Finance

Risk Graph Definition

Published: January 21, 2024

Learn what a risk graph is in finance and how it can help you visualize and analyze potential risks in your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Importance of Understanding Risk Graphs in Finance

Welcome to our “Finance” blog category where we dive deep into various financial concepts, helping you gain a better understanding of how the world of finance works. In this post, we’re going to shed light on the concept of risk graphs in finance and why it’s crucial for every investor to comprehend them. If you’ve ever wondered what a risk graph is, how it’s constructed, and why it matters, you’re in the right place! Let’s get started.

Key Takeaways:

- A risk graph is a visual representation of the potential profit and loss of a particular investment strategy.

- Understanding risk graphs helps investors assess the potential risks and rewards of different investment scenarios.

What is a Risk Graph?

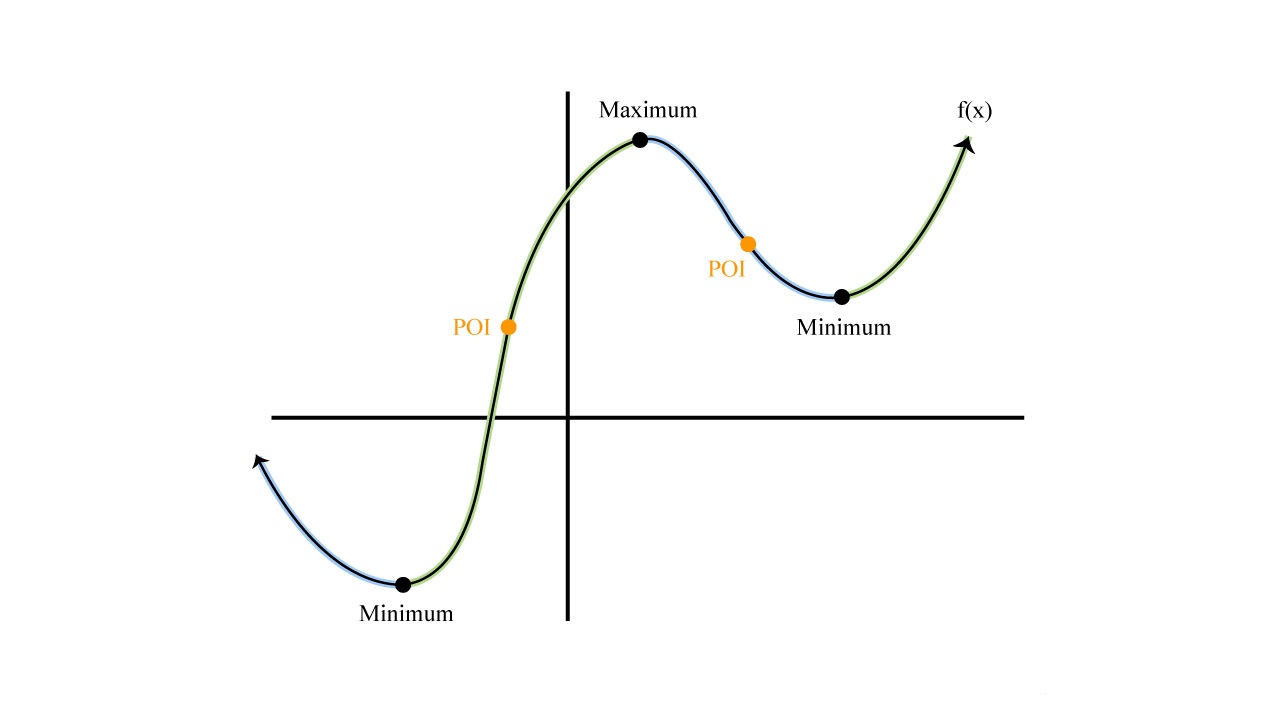

A risk graph is a graphical representation of the potential profit and loss of a specific investment strategy. It allows investors to assess the performance and potential risks associated with different investment scenarios, making it an invaluable tool in the field of finance. By analyzing risk graphs, investors can better understand the potential outcomes of their investment decisions, helping them make informed choices and manage their risk exposure effectively.

How is a Risk Graph Constructed?

Risk graphs are constructed by plotting the potential profit or loss on the y-axis and the price of the underlying asset on the x-axis. The shape of the graph is determined by various factors, including the type of investment strategy, the underlying asset’s price movements, and the option or strategy being employed. The resulting graph provides a visual representation of the potential outcomes, allowing investors to gauge the range of possible profits or losses.

Why Understanding Risk Graphs is Crucial

Now that we know what a risk graph is and how it’s constructed, let’s delve into why understanding risk graphs is critically important for investors:

- Assessing Potential Risks: Risk graphs help investors evaluate the potential risks of an investment strategy. By visually representing the potential profit and loss scenarios, risk graphs enable investors to identify potential pitfalls and assess the overall risk exposure of their investments.

- Evaluating Reward Potential: Alongside assessing risks, risk graphs also allow investors to evaluate the potential rewards of different investment strategies. By visualizing the profit possibilities, investors can determine if the potential returns are in line with their investment goals and appetite for risk.

By understanding the construction and interpretation of risk graphs, investors can make more informed decisions, optimize their investment strategies, and better manage their risk exposure.

So, if you’re serious about your financial journey, take the time to master the art of understanding risk graphs in finance. It will empower you to navigate the complex world of investments with confidence and enhance your chances of financial success.