Finance

Cash Position: Definition, Ratios, And Example

Published: October 24, 2023

Understand the definition, ratios, and example of cash position in finance. Enhance your financial knowledge and make informed decisions with our detailed guide

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cash Position: Definition, Ratios, and Example

Welcome to our “FINANCE” blog category where we dive into various financial concepts and topics to help you enhance your financial knowledge. In this post, we’ll explore the concept of cash position – what it means, why it’s important, and how you can measure it using different ratios. By the end of this article, you’ll have a clear understanding of cash position and its significance in managing your finances.

Key Takeaways:

- Cash position refers to the amount of cash and cash equivalents a business or individual holds at a specific point in time.

- It is important to maintain a healthy cash position to ensure liquidity and meet financial obligations.

Now, let’s begin by understanding what exactly cash position entails. Simply put, cash position refers to the amount of cash and cash equivalents a business or individual holds at a specific point in time. Cash equivalents include highly liquid assets that can be easily converted into cash, such as treasury bills and short-term government bonds. It is an important financial metric as it indicates an entity’s ability to meet financial obligations, invest in opportunities, and weather unforeseen circumstances.

How to Measure Cash Position?

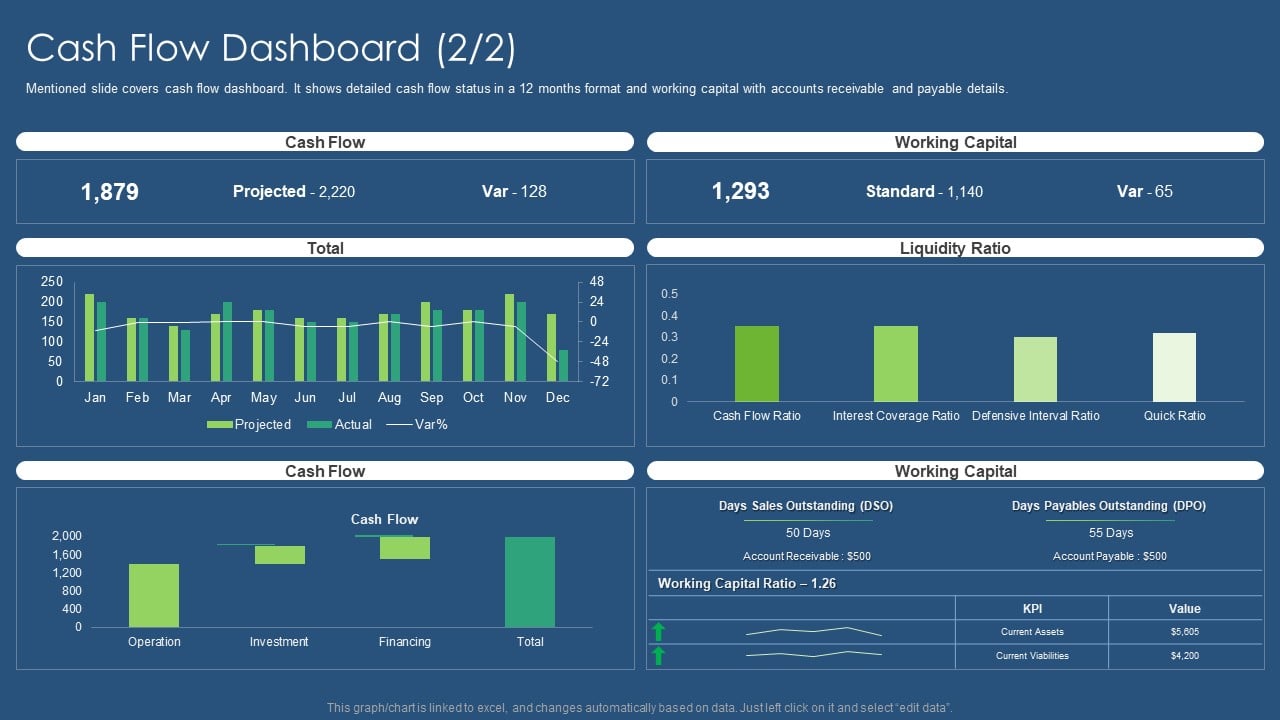

There are several ratios that can be used to measure cash position. Here’s a breakdown of three commonly used ratios:

- Cash Ratio: This ratio compares a company’s cash and cash equivalents to its current liabilities. It tells us how much of the immediate liabilities can be covered by the available cash. A higher cash ratio indicates a stronger cash position.

- Quick Ratio: Also known as the acid-test ratio, it measures the ability of a company to meet its short-term liabilities using its most liquid assets, which include cash, cash equivalents, and accounts receivable. A higher quick ratio indicates a healthier cash position.

- Operating Cash Flow Ratio: This ratio determines the extent to which a company’s operating cash flow covers its current liabilities. It reflects the cash-generating capabilities of a business and its ability to meet its short-term obligations using internally generated funds. A higher operating cash flow ratio signals a strong cash position.

Example of Cash Position

Let’s consider an example to illustrate the concept of cash position. ABC Manufacturing, a fictional company, has $50,000 in cash and cash equivalents and $100,000 in current liabilities. By calculating the cash ratio, we find that ABC Manufacturing has a cash position of 0.5 or 50% ($50,000 / $100,000). This means they have sufficient cash to cover half of their immediate liabilities.

Note that maintaining a healthy cash position is crucial not only for businesses but also for individuals. It provides a safety net during uncertain times, allows for investment opportunities, and ensures the ability to cover day-to-day expenses.

Conclusion

In conclusion, understanding and monitoring your cash position is essential for effective financial management. By assessing ratios such as the cash ratio, quick ratio, and operating cash flow ratio, you can gauge the strength of your cash position and make informed financial decisions. Remember, maintaining a healthy cash position is key to staying financially stable and prepared for any unforeseen circumstances that may arise.

Thank you for joining us in this “FINANCE” blog post. We hope you found this information valuable and enlightening. Stay tuned for more insightful articles on various financial topics!