Finance

Satoshi Cycle Definition

Published: January 23, 2024

Learn the meaning of Satoshi Cycle in finance and how it impacts the cryptocurrency market. Discover the key factors driving this recurring pattern.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Satoshi Cycle Definition: A Comprehensive Guide

Welcome to our Finance category, where we dive deep into various financial topics and help you build a strong foundation of knowledge. Today, we are going to explore an intriguing concept known as the Satoshi Cycle. What exactly is the Satoshi Cycle, and why is it important in the world of finance? In this blog post, we’ll answer all your questions as we unravel the secrets behind this fascinating phenomenon.

Key Takeaways:

- The Satoshi Cycle refers to the periodic phases of euphoria and despair that occur within the cryptocurrency market.

- This cyclical behavior is named after Satoshi Nakamoto, the mysterious individual or group who created Bitcoin and introduced the revolutionary concept of blockchain technology.

Now, let’s deep dive into the Satoshi Cycle and understand its significance.

What is the Satoshi Cycle?

The Satoshi Cycle is an observed pattern of behavior that occurs within the cryptocurrency market, characterized by alternating periods of extreme optimism (euphoria) and extreme pessimism (despair). This pattern is named after Satoshi Nakamoto, the pseudonymous creator(s) of Bitcoin, who introduced the concept of blockchain technology to the world.

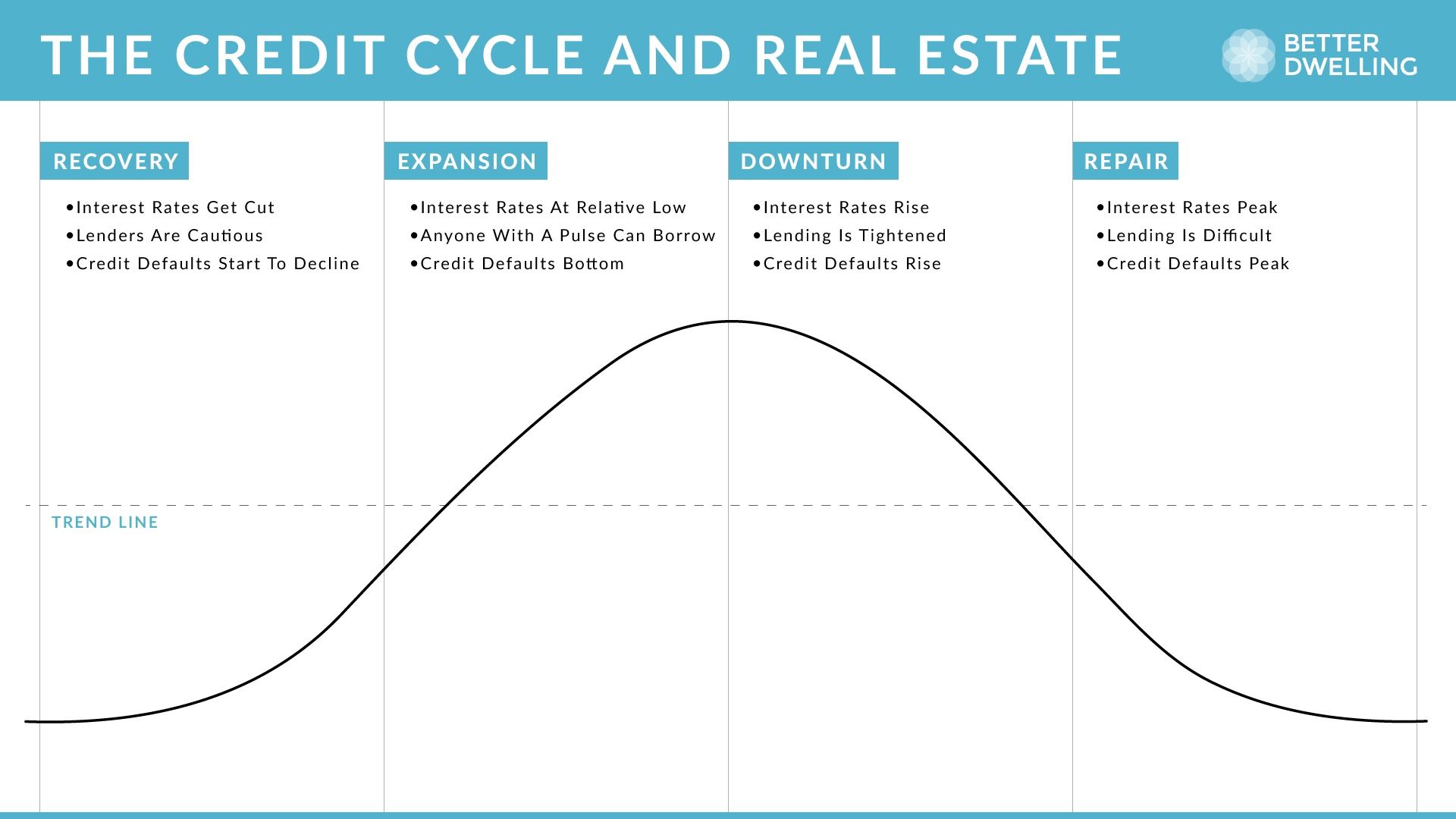

Similar to economic cycles prevalent in traditional financial markets, the Satoshi Cycle represents the emotional swings of investors and traders in the cryptocurrency space. It is driven by various factors, including market news, technological advancements, regulatory changes, and overall market sentiment.

Understanding the Phases of the Satoshi Cycle:

The Satoshi Cycle typically consists of four distinct phases:

- Accumulation: In this phase, cryptocurrency prices are at their lowest point, and investor sentiment is predominantly negative. Savvy investors who believe in the long-term potential of a particular cryptocurrency start accumulating positions, taking advantage of low prices.

- Mark Up: As the market begins to recover, prices start to rise. This phase is characterized by increasing optimism, attracting more investors and traders who missed the initial opportunity during the accumulation phase.

- Distribution: During this phase, the market reaches a peak as prices soar to new heights. The mainstream media often covers the cryptocurrency’s success stories, leading to a surge in attention and a flood of new market participants.

- Mark Down: After reaching its peak, the market begins a sharp decline. This phase is marked by panic selling, as euphoria is replaced by despair. Prices drop, and investors and traders rush to exit their positions, fearing further losses.

Why is the Satoshi Cycle Relevant?

The Satoshi Cycle is crucial for investors and traders in the cryptocurrency space, as it provides insights into market behavior and potential trading opportunities. By understanding the various phases of the cycle, one can adapt their investment strategies accordingly:

- Buying the Dip: During the accumulation and mark-down phases, when prices are low, some investors may choose to buy cryptocurrencies at a discounted rate, anticipating an eventual recovery.

- Selling the Peak: Conversely, during the distribution phase, when prices are at their peak, some traders may decide to sell their holdings to lock in profits before the inevitable downturn.

While the Satoshi Cycle is not a fool-proof predictor of market movements, it serves as a valuable tool for understanding the psychological dynamics at play in the cryptocurrency market and making informed decisions.

Conclusion

The Satoshi Cycle is a fascinating phenomenon that captures the cyclical nature of investor emotions within the cryptocurrency market. By recognizing and understanding the four phases of the cycle, investors and traders can navigate through the market’s ups and downs more effectively. While it’s essential to remember that the market can be unpredictable, being aware of these emotional patterns can enhance decision-making and potentially lead to more favorable outcomes.

So, the next time you’re investing in cryptocurrencies, keep an eye on the Satoshi Cycle and use it as a tool to help guide your financial journey in this exciting and evolving financial sector!