Finance

Uptick Volume Definition

Published: February 14, 2024

Learn the definition of uptick volume in finance and how it impacts trading activity. Increase your knowledge of finance terms with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Uptick Volume in Finance: Definition and Importance

Welcome to our Finance blog category! In this blog post, we will dive into the fascinating world of uptick volume, a concept that plays a crucial role in the world of finance and investing. Whether you’re a seasoned investor or just starting out, understanding uptick volume is essential for making informed decisions in the stock market. Today, we will explore the definition of uptick volume, its importance, and how it can be a valuable tool in your investing arsenal.

Key Takeaways:

- Uptick volume refers to the number of shares traded at a price higher than the previous trade.

- Uptick volume is used to analyze market sentiment and identify potential buying or selling opportunities.

What is Uptick Volume?

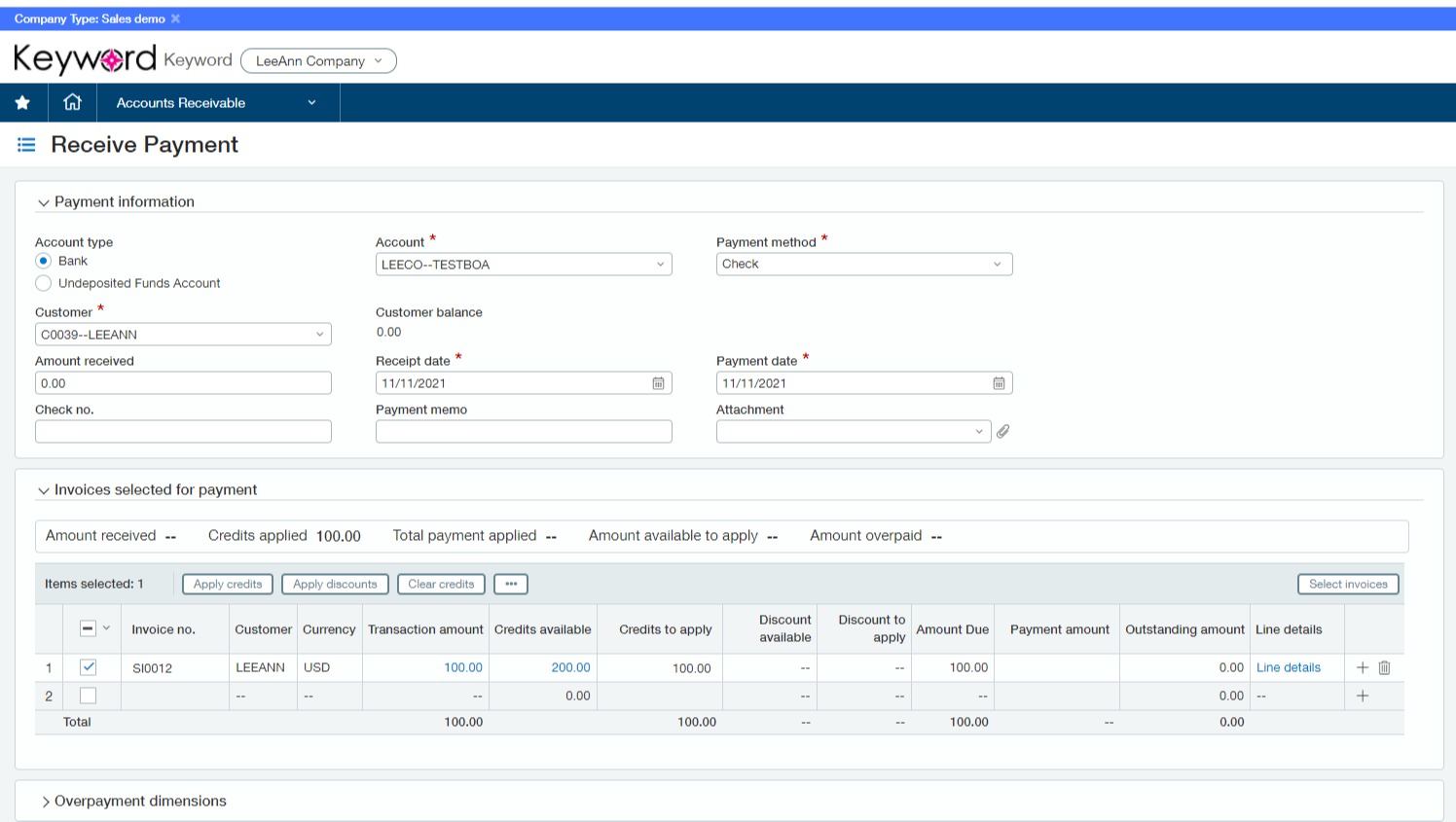

Uptick volume, also known as plus tick volume, refers to the number of shares traded in a given period where the trade price is higher than the previous trade price. In other words, it measures the trading activity when a stock’s price is on the rise. When a trade is executed at a price higher than the previous trade, it is considered an uptick, and the volume of shares traded on that uptick is known as uptick volume.

Uptick volume is an important metric used by traders and investors to gauge market sentiment. By analyzing uptick volume, market participants can gain insights into whether there is buying or selling pressure in a particular stock or the overall market. It provides valuable information to determine how market participants are reacting to price movements and can help identify potential trends and reversals.

When uptick volume is high, it suggests bullish sentiment, indicating that investors are actively buying shares. On the other hand, low uptick volume may indicate a lack of interest or potential selling pressure. By monitoring uptick volume alongside price movements, traders can identify potential entry or exit points for their trades, enhancing their decision-making process.

The Importance of Uptick Volume

Uptick volume serves as a powerful tool for market analysis and decision making. By understanding the dynamics of uptick volume, investors can benefit in several ways:

- Identifying Buying Opportunities: High uptick volume can indicate that market participants are actively buying shares, signaling a potential upward trend in price. This information can help investors identify buying opportunities and enter positions at favorable prices.

- Detecting Selling Pressure: Analyzing uptick volume can also reveal potential selling pressure in the market. When uptick volume is low or declining while prices are rising, it suggests a lack of buying interest or potential selling pressure. This insight can be valuable in managing risk and avoiding potential downturns.

By incorporating uptick volume analysis into your investment strategy, you can gain a deeper understanding of market sentiment and enhance your decision-making process. However, it’s important to note that uptick volume analysis should be used in conjunction with other technical and fundamental analysis tools to make well-rounded investment decisions.

In conclusion, uptick volume plays a significant role in the world of finance and investing. By understanding its definition and importance, you can utilize this powerful tool to make informed decisions in the stock market and potentially improve your investment outcomes. So, next time you analyze a stock’s behavior, don’t forget to include uptick volume in your analysis! Happy investing!