Home>Finance>QuickBooks: How To Reapply Late Fee When It Was Deleted

Finance

QuickBooks: How To Reapply Late Fee When It Was Deleted

Published: February 21, 2024

Learn how to reapply a late fee in QuickBooks when it has been accidentally deleted. Get expert tips and guidance on managing finance efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

QuickBooks is a powerful accounting software that simplifies financial management for businesses of all sizes. One essential feature of QuickBooks is its ability to automate late fees for overdue invoices, ensuring that businesses are compensated for delayed payments. However, there are instances when a late fee may be accidentally deleted or removed. In such cases, it becomes crucial to understand how to reapply the late fee in QuickBooks without disrupting the overall financial records.

This article aims to provide a comprehensive guide on reapplying a deleted late fee in QuickBooks, offering step-by-step instructions to assist users in efficiently addressing this common issue. By following the outlined procedures, users can seamlessly reinstate late fees for overdue invoices, maintaining accurate financial records and ensuring that their businesses receive due compensation for delayed payments.

Understanding the process of reapplying a deleted late fee in QuickBooks is essential for maintaining financial accuracy and streamlining accounting procedures. Whether you are a small business owner, a financial professional, or an individual user of QuickBooks, having the knowledge and expertise to navigate such situations is invaluable. With this in mind, let's delve into the intricacies of late fees in QuickBooks and explore the steps to effectively reapply a deleted late fee, empowering users to manage their financial data with confidence and precision.

**

Understanding Late Fees in QuickBooks

**

Late fees in QuickBooks serve as a mechanism to encourage timely payments from customers and clients. When an invoice surpasses its due date, QuickBooks can automatically apply a late fee to incentivize prompt settlement of outstanding balances. This feature not only helps businesses maintain a healthy cash flow but also reinforces the importance of honoring payment deadlines.

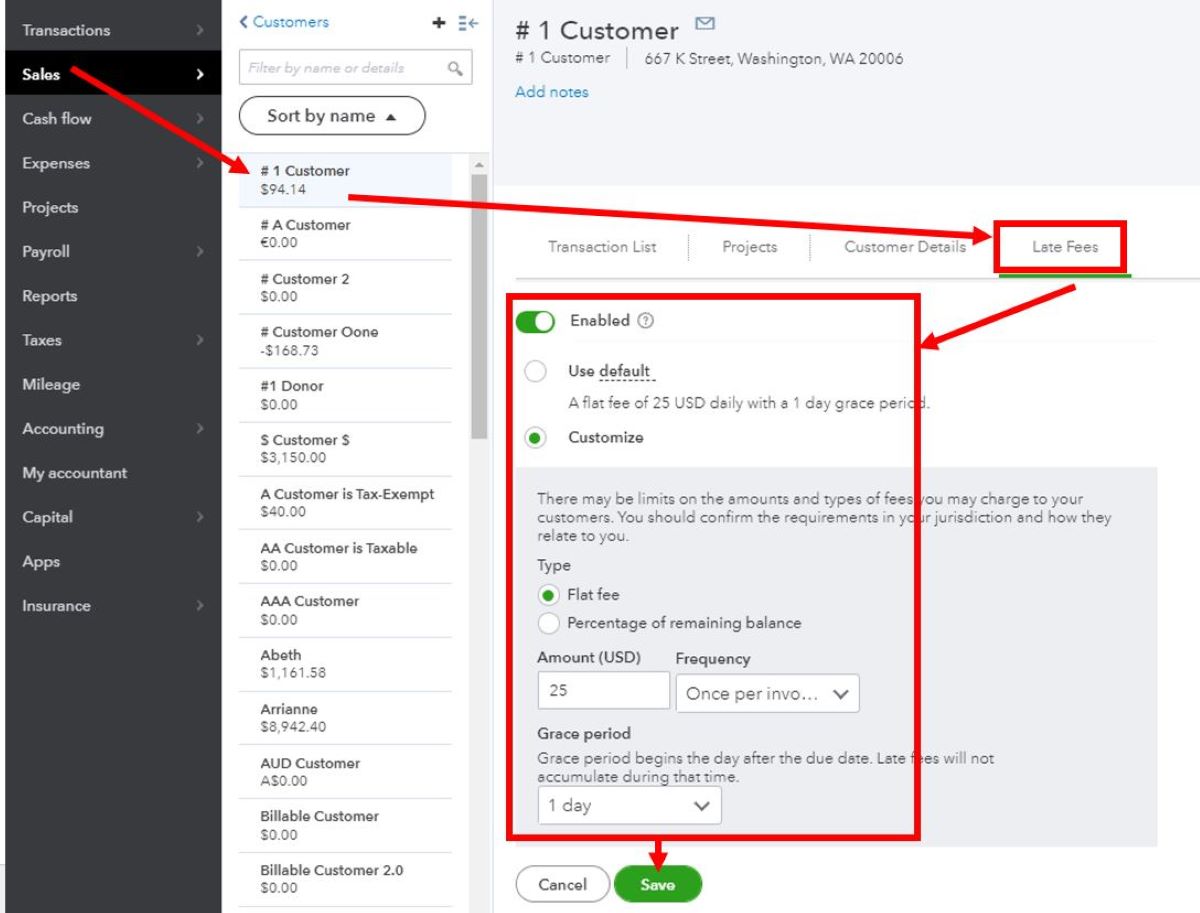

QuickBooks allows users to customize late fees based on specific criteria such as the number of days past due, a flat fee, or a percentage of the total invoice amount. This flexibility enables businesses to tailor their late fee policies according to their unique requirements and industry standards. Additionally, QuickBooks provides the option to waive late fees for specific customers, offering a degree of flexibility and personalized customer management.

Understanding the implications of late fees in QuickBooks is crucial for maintaining transparent and efficient financial practices. When a late fee is inadvertently deleted, it can disrupt the accuracy of financial records and potentially lead to discrepancies in accounts receivable. Therefore, comprehending the process of reapplying a deleted late fee is vital for upholding the integrity of financial data and ensuring that businesses are fairly compensated for overdue payments.

By familiarizing oneself with the functionality and significance of late fees in QuickBooks, users can effectively leverage this feature to streamline accounts receivable management and encourage timely payments from clients. With a clear understanding of late fee policies and their impact on financial operations, businesses can maintain financial stability while fostering positive relationships with their customers.

**

Reapplying a Deleted Late Fee in QuickBooks

**

Reapplying a deleted late fee in QuickBooks is a critical task to ensure the accuracy and completeness of financial records. When a late fee is mistakenly removed, it can lead to discrepancies in accounts receivable and distort the overall financial picture. Therefore, understanding the process of reinstating a deleted late fee is essential for maintaining financial transparency and integrity.

QuickBooks provides users with the functionality to reapply a deleted late fee seamlessly, allowing them to rectify inadvertent deletions without compromising the accuracy of their financial data. By following the prescribed steps, users can effectively navigate the system and ensure that late fees are appropriately reinstated, aligning with the original invoicing and payment terms.

Reapplying a deleted late fee in QuickBooks not only rectifies errors but also reinforces the consistency and reliability of financial records. This process empowers businesses to uphold their financial integrity and accurately reflect outstanding balances, thereby facilitating informed decision-making and strategic financial planning.

Understanding the intricacies of reapplying a deleted late fee in QuickBooks equips users with the knowledge and expertise to address this common issue effectively. By following the subsequent steps outlined in this article, users can confidently navigate QuickBooks and reinstate late fees with precision, ensuring that their financial records remain comprehensive and error-free.

**

Steps to Reapply a Deleted Late Fee in QuickBooks

**

Reapplying a deleted late fee in QuickBooks involves a series of systematic steps to ensure that the late fee is accurately reinstated. By following these steps, users can navigate QuickBooks with confidence and precision, rectifying any inadvertent deletions and maintaining the integrity of their financial records. The following guidelines outline the process of reapplying a deleted late fee in QuickBooks:

- 1. Accessing the Invoice: Begin by accessing the original invoice to which the late fee was initially applied. Navigate to the specific invoice within QuickBooks to identify the late fee that needs to be reinstated.

- 2. Reviewing Transaction History: Once the invoice is accessed, review the transaction history to identify the deleted late fee. QuickBooks maintains a comprehensive transaction log, enabling users to track any modifications or deletions made to the invoice, including the late fee.

- 3. Recreating the Late Fee: After identifying the deleted late fee, recreate the late fee by applying the appropriate late fee policy based on the original terms and conditions. QuickBooks allows users to manually input late fees, ensuring that the reinstated late fee aligns with the initial invoicing terms.

- 4. Verifying Accuracy: Double-check the accuracy of the reinstated late fee to ensure that it aligns with the original terms and conditions. Verify that the late fee amount, calculation method, and application date correspond to the initial invoicing details.

- 5. Saving the Changes: Once the late fee is accurately recreated, save the changes to the invoice within QuickBooks. Confirm that the reinstated late fee is reflected in the invoice total and accounts receivable balance.

By diligently following these steps, users can effectively reapply a deleted late fee in QuickBooks, mitigating the impact of inadvertent deletions and preserving the accuracy of their financial records. This systematic approach empowers users to navigate QuickBooks with precision, ensuring that late fees are consistently and accurately applied to overdue invoices.

**

Conclusion

**

Reapplying a deleted late fee in QuickBooks is a fundamental aspect of maintaining accurate and transparent financial records. Understanding the significance of late fees, the implications of inadvertent deletions, and the systematic steps to rectify such errors is essential for businesses and individuals utilizing QuickBooks for their accounting needs.

By comprehending the process of reapplying a deleted late fee and following the prescribed steps, users can navigate QuickBooks with confidence and precision, ensuring that their financial data remains comprehensive and error-free. This level of proficiency empowers businesses to uphold their financial integrity, make informed decisions, and maintain healthy cash flow by incentivizing timely payments through late fee policies.

Furthermore, the ability to effectively manage late fees in QuickBooks contributes to streamlined accounts receivable management and fosters positive relationships with clients and customers. By leveraging the late fee feature in QuickBooks and addressing any inadvertent deletions in a systematic manner, users can enhance their financial practices and uphold the professionalism and accuracy of their accounting processes.

In conclusion, the knowledge and expertise required to reapply a deleted late fee in QuickBooks are invaluable for ensuring the integrity and accuracy of financial records. By following the guidelines outlined in this article, users can navigate QuickBooks with proficiency, rectify inadvertent deletions, and maintain comprehensive and error-free financial data, ultimately contributing to the financial stability and success of their businesses.