Home>Finance>How To Check Status Of Employee Retention Credit

Finance

How To Check Status Of Employee Retention Credit

Modified: January 5, 2024

Learn how to check the status of the Employee Retention Credit and maximize your financial benefits. Discover key strategies and insights in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is the Employee Retention Credit?

- Eligibility Criteria for the Employee Retention Credit

- Calculating the Employee Retention Credit

- How to Check the Status of Employee Retention Credit

- Method 1: Using the IRS Online Portal

- Method 2: Contacting the IRS by Phone

- Method 3: Engaging a Tax Professional

- Frequently Asked Questions (FAQs) about Checking Employee Retention Credit Status

- Conclusion

Introduction

As a business owner or employer, it is essential to stay updated on the latest tax credits and incentives that can help save your company money. One such credit is the Employee Retention Credit (ERC), which was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The ERC aims to provide financial relief to eligible businesses who have experienced a significant decline in revenue due to the COVID-19 pandemic.

The Employee Retention Credit can be a valuable resource for businesses looking to retain employees and sustain their operations during these challenging times. However, understanding how to check the status of this credit can sometimes be confusing. In this article, we will walk you through the process of checking the status of your Employee Retention Credit, ensuring that you can stay informed and take advantage of any benefits you are entitled to.

Whether you are a small business owner, a majority shareholder in a corporation, or a non-profit organization, the Employee Retention Credit may be available to you. It is essential to familiarize yourself with the eligibility criteria and understand the calculations involved in determining the amount of credit you might be eligible for. By keeping track of the status of your Employee Retention Credit, you can ensure that you are maximizing the benefits and addressing any potential issues or inquiries promptly.

What is the Employee Retention Credit?

The Employee Retention Credit (ERC) is a tax credit designed to provide financial relief to eligible businesses that have been significantly impacted by the COVID-19 pandemic. It was introduced as a part of the CARES Act and later extended and expanded by the Consolidated Appropriations Act of 2021 and the American Rescue Plan Act of 2021.

The purpose of the ERC is to incentivize employers to retain their employees and continue paying wages even during periods of economic downturn or business interruption. The credit is available to both for-profit businesses and tax-exempt organizations, including non-profits. It provides a dollar-for-dollar reduction in the employer’s share of Social Security taxes or, for tax-exempt organizations, a refundable credit against payroll taxes.

To be eligible for the Employee Retention Credit, businesses must meet specific criteria. Firstly, they must demonstrate a significant decline in gross receipts when comparing specific quarters of 2020 or 2021 to the same quarter in 2019. Alternatively, businesses that were partially or fully suspended due to government orders related to COVID-19 may also qualify for the credit.

The credit amount is determined by the number of full-time employees retained during the qualifying period and the wages paid to them. For businesses with fewer than 100 employees, all wages paid during the qualifying period, regardless of whether employees are working or not, are eligible for the credit. For businesses with more than 100 employees, only wages paid to employees who are not working due to the above mentioned COVID-19 factors qualify for the credit.

Importantly, businesses that receive Paycheck Protection Program (PPP) loans are not eligible to claim the Employee Retention Credit for wages paid with forgiven PPP loan proceeds. However, the ERC can still be claimed for wages that were not paid with forgiven PPP loan funds.

The Employee Retention Credit is a valuable resource for businesses and organizations looking to weather the economic challenges posed by the pandemic. By understanding the eligibility criteria and the calculations involved in determining the credit amount, business owners can take advantage of this relief and help ensure the continuity and stability of their operations.

Eligibility Criteria for the Employee Retention Credit

In order to qualify for the Employee Retention Credit (ERC), businesses and organizations must meet certain eligibility criteria. These criteria include demonstrating a significant decline in gross receipts or experiencing a partial or full suspension of operations due to COVID-19-related government orders.

The key requirements for eligibility are as follows:

- Gross Receipts: Businesses must demonstrate a significant decline in gross receipts when comparing specific quarters of 2020 or 2021 to the same quarter in 2019. Specifically, businesses qualify if their gross receipts for a calendar quarter have declined by 50% or more when compared to the same quarter in the previous year. Once the decline reaches this threshold, the business remains eligible until the quarter in which gross receipts exceed 80% of the same quarter in the previous year.

- Suspension of Operations: If a business has been partially or fully suspended due to government orders related to COVID-19, it may also qualify for the ERC. This includes businesses that have been ordered to close their physical locations or that have experienced a significant reduction in their operations due to social distancing measures or other restrictions.

- Non-Profit Organizations: Tax-exempt organizations, including non-profits, are also eligible for the Employee Retention Credit. They must meet the same eligibility requirements related to gross receipts and suspension of operations as for-profit businesses.

It is important to note that businesses that have received Paycheck Protection Program (PPP) loans may still qualify for the ERC on wages that were not paid using forgiven PPP loan funds. However, wages paid with forgiven PPP loan funds are not eligible for the credit.

Furthermore, businesses that are related to each other through common ownership or a combination of ownership and control, or that have a significant commonality of officers, key employees, or board members, must aggregate their gross receipts when determining eligibility for the ERC. This aggregation rule is in place to prevent businesses from artificially reducing their eligibility by creating multiple entities.

Meeting the eligibility criteria is the first step in determining if a business or organization can claim the Employee Retention Credit. By carefully analyzing their gross receipts and considering the impact of government orders, businesses can determine whether they qualify for this valuable tax credit and can proceed to calculate the credit amount based on the wages paid to retained employees.

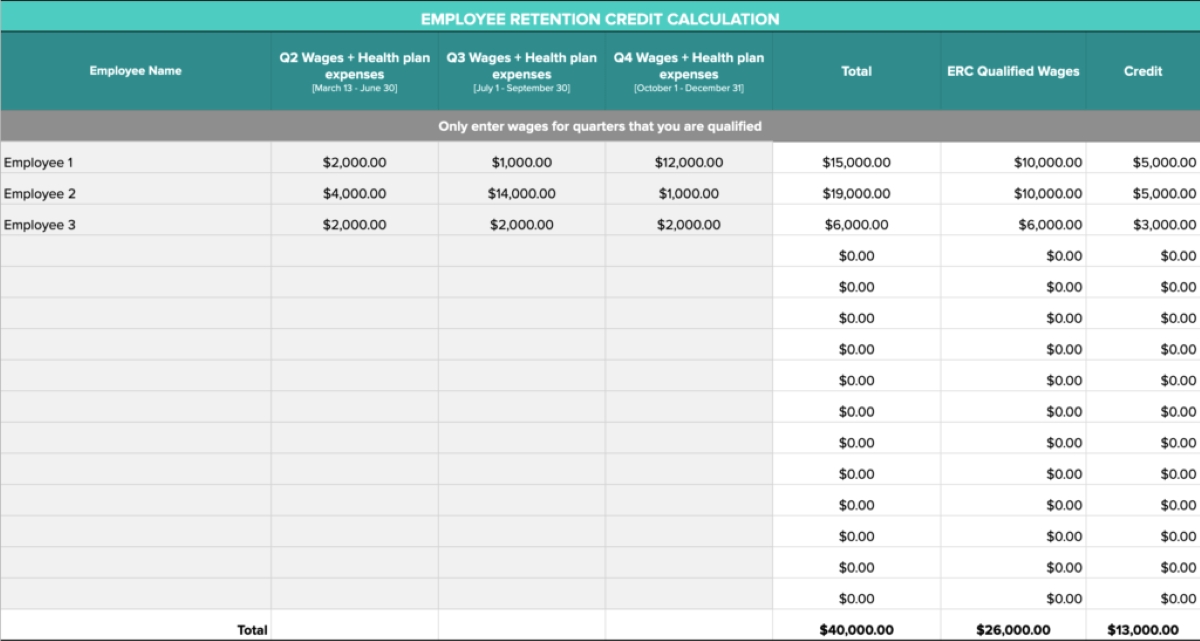

Calculating the Employee Retention Credit

Calculating the Employee Retention Credit (ERC) can be a complex process that requires careful consideration of various factors. The credit is based on the wages paid to eligible employees during the qualifying period. Understanding the calculation methodology is crucial for businesses to determine the credit amount they are eligible for.

Here are the key factors involved in calculating the ERC:

- Number of Full-Time Employees: The ERC is calculated based on the number of full-time employees retained during the qualifying period. Full-time employees are those who work an average of at least 30 hours per week or 130 hours per calendar month.

- Qualifying Wages: The credit is applied to the wages paid to eligible employees during the qualifying period. For businesses with fewer than 100 employees, all wages paid during the qualifying period are eligible for the credit, regardless of whether the employees are working or not. For businesses with more than 100 employees, only wages paid to employees who are not working due to COVID-19-related factors qualify for the credit.

- Credit Rate: The credit rate is 70% of qualified wages for each eligible employee, up to a maximum of $10,000 per employee for all calendar quarters. This means that the maximum credit amount per employee is $7,000 ($10,000 x 70%).

Once you have determined the number of full-time employees and the amount of qualifying wages, you can calculate the ERC by multiplying the credit rate by the eligible wages for each employee.

For example, if you have 10 full-time employees and paid them a total of $100,000 in qualifying wages during the qualifying period, your ERC calculation would be as follows:

ERC = Number of Employees × Qualified Wages × Credit Rate

ERC = 10 employees × $100,000 × 70%

ERC = $700,000

In this example, the business would be eligible for an Employee Retention Credit of $700,000. This credit can be claimed by reducing the employer’s share of Social Security taxes or, for tax-exempt organizations, as a refundable credit against payroll taxes.

It is important to carefully track and document the number of employees retained, as well as the qualifying wages paid, in order to accurately calculate and claim the Employee Retention Credit. Additionally, consulting with a tax professional or utilizing reputable software can help ensure accurate calculations and compliance with the ever-changing IRS guidelines.

How to Check the Status of Employee Retention Credit

As a business owner or employer, it’s crucial to stay informed about the status of your Employee Retention Credit (ERC). Knowing the status allows you to track the progress of your claim, verify its approval, and address any potential issues or inquiries promptly. Here are three methods you can use to check the status of your Employee Retention Credit:

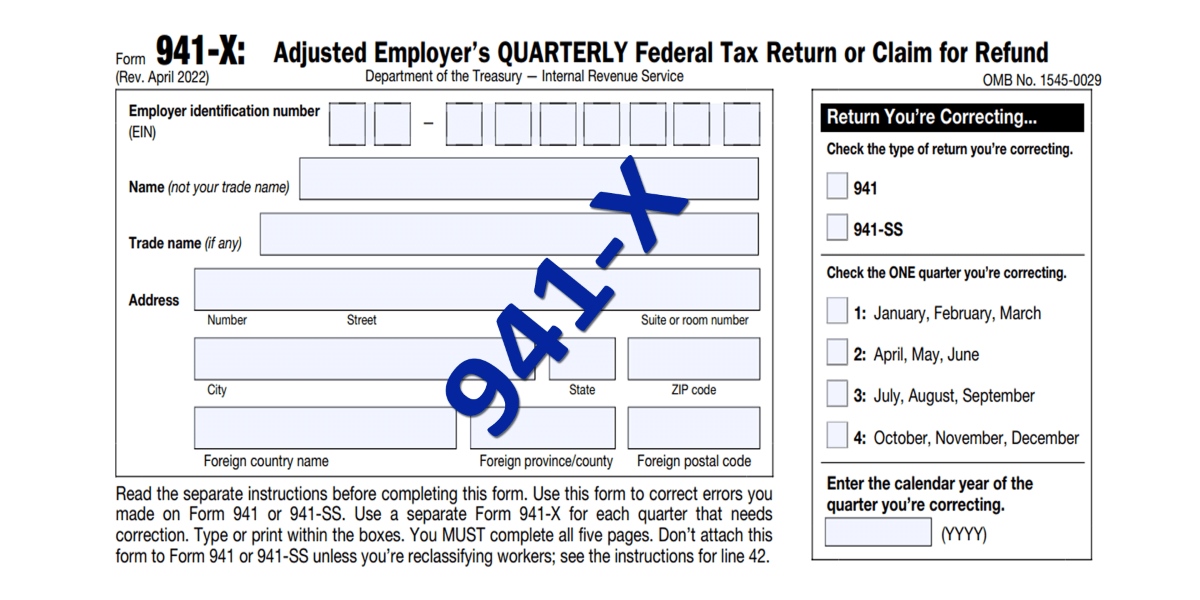

- Method 1: Using the IRS Online Portal: The Internal Revenue Service (IRS) provides an online portal called “Get My Payment” where you can check the status of various tax credits, including the ERC. To use this method, visit the official IRS website and navigate to the “Get My Payment” section. You will need to provide your tax identification number and other relevant information to access your account and view the status of your credit.

- Method 2: Contacting the IRS by Phone: If you prefer to communicate directly with the IRS, you can contact their dedicated phone line for inquiries regarding the Employee Retention Credit. Call the IRS business and specialty tax line at 1-800-829-4933 and follow the prompts to reach a representative who can provide you with information regarding your credit status. Be prepared to provide your business details and any documentation that may be required.

- Method 3: Engaging a Tax Professional: If you have engaged the services of a tax professional or accountant, they can help you check the status of your Employee Retention Credit. They have access to specialized tools and resources that can provide real-time updates on your claim status. They can also offer valuable guidance and assistance in case there are any issues or discrepancies with your credit claim.

It is important to note that checking the status of your Employee Retention Credit may take some time. The IRS processes a large volume of claims and inquiries, so it is advisable to be patient while waiting for updates. Keep in mind that it is always a good idea to retain copies of any supporting documentation related to your credit claim, as you may be required to provide them as evidence in case of an audit or verification process.

By staying proactive and using these methods, you can stay updated on the status of your Employee Retention Credit and ensure that you are taking full advantage of this valuable financial benefit for your business.

Method 1: Using the IRS Online Portal

One of the most convenient ways to check the status of your Employee Retention Credit (ERC) is by using the online portal provided by the Internal Revenue Service (IRS). The IRS has developed the “Get My Payment” portal, which allows taxpayers to access information about various tax credits, including the ERC. Here’s how you can use this method to check the status of your credit:

- Visit the official IRS website and navigate to the “Get My Payment” section.

- On the “Get My Payment” page, you will be prompted to enter your tax identification number, such as your employer identification number (EIN) or social security number (SSN).

- Provide any additional information that may be required, such as your filing status, tax year, and any other relevant details.

- Once you have entered the necessary information, click on the “Submit” or “Find My Payment” button to access your account.

- On the next page, you will be able to see the status of your Employee Retention Credit. The portal will display information such as whether your credit has been approved, the amount of the credit, and any other relevant updates or notifications.

- Take note of the information displayed on the screen, as well as any reference numbers or confirmation details provided. This information may be useful for future reference or communication with the IRS.

Using the IRS online portal is a convenient and efficient way to check the status of your Employee Retention Credit. It provides instant access to your account information, allowing you to stay informed about the progress of your credit claim. However, keep in mind that the portal may experience occasional downtime or technical issues due to high volumes of traffic, so it’s advisable to try accessing it during less busy times whenever possible.

If you encounter any difficulties or have specific questions about your credit status while using the online portal, the IRS website also provides resources such as FAQs and online assistance to help you navigate through the process. Alternatively, contacting the IRS directly through their phone line or consulting a tax professional can provide additional support and guidance in checking the status of your Employee Retention Credit.

Method 2: Contacting the IRS by Phone

If you prefer direct communication and personalized assistance, you can check the status of your Employee Retention Credit (ERC) by contacting the Internal Revenue Service (IRS) through their dedicated phone line. Following these steps will help you get the information you need:

- Call the IRS business and specialty tax line at 1-800-829-4933. This is the dedicated line for inquiries related to the ERC and other tax credits.

- Listen carefully to the available options and select the one that pertains to your specific tax credit inquiry. The options may include questions related to business tax credits or the ERC specifically.

- Be prepared to provide relevant information, such as your employer identification number (EIN) or social security number (SSN), business details, and any other documentation that may be required to verify your identity and access your credit status.

- After providing the necessary information, wait for a representative to assist you. Depending on the volume of calls and available resources, there may be a waiting period before you are connected to a representative.

- Once connected to a representative, kindly explain that you would like to check the status of your Employee Retention Credit. Be ready to provide any additional details or answer questions they may have to assist them in locating your file.

- The IRS representative will provide you with the information regarding the status of your Employee Retention Credit, including whether it has been approved, the amount of the credit, and any other relevant updates or inquiries.

- Take note of the representative’s name, any reference numbers provided, and any instructions or next steps that they may offer. This information will be useful for future reference or if you need to follow up on your credit status.

When contacting the IRS by phone, it’s important to be patient, as wait times may vary depending on call volumes and IRS resources. Additionally, having all the necessary information and documentation readily available can help expedite the process and ensure accurate and efficient assistance.

If you encounter any challenges or difficulties while attempting to check the status of your Employee Retention Credit, it may be beneficial to consult with a tax professional. They can provide valuable insights, assist with the necessary documentation, and serve as a liaison with the IRS on your behalf.

Remember, contacting the IRS by phone is a direct and personal approach to obtain information about your credit status. Their trained representatives are equipped to address your concerns and provide the guidance you need in relation to your Employee Retention Credit claim.

Method 3: Engaging a Tax Professional

When it comes to checking the status of your Employee Retention Credit (ERC) and ensuring compliance with tax regulations, engaging a tax professional can provide valuable expertise and peace of mind. Here’s how a tax professional can assist you in checking the status of your ERC:

- Expert Guidance: A tax professional has in-depth knowledge of tax laws and regulations, including the ERC. They can guide you in understanding the eligibility requirements, calculating the credit amount, and staying updated on any changes or updates to the program.

- Access to Specialized Tools: Tax professionals have access to specialized software and resources that can help expedite the process of checking the status of your ERC. They can navigate through dedicated portals and systems to provide you with real-time updates on the progress of your credit claim.

- Accurate Documentation: Tax professionals can help ensure that you have all the necessary documentation in place to support your ERC claim. They will review your records, including payroll information and financial statements, to verify the accuracy and completeness of your documentation.

- Liaison with the IRS: If there are any issues or inquiries regarding your ERC claim, a tax professional can act as a liaison between you and the Internal Revenue Service (IRS). They can communicate with the IRS on your behalf, address any concerns or questions, and follow up on the status of your credit claim.

- Audit Support: In the event of an IRS audit or examination, a tax professional can provide valuable support and representation. They can assist in gathering the necessary documentation, preparing responses to inquiries, and representing your interests during the audit process.

- Comprehensive Tax Planning: Beyond checking the status of your ERC, tax professionals can offer comprehensive tax planning services. They can help you identify other potential tax credits or incentives that your business may qualify for, ensuring you maximize tax savings and comply with all relevant tax laws.

Engaging a tax professional can provide you with the expertise and peace of mind needed to navigate the complexities of the ERC. They have the knowledge, resources, and experience to guide you through the process of checking the status of your credit claim and maintaining compliance with tax regulations.

When choosing a tax professional, ensure that they have experience in business taxation, specifically with the ERC. Ask for references or seek recommendations from other business owners to find a reputable professional who can meet your specific needs. By working with a tax professional, you can have confidence that your ERC claim is handled efficiently and accurately, allowing you to focus on running and growing your business.

Frequently Asked Questions (FAQs) about Checking Employee Retention Credit Status

Here are some common questions and answers regarding the process of checking the status of your Employee Retention Credit (ERC):

-

Can I check the status of my ERC claim online?

Yes, the Internal Revenue Service (IRS) provides an online portal called “Get My Payment” where you can check the status of various tax credits, including the ERC. By entering your tax identification number and other required information, you can access your account and view the status of your credit claim. -

What information do I need to check the status of my ERC online?

To check your ERC status online, you will typically need your tax identification number, such as your employer identification number (EIN) or social security number (SSN). The specific information required may vary, so it’s advisable to have your tax documents and relevant business information on hand. -

How long does it take to get a status update on my ERC claim?

The timing of receiving the status update on your ERC claim can vary. It depends on factors such as the volume of claims being processed by the IRS and any additional documentation or verification requirements for your specific case. It’s best to be patient and allow sufficient time for the IRS to review and update your claim status. -

Can I check the status of my ERC claim by calling the IRS?

Yes, you can check the status of your ERC claim by contacting the IRS by phone. The IRS business and specialty tax line, at 1-800-829-4933, is available to address inquiries related to tax credits, including the ERC. Be prepared with the necessary information, such as your tax identification number and business details, when calling. -

What if I encounter issues while checking the status of my ERC claim?

If you encounter difficulties or have specific questions during the process of checking your ERC claim status, it may be beneficial to consult with a tax professional. They can provide guidance, assist with any documentation requirements, and act as a liaison with the IRS to resolve any issues or inquiries. -

Should I retain copies of my documentation when checking my ERC claim status?

Yes, it’s essential to retain copies of any supporting documentation related to your ERC claim. These documents may include payroll records, financial statements, and any other relevant records. Having these documents readily available can help facilitate the process and provide evidence if required during the status-checking or audit processes.

While these FAQs address common concerns, it’s important to note that the specific process and requirements for checking the status of your ERC claim may vary. It’s a good practice to refer to official IRS guidelines, consult with a tax professional, or utilize the online resources provided by the IRS for the most accurate and up-to-date information.

Conclusion

The Employee Retention Credit (ERC) provides valuable financial relief to businesses impacted by the COVID-19 pandemic. Understanding how to check the status of your ERC claim is crucial for staying informed and ensuring that you can benefit from this tax credit.

In this article, we explored three methods for checking the status of your Employee Retention Credit:

- Using the IRS online portal “Get My Payment” allows you to access real-time updates on your claim status. By providing your tax identification number, you can view information about the approval and amount of your credit.

- Contacting the IRS by phone through their business and specialty tax line is another option. Be prepared to provide your tax identification number and business details to communicate with an IRS representative who can assist you with your ERC status inquiry.

- Engaging a tax professional can provide expert guidance on checking your ERC status. They have the knowledge, resources, and experience to verify your claim information, communicate with the IRS, and assist you with any inquiries or issues that may arise.

Remember to retain copies of your documentation and be patient while awaiting updates on your ERC claim status. If you encounter any challenges or have specific questions, consulting a tax professional can provide valuable support and ensure accurate compliance with tax regulations.

By staying informed and actively checking the status of your Employee Retention Credit, you can maximize the benefits and financial relief available to your business. The ERC is a valuable resource designed to help businesses retain employees and weather the economic challenges posed by the pandemic.

As always, it’s important to refer to official IRS guidelines or seek professional advice for the most accurate and up-to-date information regarding the Employee Retention Credit and its status-checking procedures.