Finance

What Is A Consumer Finance Company Account

Modified: December 30, 2023

Learn more about consumer finance company accounts and how they can help you manage your finances. Find out how finance institutions can assist with loans, credit cards, and other financial services.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Consumer Finance Company Account

- Functions and Services Provided by Consumer Finance Companies

- Comparison with Traditional Banks

- Benefits of a Consumer Finance Company Account

- Potential Drawbacks of a Consumer Finance Company Account

- How to Open a Consumer Finance Company Account

- Factors to Consider Before Choosing a Consumer Finance Company

- Conclusion

Introduction

Welcome to the world of consumer finance companies! In this digital age, where financial services are constantly evolving, it’s important to understand the various options and alternatives available to manage your finances effectively. One such option is a consumer finance company account, which offers a range of services tailored to meet the specific needs of individuals.

A consumer finance company account is a type of financial account provided by specialized institutions that focus on offering a wide range of financial products and services to consumers. These companies are licensed and regulated by the appropriate financial authorities, ensuring that they operate in compliance with industry standards and guidelines. Unlike traditional banks, which cater to a broader customer base, consumer finance companies specialize in meeting the financial requirements of individuals who may have unique circumstances or face challenges in accessing traditional banking services.

Consumer finance companies provide various services, including personal loans, credit cards, installment plans, and other forms of credit to help individuals manage their personal finances. They also offer tailored solutions for individuals with less-than-perfect credit scores or limited credit history, providing them with opportunities to build or rebuild their credit profiles. Moreover, consumer finance companies often have streamlined application processes and faster loan approval times compared to traditional banks, making them a convenient option when individuals need financial assistance quickly.

Definition of a Consumer Finance Company Account

A consumer finance company account is a specialized financial account provided by consumer finance companies to meet the unique financial needs of individuals. Unlike traditional bank accounts, which generally offer a range of services such as checking, savings, and loans, a consumer finance company account typically focuses on credit-based products and services.

Consumer finance companies are financial institutions that specialize in providing credit and lending solutions to consumers. These companies may operate as independent entities or as subsidiaries of larger financial institutions. They are regulated by the appropriate financial authorities and must adhere to specific guidelines and regulations to ensure consumer protection.

When you open a consumer finance company account, you gain access to a variety of financial products and services tailored to your specific needs. These can include personal loans, credit cards, installment plans, and other forms of credit. Consumer finance companies are often more willing to work with individuals who have less-than-perfect credit scores or limited credit history, providing them with opportunities to build or rebuild their credit profiles.

With a consumer finance company account, you can typically manage your finances digitally through online banking platforms or mobile applications. This allows you to conveniently monitor your account balance, make payments, view transaction history, and access additional features provided by the consumer finance company.

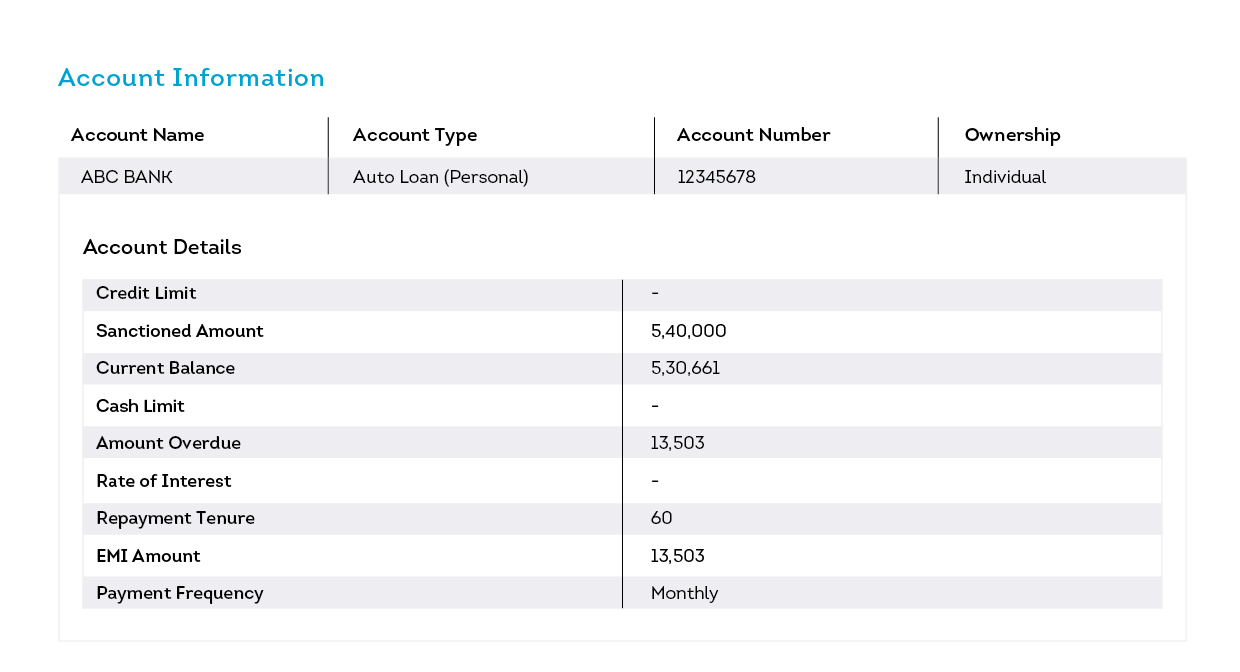

It’s important to note that consumer finance company accounts function differently from traditional bank accounts. While traditional bank accounts focus on providing a range of financial services and products, consumer finance company accounts primarily revolve around credit-based offerings. Therefore, it’s crucial to familiarize yourself with the specific terms and conditions, fees, interest rates, and repayment options associated with your consumer finance company account.

By understanding the definition and purpose of a consumer finance company account, you can make informed decisions about managing your finances and choosing the right financial institutions to meet your needs.

Functions and Services Provided by Consumer Finance Companies

Consumer finance companies offer a range of functions and services to cater to the financial needs of individuals. These specialized institutions understand that everyone’s financial situation is unique, and they strive to provide tailored solutions to help individuals manage their personal finances effectively. Here are some of the key functions and services provided by consumer finance companies:

- Personal Loans: One of the primary services offered by consumer finance companies is personal loans. These loans provide individuals with a lump sum of money that can be used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Consumer finance companies often have flexible loan terms and repayment options to accommodate individual needs.

- Credit Cards: Consumer finance companies also issue credit cards, allowing individuals to make purchases and access credit on a revolving basis. These credit cards may come with specific features and benefits, such as rewards programs or cashback offers. Unlike traditional banks, consumer finance companies may be more willing to extend credit to individuals with limited credit history or lower credit scores.

- Installment Plans: Installment plans are another service provided by consumer finance companies. These plans allow individuals to make large purchases and pay for them over time in fixed monthly installments. This can be particularly beneficial for individuals who need to spread out the cost of a significant purchase, such as furniture, electronic devices, or appliances.

- Credit Building Opportunities: Consumer finance companies often provide individuals with opportunities to improve their credit profiles. They may offer credit-building programs or secured credit cards, where individuals can establish or rebuild their credit history by making regular, on-time payments and demonstrating responsible credit behavior.

- Financial Education and Resources: Many consumer finance companies also prioritize financial education and resources to help individuals make informed financial decisions. They may offer online resources, budgeting tools, and financial literacy programs to empower individuals to better manage their money, understand credit, and plan for their financial future.

These are just a few examples of the functions and services provided by consumer finance companies. It’s important to note that the specific offerings may vary depending on the institution and the region in which they operate. Therefore, it’s advisable to research and compare different consumer finance companies to find the one that aligns with your financial goals and needs.

Comparison with Traditional Banks

Consumer finance companies and traditional banks are both financial institutions that offer a range of services, but there are some notable differences between the two. Understanding these differences can help you make an informed choice when it comes to managing your finances. Here’s a comparison of consumer finance companies and traditional banks:

- Customer Focus: While traditional banks cater to a broad customer base, consumer finance companies specialize in serving individuals who may have unique financial circumstances or face challenges in accessing traditional banking services. This customer-focused approach allows consumer finance companies to provide tailored solutions and cater to the specific needs of their customers.

- Credit Requirements: Consumer finance companies may be more willing to work with individuals who have less-than-perfect credit scores or limited credit history. They offer credit-based products and services that can help individuals build or rebuild their credit profiles. In contrast, traditional banks typically have stricter credit requirements and may be less accommodating to individuals with lower credit scores.

- Loan Approval Process: Consumer finance companies often have more streamlined application processes and faster loan approval times compared to traditional banks. This can be beneficial when individuals need quick access to funds for emergencies or time-sensitive financial needs.

- Product Options: Traditional banks typically offer a wide range of financial products and services, including checking accounts, savings accounts, mortgages, and investment options. In contrast, consumer finance companies primarily focus on credit-based services such as personal loans, credit cards, and installment plans.

- Interest Rates and Fees: Interest rates and fees charged by consumer finance companies may vary and could be higher compared to traditional banks. It’s essential to carefully review the terms, conditions, and associated costs before committing to any financial product or service.

- Branch Network: Traditional banks often have a larger physical branch network, making it convenient for customers to access in-person services, speak with representatives, and make transactions. Consumer finance companies typically have a more limited physical presence, with a greater emphasis on online and digital banking services.

- Regulation and Oversight: Both consumer finance companies and traditional banks are regulated and supervised by the appropriate financial authorities. However, the specific regulations and oversight may differ depending on the region and the institution. It’s important to ensure that any financial institution you choose is licensed and operates in compliance with the regulations applicable to your region.

When considering whether to choose a consumer finance company or a traditional bank, it’s crucial to assess your own financial needs, goals, and circumstances. Take into account factors such as credit requirements, product offerings, convenience, and cost to determine which option best aligns with your requirements.

Benefits of a Consumer Finance Company Account

Opening a consumer finance company account can provide individuals with several benefits that cater to their unique financial needs and circumstances. Here are some of the key advantages of having a consumer finance company account:

- Access to Credit: Consumer finance companies are often more flexible when it comes to extending credit to individuals with less-than-perfect credit scores or limited credit history. Having a consumer finance company account can provide individuals with the opportunity to access credit products, such as personal loans or credit cards, that can help them meet their financial goals or cover unexpected expenses.

- Faster Loan Approvals: Consumer finance companies typically have streamlined application processes and faster loan approval times compared to traditional banks. This can be advantageous when individuals need quick access to funds for emergency situations or time-sensitive financial needs.

- Credit Building Opportunities: Consumer finance companies often offer credit-building programs or secured credit cards that can help individuals improve their credit profiles. By using credit responsibly and making timely payments, individuals can demonstrate their creditworthiness and work towards improving their credit scores over time.

- Tailored Services: Consumer finance companies focus on understanding the unique financial needs of individuals and providing tailored solutions. They offer products and services that cater specifically to different circumstances, such as debt consolidation loans or installment plans, which can help individuals manage their finances effectively.

- Convenience: Consumer finance companies usually provide digital banking platforms and mobile applications that allow individuals to conveniently manage their accounts. This includes features such as account balance monitoring, payment management, and transaction history, making it easier for individuals to stay on top of their finances and make informed financial decisions.

- Increased Financial Access: For individuals who may have limited access to traditional banking services, consumer finance companies present an opportunity to access financial products and services that can help improve their financial well-being. This can lead to greater financial inclusion and empowerment.

It’s important to keep in mind that the specific benefits and offerings may vary between consumer finance companies. It’s advisable to research and compare different companies to ensure that their services align with your financial goals and needs.

Potential Drawbacks of a Consumer Finance Company Account

While consumer finance company accounts offer several benefits, it’s essential to be aware of potential drawbacks that come with these types of accounts. Understanding these drawbacks can help individuals make informed decisions about whether a consumer finance company account is the right choice for their financial needs. Here are some potential drawbacks to consider:

- Higher Interest Rates: Consumer finance companies may charge higher interest rates compared to traditional banks. This is often due to their willingness to extend credit to individuals with less-than-perfect credit scores or limited credit history. It’s important to carefully review the interest rates and terms associated with any credit products or loans offered by consumer finance companies.

- Additional Fees: Like any financial institution, consumer finance companies may charge fees for various services and transactions. Common fees can include application fees, annual fees for credit cards, late payment fees, and prepayment penalties on loans. It’s important to understand the fee structure associated with a consumer finance company account to avoid any unexpected charges.

- Limited Product Options: Unlike traditional banks that offer a wide range of financial products and services, consumer finance companies typically focus on credit-based offerings such as personal loans, credit cards, and installment plans. If you require a broader range of services, such as investment options or mortgage loans, a consumer finance company account may not fulfill all of your financial needs.

- Smaller Branch Network: Consumer finance companies often have a smaller physical presence compared to traditional banks. They may have fewer branch locations, which can limit in-person assistance and access to certain services. This can be a drawback for individuals who prefer face-to-face interactions or need immediate assistance with their accounts.

- Less Familiarity: While traditional banks have been around for generations and are well-established institutions, consumer finance companies may not have the same level of familiarity or brand recognition. This lack of familiarity may cause some individuals to hesitate when choosing a consumer finance company account.

- Regulatory Differences: Consumer finance companies operate under specific regulations and oversight, but these regulations may differ from those governing traditional banks. It’s important to ensure that any consumer finance company you choose is licensed, regulated, and operates in compliance with industry standards to ensure the protection of your rights and financial well-being.

Considering these potential drawbacks, it’s crucial to carefully evaluate your financial needs and preferences before deciding whether a consumer finance company account is the right fit for you. Reviewing the terms, conditions, and associated costs, and comparing different consumer finance companies can help you make an informed decision.

How to Open a Consumer Finance Company Account

If you’re interested in opening a consumer finance company account, the process is typically straightforward and can be completed in a few simple steps. Here’s a general guide on how to open a consumer finance company account:

- Research and Compare: Start by researching different consumer finance companies to find one that aligns with your financial needs, preferences, and goals. Compare factors such as interest rates, fees, product offerings, and customer reviews to make an informed decision.

- Gather Required Documentation: Once you’ve chosen a consumer finance company, gather the necessary documentation required to open an account. This may include identification documents, proof of address, proof of income, and any additional information the company requires for the account opening process.

- Complete the Application: Fill out the application form provided by the consumer finance company. This form collects personal information and details about your financial situation. Be sure to provide accurate and up-to-date information to expedite the account opening process.

- Review Terms and Conditions: Carefully read and understand the terms and conditions associated with the consumer finance company account. This includes information on interest rates, fees, repayment terms, and any other relevant factors. If there are any areas you are unsure about, seek clarification from the company’s customer service representatives.

- Submit the Application: Submit your completed application along with the required documentation to the consumer finance company. This can typically be done online through their secure portal or by visiting a physical branch if available.

- Wait for Approval: After submitting your application, the consumer finance company will review it and assess your eligibility. They may conduct a credit check and verify the information you provided. The approval process duration can vary depending on the company, but you can typically expect to receive a decision within a few business days.

- Activate and Fund the Account: Once your application is approved, you will receive instructions on how to activate and fund your consumer finance company account. This may involve making an initial deposit or linking another account for transfer purposes.

- Access Your Account: After your account is active and funded, you can start accessing and managing your account. Most consumer finance companies offer online banking platforms, mobile applications, or customer service hotlines to assist you in navigating and utilizing your account’s features.

It’s important to note that the specific steps and requirements may vary between consumer finance companies. Be sure to follow the instructions provided by the company you choose and reach out to their customer support if you have any questions or require further assistance.

Factors to Consider Before Choosing a Consumer Finance Company

When selecting a consumer finance company to open an account with, it’s important to consider several factors to ensure that it aligns with your financial goals and needs. Here are some key factors to consider before choosing a consumer finance company:

- Reputation and Trustworthiness: Research the reputation and trustworthiness of the consumer finance company. Look for customer reviews, ratings, and testimonials to gain insights into the experiences of others who have used their services. It’s important to choose a reputable company that has a track record of providing quality customer service and transparent business practices.

- Product Offerings: Evaluate the range of products and services offered by the consumer finance company. Consider whether they provide the specific financial products you need, such as personal loans, credit cards, or installment plans. Additionally, assess the terms, interest rates, fees, and repayment options associated with these products to ensure they align with your financial objectives.

- Interest Rates and Fees: Compare the interest rates and fees charged by different consumer finance companies. Higher interest rates and fees can significantly impact the total cost of borrowing and the overall value of the account. Carefully review the terms and conditions to understand the complete cost structure associated with the account.

- Customer Service: Consider the level and quality of customer service provided by the consumer finance company. Ensure that they have responsive and helpful customer support channels available, such as phone, email, or online chat, to assist you when you have questions, concerns, or need assistance with your account.

- Online and Mobile Banking: Evaluate the digital banking capabilities offered by the consumer finance company. Check whether they provide user-friendly online banking platforms or mobile applications that allow you to conveniently access and manage your account. Features such as bill payment, transaction history, and account alerts can enhance the overall banking experience.

- Security Measures: Explore the security measures implemented by the consumer finance company to protect your personal and financial information. Look for features such as encryption technology, multi-factor authentication, and fraud prevention measures to ensure the safety and security of your account.

- Flexibility and Additional Services: Assess whether the consumer finance company offers additional services or benefits that enhance your financial experience. These can include features such as credit monitoring, financial literacy resources, or rewards programs that provide added value and convenience.

- Regulatory Compliance: Verify that the consumer finance company is duly licensed, regulated, and operates in compliance with the financial regulations applicable in your region. This ensures that they adhere to industry standards, consumer protection guidelines, and regulatory oversight.

By considering these factors, you can make an informed decision when choosing a consumer finance company. It’s advisable to compare multiple options, weigh the pros and cons of each, and select the company that aligns with your financial needs and priorities.

Conclusion

Opening a consumer finance company account can provide individuals with access to credit and tailored financial solutions to meet their unique needs. By understanding the functions and services provided by consumer finance companies, comparing them with traditional banks, and considering the benefits and drawbacks, individuals can make informed decisions about their financial situation.

When choosing a consumer finance company, it’s essential to research and compare different options, considering factors such as reputation, product offerings, interest rates, fees, customer service, and online banking capabilities. By evaluating these factors, individuals can select a consumer finance company that aligns with their financial goals and preferences.

It’s important to note that while consumer finance companies may offer advantages such as flexible credit options, faster loan approval times, and tailored services, there can also be potential drawbacks such as higher interest rates and limited product options. Individuals should carefully review the terms and conditions associated with consumer finance company accounts to ensure they are comfortable with the costs and features.

In conclusion, a consumer finance company account can be a viable option for individuals who may have unique financial circumstances or difficulties accessing traditional banking services. By considering the factors outlined and conducting thorough research, individuals can make informed decisions that serve their financial needs effectively.