Home>Finance>Regulation W: Definition In Banking And When It Applies

Finance

Regulation W: Definition In Banking And When It Applies

Published: January 18, 2024

Learn the definition of Regulation W in finance and understand when it applies in banking. Stay compliant with this essential financial regulation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Regulation W in Banking

When it comes to banking, there are numerous regulations in place to protect both the financial institutions and their customers. One such regulation is Regulation W, which plays a crucial role in governing certain transactions within the banking industry. In this blog post, we will explore the definition of Regulation W, its scope, and when it applies.

Key Takeaways:

- Regulation W is a banking regulation that governs certain transactions between banks and their affiliates.

- It aims to prevent banks from engaging in risky transactions that could jeopardize their financial stability.

What is Regulation W?

Regulation W, also known as the “Transactions with Affiliates” regulation, is a federal regulation issued by the Federal Reserve. Its primary objective is to prevent banks from engaging in risky transactions with their affiliates that could potentially harm their financial stability. Affiliates, in this context, refer to entities that have a direct or indirect control or influence over the bank.

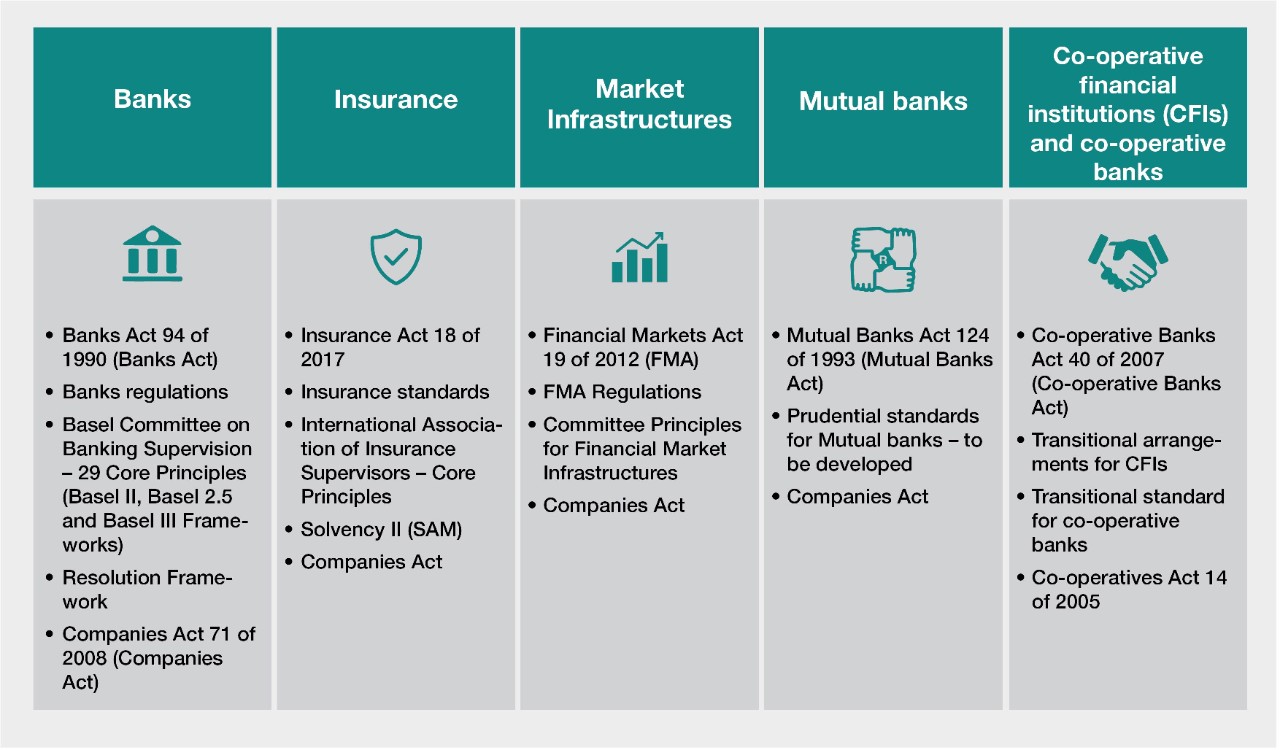

Regulation W covers a wide range of transactions, including loans, investments, purchases of assets, and the issuance of guarantees between a bank and its affiliates. By placing restrictions on these transactions, the regulation ensures that banks operate within a framework that minimizes risks and protects the interests of all stakeholders involved.

When Does Regulation W Apply?

Regulation W applies to any transaction between a bank and its affiliates. However, it is most relevant when three conditions are met:

- The bank and its affiliate share a common management or ownership.

- The transaction involves the transfer of funds, assets, or liabilities between the bank and its affiliate.

- The transaction has the potential to create a risk to the bank’s safety and soundness.

It’s essential to note that Regulation W does not apply to all transactions between banks and their affiliates. It focuses on transactions that pose a risk to the bank’s stability. The ultimate goal is to prevent conflicts of interest and ensure that banks operate in a manner that protects both their own financial well-being and the best interests of their customers.

Conclusion

Regulation W is a vital component of the regulatory framework in the banking industry. By limiting certain transactions between banks and their affiliates, it helps to maintain the stability of the financial system and protect the interests of all stakeholders involved. As a customer, it’s important to be aware of these regulations to ensure that your bank operates within the confines of the law and maintains its financial strength.

Remember, regulation exists to provide a solid foundation for the banking industry, ensuring that stability and responsibility remain central to the operations of financial institutions. If you have any doubts or concerns about Regulation W or any other banking regulations, don’t hesitate to reach out to your bank for clarification and guidance.