Finance

What Are Consumer Finance Loans Vs. A Car Loan

Modified: February 21, 2024

Discover the key differences between consumer finance loans and car loans. Learn about the various financing options available to you and make an informed decision.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Consumer Finance Loans

- Characteristics of Consumer Finance Loans

- Types of Consumer Finance Loans

- Pros and Cons of Consumer Finance Loans

- Understanding Car Loans

- Characteristics of Car Loans

- Types of Car Loans

- Pros and Cons of Car Loans

- Comparison between Consumer Finance Loans and Car Loans

- Conclusion

Introduction

Welcome to the world of personal finance, where loans are a common tool to help individuals achieve their financial goals. Two popular loan options that often come up are consumer finance loans and car loans. Both serve different purposes and have unique features that make them suitable for specific needs.

In this article, we will take a closer look at consumer finance loans and car loans, understand their characteristics, explore the various types available, and weigh the pros and cons of each. By the end of this article, you will have a better understanding of which loan option might be best suited for your specific circumstances.

Before delving into the specifics, it’s important to note that both consumer finance loans and car loans fall under the larger umbrella of installment loans. These types of loans allow borrowers to repay the borrowed funds over time, with fixed monthly payments and an agreed-upon interest rate.

If you’re in need of funds for a personal expense or purchasing a vehicle, understanding the differences between consumer finance loans and car loans can help you make an informed decision and ensure you select the loan that aligns with your financial goals and circumstances.

Now, let’s dive into the world of consumer finance loans and car loans to explore their unique features and what sets them apart.

Understanding Consumer Finance Loans

Consumer finance loans, also known as personal loans or unsecured loans, are a type of loan that individuals can use for various personal expenses. Unlike car loans, consumer finance loans do not require collateral, such as a car or property, to secure the loan. This makes them accessible to a wider range of borrowers.

These loans can be used for a multitude of purposes, including debt consolidation, home improvement projects, medical expenses, or even a dream vacation. Consumer finance loans provide borrowers with the flexibility to use the funds as they see fit, without any restrictions on how the money is spent.

One of the key features of consumer finance loans is that they are typically offered as fixed-rate loans. This means that the interest rate remains the same throughout the repayment period, providing borrowers with predictable monthly payments. Additionally, consumer finance loans often have a fixed repayment term, usually ranging from one to five years, allowing borrowers to plan their budget accordingly.

When applying for a consumer finance loan, lenders will consider various factors, including the borrower’s credit history, income, and debt-to-income ratio. A good credit score is beneficial in obtaining favorable terms and interest rates. However, even individuals with lower credit scores may still be eligible for a consumer finance loan, albeit potentially at a higher interest rate.

It’s important to note that consumer finance loans typically involve fees and charges, such as origination fees or prepayment penalties. These additional costs should be taken into consideration when evaluating the overall cost of the loan.

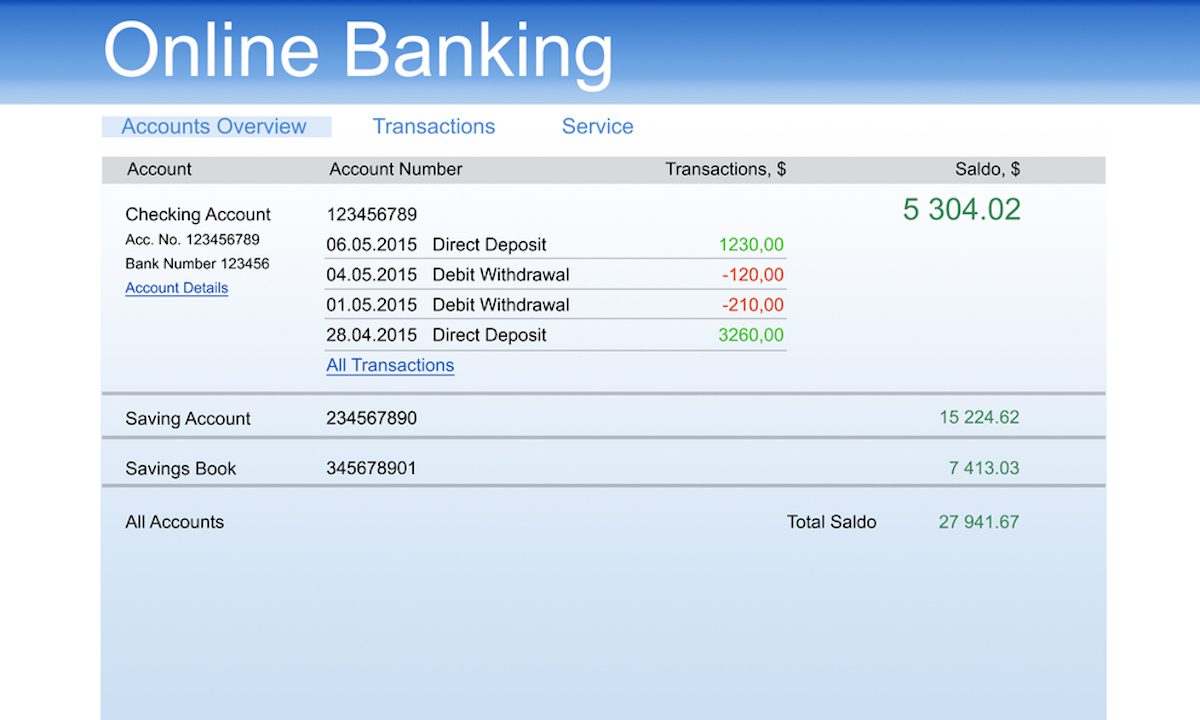

Consumer finance loans offer borrowers the advantage of quick access to funds, as the application process is often streamlined and can be completed online. Once approved, the funds are typically deposited into the borrower’s bank account within a few business days. This convenience makes consumer finance loans an attractive option for those in need of immediate funds for unforeseen expenses or time-sensitive purchases.

Now that we have a basic understanding of consumer finance loans, let’s explore the different types of consumer finance loans available.

Characteristics of Consumer Finance Loans

Consumer finance loans have several key characteristics that distinguish them from other types of loans. Understanding these characteristics can help borrowers make informed decisions when considering this loan option.

1. Unsecured Loans: Consumer finance loans are typically unsecured loans, meaning they do not require collateral. Unlike a car loan where the vehicle itself serves as collateral, consumer finance loans rely primarily on the borrower’s creditworthiness and income to determine eligibility.

2. Fixed Interest Rates: Most consumer finance loans come with fixed interest rates. This means that the interest rate remains the same throughout the loan term, providing borrowers with predictable monthly payments. Fixed interest rates allow borrowers to budget effectively and plan their repayment schedule with confidence.

3. Fixed Repayment Terms: Consumer finance loans often have fixed repayment terms ranging from one to five years. Unlike credit cards or lines of credit, which have revolving terms, consumer finance loans provide a structured timeline for repayment. This can be advantageous for borrowers who prefer a defined end date for their debt.

4. Flexible Use of Funds: Consumer finance loans offer borrowers flexibility in how they use the borrowed funds. Unlike car loans, which are specifically tied to the purchase of a vehicle, consumer finance loans can be used for various personal expenses, such as debt consolidation, home renovations, medical bills, or even a wedding.

5. Application Process: Applying for a consumer finance loan is often a straightforward and streamlined process. Many lenders offer online applications, allowing borrowers to submit their information and supporting documents electronically. This can expedite the approval process and provide borrowers with quick access to funds.

6. Credit Consideration: Lenders evaluate the creditworthiness of borrowers when approving consumer finance loans. Credit history and credit scores play a significant role in determining eligibility and the terms offered. While a good credit score can result in more favorable interest rates, individuals with lower credit scores may still be eligible for a consumer finance loan, albeit potentially at higher interest rates.

7. Fees and Charges: Consumer finance loans may involve fees and charges beyond the interest rate. These can include origination fees, prepayment penalties, or late payment fees. It’s important for borrowers to understand and consider these additional costs when evaluating the overall affordability of the loan.

Understanding the characteristics of consumer finance loans can help borrowers determine if this loan option aligns with their financial needs and goals. In the next section, we will explore the different types of consumer finance loans available to borrowers.

Types of Consumer Finance Loans

Consumer finance loans come in various forms, each designed to cater to specific financial needs. Understanding the different types of consumer finance loans can help borrowers choose the one that best aligns with their goals and circumstances.

1. Debt Consolidation Loans: Debt consolidation loans are used to combine multiple debts into a single loan. By consolidating debts, borrowers can simplify their repayment process and potentially secure a lower interest rate, saving money in the long run.

2. Personal Loans: Personal loans are the most common type of consumer finance loans. These loans can be used for a variety of personal expenses, such as home improvements, medical bills, or unexpected emergencies. Personal loans provide borrowers with the flexibility to use the funds as they see fit.

3. Payday Loans: Payday loans are short-term loans intended to provide quick cash to borrowers until their next paycheck. These loans typically have high-interest rates and are repaid in full on the borrower’s next payday.

4. Installment Loans: Installment loans allow borrowers to repay the borrowed funds over time in fixed monthly installments. These loans are often used for larger purchases, such as electronics or home appliances, and can offer competitive interest rates.

5. Medical Loans: Medical loans are specifically designed to cover medical expenses that may not be fully covered by health insurance. These loans can help individuals manage unexpected medical bills and allow them to receive necessary treatments without delay.

6. Vacation Loans: Vacation loans, also known as travel loans, are used to finance vacations and travel expenses. These loans provide borrowers with the opportunity to fund their dream trips and pay off the costs over time.

7. Wedding Loans: Wedding loans are designed to cover the expenses associated with planning and hosting a wedding. From venue costs to catering and everything in between, wedding loans can help finance the wedding of your dreams.

These are just a few examples of the types of consumer finance loans available. It’s important for borrowers to research and compare different loan options to find the one that best suits their needs.

In the next section, we will discuss the advantages and disadvantages of consumer finance loans to help borrowers evaluate whether this loan option is suitable for them.

Pros and Cons of Consumer Finance Loans

Consumer finance loans offer several advantages and disadvantages that borrowers should consider before making a decision. Let’s take a closer look at the pros and cons of consumer finance loans:

Pros:

- Flexible use of funds: Consumer finance loans provide borrowers with the flexibility to use the funds for a variety of personal expenses, giving them control over how the loan proceeds are spent.

- No collateral required: Unlike secured loans, such as car loans, consumer finance loans generally do not require collateral, making them accessible to a wider range of individuals who may not have valuable assets to offer as security.

- Fixed interest rates: Consumer finance loans often come with fixed interest rates, allowing borrowers to know exactly how much they need to repay each month. This stability can make budgeting and financial planning easier.

- Quick processing and approval: The application process for consumer finance loans is typically streamlined, with loan approval often taking just a few business days. This quick turnaround time means borrowers can access the funds promptly when needed.

- Potential for credit improvement: Successfully repaying a consumer finance loan can have a positive impact on a borrower’s credit score. Timely payments and responsible loan management can help build or repair credit history, leading to better financial opportunities in the future.

Cons:

- Higher interest rates: Consumer finance loans can have higher interest rates compared to secured loans. This is because lenders face a higher level of risk by extending funds without collateral. It’s important for borrowers to carefully consider the interest rate and factor it into their budget and repayment plans.

- Potential for fees and charges: Some consumer finance loans may come with additional fees, such as origination fees or prepayment penalties. It’s crucial to review the loan terms and conditions to understand any associated costs and factor them into the overall affordability of the loan.

- Creditworthiness requirements: Lenders assess a borrower’s creditworthiness, including credit history, income, and debt-to-income ratio, when approving consumer finance loans. Borrowers with lower credit scores may face challenges in obtaining favorable terms or may be subject to higher interest rates.

- Potential for overborrowing: Without a specific purpose or restriction on how the funds should be used, borrowers may be tempted to borrow more than necessary, leading to potential financial strain or difficulties in repayment.

Considering these pros and cons can help borrowers make an informed decision about whether a consumer finance loan is the right choice for their financial needs and goals. In the next section, we will shift our focus to car loans and explore their characteristics.

Understanding Car Loans

Car loans are a type of installment loan specifically designed to finance the purchase of a vehicle. Unlike consumer finance loans, car loans are secured loans, meaning the vehicle itself serves as collateral for the loan.

Car loans are offered by financial institutions, such as banks, credit unions, or car dealerships, and can come with various terms and conditions. The loan amount is typically based on the purchase price of the vehicle, minus any down payment or trade-in value.

One of the key advantages of car loans is that they allow individuals to spread out the cost of purchasing a vehicle over a predetermined period, usually ranging from two to seven years. This makes it more affordable for borrowers to own a car without the need for a large upfront payment.

When applying for a car loan, the lender will consider various factors, including the borrower’s credit history, income, and down payment amount. A good credit score can improve the chances of getting approved for a car loan and securing favorable terms, such as lower interest rates.

It’s important to note that car loans often come with specific conditions related to the vehicle. For instance, the lender may place restrictions on the age, mileage, and condition of the car being financed. Additionally, car loans may require full coverage auto insurance to protect the lender’s interest in the vehicle.

Car loans typically have a fixed interest rate, which means the interest rate remains the same throughout the loan term. This allows borrowers to have consistent monthly payments and makes budgeting easier.

Repayment terms for car loans can vary depending on the lender and the borrower’s preferences. It’s common for car loans to have a monthly repayment schedule, with the loan being fully paid off at the end of the term.

Understanding the intricacies of car loans is vital for anyone considering purchasing a vehicle. Now that we have a better understanding of car loans, let’s delve into their characteristics.

Characteristics of Car Loans

Car loans have several key characteristics that distinguish them from other types of loans. Understanding these characteristics is crucial for borrowers considering a car loan for their vehicle purchase. Let’s explore the key features of car loans:

1. Secured Loans: Car loans are secured loans, meaning the vehicle serves as collateral. If the borrower defaults on the loan, the lender has the right to repossess the vehicle to recover their funds. This collateral reduces the risk for the lender, which often leads to more favorable interest rates compared to unsecured loans.

2. Loan Amount and Down Payment: The loan amount for a car loan is typically based on the purchase price of the vehicle, minus any down payment or trade-in value. A larger down payment can lower the total amount borrowed and potentially lead to better loan terms.

3. Fixed Interest Rates: Car loans often come with fixed interest rates. This means that the interest rate remains constant throughout the loan term, providing borrowers with predictable monthly payments. Fixed interest rates allow for easier budgeting and planning.

4. Loan Term: Car loans have set repayment terms, typically ranging from two to seven years. The loan term affects the monthly payments and the total interest paid over the life of the loan. Longer loan terms may result in lower monthly payments, but borrowers may end up paying more in interest over time.

5. Vehicle Restrictions: Lenders may impose certain restrictions on the type of vehicle that can be financed. These restrictions may include factors such as the age, mileage, and condition of the car. Borrowers should be aware of any limitations set by the lender before finalizing the loan.

6. Insurance Requirements: Car loans often require borrowers to maintain full coverage auto insurance on the financed vehicle. This insurance helps protect the lender’s interests in case of damage or loss to the vehicle.

7. Trade-ins: Borrowers purchasing a new vehicle may have the option to trade in their existing car as part of the transaction. The trade-in value can be used as a down payment or to reduce the loan amount, potentially lowering monthly payments.

Understanding the characteristics of car loans can help borrowers make informed decisions when financing a vehicle purchase. In the next section, we will explore the different types of car loans available in the market.

Types of Car Loans

Car loans come in various types to suit the diverse needs and preferences of borrowers. Understanding the different types of car loans can help individuals make informed decisions when financing their vehicle purchase. Let’s explore the common types of car loans:

1. New Car Loans: New car loans are specifically designed for purchasing brand-new vehicles. Lenders often offer competitive interest rates and favorable terms for new car loans since the vehicle’s value is higher and there is less risk of depreciation.

2. Used Car Loans: Used car loans are for purchasing pre-owned vehicles. The terms and interest rates for used car loans may vary depending on factors such as the age, mileage, and condition of the vehicle.

3. Dealership Financing: Dealership financing is when the car dealership provides the financing for the vehicle purchase. While convenient, it’s essential to carefully review the terms and compare them with other financing options, as dealership financing may come with higher interest rates.

4. Private Party Loans: Private party loans are used when purchasing a vehicle from an individual rather than from a dealership. These loans facilitate the transfer of funds directly from the lender to the seller and allow borrowers to buy used vehicles from private sellers.

5. Refinance Loans: Refinance loans are used to replace an existing car loan by obtaining a new loan with better terms. Borrowers may refinance their car loan to lower the interest rate, reduce the monthly payment, or modify the loan term.

6. Lease Buyout Loans: Lease buyout loans are for individuals who want to purchase the vehicle they have been leasing. These loans allow borrowers to buy their leased vehicle at the end of the lease term or during the lease period.

7. Balloon Payment Loans: Balloon payment loans involve lower monthly payments throughout the loan term, with a lump sum payment due at the end. These loans are suited for borrowers who can afford smaller monthly payments but have the means to make a substantial payment at the end of the loan term.

Each type of car loan has its own advantages and considerations. It’s important to carefully evaluate the options available and consider factors such as interest rates, repayment terms, and eligibility requirements to select the most suitable car loan.

In the next section, we will compare consumer finance loans and car loans to help borrowers make an informed decision based on their specific needs and preferences.

Pros and Cons of Car Loans

Car loans offer several advantages and disadvantages that borrowers should consider when deciding to finance their vehicle purchase. Let’s explore the pros and cons of car loans:

Pros:

- Ownership: Car loans provide an opportunity for individuals to own a vehicle without having to pay the full purchase price upfront. This enables borrowers to enjoy the benefits of car ownership while spreading out the payments over a set period.

- Flexible Loan Terms: Car loans offer various options for loan terms, giving borrowers the flexibility to choose a repayment period that aligns with their financial capabilities. This allows borrowers to customize their monthly payments and budget accordingly.

- Fixed Interest Rates: Many car loans come with fixed interest rates, providing borrowers with predictable monthly payments throughout the loan term. This stability makes it easier to plan and manage finances.

- Potential for Lower Interest Rates: Car loans often have lower interest rates compared to other types of loans since the vehicle serves as collateral. Borrowers with good credit scores may qualify for even more favorable interest rates.

- Opportunity for Credit Improvement: Successfully repaying a car loan can positively impact a borrower’s credit history and credit score. Consistently making timely payments demonstrates responsible financial behavior and can enhance creditworthiness.

Cons:

- Depreciation: Vehicles depreciate over time, meaning their value decreases. With a car loan, borrowers may owe more on the loan than the vehicle is worth, especially during the early years of ownership. This can pose challenges if the borrower needs to sell or trade-in the vehicle before the loan is paid off.

- Higher Overall Cost: Car loans, especially those with longer terms, can result in a higher overall cost of the vehicle due to interest payments. Borrowers should carefully consider the total cost of the loan, including interest, when evaluating affordability.

- Risk of Negative Equity: If the value of the vehicle depreciates rapidly or the borrower has a small down payment, there is a risk of negative equity. Negative equity occurs when the outstanding loan balance is higher than the vehicle’s value, which can complicate refinancing or selling the vehicle.

- Limited Flexibility: Once a car loan is in place, borrowers may have limited flexibility to make changes to the vehicle or sell it without affecting the loan. Extra costs or potential penalties may be associated with early loan payoff or refinancing.

- Insurance and Maintenance Requirements: Car loans typically require borrowers to maintain full coverage auto insurance and keep the vehicle in good condition. These additional costs should be factored into the overall affordability of the loan.

Evaluating the pros and cons of car loans is essential to ensure borrowers make informed decisions regarding their vehicle financing. It’s important to consider personal financial circumstances and future goals before committing to a car loan.

Next, we will compare consumer finance loans and car loans to help borrowers understand which option may be the most suitable for their specific needs.

Comparison between Consumer Finance Loans and Car Loans

Consumer finance loans and car loans serve different purposes and have distinct characteristics that borrowers should consider when deciding on the most suitable loan option. Let’s compare them side by side:

1. Purpose:

Consumer finance loans can be used for a variety of personal expenses, such as debt consolidation, home improvements, or medical bills. They offer borrowers flexibility in how the funds are spent.

Car loans, on the other hand, are specifically designed to finance the purchase of a vehicle. The loan amount is based on the vehicle’s purchase price, and the loan is secured by the vehicle itself.

2. Collateral:

Consumer finance loans are typically unsecured loans, meaning they do not require collateral. Borrowers do not need to offer any assets, such as a vehicle or property, to secure the loan.

Car loans, on the other hand, are secured loans where the vehicle being financed serves as collateral. If the borrower defaults on the loan, the lender has the right to repossess the vehicle to recover their funds.

3. Repayment Terms:

Both consumer finance loans and car loans often come with fixed interest rates, providing predictability for borrowers. However, the loan terms differ.

Consumer finance loans typically have shorter repayment terms, ranging from one to five years. On the other hand, car loans generally have longer repayment terms, typically ranging from two to seven years. The longer terms of car loans allow borrowers to spread out the cost of the vehicle over time, resulting in lower monthly payments, but potentially higher overall interest costs.

4. Use of Funds:

Consumer finance loans provide borrowers with the flexibility to use the borrowed funds for various personal expenses, without any specific restrictions on how the money is spent.

Car loans, as the name suggests, are specifically dedicated to financing a vehicle purchase. The loan amount is based on the vehicle’s purchase price, and borrowers must use the funds solely for that purpose.

5. Depreciation and Equity:

When it comes to consumer finance loans, the loan amount is not tied to the value of any specific asset and is unrelated to potential depreciation or equity concerns.

In contrast, car loans are directly linked to the value of the vehicle being financed. As vehicles depreciate over time, borrowers may experience a period of negative equity, where the outstanding loan balance is higher than the vehicle’s value. This can pose challenges if the borrower needs to sell or trade-in the vehicle before the loan is paid off.

6. Insurance and Maintenance:

Consumer finance loans typically do not have specific insurance or maintenance requirements associated with them.

Car loans, however, often require borrowers to maintain full coverage auto insurance on the financed vehicle to protect the lender’s interest. Additionally, borrowers are responsible for the ongoing maintenance and upkeep of the vehicle.

Understanding these key differences between consumer finance loans and car loans can help borrowers decide which option aligns best with their specific needs, financial situation, and long-term goals.

Finally, let’s conclude our discussion on consumer finance loans and car loans.

Conclusion

When it comes to financing personal expenses or purchasing a vehicle, consumer finance loans and car loans are two popular options to consider. Both loan types have their own characteristics, advantages, and disadvantages that borrowers should carefully weigh before making a decision.

Consumer finance loans offer flexibility in terms of fund usage, allowing borrowers to use the borrowed funds for various personal expenses. These loans do not require collateral and often come with fixed interest rates and shorter repayment terms. Consumer finance loans can be a suitable choice for individuals looking to consolidate debt, cover unexpected expenses, or fund personal projects.

On the other hand, car loans are specifically designed to finance the purchase of a vehicle. These loans are secured by the vehicle itself, and repayment terms can be longer, allowing borrowers to spread out the cost of the vehicle over time. Car loans often come with fixed interest rates and may require full coverage auto insurance. Car loans are a suitable option for individuals looking to become vehicle owners and prefer a structured repayment schedule.

When considering which loan option is right for you, it’s important to assess your financial goals, budget, and individual circumstances. Factors such as credit history, loan terms, interest rates, collateral requirements, and future plans should all be taken into consideration.

Remember to evaluate the pros and cons of each loan type, understand the specific terms and conditions offered by various lenders, and compare the costs and benefits of different loan options. It may also be helpful to consult with a financial advisor to get personalized guidance based on your unique situation.

By making an informed decision, you can choose the loan option that best suits your financial needs, helps you achieve your goals, and sets you on a path towards a more secure financial future.