Finance

What Are Common Stocks

Published: January 18, 2024

Learn about common stocks and their role in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of common stocks! Whether you’re a seasoned investor or simply curious about the financial markets, understanding common stocks is essential. Common stocks are an integral part of the stock market and provide individuals with an opportunity to own a portion of a company. In this article, we will explore the definition, characteristics, and investment considerations of common stocks.

Common stocks represent ownership stakes in publicly traded companies. When you invest in common stocks, you become a shareholder and have a claim on the company’s assets and future profits. These stocks are bought and sold on stock exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ. Companies issue common stocks to raise capital for various purposes, such as expanding operations, funding research and development, or making acquisitions.

Common stocks come with certain rights and benefits. Shareholders have the potential to earn dividends, which are a portion of the company’s profits distributed to shareholders. Additionally, owning common stocks grants shareholders voting rights, allowing them to participate in major decisions that affect the company’s direction.

Investing in common stocks offers potential rewards, but it also comes with risks. Stock prices can be volatile, influenced by various factors such as economic conditions, company performance, industry trends, and investor sentiment. Understanding these dynamics is crucial for making informed investment decisions.

Whether you’re a long-term investor aiming for capital appreciation or seeking dividend income, common stocks can offer opportunities for growth and wealth accumulation. However, it is important to conduct thorough research and consider your investment goals, risk tolerance, and time horizon before investing in individual stocks.

Throughout this article, we will delve into the intricacies of common stocks, including their characteristics, ownership and voting rights, dividends and stock returns, potential risks and rewards, factors influencing stock prices, and tips for investing. By the end, you will have a comprehensive understanding of common stocks and be better equipped to navigate the world of stock market investing.

Definition of Common Stocks

Common stocks, also known as ordinary shares, are a type of equity security that represents ownership in a corporation. When you purchase common stocks, you become a partial owner of the company and have a claim on its assets and earnings.

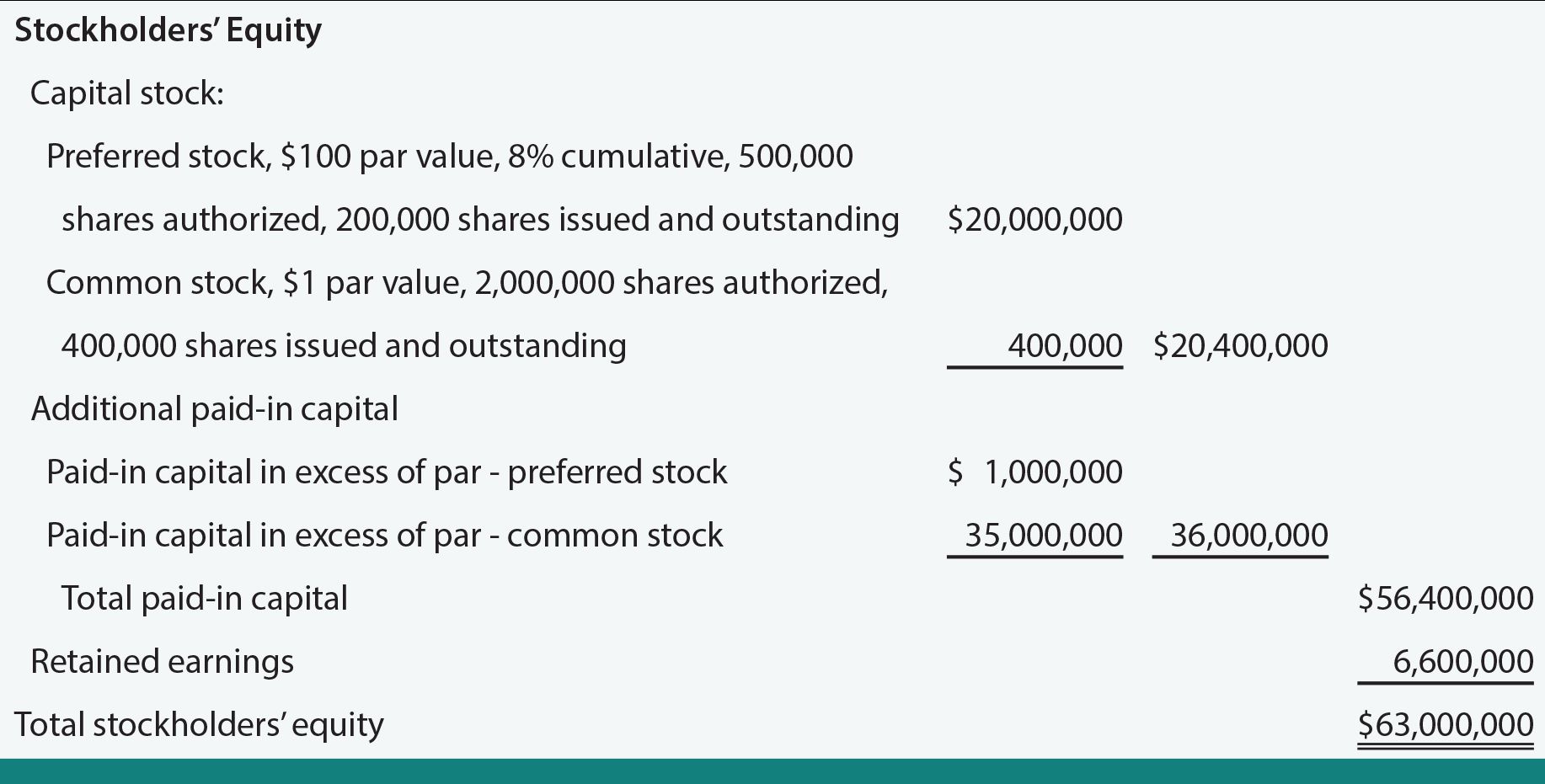

Unlike preferred stocks, which have specific dividend rights and limited voting rights, common stocks carry voting rights and offer potential for capital appreciation. This means that as a common stock shareholder, you have the right to vote on important company matters, such as electing the board of directors or approving major corporate decisions.

The ownership of common stocks is represented by shares, which are units of the company’s stock. Each share gives the shareholder a proportional ownership stake in the business. For example, if a company has one million shares outstanding, and you own 100,000 shares, you would own 10% of the company.

Common stocks are traded on stock exchanges, where investors can buy and sell shares. The price of common stocks is determined by supply and demand in the market, based on investors’ perceptions of the company’s value and expected future performance.

It’s important to note that owning common stocks does not guarantee fixed income. The return on investment primarily comes from capital appreciation, which occurs when the share price increases over time.

In addition, common stockholders may also receive dividends. Dividends are a portion of the company’s profits that are distributed to shareholders on a regular basis. However, companies are not obligated to pay dividends, and the decision to distribute them is at the discretion of the company’s management.

Common stocks can be found in various sectors and industries, ranging from technology and healthcare to finance and consumer goods. Investors have the opportunity to diversify their portfolios by investing in shares of multiple companies across different sectors.

Overall, common stocks provide individuals with an opportunity to invest in the growth and success of companies, while also carrying the potential for financial rewards. However, it is important to carefully evaluate and research companies before investing in their common stocks, taking into consideration factors such as financial performance, industry trends, and potential risks.

Characteristics of Common Stocks

Common stocks possess several key characteristics that set them apart from other types of investments. Understanding these characteristics is crucial for investors looking to invest in individual stocks and build a diversified portfolio. Below, we will explore some of the main characteristics of common stocks:

- Ownership Stake: When you invest in common stocks, you become a partial owner of the company. This ownership stake entitles you to certain rights, such as voting on important company matters and sharing in the company’s profits.

- Risk and Return: Common stocks offer the potential for significant returns but also carry a higher level of risk compared to other investment options. The return on common stocks is primarily driven by capital appreciation – the increase in the stock’s price over time.

- Voting Rights: Owning common stocks grants shareholders the right to vote on matters affecting the company. Shareholders can vote on the election of the board of directors, approving mergers or acquisitions, and other critical decisions that impact the company’s future.

- Dividends: While not guaranteed, common stockholders may receive dividends – a portion of the company’s profits distributed to shareholders. Dividends can provide a steady income stream for investors and are typically paid on a regular basis.

- Limited Liability: As a common stockholder, you have limited liability. This means that your liability is generally limited to the amount you originally invested. In the event of bankruptcy or legal issues, shareholders are not held personally responsible for the company’s debts or obligations.

- Market Volatility: Common stocks are subject to market volatility, meaning their prices can fluctuate widely in response to news, economic conditions, or investor sentiment. This volatility can present both opportunities and risks for investors.

- Liquidity: Common stocks are generally highly liquid, meaning they can be bought or sold quickly without significantly impacting the stock’s price. This provides investors with the flexibility to enter or exit their positions as needed.

- Long-Term Growth Potential: Common stocks have the potential to generate significant long-term growth. By investing in companies with strong fundamentals and growth prospects, investors can benefit from the increased value of their shares over time.

It’s important to note that these characteristics can vary between companies and industries. Each company may have different voting structures, dividend policies, and growth prospects. It’s crucial for investors to carefully analyze and understand these characteristics before investing in common stocks, as they can heavily influence investment decisions and outcomes.

By considering these characteristics and conducting thorough research on individual companies, investors can make informed decisions and build a diversified portfolio of common stocks that aligns with their investment goals and risk tolerance.

Ownership and Voting Rights

When you invest in common stocks, you become a partial owner of the company. This ownership comes with certain rights and privileges, including the right to vote on important company matters. Let’s delve into the concept of ownership and voting rights in the context of common stocks:

Ownership: By purchasing common stocks, you acquire an ownership stake in the company. The number of shares you own determines your proportional ownership. For example, if a company has one million shares outstanding and you own 10,000 shares, you own 1% of the company. As an owner, you have a claim on the company’s assets, earnings, and future growth.

Voting Rights: Ownership of common stocks grants shareholders the right to vote on various corporate matters. This gives shareholders a voice in shaping the company’s direction and decision-making. Common stockholders typically have the right to vote on important issues, including the election of the board of directors, approval of mergers and acquisitions, and other major corporate decisions. The voting power each share carries is typically equal, meaning that each share has one vote. However, some companies may have multiple classes of common stock with different voting rights.

Proxy Voting: Shareholders are not always required to attend company meetings in person to vote. Proxy voting allows shareholders to assign their voting rights to someone else, typically the company’s management or an independent proxy firm, to vote on their behalf. This allows shareholders who are unable to attend meetings to still participate in the voting process.

Dual-Class Structures: Some companies have dual-class structures, where different classes of common stock carry different voting rights. For example, a company may issue Class A shares with full voting rights and Class B shares with reduced or no voting rights. This structure allows founders or early investors to maintain control of the company even when their ownership stake diminishes over time. Dual-class structures can significantly impact the voting power and influence of different shareholders.

Shareholder Activism: Shareholders who own a significant number of common shares may choose to engage in shareholder activism. Shareholder activism involves taking an active role in influencing company policies, decisions, or corporate governance practices. Activist shareholders may advocate for changes such as board reforms, executive compensation adjustments, or strategic shifts to enhance shareholder value.

It’s important to note that while common stockholders have voting rights, their influence may be diluted in certain scenarios. Companies with a large number of shareholders or institutional investors may require a substantial amount of votes to impact decision-making. Additionally, the voting power of small individual investors may be limited in the presence of majority shareholders or institutional investors with significant control over the company.

Understanding ownership and voting rights is essential for investors considering common stocks. These rights allow shareholders to participate in the decision-making process and play a role in shaping the company’s future. By exercising their voting rights responsibly and staying informed about important corporate matters, common stockholders can actively contribute to the governance and success of the companies they invest in.

Dividends and Stock Returns

Dividends and stock returns are important aspects of investing in common stocks. While stock returns primarily come from capital appreciation, dividends provide an additional source of income for shareholders. Let’s explore the relationship between dividends and stock returns:

Dividends: Dividends are a portion of a company’s earnings that are distributed to its shareholders. When a company generates profits, it may choose to distribute a portion of those profits to its shareholders as dividends. Dividends are typically paid on a regular basis, such as quarterly or annually, and are expressed as a fixed amount per share or as a percentage of the stock’s price (dividend yield).

Dividend Yield: The dividend yield is calculated by dividing the annual dividend by the current stock price and expressing it as a percentage. It gives investors an idea of the income potential of a stock investment. For example, if a stock has an annual dividend of $2 per share and its current price is $50, the dividend yield would be 4% ($2 / $50).

Effects on Stock Returns: Dividends contribute to overall stock returns in two main ways. First, they provide a direct income stream for shareholders. Dividends can be reinvested or used to supplement investors’ regular income. Second, dividends can enhance long-term total returns by compounding over time. Reinvesting dividends by purchasing additional shares allows shareholders to benefit from the potential capital appreciation of those shares.

Dividend Policy: Companies have varying dividend policies. Some companies, known as dividend growth companies, strive to increase their dividends consistently over time. These types of stocks are appealing to income-focused investors who seek a reliable and growing income stream. Other companies may have a more variable or inconsistent dividend policy, with dividends being tied to their profitability or other factors. Some companies may choose to reinvest their earnings back into the business for growth opportunities rather than distributing them as dividends.

Stock Buybacks: In addition to dividends, some companies implement stock buyback programs. In a stock buyback, a company repurchases its own shares from the shareholders. Stock buybacks reduce the number of outstanding shares, effectively increasing the ownership stake of remaining shareholders. When a company buys back its shares, it may do so in the open market or through a tender offer, in which it offers to buy back shares directly from shareholders at a certain price.

Capital Appreciation: While dividends provide income, the primary driver of stock returns is capital appreciation. Capital appreciation occurs when the stock price increases over time, allowing shareholders to sell their shares at a higher price than what they paid for them. The overall stock return is the combination of capital appreciation and any dividends received over the holding period.

It’s important to note that not all companies pay dividends. Some younger or growth-oriented companies may reinvest their earnings back into the business instead of distributing them as dividends. Such companies may offer potential capital appreciation through stock price growth rather than immediate income through dividends.

Investors should consider their investment goals, risk tolerance, and income needs when evaluating companies for potential dividends and stock returns. Balancing the desire for income through dividends and the potential for capital appreciation is an important aspect of constructing a well-rounded investment portfolio of common stocks.

Risks and Rewards of Common Stocks

Investing in common stocks offers both potential rewards and inherent risks. Understanding and weighing these factors is crucial for investors seeking to build a successful investment portfolio. Let’s explore the risks and rewards associated with investing in common stocks:

Rewards: Common stocks have the potential to generate substantial rewards for investors:

- Capital Appreciation: The primary reward of investing in common stocks is the opportunity for capital appreciation. As a company grows and becomes more profitable, its stock price can increase, allowing shareholders to sell their shares at a higher price and earn a profit.

- Dividends: Some companies pay regular dividends to their shareholders. Dividends can provide a steady income stream for investors, especially for those seeking regular income in addition to potential price appreciation.

- Ownership and Influence: Owning common stocks grants investors partial ownership in the company. This ownership can translate into voting rights and the ability to participate in major decisions that impact the company’s future.

- Diversification: By investing in a variety of common stocks across different industries and sectors, investors can diversify their portfolios and reduce risk. Diversification allows investors to potentially benefit from the success of different companies while mitigating the impact of poor performance from individual stocks.

- Long-Term Growth: Historically, stock markets have shown long-term growth trends. Investing in common stocks with strong fundamentals and growth potential can provide the opportunity to build wealth over time.

Risks: Alongside the potential rewards, common stocks also carry certain risks that investors should carefully consider:

- Market Volatility: Stock prices can be highly volatile, subject to fluctuations influenced by various factors such as economic conditions, industry trends, and investor sentiment. Market volatility can lead to sudden and significant price swings, potentially resulting in losses for investors.

- Company-Specific Risks: Each company has its own unique risks, such as competition, regulatory changes, technological disruptions, or poor management decisions. Investing in individual stocks exposes investors to the specific risks associated with those companies, which may impact the investment’s performance.

- Systemic Risks: Events that affect the overall stock market, such as economic recessions, geopolitical tensions, or financial crises, can have a broad impact on common stocks. These systemic risks can lead to decreased stock prices and market downturns.

- Loss of Capital: Investing in common stocks carries the risk of losing the capital invested. If a company performs poorly or faces financial difficulties, the value of its stock may decline, potentially resulting in losses for investors.

- Liquidity Risk: While common stocks are generally considered liquid investments, there can be instances when it may be difficult to buy or sell shares at desired prices, especially for stocks with low trading volumes or during times of market turbulence.

- Psychological Factors: Investor behavior and emotions can have an impact on investment decisions and outcomes. Fear, greed, and market speculation can influence stock prices in ways that may not necessarily align with a company’s underlying fundamentals.

It’s important for investors to assess their risk tolerance, investment goals, and time horizon before investing in common stocks. A diversified portfolio that includes assets with varying risk profiles can help mitigate risk exposure. Additionally, staying informed, conducting thorough research, and seeking professional advice can enhance investment decision-making and potentially mitigate potential risks.

Investing in common stocks can provide opportunities for wealth accumulation, but it’s important to understand and manage the associated risks. By carefully considering the rewards and risks, investors can make informed decisions and navigate the stock market with confidence.

Factors Influencing Common Stock Prices

Common stock prices are influenced by a multitude of factors, both internal and external to the company. Understanding these factors can help investors make informed decisions and navigate the stock market. Let’s explore some of the key factors that influence common stock prices:

- Company Performance: The financial performance of a company is a significant factor that affects its stock price. Factors such as revenue growth, profitability, and earnings per share (EPS) are closely monitored by investors. Positive financial results can drive stock prices higher, indicating that investors have confidence in the company’s ability to generate profits.

- Industry and Sector Trends: Stock prices can be influenced by broader industry and sector trends. Developments, innovations, or regulatory changes within an industry can impact the overall sentiment and performance of companies within that sector. Positive industry trends can lead to increased stock prices, while negative trends may cause prices to decline.

- Market Sentiment: Investor sentiment and market conditions play a significant role in determining stock prices. Positive sentiment, driven by optimism and confidence in the economy, can lead to increased buying activity and higher stock prices. Conversely, negative sentiment, driven by economic concerns or geopolitical uncertainty, can prompt selling pressure and lower stock prices.

- Interest Rates: Changes in interest rates can impact stock prices. When interest rates are low, investors may shift their focus from fixed-income investments to stocks in search of higher returns, potentially driving up stock prices. Conversely, rising interest rates can make fixed-income investments more attractive, leading to a decrease in stock prices.

- Macroeconomic Factors: Economic indicators, such as GDP growth, inflation rates, and employment data, can impact stock prices. Positive economic indicators can instill confidence in the market, leading to higher stock prices. Conversely, negative economic indicators can raise concerns and lead to lower stock prices.

- Company News and Announcements: News related to a company, such as product launches, earnings reports, or major acquisitions, can significantly influence its stock price. Positive news can generate investor excitement and increase stock prices, while negative news can cause stock prices to decline.

- Investor Expectations: Stock prices are also driven by investor expectations of future performance. If investors believe that a company will experience strong growth and profitability in the future, they may bid up the stock price in anticipation of those positive outcomes. Conversely, if investors have low expectations or anticipate poor performance, stock prices may decline.

- Market Manipulation: While not a legitimate factor, it’s worth mentioning that stock prices can be influenced by market manipulation. Activities such as insider trading, pump-and-dump schemes, or speculative trading can artificially inflate or deflate stock prices. Regulatory bodies work to detect and prevent such manipulations, but it’s important for investors to be aware of this risk.

It’s important to note that stock prices are influenced by a combination of these factors and can be highly unpredictable in the short term. It is impossible to accurately predict stock prices based on any single factor, making it crucial for investors to conduct thorough research, monitor market conditions, and diversify their investments.

By understanding the factors that influence stock prices, investors can gain insight into market dynamics and make more informed investment decisions. However, it’s essential to recognize that the stock market is influenced by various unpredictable factors, making it wise to adopt a long-term investment approach rather than attempting to time stock price movements based on short-term factors.

Investing in Common Stocks

Investing in common stocks can be an effective way to grow your wealth over the long term. While it carries risks, it also offers opportunities for capital appreciation and potential dividend income. Here are some key considerations when investing in common stocks:

- Set Clear Investment Goals: Before investing in common stocks, it’s important to define your investment goals. Are you looking for long-term growth or regular dividend income? Understanding your objectives will help shape your investment strategy.

- Research and Due Diligence: Thoroughly research companies before investing in their common stocks. Analyze factors such as financial performance, competitive positioning, industry trends, and potential risks. Understanding the fundamentals of companies can help identify strong investment opportunities.

- Diversify Your Portfolio: Diversification is key to managing risk. Invest in a variety of companies across different sectors and regions. Diversifying your portfolio can help minimize the impact of poor performance from individual stocks and provide exposure to different growth opportunities.

- Consider Your Risk Tolerance: Assess your risk tolerance before investing in common stocks. Understand that stock prices can be volatile, and there is a potential for losses. Investing in stocks requires a long-term perspective and the ability to weather short-term market fluctuations.

- Timing the Market: Timing the market consistently is extremely difficult. Instead of trying to predict short-term price movements, adopt a long-term investing approach and focus on the fundamentals of the companies you invest in.

- Consider Dividend Reinvestment: Consider reinvesting dividends to take advantage of compounding. Reinvesting dividends can lead to the purchase of additional shares, potentially magnifying your returns over time.

- Stay Informed: Keep abreast of company news, earnings releases, and market events that may impact your investments. Staying informed can help you make informed decisions and adjust your investment strategy when necessary.

- Consider Professional Advice: If you’re uncertain about investing in common stocks or need guidance, consider seeking advice from a qualified financial advisor. A professional can offer expertise and help tailor an investment plan that aligns with your goals and risk tolerance.

Remember, investing in common stocks involves inherent risks, and past performance is not indicative of future results. No investment is completely free from risk, but by conducting thorough research, diversifying your portfolio, and adopting a long-term perspective, you can increase your chances of achieving investment success.

Investing in common stocks requires patience, discipline, and a commitment to ongoing learning. By continuously educating yourself about the stock market and improving your investment knowledge, you can become a more astute investor.

Lastly, it’s important to monitor your investments regularly but resist the temptation to make impulsive changes. Investing is a long-term journey, and staying focused on your investment strategy can help you navigate the inevitable market fluctuations and achieve your financial goals.

Conclusion

Investing in common stocks can be an exciting and potentially rewarding journey. By understanding the definition, characteristics, risks, and rewards of common stocks, as well as the factors that influence stock prices, you can make informed investment decisions and build a successful portfolio.

Common stocks offer investors the opportunity to become partial owners in publicly traded companies, with the potential for capital appreciation and dividend income. However, it’s crucial to recognize that investing in common stocks carries inherent risks, including market volatility, company-specific risks, and systemic factors that can impact stock prices.

When investing in common stocks, set clear investment goals, conduct thorough research, and consider diversifying your portfolio to manage risk effectively. Understand your risk tolerance and adopt a long-term investing approach, focusing on the underlying fundamentals of the companies you invest in rather than attempting to time the market.

It’s important to stay informed about market conditions, company news, and economic trends that may impact your investments. This knowledge can help you make informed decisions and adjust your investment strategy when necessary.

Remember, investing in common stocks is a long-term endeavor. It requires patience, discipline, and an ongoing commitment to learning and adapting to changing market dynamics. By aligning your investment approach with your goals and risk tolerance, seeking professional advice when needed, and maintaining a diversified portfolio, you can navigate the world of common stocks and work towards achieving your financial objectives.

Start your stock market journey today and embrace the opportunities and challenges that investing in common stocks entails. With careful research, a long-term perspective, and a commitment to continuous learning, you can participate in the growth and success of companies while potentially achieving your own financial success.