Finance

What Are 199A Dividends

Published: January 3, 2024

Learn about 199A dividends and their impact on your finances. Find out how you can maximize your earnings and leverage this tax advantage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

As an investor or someone who is involved in the world of finance, you may have come across the term “199A dividends” or “Section 199A dividends.” But what exactly are these dividends, and how do they differ from traditional dividends?

Section 199A dividends refer to a specific type of dividend that is eligible for a deduction under Section 199A of the Internal Revenue Code. This deduction was introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017, and it aims to provide tax relief to pass-through businesses such as partnerships, S corporations, and limited liability companies (LLCs).

Before we delve deeper into the specifics of 199A dividends, it’s important to understand the concept of pass-through entities. Unlike traditional corporations, which are subject to corporate taxes, pass-through entities do not pay taxes at the entity level. Instead, the income “passes through” to the owners or shareholders, who report it on their individual tax returns and pay taxes at their individual tax rates.

Now, let’s explore what sets 199A dividends apart. In order to qualify as a 199A dividend, the dividend must be received from a qualified business entity, such as a partnership or S corporation, that generates income from qualified sources. These qualified sources include income from a trade or business conducted in the United States, as well as qualified real estate investment trust (REIT) dividends and publicly traded partnership (PTP) income.

One of the key benefits of 199A dividends is that they are eligible for a deduction, known as the 199A deduction, which can significantly reduce the taxable income of eligible individuals or entities. This deduction can be as much as 20% of the 199A dividends, subject to certain limitations and restrictions.

Throughout this article, we will delve deeper into the qualification requirements for 199A dividends, the calculation of these dividends, the reporting and tax treatment, as well as the limitations and restrictions associated with them. Additionally, we will explore the potential benefits and considerations of 199A dividends, so that you can determine if they are an advantageous option for your investment strategy.

So, if you’re curious about how 199A dividends can impact your taxes and investment returns, read on to discover all the essential information you need to know about this unique type of dividend.

Understanding Section 199A Dividends

In order to fully understand the implications and benefits of Section 199A dividends, it’s important to have a clear grasp of the underlying legislation and its purpose. Section 199A, also known as the Qualified Business Income Deduction (QBID), was introduced through the Tax Cuts and Jobs Act of 2017. This provision was designed to provide tax relief to owners of pass-through businesses, such as partnerships, S corporations, and certain LLCs.

Section 199A allows eligible individuals and entities to deduct up to 20% of their qualified business income (QBI) from their taxable income. QBI is the net income generated from a qualified trade or business conducted in the United States, excluding specified investment income and certain other items.

Now, within the realm of Section 199A, we have what are commonly known as “199A dividends.” These dividends are payments made by qualifying pass-through entities that are eligible for the 199A deduction. In other words, if you receive a dividend from a partnership or S corporation that meets the criteria set forth by Section 199A, that dividend would be classified as a 199A dividend.

It’s important to note that not all dividends qualify as 199A dividends. Section 199A specifically outlines the requirements that must be met in order for a dividend to be eligible for the deduction. The dividend must be received from a qualified business entity and must be sourced from qualified income, such as income generated from a trade or business conducted in the United States, qualified REIT dividends, or PTP income.

Additionally, 199A dividends must be reported separately from other ordinary dividends received. When filing your tax return, you will need to provide the necessary documentation and disclose the amount of 199A dividends received, along with any other relevant information requested by the Internal Revenue Service (IRS).

By understanding the nature of Section 199A dividends, you can assess their potential impact on your overall tax liability and investment strategy. The ability to deduct a portion of your 199A dividends can result in significant tax savings and may serve as an incentive to invest in qualifying pass-through entities.

In the following sections of this article, we will explore the qualification requirements for 199A dividends, delve into the calculation methodology, and shed light on the reporting and tax treatment of these dividends. Additionally, we will discuss the limitations and restrictions associated with 199A dividends, as well as the potential benefits and considerations to keep in mind when incorporating them into your investment strategy.

Stay tuned to discover the intricacies of 199A dividends and how they can impact your finances and tax planning.

Qualification Requirements for 199A Dividends

In order for a dividend to be classified as a 199A dividend and be eligible for the associated deduction, several qualification requirements must be met. These requirements are outlined in Section 199A of the Internal Revenue Code and apply to both the pass-through entity distributing the dividend and the individual or entity receiving the dividend.

First and foremost, the distribution of the dividend must come from a qualified business entity. This includes partnerships, S corporations, and certain limited liability companies (LLCs) that elect to be treated as a partnership or an S corporation for tax purposes. It’s important to note that regular C corporations are not eligible for the 199A deduction.

Furthermore, the dividend must be sourced from qualified income. This includes income generated from a trade or business conducted in the United States, as well as qualified real estate investment trust (REIT) dividends and publicly traded partnership (PTP) income. It’s essential that the income generating the dividend meets these qualification criteria to ensure it qualifies as a 199A dividend.

Another key requirement is that the dividend must be received by an eligible individual or entity. Eligible individuals include individual taxpayers, trusts, and estates. Certain entities, such as C corporations and tax-exempt organizations, are not eligible to receive the 199A deduction.

Additionally, there are limitations on the types of entities that can distribute 199A dividends. For example, professional service businesses, such as doctors, lawyers, accountants, and consultants, may face limitations or exclusions when it comes to qualifying for the 199A deduction. These limitations are intended to prevent high-income individuals from circumventing the restrictions imposed on the deduction.

It’s worth noting that the qualification requirements for 199A dividends can be complex and may require consultation with a tax professional or CPA to ensure compliance. The IRS provides detailed guidelines and regulations regarding the eligibility criteria and limitations associated with Section 199A. Therefore, it’s crucial to stay up-to-date with the latest regulations and consult with a qualified tax advisor to ensure you meet the necessary requirements.

Understanding the qualification requirements for 199A dividends is essential for maximizing the tax benefits associated with these dividends. By ensuring that both the distributing entity and the receiving individual or entity meet the necessary criteria, you can take full advantage of the 199A deduction and potentially reduce your overall tax liability.

In the next section, we will explore the calculation methodology of 199A dividends, providing insights into the formulas and factors used to determine the deductible amount. Understanding the calculation process will further enhance your comprehension of 199A dividends and their potential impact on your taxes.

Calculation of 199A Dividends

The calculation of 199A dividends involves several factors and formulas to determine the deductible amount. Understanding how these dividends are calculated is essential for accurately reporting them on your tax returns and maximizing the available deduction.

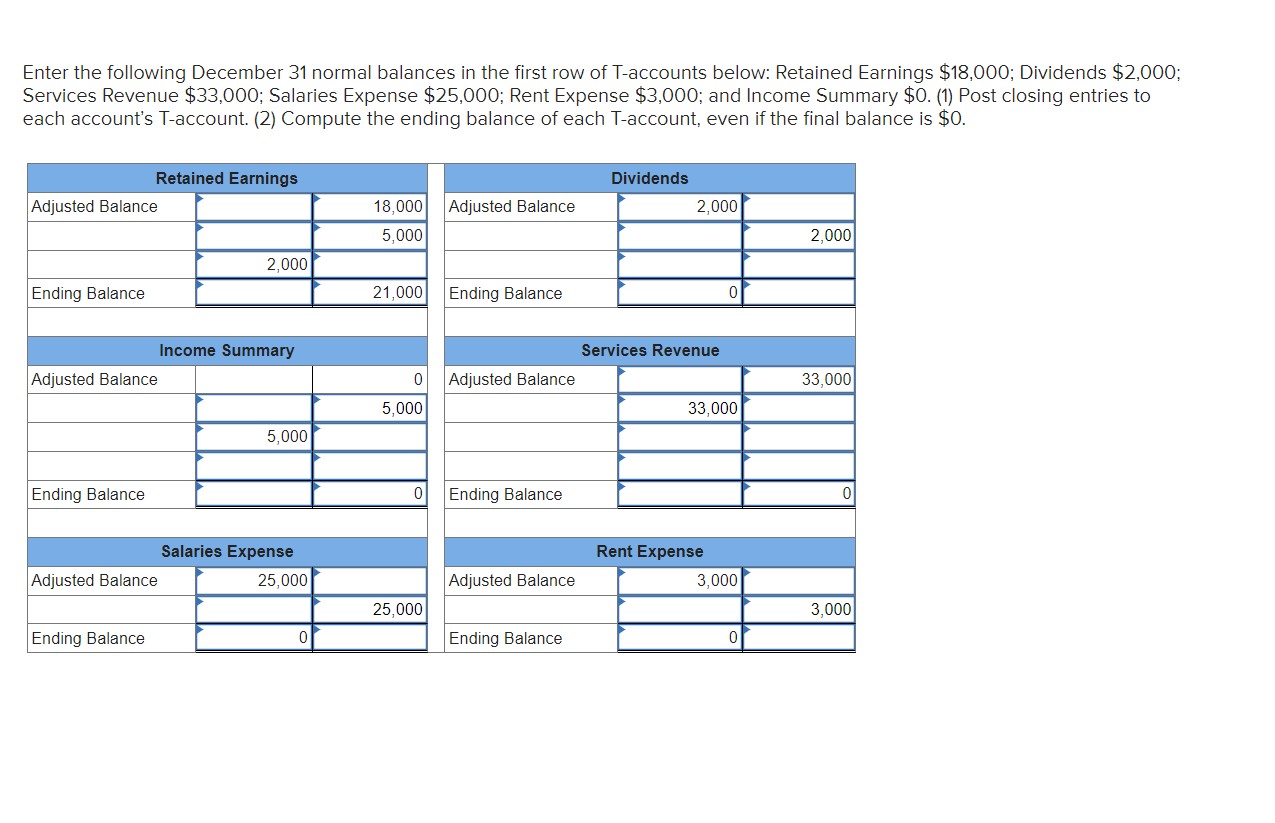

The first step in calculating 199A dividends is determining the qualified business income (QBI) of the pass-through entity distributing the dividend. QBI is the net income generated from a qualified trade or business conducted in the United States, excluding specified investment income and certain other items. It is important to note that QBI does not include salary or wages received by the taxpayer as an employee.

Once the QBI is determined, the next step is to calculate the deductible amount. The 199A deduction is generally 20% of the QBI, subject to limitations and restrictions. However, the deduction is not always a straightforward 20% of the QBI. There are additional factors that may affect the calculation.

One such factor is the taxable income of the taxpayer receiving the 199A dividend. The deduction may be limited if the taxpayer’s taxable income exceeds certain thresholds. For example, for individuals, the 199A deduction may be limited if their taxable income is above the threshold amount specified by the IRS. These thresholds are adjusted annually for inflation.

Another factor to consider is the type of business from which the dividend is received. Certain businesses, such as Specified Service Trades or Businesses (SSTBs), may face additional limitations or exclusions when it comes to qualifying for the 199A deduction. SSTBs include professional service businesses such as doctors, lawyers, consultants, and accountants. These limitations are in place to prevent high-income individuals from taking advantage of the deduction to reduce their tax liability.

The deduction is also subject to a wage and capital limit. This limit is calculated by the greater of 50% of the W-2 wages paid by the business or 25% of the W-2 wages plus 2.5% of the unadjusted basis of qualified property used in the business. The wage and capital limit is designed to provide an additional safeguard and ensure that the deduction is proportionate to the labor and capital invested in the business.

Lastly, it’s important to note that there may be other specific rules and calculations that apply based on the individual circumstances and the nature of the pass-through entity. Consulting with a tax professional or CPA is highly recommended to ensure accurate calculation and reporting of 199A dividends.

Understanding the calculation methodology of 199A dividends allows taxpayers to accurately determine the deductible amount and make informed decisions regarding their tax planning and investment strategy. By considering the various factors and limitations, individuals and entities can optimize the available 199A deduction and potentially reduce their overall tax liability.

In the next section, we will explore the reporting and tax treatment of 199A dividends, providing insights into the necessary documentation and compliance requirements when reporting these dividends to the IRS.

Reporting and Tax Treatment of 199A Dividends

When it comes to reporting and tax treatment, 199A dividends require careful attention to detail and compliance with the guidelines set forth by the Internal Revenue Service (IRS). Reporting these dividends accurately is crucial to ensure compliance with tax laws and maximize the available deduction.

First and foremost, it’s important to separate 199A dividends from other ordinary dividends received. This means that when reporting your dividend income on your tax return, you should clearly distinguish the amount of 199A dividends received and report them separately.

Typically, the pass-through entity distributing the 199A dividends will provide you with a Form 1099-DIV, which will detail the amount of 199A dividends you received during the tax year. It’s important to carefully review this form and ensure that the information provided aligns with your records.

When filing your tax return, you will need to report the amount of 199A dividends received on the appropriate section of your individual or entity tax form. This is typically done on Schedule B or an equivalent form for partnerships and S corporations, and Schedule K-1 for individuals or entities receiving the dividends.

Additionally, you may be required to provide additional information about the pass-through entity distributing the dividends, such as its name, taxpayer identification number (TIN), and other relevant details. This information is crucial for the IRS to verify the eligibility of the dividend for the 199A deduction.

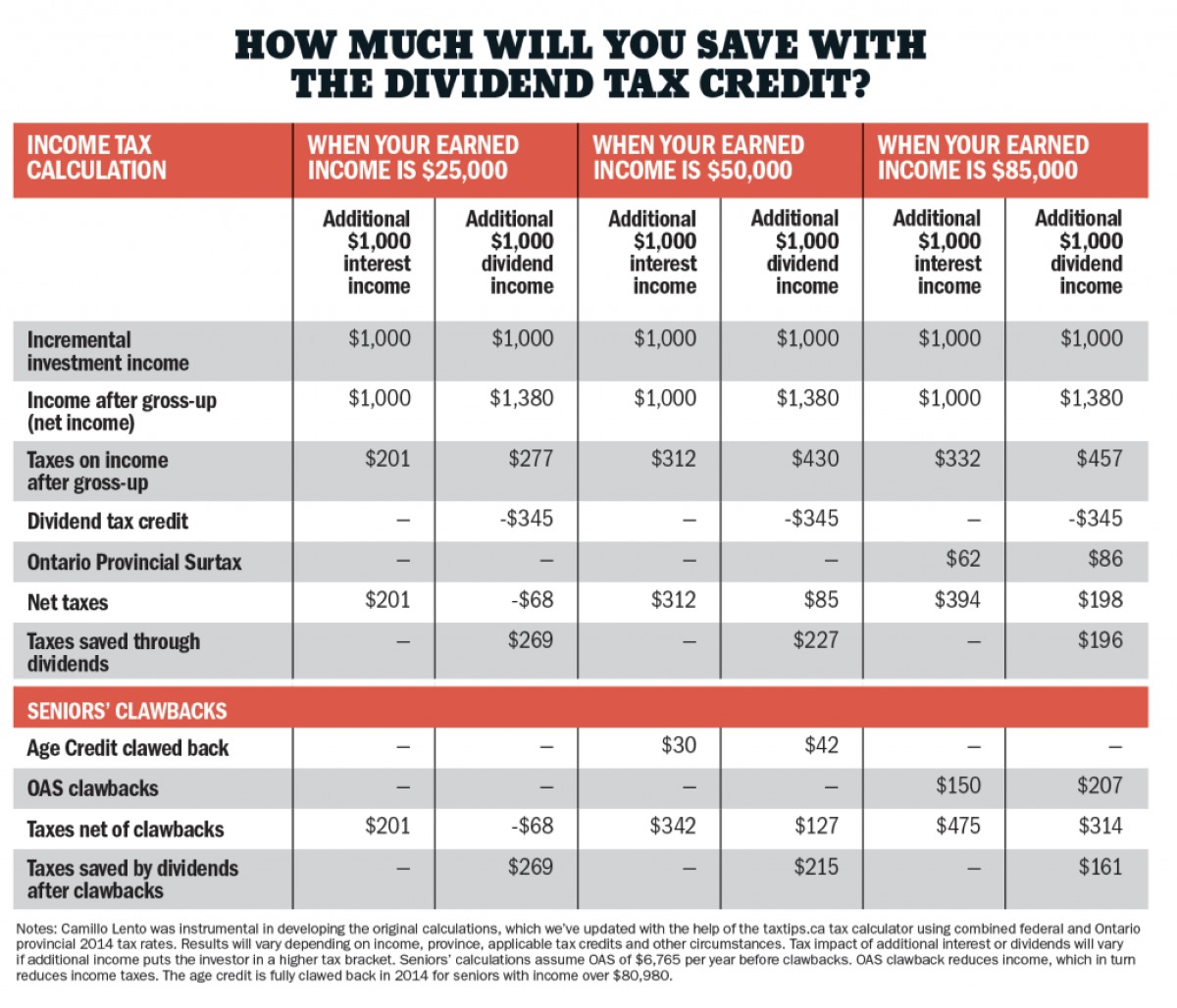

The tax treatment of 199A dividends is different from that of traditional dividends. While traditional dividends are generally subject to ordinary income tax rates, 199A dividends are eligible for a deduction. The deduction allows eligible individuals and entities to reduce their taxable income by up to 20% of the 199A dividends received.

It’s important to note that the deduction is subject to certain limitations and restrictions. The deduction may be limited based on taxable income thresholds, the type of business from which the dividend is received (e.g., SSTBs), and the wage and capital limit. These factors can impact the overall tax treatment of 199A dividends and the resulting tax savings.

As with any tax-related matter, it is highly recommended to consult with a tax professional or CPA to ensure accurate reporting and compliance with the tax laws. They can provide guidance specific to your situation and help optimize the available 199A deduction.

Understanding the reporting requirements and tax treatment of 199A dividends is essential for ensuring compliance and accurately taking advantage of the available deduction. By reporting these dividends correctly and following the guidelines provided by the IRS, individuals and entities can maximize their tax benefits and potentially reduce their overall tax liability.

In the next section, we will explore the limitations and restrictions associated with 199A dividends, providing insights into the factors that may affect the eligibility and availability of the deduction.

Limitations and Restrictions on 199A Dividends

While 199A dividends offer potential tax benefits, it’s important to understand that there are limitations and restrictions associated with these dividends. These limitations are in place to prevent abuse and ensure that the deduction is fairly distributed. Familiarizing yourself with these restrictions will help you make informed decisions and manage your tax planning effectively.

One of the key limitations is related to the type of business from which the 199A dividend is received. The IRS has categorized certain businesses as Specified Service Trades or Businesses (SSTBs). These include professions such as doctors, lawyers, accountants, consultants, and others. The primary limitation for these SSTBs is that the 199A deduction may be completely or partially phased out once the taxable income exceeds certain thresholds. The threshold amounts are adjusted yearly for inflation and depend on the taxpayer’s filing status.

For non-SSTB businesses, the 199A deduction is generally available without limitations, provided all other qualification requirements are met. However, even for non-SSTB businesses, there are potential limitations based on the taxable income of the taxpayer, which can affect the overall amount of the deduction. These limitations are designed to prevent high-income individuals from excessively benefiting from the deduction.

Another restriction to consider is the wage and capital limit. The deduction is subject to a calculation that takes into account the greater of 50% of W-2 wages paid by the business or 25% of the W-2 wages plus 2.5% of the unadjusted basis of qualified property used in the business. This limit is intended to ensure that the deduction is proportionate to the labor and capital invested in the business.

Furthermore, it’s important to note that eligibility for the 199A deduction is subject to compliance with the necessary filing and reporting requirements. Failure to report the dividend accurately or provide necessary documentation may result in the disqualification of the deduction or potential penalties from the IRS.

Lastly, it’s crucial to stay up-to-date with any changes or updates to the tax laws and regulations that may impact the availability and limitations of the 199A deduction. The IRS could introduce new guidelines or modify existing ones, affecting the eligibility criteria and deduction limits.

Understanding the limitations and restrictions on 199A dividends is essential for managing your tax planning effectively. By being aware of these factors, you can make informed decisions about your investments and optimize the available deduction to minimize your tax liability.

In the next section, we will explore the potential benefits and considerations of 199A dividends, providing insights into the advantages and implications of incorporating them into your investment strategy.

Potential Benefits and Considerations of 199A Dividends

As an investor or business owner, understanding the potential benefits and considerations of 199A dividends is crucial for making informed decisions about your investment strategy and tax planning. Let’s explore some of the key advantages and implications of incorporating these dividends into your financial strategy.

One of the primary benefits of 199A dividends is the potential for tax savings. The ability to deduct up to 20% of the dividend can significantly reduce your taxable income, resulting in lower overall tax liability. This deduction can be particularly advantageous for individuals with substantial 199A dividends from qualifying pass-through entities.

Another benefit is the flexibility that 199A dividends provide in structuring your investments. By investing in qualifying pass-through entities, you can potentially benefit from the 199A deduction while enjoying the advantages of pass-through taxation. This can allow for greater control over your tax strategy and potentially optimize your after-tax returns.

Moreover, 199A dividends offer an opportunity to support small businesses and stimulate economic growth. As the deduction incentivizes investment in pass-through entities, it can contribute to the growth and development of small and medium-sized businesses, which play a vital role in the economy.

However, it’s important to consider the limitations and restrictions associated with 199A dividends. Certain businesses, particularly specified service trades or businesses (SSTBs), may face limitations or exclusions when it comes to qualifying for the deduction. This means that if you have significant income from an SSTB, you may not be eligible for the full 199A deduction, or it may be completely phased out if your taxable income exceeds the threshold amounts set by the IRS.

Additionally, the wage and capital limit can impact the overall deduction amount. The limit is designed to ensure that the deduction is proportionate to the labor and capital invested in the business. It’s important to consider this factor when evaluating the potential tax benefits of 199A dividends.

Another consideration is the evolving nature of tax laws and regulations. The rules surrounding 199A dividends may change over time, potentially impacting the eligibility criteria and deduction limits. Staying informed about any updates or modifications to the tax laws is essential for maximizing the benefits of 199A dividends and ensuring compliance with the current regulations.

In summary, while 199A dividends offer potential tax benefits and investment flexibility, it’s important to consider the limitations and restrictions associated with them. By evaluating your specific circumstances and consulting with a tax professional, you can determine whether incorporating 199A dividends into your investment strategy aligns with your overall financial goals and maximizes your tax efficiency.

In the final section, we will conclude our exploration of 199A dividends, summarizing the key points discussed throughout this article.

Conclusion

In conclusion, 199A dividends, also known as Section 199A dividends, offer a unique opportunity for tax relief and investment optimization. These dividends, eligible for a deduction under Section 199A of the Internal Revenue Code, provide tax benefits to owners of qualifying pass-through entities.

Understanding the key aspects of 199A dividends is essential for maximizing their potential benefits. Qualification requirements, such as the source of income and the eligible business entity, must be met to classify a dividend as a 199A dividend. Calculating the deductible amount involves considering factors such as qualified business income, taxable income, and the wage and capital limit.

When reporting 199A dividends, it is important to separate them from other ordinary dividends received and provide the necessary documentation on your tax return. The tax treatment of 199A dividends differs from traditional dividends, as they are eligible for a deduction up to 20% of the dividend, subject to limitations and restrictions.

Speaking of limitations and restrictions, it is crucial to consider the specific rules that apply to your situation. Specified Service Trades or Businesses (SSTBs) and the wage and capital limit can impact the availability and amount of the 199A deduction. Staying informed about updates to tax laws is also important to ensure compliance and take advantage of any changes that may benefit you.

While there are considerations and limitations associated with 199A dividends, they offer potential benefits such as tax savings, investment flexibility, and support for small businesses. By carefully evaluating your circumstances and consulting with a tax professional, you can determine whether 199A dividends align with your financial goals and optimize your tax planning accordingly.

Incorporating 199A dividends into your investment strategy requires a thorough understanding of the regulations and eligibility criteria. By staying informed, seeking expert advice, and keeping track of any changes in tax laws, you can leverage the potential benefits of 199A dividends and make informed decisions for your financial future.

We hope this article has provided you with valuable insights into 199A dividends and their implications. Remember to always consult with a qualified tax advisor or CPA to ensure accurate reporting and compliance with tax regulations. With the right knowledge and guidance, you can navigate the world of 199A dividends and maximize your tax-saving potential.