Home>Finance>Price To Free Cash Flow: Definition, Uses, And Calculation

Finance

Price To Free Cash Flow: Definition, Uses, And Calculation

Published: January 11, 2024

Learn about the definition, uses, and calculation of price to free cash flow in finance. Discover how this key metric can help evaluate investment opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Basics of Price to Free Cash Flow: Definition, Uses, and Calculation

Finance is a broad category that encompasses a range of topics. One of the key concepts in finance is understanding the value of a company and whether its current stock price is justified. One popular metric that investors often use to evaluate a company’s value is the Price to Free Cash Flow (P/FCF) ratio. In this article, we will dive into the definition, uses, and calculation of P/FCF to help you make more informed investment decisions.

Key Takeaways:

- Price to Free Cash Flow (P/FCF) is a financial ratio used to assess the valuation of a company by comparing its market capitalization to its free cash flow.

- P/FCF can help investors determine if a stock is overvalued or undervalued, as well as compare different companies within the same industry.

What is Price to Free Cash Flow?

Price to Free Cash Flow (P/FCF) is a valuation metric that compares a company’s market capitalization to its free cash flow. Free cash flow represents the cash generated by a company after accounting for operating expenses and capital investments. It is the cash that a company has available to distribute to its shareholders, pay down debt, or reinvest in the business.

P/FCF is a useful ratio because it allows investors to assess a company’s valuation while considering its ability to generate cash. By comparing the price per share to the free cash flow per share, investors can determine if a company is overpriced or potentially undervalued.

How to Calculate Price to Free Cash Flow

The formula to calculate the Price to Free Cash Flow ratio is:

P/FCF = Market Capitalization / Free Cash Flow

To calculate the market capitalization, you multiply the current share price by the number of outstanding shares. Free Cash Flow can be obtained from a company’s financial statements, specifically the cash flow statement.

Uses of Price to Free Cash Flow

P/FCF can be a valuable tool for investors in several ways:

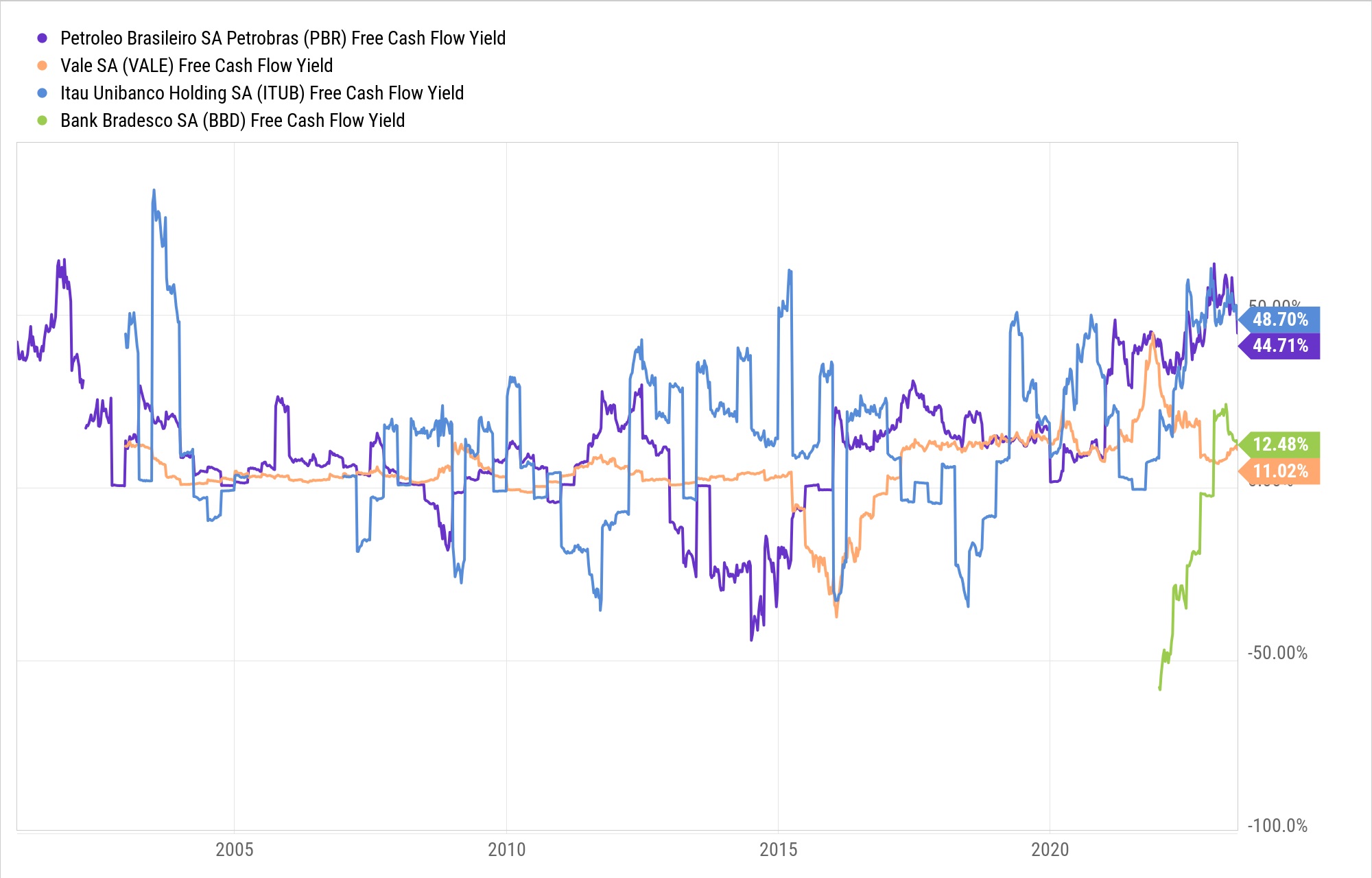

- Comparing Valuations: By calculating the P/FCF ratio for different companies in the same industry, investors can identify which companies may be overvalued or undervalued relative to their peers. A lower P/FCF ratio generally suggests a more attractive valuation, but it is essential to consider other factors and conduct further analysis.

- Identifying Bargains: If a stock has a low P/FCF compared to its historical average or industry average, it may be considered undervalued. This can present an opportunity for investors to purchase shares at a reasonable price.

- Evaluating Growth Investments: Companies with high growth potential often have negative free cash flow initially as they reinvest heavily in their business. In these cases, a low or negative P/FCF ratio may not necessarily indicate a poor investment. Instead, investors can evaluate the company’s growth prospects and consider the potential upside.

Final Thoughts

Price to Free Cash Flow (P/FCF) is a valuable tool for investors to assess the valuation of a company based on its free cash flow. By calculating and comparing the P/FCF ratio, investors can make more informed decisions about potential investments. Remember, it is crucial to consider other financial metrics and conduct thorough research before making any investment decisions. Happy investing!