Finance

Which Banking Regulations Should Be Changed?

Published: December 20, 2023

Explore the crucial changes needed in banking regulations to ensure a more secure and transparent financial system. Gain insights on how finance can be better regulated for the benefit of all stakeholders.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Banking regulations play a crucial role in maintaining the stability and integrity of the financial system. They are designed to protect consumers, promote fair competition, and prevent financial crises. However, just like any other set of regulations, they are not without their flaws and limitations. As the banking industry evolves and new challenges emerge, it becomes necessary to reevaluate and potentially revise the existing regulations.

In recent years, the financial landscape has undergone significant changes. Technological advancements, such as the rise of fintech companies and the increasing use of cryptocurrencies, have disrupted traditional banking practices. Additionally, the global financial crisis of 2008 exposed weaknesses in the regulatory framework and raised questions about its effectiveness.

The purpose of this article is to explore the need for changes in banking regulations and discuss the potential areas where amendments could be made. We will examine the current state of banking regulations, identify the issues and shortcomings, and propose some possible changes. Furthermore, we will discuss the benefits and challenges associated with changing banking regulations.

It is important to note that any changes to banking regulations should aim to strike a balance between safeguarding the stability of the financial system and facilitating innovation and competition. The objective is to create a regulatory environment that is adaptable, efficient, and responsive to the evolving needs of the banking industry and the consumers it serves.

It is also worth mentioning that the discussion of specific changes to banking regulations in this article is purely hypothetical and intended for informative purposes. Any actual changes would require in-depth analysis, consultation with experts, and consideration of various factors, including economic and political implications.

Now, let us delve into the background of banking regulations to better understand their purpose and importance.

Background of Banking Regulations

Banking regulations have been in existence for centuries, dating back to the early days of banking. They were initially established to address issues related to the safety and soundness of financial institutions, protect depositors’ funds, and prevent fraudulent activities.

One of the earliest and most important banking regulations was the creation of central banks. Central banks, such as the Federal Reserve in the United States, were established to oversee monetary policy, regulate banks, and ensure the stability of the financial system. They have the authority to set interest rates, control the money supply, and act as a lender of last resort during times of financial stress.

Over time, banking regulations have evolved in response to changes in the financial industry, technological advancements, and geopolitical events. The global financial crisis of 2008, in particular, highlighted the need for stricter regulations to prevent excessive risk-taking and protect consumers.

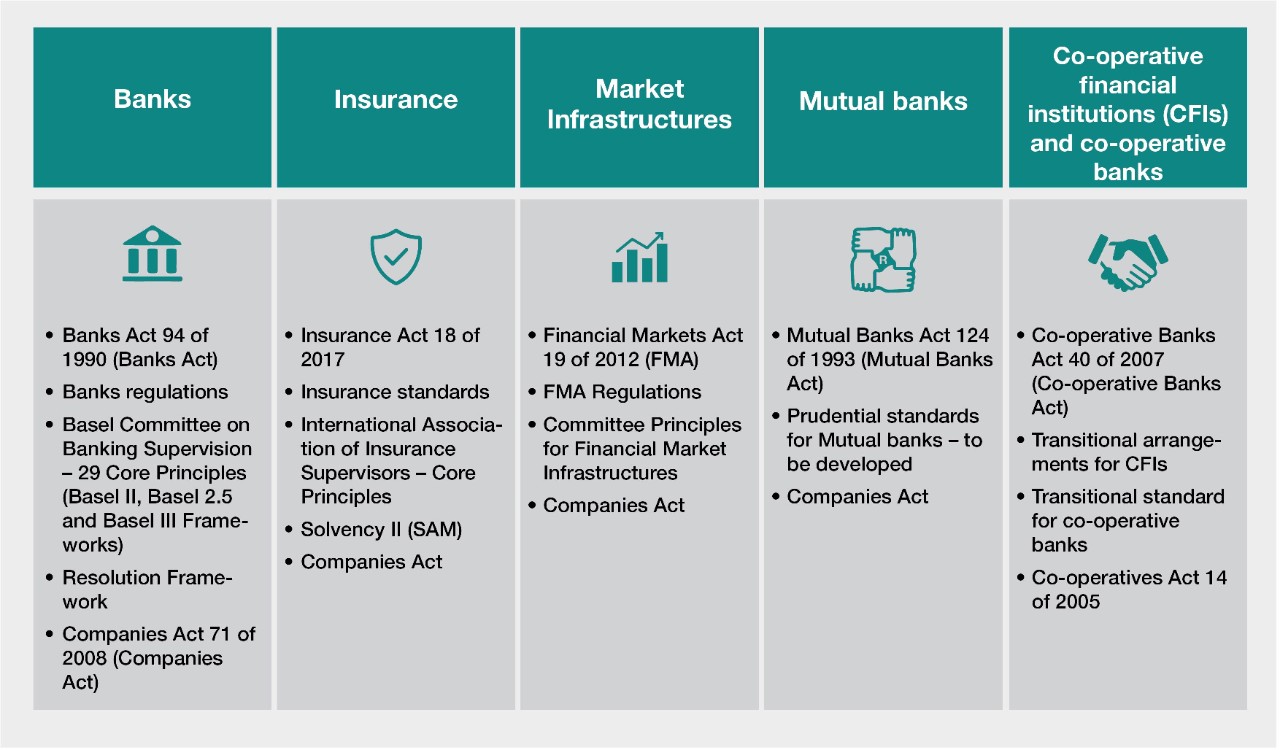

Today, banking regulations encompass a wide range of areas, including capital requirements, liquidity management, risk management, consumer protection, and anti-money laundering measures. These regulations are enforced by regulatory bodies, such as the Office of the Comptroller of the Currency (OCC), the Securities and Exchange Commission (SEC), and the Financial Conduct Authority (FCA), among others.

The primary objectives of banking regulations are:

- Financial Stability: Regulations aim to promote the stability and resilience of the financial system by setting prudential standards for banks, requiring risk management practices, and conducting regular audits to detect potential weaknesses.

- Consumer Protection: Regulations seek to protect consumers from unfair or deceptive practices, ensure transparency in financial transactions, and provide avenues for dispute resolution.

- Fair Competition: Regulations aim to prevent monopolistic practices and promote fair competition in the banking industry. This includes regulations related to market entry, mergers and acquisitions, and anti-competitive behavior.

While banking regulations have played a vital role in safeguarding the financial system, they are not without their challenges. In the next section, we will explore the current state of banking regulations and identify the issues and shortcomings that have led to calls for change.

Current Banking Regulations

The current banking regulations vary from country to country and are governed by specific regulatory bodies. These regulations aim to ensure the stability and integrity of the financial system, protect consumer interests, and promote fair competition in the banking industry.

Key elements of current banking regulations include:

- Capital Requirements: Banks are required to maintain a certain level of capital to absorb losses and protect depositors’ funds. These requirements are determined by regulatory bodies and are based on the size, risk profile, and activities of the bank.

- Liquidity Management: Banks are required to maintain sufficient liquidity to meet their obligations, both in normal times and during periods of financial stress. This ensures that banks can continue to operate and fulfill their role as financial intermediaries.

- Risk Management: Banks are expected to have robust risk management frameworks in place to identify, assess, and manage various types of risks, including credit risk, market risk, operational risk, and legal risk.

- Consumer Protection: Regulations focus on protecting consumers from unfair and deceptive practices in banking transactions. This includes transparency in pricing, clear disclosure of terms and conditions, and mechanisms for resolving disputes.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Banks are required to implement measures to prevent money laundering, terrorist financing, and other illicit activities. They must establish due diligence procedures to verify the identity of customers and monitor transactions for suspicious activities.

- Market Conduct and Competition Regulations: Regulations are in place to ensure fair competition among banks. This includes restrictions on anti-competitive practices, such as price-fixing or market manipulation, and measures to promote market entry and innovation.

While these regulations provide a framework for the functioning of the banking industry, they are not without their limitations and challenges. In the next section, we will explore some of the issues and shortcomings of the current banking regulations that have led to calls for change.

Issues with Current Banking Regulations

While current banking regulations have played a crucial role in ensuring the stability and integrity of the financial system, they are not without their flaws and limitations. The following are some of the key issues and shortcomings that have been identified:

- Complexity: Banking regulations are often complex and challenging to navigate. They can be filled with technical jargon and intricate requirements, making it difficult for banks to fully understand and comply with them. This complexity increases the compliance burden and can result in inefficiencies within the banking industry.

- One-size-fits-all approach: Current regulations often take a one-size-fits-all approach, applying the same rules to banks of different sizes and risk profiles. This can create a disproportionate burden for smaller banks that may lack the resources and expertise to comply with the same level of requirements as larger institutions.

- Slow adaptability to technological advances: The rapid advancement of technology in the financial industry has outpaced the ability of current regulations to keep up. Fintech companies and digital banking services have introduced innovative products and services that may not fit neatly into existing regulatory frameworks, creating a regulatory lag.

- Fragmented regulatory landscape: Banking regulations can vary significantly from country to country, creating a fragmented regulatory landscape. This can lead to regulatory arbitrage, where banks may seek jurisdictions with less stringent regulations to gain a competitive advantage. It also complicates regulatory compliance for multinational banks operating in multiple jurisdictions.

- Insufficient focus on risk culture: While current regulations prescribe specific risk management practices, they may not adequately address the importance of fostering a strong risk culture within banks. A robust risk culture is essential for minimizing excessive risk-taking and promoting prudent decision-making.

- Unintended consequences: Some current regulations have unintended consequences that may hinder economic growth. For example, strict lending standards imposed after the 2008 financial crisis may have restricted access to credit for small businesses and individuals, potentially stifling economic development.

These issues have prompted discussions about the need for changes in banking regulations to address these shortcomings and ensure that regulations remain effective and appropriate in a rapidly evolving financial landscape. In the next section, we will explore some of the proposed changes to banking regulations that have been put forward by regulators, policymakers, and industry experts.

Proposed changes to Banking Regulations

Recognizing the shortcomings of current banking regulations, there have been various proposals for changes to ensure that regulations remain effective, relevant, and adaptable to the evolving financial landscape. The following are some of the key proposed changes:

- Simplification and streamlining: One proposed change is to simplify and streamline banking regulations to reduce complexity and improve clarity. This could involve revisiting the language and structure of regulations to make them more accessible and easier to understand for banks and regulators alike. By eliminating unnecessary red tape and duplication, banks can focus on the core objectives of regulatory compliance.

- Proportionality: Another proposed change is to introduce a more proportionate approach to regulation, taking into consideration the size, complexity, and risk profile of banks. This would mean tailoring regulations to be more appropriate and realistic for smaller banks while maintaining higher standards for larger banks with a greater systemic impact. This would help ensure a level playing field and reduce the compliance burden on smaller institutions.

- Technology and innovation-friendly regulations: As technology continues to transform the banking industry, there is a need for regulations that are technology and innovation-friendly. This includes creating regulatory sandboxes or innovation hubs where fintech companies can test and develop new products and services within a controlled environment. It also involves revisiting existing regulations to accommodate emerging technologies such as blockchain, artificial intelligence, and digital currencies.

- Harmonization of regulations: To address the challenge of a fragmented regulatory landscape, there have been calls for greater international cooperation and harmonization of regulations. This would ensure a consistent and coordinated approach to banking regulations across countries, reducing regulatory arbitrage and improving global financial stability.

- Focus on risk culture and conduct: Proposed changes also emphasize the importance of fostering a strong risk culture within banks. This involves aligning the incentives of management and employees with long-term risk management objectives, improving board oversight, and promoting ethical conduct. By placing a greater emphasis on risk culture, banks can better manage risks and prevent misconduct within their organizations.

- Evaluation and reassessment: Regular evaluation and reassessment of banking regulations are necessary to ensure their effectiveness. This involves conducting periodic reviews of regulations to assess their impact, identify areas requiring improvement, and make necessary adjustments. This iterative process allows for continuous improvement and adaptation to changing market conditions.

These proposed changes aim to address the issues and shortcomings of current banking regulations and create a more robust and responsive regulatory framework. It is important to note that the specific changes that are implemented will depend on various factors, including the regulatory environment, political considerations, and input from stakeholders in the banking industry.

In the next section, we will explore the potential benefits that could be derived from changing banking regulations.

Benefits of Changing Banking Regulations

Proposed changes to banking regulations have the potential to bring about several benefits to the banking industry, consumers, and the overall financial system. The following are some of the key benefits that could be derived from changing banking regulations:

- Improved Financial Stability: By addressing the shortcomings of current regulations, the proposed changes can enhance the financial stability of the banking system. Simplification and streamlining of regulations can reduce compliance costs for banks, allowing them to focus more resources on risk management and maintaining adequate capital buffers. Proportionate regulations can ensure that banks of all sizes are subject to appropriate levels of oversight, minimizing the risks of systemic failures.

- Enhanced Consumer Protection: Changing banking regulations can strengthen consumer protection measures in the industry. Regulations that are more technology-friendly and innovation-oriented can support the development of new financial products and services that better cater to consumer needs. Additionally, revisiting regulations related to transparency, pricing, and dispute resolution can empower consumers with greater knowledge and recourse to ensure fair treatment in their banking relationships.

- Promotion of Innovation: Technology-driven changes to regulations can foster innovation within the banking industry. By creating sandboxes and providing a regulatory framework that is adaptable to emerging technologies, regulators can encourage the development of fintech solutions that enhance financial services and expand access to underserved markets. This can drive competition, improve efficiency, and promote financial inclusion.

- International Coordination: Harmonization of banking regulations across countries can facilitate cross-border financial transactions and promote global financial stability. Standardizing regulatory frameworks can reduce complexity, enhance supervisory cooperation, and create a level playing field for banks operating in different jurisdictions. This can lead to a more efficient allocation of capital and resources within the global banking system.

- Efficient Risk Management: Changing regulations can contribute to more effective risk management practices within banks. By focusing on risk culture and conduct, regulations can encourage a strong risk management mindset, reducing the likelihood of excessive risk-taking and misconduct. Implementing proportionate regulations can also ensure that banks allocate resources based on the actual risks they face, enabling more efficient use of capital and risk management strategies.

- Promotion of Economic Growth: Well-designed and balanced banking regulations can support economic growth and stability. By fostering a sound and secure financial system, regulations contribute to investor confidence, encourage lending to productive sectors of the economy, and facilitate the efficient allocation of capital. This, in turn, can stimulate business growth, job creation, and overall economic prosperity.

It is important to note that while the proposed changes have the potential to bring about these benefits, they also need to be carefully designed and implemented to mitigate any unintended consequences and ensure a well-balanced regulatory environment.

In the next section, we will discuss some of the challenges that may arise during the process of changing banking regulations.

Challenges in Changing Banking Regulations

While changing banking regulations can bring about several benefits, there are also various challenges that need to be addressed during the process. These challenges include:

- Complexity and Interdependencies: The banking industry operates within a complex ecosystem, and any changes to regulations can have far-reaching effects. It is crucial to consider the interdependencies between different regulations, as well as the potential unintended consequences that can arise from altering one regulation without considering its broader impact.

- Balancing Stability and Innovation: One of the key challenges in changing banking regulations is striking the right balance between maintaining stability and fostering innovation. Regulators need to ensure that any changes do not compromise the safety and soundness of the financial system while still encouraging advancements in technology, product development, and competition.

- Political and Regulatory Hurdles: Implementing changes to banking regulations can face political and regulatory hurdles. The process may involve multiple stakeholders, including regulatory bodies, policymakers, industry associations, and consumer advocates. Aligning their interests and navigating the complexities of the regulatory environment can be challenging and time-consuming.

- Compliance and Implementation Costs: Changing regulations often entail compliance and implementation costs for banks. These costs can include modifying existing systems, retraining staff, and ensuring ongoing adherence to new requirements. Smaller banks may face additional challenges due to limited resources and may require support and guidance from regulatory bodies to meet the new compliance obligations.

- Global Coordination: Harmonizing banking regulations across countries requires international coordination and cooperation. This can be challenging due to differences in legal frameworks, regulatory cultures, and economic priorities. Achieving consensus on common standards and principles may take time and require ongoing dialogue between regulators and policymakers at the international level.

- Risk of Regulatory Capture: A potential challenge in changing banking regulations is the risk of regulatory capture, where regulatory decisions are influenced by the interests of the regulated entities rather than the broader public interest. Maintaining independence, transparency, and accountability in the regulatory process is essential to mitigate this risk.

Overcoming these challenges requires careful planning, consultation, and collaboration among regulators, policy-makers, banks, and other stakeholders. It is crucial to assess the potential impacts of proposed changes, conduct rigorous cost-benefit analysis, and maintain an ongoing dialogue to address concerns and ensure the effectiveness of the regulatory framework.

In the next section, we will wrap up the article by summarizing the key points discussed and emphasizing the importance of finding the right balance in changing banking regulations.

Conclusion

Banking regulations play a critical role in ensuring the stability and integrity of the financial system. However, the evolving banking landscape and emerging challenges necessitate a reevaluation of the existing regulations. The proposed changes aim to address the shortcomings of current regulations and create a regulatory framework that is adaptable, efficient, and responsive to the needs of the industry and consumers.

By simplifying and streamlining regulations, proportionately tailoring them to different banks, and promoting innovation-friendly frameworks, the banking industry can thrive in the rapidly advancing technological landscape. Furthermore, harmonizing regulations internationally can promote global financial stability and reduce regulatory arbitrage.

While changing banking regulations offers numerous benefits, there are also challenges to navigate, such as the complexity of the banking ecosystem, balancing stability and innovation, and managing compliance and implementation costs. Political and regulatory hurdles, global coordination, and the risk of regulatory capture also pose significant challenges.

To overcome these challenges, careful planning, collaboration, and ongoing evaluation are necessary. Regulators, policymakers, banks, and other stakeholders must work together to ensure a well-balanced regulatory environment that fosters stability, promotes innovation, safeguards consumer interests, and supports economic growth.

In conclusion, changing banking regulations is an ongoing process that requires continuous adaptation to the changing financial landscape. By reviewing and revising regulations with the goal of enhancing financial stability, consumer protection, and innovation, we can build a robust and resilient banking industry that serves the needs of society in the modern era.