Finance

What Is Ford Credit Interest Rate Right Now

Published: January 14, 2024

Looking to finance a Ford vehicle? Find out the current interest rate for Ford Credit to help you make an informed decision.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financing a vehicle, understanding the interest rates offered by the lender is crucial. If you’re considering purchasing a Ford vehicle, it’s essential to be aware of the current interest rates offered by Ford Credit, the financial arm of the Ford Motor Company. The interest rate you receive can have a significant impact on the total cost of your loan and your monthly payments.

Ford Credit is known for providing competitive financing options to customers, tailored to their specific needs. In this article, we will explore the world of Ford Credit interest rates, understanding how they work, the factors that influence them, and how to qualify for the best rates available. We’ll also compare Ford Credit interest rates with other financing options, so you can make an informed decision when considering a Ford vehicle purchase.

Whether you’re looking to finance a new Ford car, truck, or SUV, understanding interest rates will empower you to navigate the financing process with confidence. So, let’s dive into the world of Ford Credit interest rates and uncover what they mean for your automotive financing journey.

Understanding Interest Rates in Ford Credit

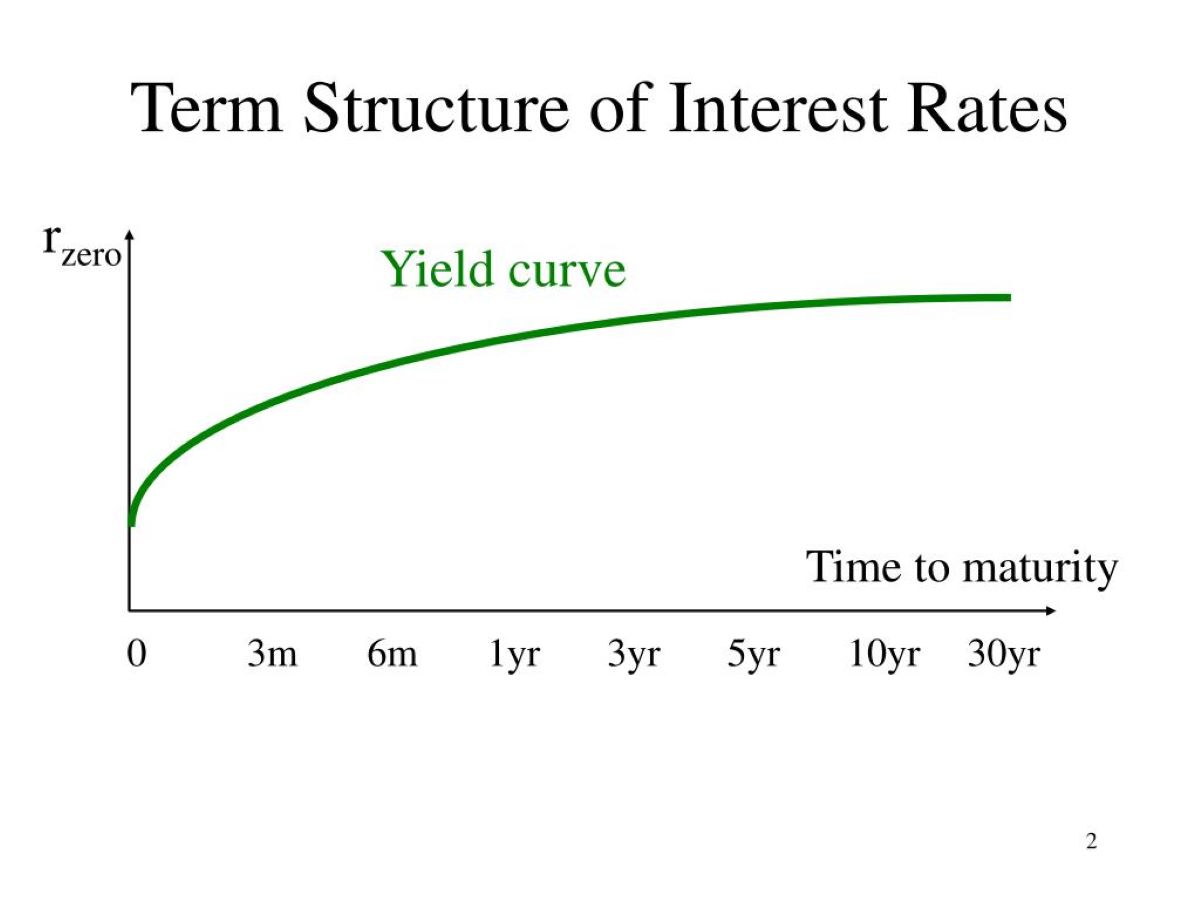

Interest rates play a significant role in determining the cost of borrowing money. When you finance a vehicle with Ford Credit, the interest rate represents the percentage of the loan amount that you will pay in addition to the principal amount borrowed. This additional amount is the lender’s compensation for providing the loan.

Interest rates can be fixed or variable. Fixed interest rates remain the same throughout the entire loan term, providing stability and predictable monthly payments. On the other hand, variable interest rates can fluctuate based on market conditions, potentially affecting your monthly payment amount.

It’s important to note that interest rates offered by Ford Credit may vary based on a variety of factors, including your creditworthiness, the loan term, the type of vehicle you’re financing, and prevailing market conditions. It’s crucial to understand the specific terms and conditions associated with the interest rate offered by Ford Credit before finalizing your financing agreement.

In addition to the interest rate, it’s essential to consider other costs associated with vehicle financing, such as any applicable fees or charges. Ford Credit may also offer promotional interest rates or special financing offers, so it’s wise to explore all the available options before making your decision.

By understanding the nuances of interest rates in Ford Credit, you can make an informed choice that aligns with your financial goals and budget. In the next section, we will explore the factors that can influence the interest rates offered by Ford Credit.

Factors Affecting Ford Credit Interest Rates

Several factors influence the interest rates offered by Ford Credit. Understanding these factors can give you insight into what determines the interest rate you may receive. Here are some key elements that can impact Ford Credit interest rates:

- Credit Score: Your credit score is a crucial determinant of the interest rate on your Ford Credit loan. Lenders use your credit history to assess your creditworthiness. A higher credit score typically results in a lower interest rate, as it indicates a lower risk for the lender.

- Loan Term: The length of your loan can affect the interest rate. Generally, longer loan terms may have slightly higher interest rates, as there is a higher perceived risk over an extended period.

- Down Payment: Making a larger down payment can help reduce your interest rate by reducing the loan amount. A higher down payment shows the lender that you have a financial stake in the vehicle, leading to potentially better interest rates.

- Vehicle Type: The type of vehicle you are financing can impact the interest rate. For example, Ford Credit may offer different rates for cars, trucks, or SUVs.

- Market Conditions: Interest rates can also be influenced by prevailing market conditions and economic factors. If interest rates are generally low, you may have access to more favorable rates.

- Loan Amount: The total loan amount can affect the interest rate. Higher loan amounts might result in slightly higher interest rates.

It’s important to note that these factors are not exhaustive, and the specific interest rates you receive can vary based on individual circumstances and Ford Credit’s assessment of your application. By understanding the factors that can influence interest rates, you can take steps to improve your chances of securing a competitive rate. In the next section, we will explore the current Ford Credit interest rates available.

Current Ford Credit Interest Rates

Ford Credit offers a range of interest rates to customers based on various factors, including creditworthiness, loan term, and vehicle type. As interest rates can vary over time, it’s important to check with Ford Credit for the most up-to-date information. However, as of [current date], the current interest rates offered by Ford Credit are as follows:

- New Vehicles: For new Ford vehicles, the interest rates typically range from [lowest rate] to [highest rate] percent. These rates are based on a combination of factors, such as credit score and loan term.

- Used Vehicles: The interest rates for used Ford vehicles may differ from those of new vehicles. Typically, the rates range from [lowest rate] to [highest rate] percent, depending on factors such as the age of the vehicle and the borrower’s creditworthiness.

- Special Financing Offers: Ford Credit occasionally offers special financing promotions that may include lower interest rates or other incentives. These promotions can vary in duration and terms, so it’s important to keep an eye out for any currently available offers.

It’s crucial to remember that these interest rates serve as a general guideline, and the specific rate you receive may differ based on your unique financial circumstances. To obtain accurate and personalized interest rate information, it’s recommended to contact a Ford dealership or Ford Credit directly.

By being aware of the current interest rates offered by Ford Credit, you can better assess your financing options and determine the affordability of your desired Ford vehicle. In the following section, we will explore how you can qualify for the best interest rates offered by Ford Credit.

How to Qualify for the Best Ford Credit Interest Rates

Obtaining the best interest rates offered by Ford Credit can help you save money over the life of your vehicle loan. While specific criteria may vary, there are steps you can take to improve your chances of qualifying for the best interest rates available. Here are some tips:

- Maintain a Good Credit Score: Your credit score plays a crucial role in determining your interest rate. Make sure to pay your bills on time, keep your credit utilization low, and avoid new credit inquiries that could negatively impact your score.

- Save for a Higher Down Payment: Providing a larger down payment can demonstrate your financial responsibility and reduce the loan amount, potentially resulting in a lower interest rate. Aim to save as much as possible before financing your Ford vehicle.

- Keep Debt-to-Income Ratio in Check: Lenders assess your debt-to-income ratio to gauge your ability to manage additional debt. Keeping your overall debt levels low in relation to your income can improve your chances of qualifying for favorable rates.

- Shop Around for the Best Deal: Don’t limit yourself to a single financing option. Explore multiple lenders, including Ford Credit, and compare the interest rates and terms they offer. This allows you to find the best deal that aligns with your financial goals.

- Consider a Co-Signer: If your credit history is limited or less than perfect, having a co-signer with a strong credit profile may help you secure a better interest rate.

It’s important to note that meeting these criteria does not guarantee the lowest interest rate, as each individual circumstance is evaluated by the lender. However, implementing these strategies can improve your chances of securing a more competitive rate.

Remember, Ford Credit is committed to providing customers with financing options that suit their needs. By taking proactive steps to strengthen your financial profile, you can increase your chances of qualifying for the best interest rates offered by Ford Credit. In the next section, we will briefly compare Ford Credit interest rates with other financing options.

Comparing Ford Credit Interest Rates with Other Financing Options

When considering financing options for your Ford vehicle, it’s important to compare Ford Credit interest rates with those offered by other lenders. While Ford Credit may provide competitive rates, exploring alternative financing options can help ensure you secure the best deal. Here are a few points to consider:

- Bank and Credit Union Loans: Banks and credit unions often offer vehicle loans with competitive interest rates. It’s worth checking with your bank or local credit union to compare their rates with those offered by Ford Credit.

- Online Lenders: Online lending platforms have become increasingly popular, offering convenient and competitive financing options. These lenders often provide quick approval processes and may offer attractive interest rates for qualified borrowers.

- Manufacturer Financing Programs: Apart from Ford Credit, other automakers also offer their financing programs. Investigate if other manufacturers have any special incentives or promotional interest rates that may be more advantageous for you.

- Dealership Financing: Dealerships typically have relationships with multiple lenders, allowing them to provide financing options tailored to your needs. While convenient, it’s important to carefully review the interest rates and terms to ensure they are competitive.

When comparing interest rates across different lenders, be sure to consider other factors like loan terms, fees, and repayment options. Additionally, factor in the reputation and customer service of the lender, as these aspects can play a role in your overall financing experience.

Ultimately, the goal is to find the financing option that offers the most competitive interest rate and aligns with your financial goals. By exploring all available options and comparing interest rates, you can make an informed decision that provides the best value for your investment.

Remember to consider the overall cost of the loan, including factors beyond interest rates, when choosing a financing option for your Ford vehicle. In the following section, we will conclude our discussion on Ford Credit interest rates and summarize the key takeaways.

Conclusion

Understanding the interest rates offered by Ford Credit is essential when considering financing options for your Ford vehicle purchase. By familiarizing yourself with the factors that influence interest rates and qualifying for the best rates, you can make informed decisions that align with your financial goals. Here are the key takeaways from our discussion:

- Interest rates in Ford Credit represent the additional amount charged on top of the principal loan amount. They can be fixed or variable.

- Factors that affect Ford Credit interest rates include credit score, loan term, down payment, vehicle type, market conditions, and loan amount.

- As of [current date], the current interest rates for new and used Ford vehicles typically range from [lowest rate] to [highest rate] percent.

- To qualify for the best interest rates, focus on maintaining a good credit score, saving for a higher down payment, managing your debt-to-income ratio, and shopping around for the best deal.

- Comparing Ford Credit interest rates with other financing options, such as bank loans, online lenders, and dealership financing, can help you secure the most competitive deal.

Remember to consider not only interest rates but also other factors like loan terms, fees, and overall customer service when choosing a financing option. Ultimately, the goal is to find a financing solution that offers the best value and aligns with your financial circumstances and goals.

When you’re ready to purchase your Ford vehicle, take the time to understand the interest rates available through Ford Credit and other potential financing options. Carefully evaluate your financial situation and choose the option that best suits your needs. With the right financing in place, you’ll be one step closer to enjoying your new Ford vehicle on the road ahead.