Finance

What Are Credit Dividends

Modified: January 15, 2024

Learn about credit dividends and their significance in finance. Discover how they impact financial stability and investment returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit dividends, where investors can earn passive income by simply holding certain types of credit instruments. In the realm of finance, dividends are usually associated with stocks, but credit dividends offer a unique opportunity for individuals to generate income from their fixed income investments.

Unlike traditional dividends, which are typically paid out by companies to their shareholders, credit dividends are payments made to holders of certain credit instruments, such as bonds or preferred shares. These payments are a form of interest or income generated by the underlying credit instrument, and they can provide investors with a steady and predictable stream of cash flow.

Credit dividends can be an attractive investment option for those who are seeking a relatively stable source of income. Whether you are a seasoned investor or just starting to explore the world of finance, understanding how credit dividends work and their potential benefits can help you make informed investment decisions.

In this article, we will delve deeper into the concept of credit dividends, explore how they work, discuss their benefits and risks, and provide examples to illustrate their application in the real world. Additionally, we will highlight key factors that investors should consider before investing in credit dividends.

So, whether you’re looking to diversify your investment portfolio or seeking to earn passive income, let’s embark on this journey to uncover the fascinating world of credit dividends.

Definition of Credit Dividends

Credit dividends refer to the payments made to holders of certain credit instruments, such as bonds or preferred shares. These payments are typically in the form of periodic interest or income generated by the underlying credit instrument.

When a company borrows money through the issuance of bonds, it promises to pay interest to bondholders for the duration of the bond’s life. This interest payment is essentially a credit dividend, as it represents a portion of the income generated by the company’s operations.

Credit dividends are usually fixed, meaning that the amount and frequency of the payments are predetermined and agreed upon at the time of issuance. For example, a bond may pay an annual interest rate of 5%, distributed semi-annually to bondholders.

It is essential to note that credit dividends are different from equity dividends. Equity dividends are payments made to shareholders of a company’s common stock, representing a share of the company’s profits. In contrast, credit dividends are payments made to creditors, representing the interest or income generated by the company’s debt obligations.

In some cases, credit dividends can also refer to payments made to holders of preferred shares. Preferred shares are a hybrid security that combines elements of both equity and debt. Holders of preferred shares have a higher claim on the company’s assets and earnings compared to common shareholders, and they receive a fixed dividend payment on a regular basis.

Overall, credit dividends provide a way for investors to earn income from their fixed income investments, such as bonds or preferred shares. These dividends play a crucial role in attracting investors to credit instruments by providing them with a predictable and steady stream of cash flow.

How Credit Dividends Work

Understanding how credit dividends work requires grasping the concept of credit instruments and their income-generating potential. Credit instruments, such as bonds or preferred shares, represent debt or equity obligations of an issuer and are bought and sold in financial markets.

When investors purchase a credit instrument, they essentially become creditors or owners of the issuer’s debt or equity. In return for lending money or investing in the company, investors receive periodic payments in the form of credit dividends.

For example, let’s consider a bond with a face value of $1,000, an annual interest rate of 5%, and a maturity period of 10 years. The bondholder will receive credit dividends in the form of annual interest payments, calculated as 5% of the bond’s face value, in this case, $50 per year.

The credit dividends are typically paid to investors on a predetermined schedule, whether it’s annually, semi-annually, quarterly, or monthly. The frequency of the payments depends on the terms of the credit instrument and the issuer’s financial obligations.

Investors can hold credit instruments until maturity, allowing them to receive the full principal amount when the instrument reaches its maturity date. Alternatively, investors may choose to sell their credit instruments on the secondary market, where the instruments can be bought and sold before their maturity.

When purchasing credit instruments on the secondary market, investors should be aware that the price of the instrument may vary. The price of a bond, for example, can fluctuate based on changes in interest rates and the perceived creditworthiness of the issuer.

If an investor decides to sell a credit instrument before its maturity, they may receive a price that differs from the instrument’s face value. This price is influenced by market conditions and the prevailing interest rates at the time of sale.

It’s important to note that the payment of credit dividends is subject to the issuer’s ability to fulfill their financial obligations. If the issuer faces financial difficulties or defaults on their debt obligations, investors may not receive the full credit dividends, or in some cases, any dividends at all.

Overall, credit dividends work by providing investors with a regular stream of income in the form of interest payments or fixed dividend payments, depending on the type of credit instrument. These dividends are paid out according to a predetermined schedule, allowing investors to earn a predictable cash flow from their credit investments.

Benefits of Credit Dividends

Credit dividends offer several enticing benefits for investors seeking income and stability in their investment portfolio. Here are some key advantages of investing in credit dividends:

- Steady and Predictable Income: Credit dividends provide a reliable source of income for investors. Unlike stock dividends, which can fluctuate based on a company’s performance, credit dividends are typically fixed and predictable. Investors can count on receiving regular payments according to the terms of the credit instrument.

- Income Diversification: Investing in credit dividends allows for diversification of income sources. By adding credit instruments to their portfolio, investors can reduce their dependency on equities and spread their income streams across different asset classes. This diversification can help mitigate risks and provide a more stable overall return.

- Lower Volatility: Credit dividends tend to be less volatile compared to equity dividends. While stock prices can experience significant fluctuations, credit instruments, such as bonds, generally offer a more stable income stream. This lower volatility makes credit dividends an attractive option for risk-averse investors or those seeking a more conservative investment approach.

- Potential Capital Appreciation: In addition to the regular income provided by credit dividends, there is also the potential for capital appreciation. If interest rates decline or the creditworthiness of the issuer improves, the value of the credit instrument may increase in the secondary market. This can result in capital gains for investors when selling the instrument.

- Priority in Liquidation: In the event of a company’s bankruptcy or liquidation, holders of credit instruments generally have a higher priority in the distribution of assets compared to common shareholders. This means that creditors, including credit dividend recipients, have a greater chance of recovering their investment compared to equity holders. This priority can provide an additional layer of protection for investors in credit dividends.

Overall, credit dividends offer a range of benefits, including a steady and predictable income, income diversification, lower volatility compared to equities, the potential for capital appreciation, and priority in case of liquidation. These advantages make credit dividends an attractive option for investors looking to generate income and add stability to their investment portfolio.

Risks and Limitations of Credit Dividends

While credit dividends can be a valuable addition to an investment portfolio, it’s important to be aware of the risks and limitations associated with these income-generating instruments. Here are some key considerations:

- Default Risk: One of the primary risks of investing in credit dividends is the possibility of an issuer defaulting on their debt obligations. If a company is unable to meet its financial obligations, it may not be able to make the scheduled credit dividend payments. This can result in a loss of income for investors and, in severe cases, a potential loss of principal.

- Interest Rate Risk: Credit dividends, particularly in the case of bonds, are affected by changes in interest rates. When interest rates rise, existing bonds with lower interest rates become less attractive to investors. This can lead to a decrease in the market value of the bond, potentially resulting in capital losses if the investor decides to sell the bond before maturity. Conversely, if interest rates decline, the market value of the bond may increase, resulting in capital gains for the investor.

- Liquidity Risk: Credit instruments, especially those issued by smaller or less established companies, may suffer from limited liquidity. This means that there may not be an active secondary market for buying or selling the instruments. In such cases, investors may face challenges in selling their holdings at the desired price or in a timely manner.

- Creditworthiness Risk: The creditworthiness of the issuer is a critical factor to consider when investing in credit dividends. Higher-risk issuers, such as companies with a lower credit rating, may offer higher yields to compensate for the additional risk. However, these higher yields come with a higher probability of default. Investors should carefully assess the creditworthiness of the issuer before investing in their credit instruments.

- Market Conditions: Credit dividends are influenced by market conditions, such as economic trends, financial stability, and investor sentiment. Unfavorable market conditions, such as a recession or market downturn, can impact the value and performance of credit instruments. Investors should stay informed about the broader market conditions and assess how they may affect the credit instrument’s income and value.

It’s crucial for investors to understand and carefully evaluate the risks and limitations associated with credit dividends. Conducting thorough research, diversifying investments, and staying informed about market developments can help investors mitigate these risks and make informed decisions.

Examples of Credit Dividends

To further illustrate the concept of credit dividends, let’s explore a few examples of common credit instruments that generate income for their holders:

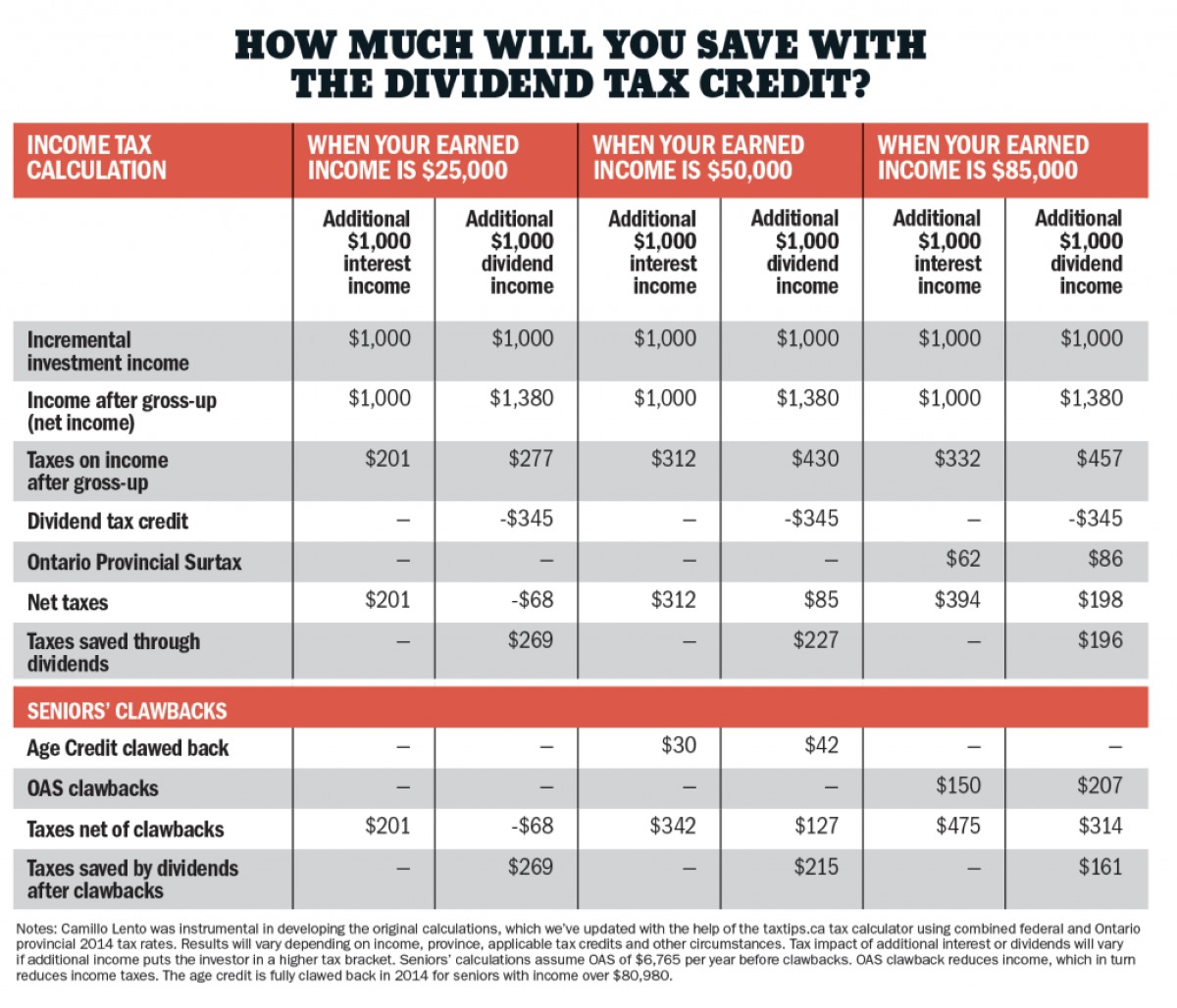

- Corporate Bonds: Companies often issue bonds to raise capital for various purposes, such as funding expansion or financing projects. Corporate bonds pay regular interest payments to bondholders, typically on a semi-annual basis. For example, if an investor holds a $10,000 corporate bond with a coupon rate of 4%, they would receive $200 in credit dividend payments annually.

- Municipal Bonds: Municipal bonds are issued by state, local, or municipal governments to finance public projects, such as infrastructure development or schools. These bonds pay interest to bondholders, and the interest income is generally exempt from federal income tax. Investors in municipal bonds receive credit dividends based on the bond’s coupon rate and the face value of the bond.

- Preferred Shares: Preferred shares are a type of equity investment that offers a fixed dividend payment to shareholders. These shares provide a higher claim on a company’s earnings compared to common shareholders but do not offer voting rights. Preferred shareholders receive credit dividends before common shareholders, making them an attractive option for income-focused investors.

- Real Estate Investment Trusts (REITs): REITs are investment vehicles that own and manage income-generating real estate properties. REITs are required to distribute a large portion of their taxable income to shareholders, often in the form of credit dividends. Investors in REITs can benefit from the regular income generated by the real estate holdings within the trust.

- Convertible Bonds: Convertible bonds offer the option for bondholders to convert their bonds into a predetermined number of common shares of the issuing company. While these bonds pay regular interest payments to bondholders, they also offer the potential for capital appreciation if the bondholder decides to convert the bond into equity. This combination of fixed income and equity potential appeals to investors seeking both credit dividends and the potential for growth.

These examples offer a glimpse into the variety of credit instruments that generate income for investors. Each instrument comes with its own terms, risk profile, and income potential. It’s important for investors to carefully evaluate the specific features and risks associated with the credit instrument before making investment decisions.

Factors to Consider before Investing in Credit Dividends

Investing in credit dividends can be a sound strategy for generating income, but it’s crucial to consider several factors before diving into this investment avenue. Here are some key considerations for investors:

- Issuer’s Creditworthiness: Assessing the creditworthiness of the issuer is essential before investing in credit dividends. Credit rating agencies provide ratings that reflect the issuer’s ability to meet its debt obligations. Higher-rated issuers generally have a lower risk of default, but they may offer lower yields. Investors should carefully evaluate the creditworthiness of the issuer to gauge the level of risk associated with the investment.

- Risk Tolerance: Different credit instruments carry varying degrees of risk. It’s important to assess your risk tolerance and investment objectives before investing in credit dividends. Higher-risk instruments may offer higher yields, but they come with an increased likelihood of default. Investors should align their risk tolerance with the risk profile of the credit instrument they choose.

- Interest Rate Environment: The prevailing interest rate environment can significantly impact the performance of credit dividends. When interest rates rise, existing bonds may decline in value, resulting in potential capital losses. Conversely, falling interest rates can lead to capital gains for bondholders. Keeping an eye on the interest rate environment can help investors make informed decisions about the timing and selection of credit instruments.

- Investment Horizon: Consider your investment horizon when investing in credit dividends. Some credit instruments have longer maturity periods, while others may have shorter durations. Long-term investors may opt for longer-duration instruments that provide a steady income stream over an extended period, while those with a shorter investment horizon may prefer shorter-duration instruments for more flexibility.

- Portfolio Diversification: Diversification is essential in any investment strategy. Consider how credit dividends fit into your overall investment portfolio and ensure you have a diversified mix of assets. Diversifying across different types of credit instruments, industries, and geographic regions can help mitigate risks and provide a more balanced income stream.

- Tax Implications: Understand the tax implications of investing in credit dividends. Different countries and jurisdictions have varying tax rules on income generated from credit instruments. Consult with a tax professional to fully comprehend the tax implications of investing in credit dividends and to optimize your tax strategy accordingly.

By carefully considering these factors, investors can make informed decisions about investing in credit dividends. It’s essential to conduct thorough research, diversify investments, and regularly review and adjust your portfolio as needed. Consulting with a financial advisor can also provide valuable guidance on navigating the world of credit dividends.

Conclusion

Credit dividends offer investors a unique opportunity to generate income and diversify their investment portfolios. These income-generating instruments, such as bonds and preferred shares, provide a steady and predictable source of cash flow. While credit dividends come with risks, such as default risk and interest rate risk, they also offer several benefits, including stability, income diversification, and potential capital appreciation.

When considering investing in credit dividends, it’s essential to evaluate factors such as the issuer’s creditworthiness, your risk tolerance, the prevailing interest rate environment, investment horizon, and portfolio diversification. Understanding these factors can help you make informed decisions and align your investments with your financial goals.

Remember, credit dividends are not the only investment option available, and it’s important to evaluate other opportunities based on your unique financial situation and objectives. Consulting with a financial advisor can provide valuable insights and guidance tailored to your specific needs.

In conclusion, credit dividends offer investors the potential for consistent income while adding stability to their investment portfolios. By considering the risks and benefits, conducting thorough research, and diversifying investments, investors can harness the power of credit dividends to generate passive income and work towards their financial goals.