Finance

What Account Has A Normal Credit Balance

Modified: March 2, 2024

Learn about the normal credit balance in finance accounts and understand how it impacts your financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and accounting, it is essential to have a clear understanding of the concept of normal credit balance. When recording financial transactions, certain accounts have a natural tendency to carry a credit balance. This means that the amount on the credit side of these accounts is typically greater than the amount on the debit side. Understanding which accounts have a normal credit balance is crucial for accurately maintaining financial records and preparing financial statements.

The concept of credits and debits plays a fundamental role in double-entry bookkeeping, which is the widely adopted method of recording financial transactions. Every transaction involves at least two accounts, with one account being credited and the other debited. These credits and debits must balance, ensuring that the accounting equation (Assets = Liabilities + Equity) remains in equilibrium.

It is important to note that the terms “credit” and “debit” do not have the same meaning as in everyday usage. In accounting, a credit does not necessarily denote an increase or a positive transaction, nor does a debit signify a decrease or a negative transaction. Instead, they indicate the direction in which the transaction affects the account’s balance.

The terms “normal credit balance” and “normal debit balance” refer to the side of the account where increases are recorded. Generally, asset accounts and expense accounts have a normal debit balance, while liability accounts, equity accounts, and revenue accounts have a normal credit balance. This means that, in these accounts, credits increase the balance, while debits decrease it. However, for a better understanding of normal credit balance, it is crucial to explore which specific accounts fall into this category.

Understanding Credits and Debits

In the realm of accounting, every financial transaction involves at least two accounts: one account is credited, and another is debited. This double-entry bookkeeping system ensures that each transaction maintains the fundamental equation of Assets = Liabilities + Equity.

Credits and debits determine the direction in which transactions affect each account. It’s crucial to understand that the terms “credit” and “debit” don’t necessarily indicate positive or negative transactions. Instead, they represent the increase or decrease of an account balance.

When a transaction is recorded, it is classified as either a credit or a debit based on the account affected. Generally, assets and expense accounts have a normal debit balance, while liability accounts, equity accounts, and revenue accounts have a normal credit balance.

A debit entry increases an asset account’s balance but decreases a liability, equity, or revenue account’s balance. Conversely, a credit entry increases a liability, equity, or revenue account’s balance but decreases an asset account’s balance.

For example, let’s consider the purchase of inventory for a retail store. The inventory account is an asset account, so the entry to record the transaction must increase its balance. This means the inventory account is debited. On the other hand, the retail store operates on a credit basis or owes money to its suppliers. Therefore, the accounts payable account, which represents the liability, is credited. By debiting inventory and crediting accounts payable, the transaction maintains balance.

Understanding the relationship between credits and debits is essential for accurately recording financial transactions. It ensures that the accounting system maintains integrity and provides accurate financial information for decision-making.

Normal Credit Balance vs. Normal Debit Balance

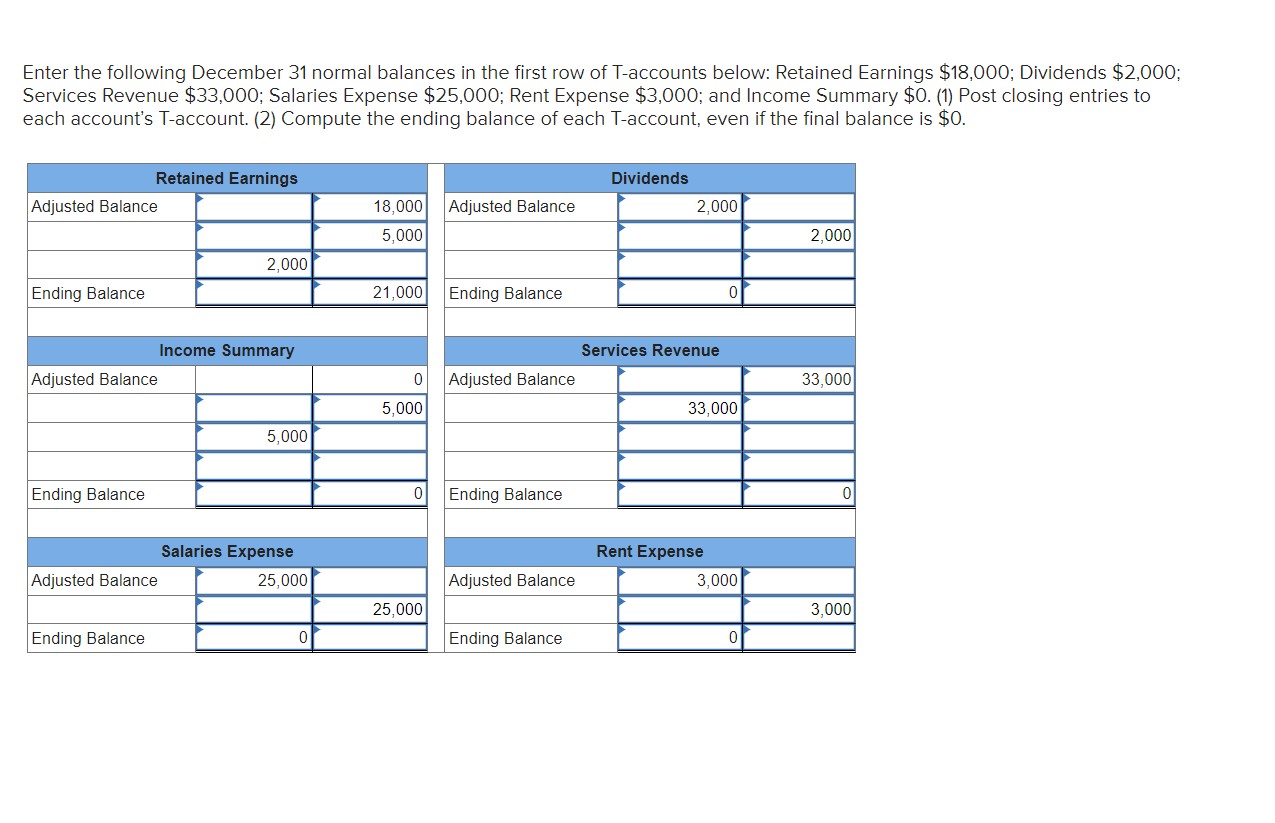

In accounting, the terms “normal credit balance” and “normal debit balance” refer to the side of an account that indicates an increase in the account’s balance. Understanding the distinction between these two concepts is vital for accurate financial record-keeping and analysis.

Generally, asset accounts and expense accounts have a normal debit balance, while liability accounts, equity accounts, and revenue accounts have a normal credit balance. This means that increases in asset and expense accounts are recorded as debits, while increases in liability, equity, and revenue accounts are recorded as credits.

Why is this important? It helps maintain consistency in recording transactions and ensures that financial statements balance correctly. When a transaction affects multiple accounts, recording the appropriate credits and debits in each account ensures that the equation Assets = Liabilities + Equity remains balanced.

For example, let’s consider a company borrowing money from a bank. The borrowing creates a liability for the company called a bank loan. Since liability accounts have a normal credit balance, the bank loan account is credited to record the increase in the loan amount. On the other hand, the company received cash from the bank, which increases its asset. Therefore, the cash account is debited to reflect the increase in cash.

The principle of normal credit balance and normal debit balance extends beyond individual transactions. It applies when preparing financial statements such as the balance sheet and income statement. When presenting financial data, accounts with similar characteristics are grouped together, making it easier to identify the financial position and performance of a business.

By understanding which accounts have a normal credit balance and which have a normal debit balance, accountants and financial professionals can accurately record transactions, prepare financial statements, and provide meaningful insights into a company’s financial health.

Accounts with Normal Credit Balance

In accounting, several types of accounts have a normal credit balance. These accounts represent the sources of funds, revenues, and increases in equity for a business. Understanding which accounts fall into this category is crucial for accurately recording transactions and preparing financial statements.

1. Liability Accounts: Liability accounts include obligations or debts that a company owes to external parties. Common examples of liability accounts with a normal credit balance are accounts payable, accrued expenses, and loans payable. When a liability increases, it is credited to reflect the increase in the company’s obligations.

2. Equity Accounts: Equity accounts represent the ownership interest in a business. Owner’s capital, retained earnings, and common stock are examples of equity accounts with a normal credit balance. When a company generates profits or owner investments increase, these accounts are credited to record the increase in equity.

3. Revenue Accounts: Revenue accounts record income generated from the primary activities of a business. Sales revenue, service revenue, and interest income are examples of revenue accounts. When a company earns revenue, it is credited to reflect the increase in its earnings.

4. Contra-Asset Accounts: Contra-asset accounts have a normal credit balance but are offset against their respective asset accounts. Examples include accumulated depreciation and allowance for doubtful accounts. These accounts are credited to decrease the amount of the asset they are associated with.

It is important to note that transactions impacting accounts with a normal credit balance must be recorded accordingly. When such accounts increase, they are credited, and when they decrease, they are debited. This ensures that the double-entry bookkeeping system remains balanced and accurate.

By correctly identifying and recording transactions in accounts with a normal credit balance, businesses can present accurate financial statements that reflect their financial position and performance. Accountants and financial professionals play a vital role in maintaining the integrity of these accounts and providing meaningful insights for decision-making purposes.

Impact on Financial Statements

The normal credit balance of certain accounts has a significant impact on the presentation of financial statements, including the balance sheet and income statement. Understanding how these accounts affect the financial statements is crucial for interpreting and analyzing a company’s financial health.

1. Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. Accounts with a normal credit balance, such as liability accounts and equity accounts, are typically presented on the right-hand side (credit side) of the balance sheet. These accounts represent the company’s sources of funds and obligations to external parties. The total of these accounts is then subtracted from the total of assets, which have a normal debit balance, resulting in the company’s net assets or shareholders’ equity.

2. Income Statement: The income statement presents a summary of a company’s revenues, expenses, and net income (or net loss) over a specific period. Accounts with a normal credit balance, such as revenue accounts, contribute to the company’s total revenue. These accounts reflect the income generated from the primary activities of the business. On the other hand, accounts with a normal debit balance, such as expense accounts, represent the costs incurred by the business to generate revenue. The difference between total revenue and total expenses is the company’s net income.

By correctly classifying accounts with a normal credit balance on the financial statements, users can assess the financial performance and stability of a company. Higher amounts in revenue accounts indicate healthy sales and income generation, while higher amounts in liability and equity accounts may indicate higher levels of obligations and external funding.

It is essential to note that the presentation of accounts on the financial statements may vary depending on the accounting framework or reporting standards followed by the company. However, the underlying principles remain the same in terms of recognizing accounts with a normal credit balance and their impact on financial statements.

Business owners, investors, creditors, and other stakeholders rely on accurate and well-prepared financial statements to make informed decisions about a company. Therefore, ensuring the correct treatment and disclosure of accounts with a normal credit balance is key to providing transparency and reliability in financial reporting.

Examples of Accounts with Normal Credit Balance

Several types of accounts have a normal credit balance in accounting. Understanding these accounts and their respective roles is essential for accurately recording transactions and preparing financial statements. Here are some examples of accounts with a normal credit balance:

1. Accounts Payable: Accounts payable represents the company’s short-term obligations to suppliers, vendors, or creditors for goods or services received on credit. When a company receives goods or services on credit, the accounts payable account is credited to reflect the increase in the amount owed to creditors.

2. Loans Payable: Loans payable represent long-term borrowings from financial institutions or lenders. As the company borrows funds, the loans payable account is credited to record the increase in the outstanding loan balance.

3. Revenue Accounts: Revenue accounts include sales revenue, service revenue, interest income, and other income-generating activities specific to a company’s operations. When a company earns revenue, such as selling products or providing services, the respective revenue account is credited to reflect the increase in earnings.

4. Owner’s Equity: Owner’s equity accounts represent the owner’s investment in the business and retained earnings. When the owner invests additional capital into the company, the owner’s equity account, also known as owner’s capital, is credited. Similarly, when the company generates profits, the retained earnings account is credited to reflect the increase in earnings retained within the business.

5. Accumulated Depreciation: Accumulated depreciation represents the cumulative depreciation of tangible assets, such as buildings, vehicles, or machinery. Depreciation is the allocation of an asset’s cost over its useful life. The accumulated depreciation account is credited to reduce the carrying value of the asset on the balance sheet.

These examples highlight accounts with a normal credit balance that play a critical role in recording financial transactions accurately. It is important to note that the proper classification and recording of these accounts enable the preparation of reliable financial statements and provide insights into a company’s financial performance and position.

Conclusion

Understanding the concept of normal credit balance is essential for anyone involved in finance and accounting. It guides the accurate recording of transactions and plays a significant role in preparing financial statements that reflect a company’s financial position and performance.

We have explored the distinction between normal credit balance and normal debit balance, noting that asset and expense accounts typically have a normal debit balance, while liability, equity, and revenue accounts have a normal credit balance.

Accounts with a normal credit balance, such as accounts payable, loans payable, revenue accounts, owner’s equity accounts, and accumulated depreciation, impact financial statements in different ways. These accounts are crucial for presenting accurate information about a company’s liabilities, equity, revenue, and asset depreciation.

By properly identifying accounts with a normal credit balance and recording transactions accordingly, businesses can maintain accurate financial records and provide meaningful insights into their financial health. Accountants and financial professionals play a vital role in ensuring the integrity and reliability of these records.

In conclusion, having a solid grasp of accounts with a normal credit balance is fundamental in the world of finance. It allows for accurate financial reporting and aids in making informed decisions based on reliable data. By understanding the nuances of credits and debits and applying the principles of normal credit balance, businesses can navigate the complexities of accounting and achieve financial success.