Finance

What Can You Do With A 670 Credit Score

Published: October 21, 2023

Discover the possibilities of what you can achieve with a 670 credit score. Explore finance options and take control of your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit scores! If you’re here, chances are you’re curious about what a credit score of 670 means and how it can impact your financial life. Credit scores play a vital role in determining your eligibility for loans, credit cards, and even certain employment opportunities. Understanding your credit score is crucial for making informed financial decisions.

A credit score is essentially a three-digit number that reflects your creditworthiness. It represents your credit history and helps lenders assess the level of risk associated with granting you credit. The higher your credit score, the more likely you are to be approved for loans and offered favorable interest rates.

In this article, we’ll dive into the specifics of a 670 credit score. We’ll explore what it means, how it can affect your financial options, and strategies to improve it. Whether you have a credit score in this range or are looking to achieve one, understanding the ins and outs of a 670 credit score will empower you to make sound financial decisions.

What is a credit score?

A credit score is a numerical representation of your creditworthiness. It is a tool used by lenders to evaluate your creditworthiness and determine the level of risk involved in extending credit to you. Credit scores are generated by credit bureaus, which collect information about your credit history and payment behavior from various sources, such as credit card companies, banks, and financial institutions.

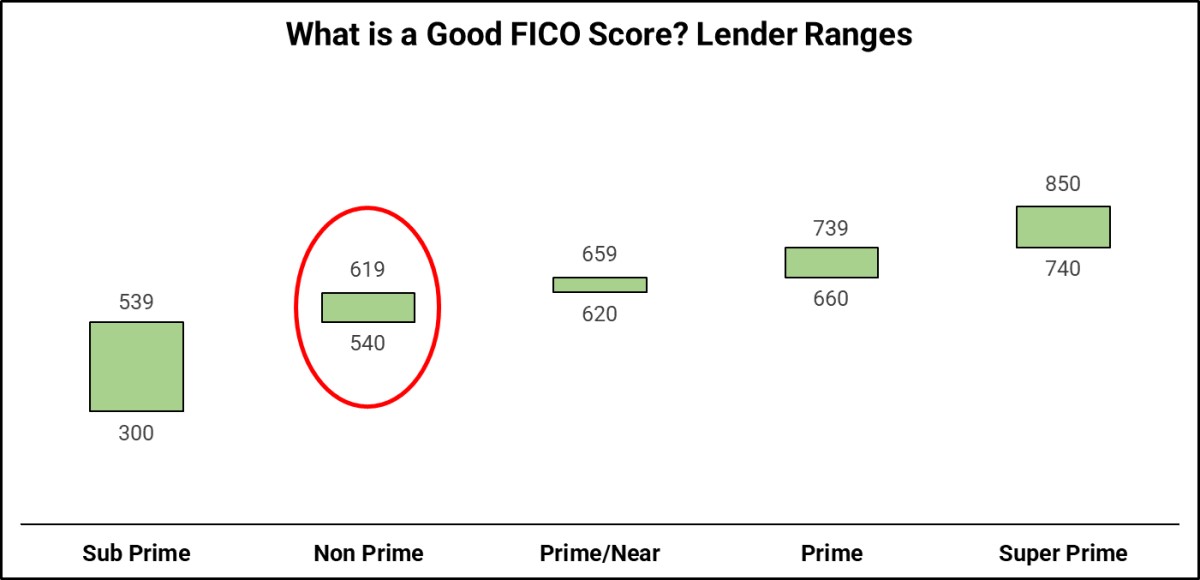

The most commonly used credit scoring model is the FICO score, developed by the Fair Isaac Corporation. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. Other credit scoring models, such as VantageScore, also exist, but FICO scores are widely used by lenders.

A credit score is calculated based on several factors, including:

- Payment history: Your track record of making on-time payments to creditors.

- Credit utilization: The amount of credit you are currently using compared to the total credit available to you.

- Length of credit history: The duration of your credit accounts and how long you have maintained them.

- Credit mix: The variety of credit accounts you have, such as credit cards, loans, and mortgages.

- New credit: The number of recently opened credit accounts and inquiries on your credit report.

A credit score serves as a measure of your creditworthiness, helping lenders determine the risk of extending credit to you. A higher credit score indicates a lower risk of defaulting on payments, making you more attractive to lenders. On the other hand, a lower credit score may result in higher interest rates or denial of credit altogether.

It’s important to note that credit scores can vary, as different credit bureaus may have slightly different information and scoring models. However, overall, a higher credit score is always considered advantageous, as it provides you with better financial opportunities and access to preferential terms.

Understanding a 670 Credit Score

A credit score of 670 falls into the “Fair” credit category, according to the FICO scoring model. While it’s not considered excellent or very good, it is still within a reasonable range and can provide you with various financial opportunities.

A credit score of 670 indicates that you have a generally positive credit history but may have some minor issues that can impact your creditworthiness. Lenders may view you as a slightly higher risk compared to individuals with higher credit scores, but you still have options for obtaining loans and credit cards.

Here are some key characteristics of a 670 credit score:

- Moderate creditworthiness: A credit score of 670 suggests that you have demonstrated a decent level of responsibility in managing your credit. It shows lenders that you have a history of making on-time payments and managing your debt, but there may be some areas for improvement.

- Potential for approval: While a 670 credit score is not the highest, it still puts you in a position to qualify for certain loans and credit cards. However, the specific terms and interest rates you are offered may vary based on other factors, such as income and employment stability.

- Room for improvement: A credit score of 670 indicates that there is some room for improvement. By taking proactive steps to enhance your credit habits, you can work towards achieving a higher credit score and unlocking more favorable financial opportunities.

It’s essential to contextualize your credit score within the broader credit landscape. While 670 may not be the highest credit score, it doesn’t mean you are unable to access credit. It’s a starting point that allows you to evaluate your financial situation and make informed decisions to improve your creditworthiness over time.

Factors that Affect a 670 Credit Score

Several factors contribute to a credit score of 670. Understanding these factors can help you make informed decisions to maintain or improve your creditworthiness. Here are the key elements that influence a 670 credit score:

- Payment history: Your payment history has a significant impact on your credit score. A track record of consistently making on-time payments will positively affect your score, while late payments or defaults will have a negative impact.

- Credit utilization: Credit utilization is the percentage of your available credit that you are using. Keeping a low credit utilization ratio, ideally below 30%, indicates responsible credit management and can positively impact your credit score.

- Length of credit history: The length of your credit history is an essential factor in calculating your credit score. A longer credit history shows a consistent payment track record and helps establish trust with lenders.

- Credit mix: A diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. It demonstrates your ability to manage different types of credit responsibly.

- New credit: Opening new credit accounts can temporarily lower your credit score due to the associated inquiries and the potential increase in overall credit utilization. However, responsible management of new credit can improve your score over time.

It’s important to note that these factors can affect your credit score differently depending on your individual circumstances. For example, missing a payment or having a high credit utilization ratio will have a more significant impact on a 670 credit score compared to a higher score.

Remember that credit scores are dynamic and can change based on your financial behavior. By practicing good credit habits, such as making timely payments, keeping credit utilization low, and maintaining a mix of credit accounts, you can steadily improve your credit score.

What Loans and Credit Cards Can You Qualify for with a 670 Credit Score?

With a credit score of 670, you may qualify for a range of loans and credit cards. While you may not have access to the most favorable terms and interest rates compared to individuals with higher credit scores, there are still options available to you. Here’s a look at the loans and credit cards you may be eligible for:

- Personal loans: Some lenders offer personal loans to individuals with fair credit scores. These loans can be used for various purposes, such as debt consolidation, home improvement, or unexpected expenses. However, it’s important to note that interest rates may be higher compared to individuals with higher credit scores.

- Secured loans: If you’re willing to provide collateral, such as a car or savings account, you may have access to secured loans. These loans are less risky for lenders and may be more readily available to individuals with fair credit scores.

- Student loans: Student loans are generally accessible to borrowers with all credit scores, as they are specifically designed to help finance education. Federal student loans do not require a credit check, making them an option for students with fair credit.

- Store credit cards: Some retail stores offer credit cards that cater to individuals with fair credit scores. These cards typically have lower credit limits and higher interest rates, but they can be a useful tool for building or rebuilding credit if used responsibly.

- Secured credit cards: Secured credit cards are an excellent option for individuals looking to rebuild their credit. With a secured credit card, you provide a security deposit that serves as collateral. The credit limit is typically equal to the deposited amount, and responsible use can help improve your credit score over time.

While these options are available, it’s essential to carefully consider the terms, interest rates, and fees associated with each loan or credit card. Comparison shopping, reading the fine print, and evaluating your ability to manage the financial obligations are critical steps in selecting the right loan or credit card for your needs.

Remember, this is not an exhaustive list, and availability may vary depending on the lender’s specific criteria. It’s always a good idea to research and reach out to lenders directly to understand their requirements.

How to Improve Your 670 Credit Score

If you have a credit score of 670 and want to improve it, there are several steps you can take to boost your creditworthiness. While improving your credit score may take time, patience, and consistency, following these strategies can help you on your journey:

- Pay your bills on time: Your payment history is a crucial factor in calculating your credit score. Make it a priority to pay all your bills on time, including credit cards, loans, and utility bills. Late or missed payments can significantly impact your score.

- Reduce your credit utilization: Keeping your credit utilization ratio low is essential for improving your credit score. Aim to use no more than 30% of your available credit. Pay off existing debt and avoid maxing out your credit cards.

- Avoid opening unnecessary credit accounts: Opening multiple new credit accounts can temporarily lower your credit score. Be selective and avoid applying for credit unless it is necessary. Each application results in a hard inquiry on your credit report.

- Monitor your credit report: Regularly check your credit report for any errors or inaccuracies. Mistakes on your credit report can negatively impact your score. If you find any errors, dispute them with the credit bureaus to have them corrected.

- Diversify your credit mix: Having a mix of different types of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. If you only have one type of credit, consider diversifying your credit portfolio over time.

- Keep old accounts open: Closing old credit accounts can shorten your credit history, which can negatively impact your score. Instead, keep old accounts active and use them responsibly to maintain a positive credit history.

- Manage your debt responsibly: Minimize your overall debt and make regular payments. Focus on paying off high-interest debts first and consider creating a budget to better manage your finances.

Improving your credit score requires discipline and consistency over time. It’s important to note that there are no quick fixes or overnight solutions. However, by implementing these strategies and maintaining good credit habits, you can gradually increase your credit score and open up better financial opportunities in the future.

Benefits and Limitations of Having a 670 Credit Score

Holding a credit score of 670 comes with both benefits and limitations that can impact your financial life. Understanding these advantages and constraints can help you make informed decisions and work towards improving your creditworthiness. Here are some key benefits and limitations of having a 670 credit score:

Benefits:

1. Access to credit: With a credit score of 670, you can still qualify for loans and credit cards. While you may not have access to the most favorable terms and interest rates, you have options available to meet your financial needs.

2. Opportunity to improve: A credit score of 670 provides room for improvement. By implementing responsible credit habits and consistently practicing good financial behavior, you can gradually increase your score and unlock even better financial opportunities in the future.

3. Building credit history: A 670 credit score indicates that you have a positive credit history to some extent. It demonstrates that you have experience managing credit and making payments on time, which is an essential aspect of building a solid credit history.

4. Financial flexibility: While not the highest credit score, a 670 score still allows you some flexibility in managing your finances. You can obtain credit when needed, and with responsible borrowing and repayment, you can work towards a more favorable credit score in the long run.

Limitations:

1. Higher interest rates: Individuals with a 670 credit score may be offered loans and credit cards with higher interest rates compared to those with better credit scores. Higher interest rates can mean higher borrowing costs over time if not managed appropriately.

2. Limited credit options: Some financial institutions may have stricter lending criteria and may limit the types of loans or credit cards available to individuals with fair credit scores. You may encounter fewer options compared to those with stronger credit profiles.

3. Harder to qualify for certain loans: Some lenders may prefer borrowers with higher credit scores for certain types of loans, such as mortgages or business loans. While it’s still possible to qualify, it may require additional documentation or a more detailed evaluation of your financial situation.

4. Potential for credit denial: While a 670 credit score indicates a generally positive credit history, there is still a risk of credit denial, particularly for credit products with strict eligibility requirements. Lenders may consider other factors, such as income and debt-to-income ratio, when assessing creditworthiness.

It’s important to recognize the advantages and limitations of your credit score and use that knowledge to set realistic financial goals. By focusing on improving your credit habits and working towards a higher credit score, you can maximize the benefits and overcome the limitations associated with a 670 credit score.

Conclusion

Your credit score of 670 opens doors to various financial opportunities, albeit with certain limitations. While it may not be the highest credit score, it still demonstrates a level of creditworthiness and allows you to qualify for loans and credit cards.

Understanding the factors that affect your credit score and taking steps to improve it can help you secure better terms and interest rates in the future. By making timely payments, keeping your credit utilization low, and maintaining a diverse credit mix, you can gradually raise your score and expand your financial options.

It’s important to remember that credit scores are not set in stone but are dynamic and can change over time. By implementing responsible credit habits and practicing financial discipline, you have the power to improve your creditworthiness and unlock greater financial flexibility.

While having a 670 credit score may come with some limitations, it’s crucial to focus on the benefits. Even with a fair credit score, you have access to credit, the opportunity to build a positive credit history, and the potential for improvement.

Lastly, monitoring your credit report regularly, disputing any errors, and staying informed about your financial obligations are essential practices to ensure that your credit score accurately reflects your creditworthiness.

Remember that your credit score is just one aspect of your overall financial health. By developing responsible financial habits, managing your debt effectively, and making informed decisions, you can pave the way for a brighter financial future.