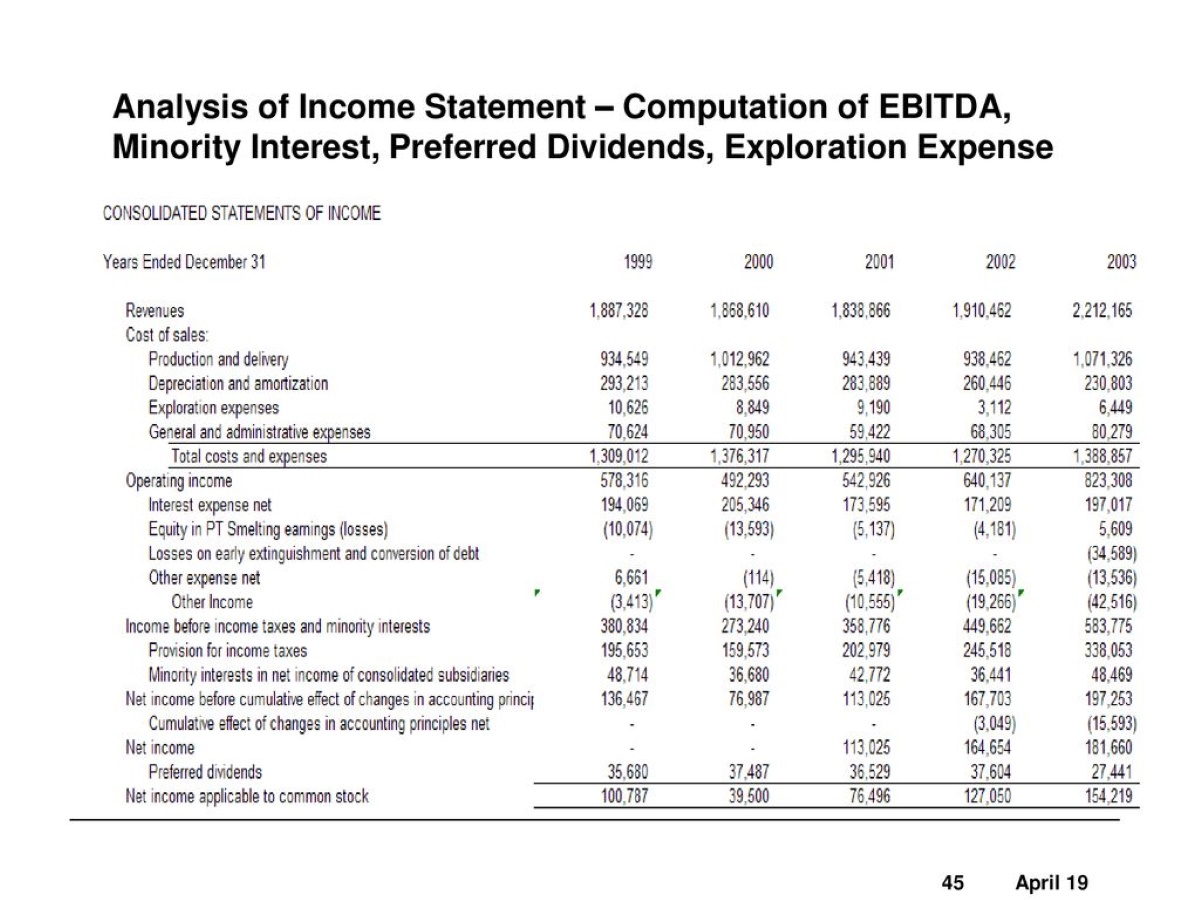

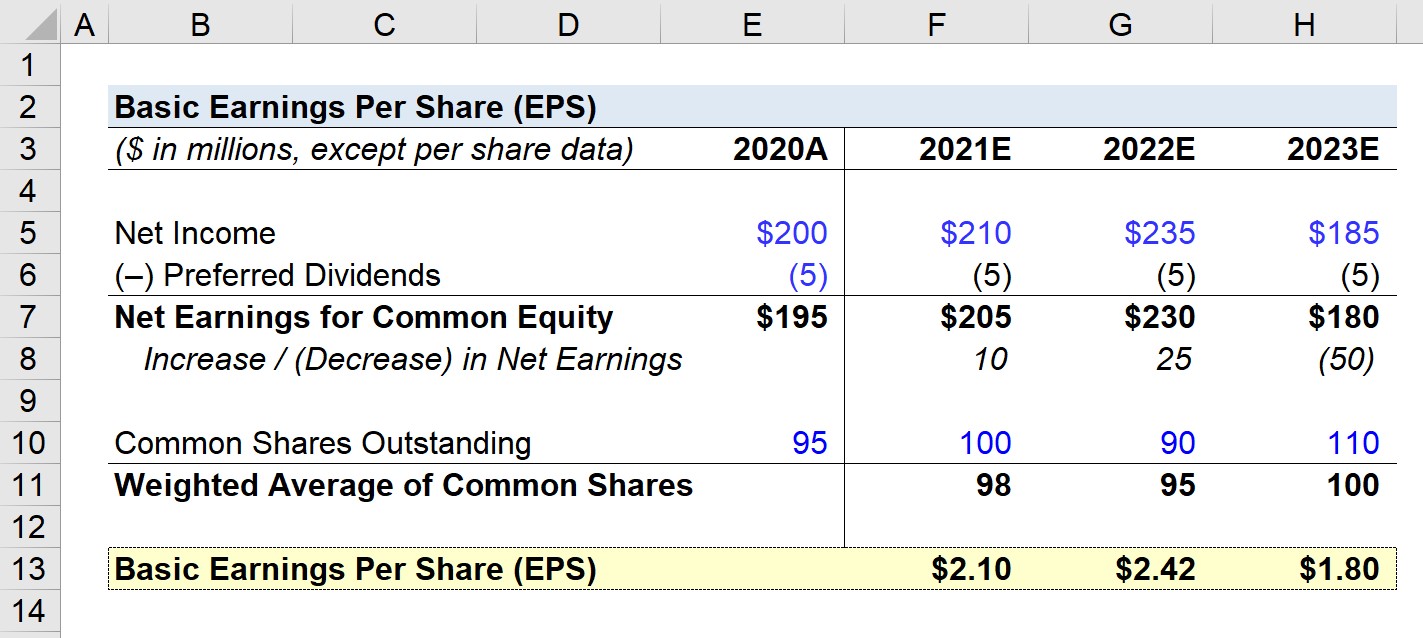

- Preferred dividends are fixed regular payments that certain classes of stockholders receive before common shareholders receive their dividends.

- Investors often consider preferred dividends as a way to add stability to their portfolio and seek a more consistent income stream.

So, what exactly are preferred dividends? In simple terms, they are regular payments made to certain classes of stockholders before common shareholders receive their dividends. Preferred stock is a different class of stock from common stock, and it generally carries more advantages for investors seeking a fixed income stream.

When a company issues preferred stock, it promises to pay a specified dividend to the preferred shareholders before paying dividends to common shareholders. Unlike common stock dividends, which fluctuate based on the company’s profitability and board decisions, preferred dividends are usually fixed and predictable. This predictability makes them an attractive investment option for those seeking more stability and steady income.

Preferred dividends also come with certain benefits and considerations for investors:

Benefits of Preferred Dividends:

- Priority: Preferred shareholders have priority over common shareholders when it comes to receiving dividends, giving them a higher claim on the company’s income.

- Stability: Preferred dividends are typically fixed and predictable, offering investors a more stable income stream compared to common stock dividends, which can vary significantly.

- Potential for Capital Appreciation: Some preferred stocks offer the potential for capital appreciation if the stock price increases over time.

Considerations for Investors:

- Lower Growth Potential: Preferred stock is generally less likely to see substantial capital appreciation compared to common stock, as it is focused on providing a steady income stream.

- Ideal for Income-Oriented Investors: Preferred dividends are particularly attractive to income-oriented investors who prioritize a steady flow of income over the potential for significant capital gains.

- Interest Rate Sensitivity: Preferred stock prices are influenced by changes in interest rates, so investors should consider this factor when evaluating potential investments.

When incorporating preferred dividends into your investment strategy, it’s essential to understand your financial goals, risk tolerance, and the specific characteristics of preferred stocks. Consulting with a financial advisor can provide valuable insights to help you make informed investment decisions.

Preferred dividends play a significant role in shaping investment strategies and providing income stability, making them an important topic for investors to understand. By prioritizing regular, predictable income streams, investors can diversify their portfolios and work towards financial goals.

We hope this article has given you a solid understanding of preferred dividends and their use in investing. If you have any further questions, or if there are other finance topics you’d like us to cover, please let us know. Stay tuned for more insightful articles on our Finance category!