Finance

What Is Dividend Credit

Published: January 10, 2024

Discover the power of dividend credit and how it can boost your financial goals. Explore the world of finance and unlock a new level of wealth creation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on dividend credit, an important concept in the world of finance. Dividend credit refers to the payment received by shareholders based on their ownership of a company’s shares. It is a way for companies to distribute profits to their shareholders as a return on their investment.

Dividend credit plays a crucial role in the investment landscape, as it provides a regular income stream for investors and can significantly impact the overall return on investment. Understanding how dividend credit works, its importance, and the factors influencing it is essential for both individual investors and financial institutions.

In this article, we will delve into the intricacies of dividend credit, discussing its definition, how it works, its importance, factors that affect dividend credit, as well as the advantages and disadvantages of dividends. We will also provide examples of dividend credit calculations to illustrate how it is determined in practice.

Whether you are an experienced investor or just starting your journey in the financial world, this guide will equip you with the knowledge needed to make informed decisions about dividend-paying stocks and better understand the implications of dividend credit.

Definition of Dividend Credit

Dividend credit refers to the portion of a company’s profits that is distributed to shareholders as a form of payment. It is essentially the amount of money that is credited to shareholders’ accounts based on their ownership of the company’s shares.

When a company generates profits, it has the option to retain those earnings for reinvestment or distribute them to shareholders. If the company chooses to distribute the profits as dividends, shareholders become eligible to receive dividend credits.

Dividend credit is typically expressed as a per-share amount. It is calculated by dividing the total amount of dividends paid by the number of shares outstanding. For example, if a company pays a dividend of $2 per share and an investor holds 100 shares, their dividend credit will be $200.

It is important to note that not all companies pay dividends. Dividend payment is typically more common among established, profitable companies that have a history of generating excess cash. Start-ups and high-growth companies often reinvest their profits back into the business to fuel expansion and innovation.

Dividend credit can either be paid in cash or in the form of additional shares, known as dividend reinvestment. When paid in cash, the dividend credit is deposited directly into the shareholder’s brokerage or investment account. In the case of dividend reinvestment, the credited amount is used to purchase additional shares of the company’s stock at the prevailing market price.

Overall, dividend credit is a way for companies to reward shareholders for their investment in the company. It provides investors with a tangible benefit in the form of regular income, making it an attractive feature for income-focused investors seeking a steady stream of returns.

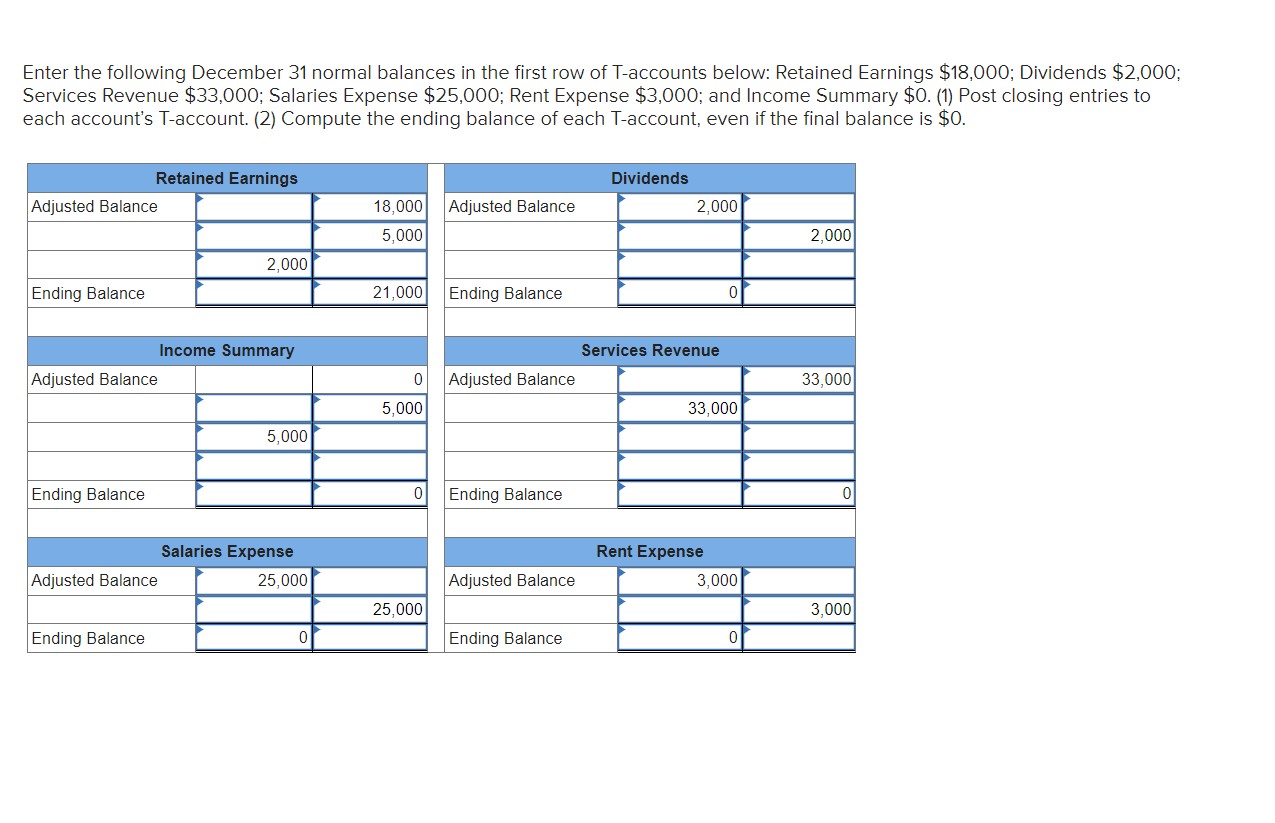

How Dividend Credit Works

Dividend credit works by allocating a portion of a company’s profits to shareholders based on their ownership of the company’s shares. Here’s a step-by-step breakdown of how dividend credit works:

- Profit Generation: A company generates profits through its operations, which can come from various sources such as sales of its products or services.

- Dividend Declaration: The company’s board of directors decides to distribute a portion of the profits as dividends to shareholders. The declaration usually occurs during the company’s annual general meeting or through other official announcements.

- Record Date: The company establishes a record date, also known as the ex-dividend date. Shareholders who own the company’s shares on or before this date are eligible to receive the dividend credit. Anyone who purchases shares after the record date will not be entitled to the dividend credit for that specific period.

- Dividend Payment: On the dividend payment date, the company transfers the dividend credit to the eligible shareholders. If the payment is in cash, it is usually deposited directly into the shareholder’s brokerage or investment account. In the case of dividend reinvestment, the credited amount is used to purchase additional shares at the market price.

The amount of dividend credit received by a shareholder is determined by two main factors: the dividend per share and the number of shares owned. Dividend per share is the total amount of dividend declared divided by the number of outstanding shares. For example, if a company declares a dividend of $1 per share and an investor owns 100 shares, they will receive a dividend credit of $100.

It’s important to understand that the dividend credit is based on the company’s profits and is subject to change. Companies may increase, decrease, or even suspend dividend payments based on their financial performance, cash flow position, and strategic priorities.

Dividend credit is a vital component of total return for shareholders. It provides them with a regular stream of income in addition to any capital gains from share price appreciation. By reinvesting the dividend credit or utilizing it for other financial goals, investors can maximize their wealth accumulation and potentially compound their returns over time.

Importance of Dividend Credit

Dividend credit is of great importance to both individual investors and the overall financial market. Here are some key reasons why dividend credit holds significance:

- Steady Income Stream: Dividend credit provides shareholders with a consistent income stream. This can be particularly valuable for retirees or investors seeking regular cash flow to cover living expenses or reinvest in other investment opportunities.

- Dividend Growth Potential: Companies that have a track record of consistently increasing their dividend payments can provide shareholders with the potential for dividend growth. Dividend growth is often an indication of a company’s financial health, stability, and successful long-term performance.

- Portfolio Diversification: Dividend-paying stocks can help diversify an investment portfolio. Adding dividend-paying companies to a portfolio can reduce overall volatility and provide a source of stable returns, especially during periods of market turbulence.

- Inflation Hedge: Dividend credit has the potential to act as a hedge against inflation. As companies increase their dividend payments over time, shareholders can benefit from a rising income stream that helps preserve their purchasing power in an inflationary environment.

- Long-Term Wealth Accumulation: Reinvesting dividend credits by purchasing additional shares can lead to long-term wealth accumulation. Through the power of compounding, reinvested dividends can generate significant returns over the course of an investor’s holding period.

- Indicator of Company Health: Dividend credit can serve as an indicator of a company’s financial health and profitability. Companies that consistently pay dividends demonstrate their ability to generate sustainable profits and effectively allocate capital.

- Attractiveness to Investors: Dividend-paying stocks are often considered attractive investments, and dividend credit can make a stock more appealing to investors. This can lead to increased demand for the company’s shares, potentially driving up the stock price.

Overall, dividend credit plays a vital role in providing investors with income, potential growth, diversification, and long-term wealth accumulation opportunities. It allows shareholders to derive value from their investment beyond capital appreciation and adds stability to their overall investment strategy.

Factors Affecting Dividend Credit

Several factors influence the amount of dividend credit that a company distributes to its shareholders. Understanding these factors can help investors make informed decisions and manage their expectations regarding dividend payments. Here are the key factors that affect dividend credit:

- Company’s Financial Performance: The financial performance of a company is a critical factor in determining its ability to pay dividends. Companies with consistent and growing profits are more likely to have the financial strength to distribute higher dividend credits to their shareholders.

- Profitability and Cash Flow: A company’s profitability and cash flow are closely tied to its dividend-paying ability. Positive cash flow is necessary to cover dividend payments, ensuring that the company does not strain its financial position.

- Dividend Policy: A company’s dividend policy outlines its intentions on paying dividends and can influence the level of dividend credit. Some companies have a policy of consistently paying dividends, while others may have more variable or irregular dividend payments.

- Investment Opportunities: Companies may choose to retain earnings and reinvest them in growth opportunities instead of distributing them as dividends. If a company identifies significant growth prospects, it may allocate funds towards investments in research and development, acquisitions, or capital expenditures, which could impact the amount of dividend credit.

- Industry and Market Conditions: Market conditions and the economic climate can impact a company’s dividend-paying ability. During challenging economic times or industry downturns, companies may reduce or suspend dividend payments to preserve cash and strengthen their financial position.

- Debt Levels and Financial Obligations: Companies with high debt levels or significant financial obligations may prioritize debt repayment or meeting other obligations over paying dividends. Servicing debt and fulfilling financial commitments take precedence, potentially leading to lower dividend credit.

- Legal Restrictions and Regulatory Requirements: Companies must comply with legal restrictions and regulatory requirements when paying dividends. These may include capital adequacy ratios, debt covenants, or specific regulations imposed by regulatory bodies, which can impact the company’s ability to distribute dividend credit.

It’s important to note that the factors affecting dividend credit can vary across companies and industries. Investors should analyze these factors, along with their own investment objectives and risk tolerance, to make informed decisions about dividend-paying stocks.

Advantages of Dividend Credit

Dividend credit offers several advantages to both individual investors and the overall market. Here are the key advantages of dividend credit:

- Regular Income: Dividend credit provides investors with a steady income stream. This is particularly beneficial for retirees or those who rely on investment income to cover living expenses.

- Income Stability: Dividend-paying stocks can help stabilize an investment portfolio by providing a consistent source of returns, even during market downturns. Dividends can offset potential capital losses and reduce overall portfolio volatility.

- Long-Term Wealth Accumulation: Reinvesting dividend credits can lead to long-term wealth accumulation. By purchasing additional shares, investors can benefit from compounding returns and potentially increase their investment over time.

- Portfolio Diversification: Dividend-paying stocks can be an effective means of diversifying an investment portfolio. They can provide an additional income stream and potentially enhance risk-adjusted returns.

- Indicator of Company Strength: Companies that consistently pay dividends demonstrate their financial strength, stability, and commitment to shareholders. Dividend credit can serve as an indicator of a company’s solid financial health and profitability.

- Attractive to Income-Focused Investors: Dividend-paying stocks are attractive to income-focused investors seeking steady and reliable income. Many dividend-paying companies prioritize maintaining and increasing their dividend payments, making them appealing for income-oriented investment strategies.

- Potential for Dividend Growth: Some companies have a history of regularly increasing their dividend payments over time. Investing in such companies can provide investors with the potential for growing dividend income, aiding in the preservation of purchasing power against inflation.

- Tax Advantages: In some jurisdictions, dividend income may have preferential tax treatment compared to other forms of investment income. Investors should consult with tax professionals to understand the tax implications of dividend credit in their specific situation.

Overall, dividend credit offers a range of advantages, including regular income, stability, wealth accumulation potential, diversification, company strength indication, attractiveness to income-focused investors, potential for dividend growth, and potential tax advantages. Investors should carefully consider these advantages in relation to their investment goals and risk tolerance when considering dividend-paying stocks.

Disadvantages of Dividend Credit

While dividend credit offers several advantages, it is important to consider the potential disadvantages associated with this form of income. Here are the key disadvantages of dividend credit:

- Market Volatility and Share Price Decline: A company’s dividend payments are not guaranteed and can fluctuate over time. If a company faces financial challenges or experiences a decline in its profitability, it may reduce or suspend dividend payments. This can result in a decline in the stock’s share price, potentially impacting the investor’s overall returns.

- Reduced Capital for Growth: When companies distribute a significant portion of their profits as dividends, it limits the availability of capital for future growth opportunities. This can have a potential impact on a company’s ability to innovate, expand, or make strategic investments.

- Opportunity Cost: Receiving dividend credit means that the investor is forgoing the opportunity to reinvest those funds elsewhere. Depending on market conditions and investment opportunities, the potential return from reinvestment may outweigh the benefit of receiving dividend income.

- Tax Implications: Dividends may be subject to different tax treatment compared to other forms of investment income. The tax liability associated with dividend income can vary depending on the investor’s jurisdiction and personal tax situation. Investors should consult with tax professionals to understand the potential tax implications of dividend credit in their specific circumstances.

- Inefficient Allocation of Capital: Companies that consistently pay dividends may be limited in their ability to allocate capital efficiently. By prioritizing dividend payments, the company may miss out on investment opportunities that could generate higher returns for shareholders.

- Reliability of Dividend Payments: It’s important to note that not all companies pay dividends. Start-ups and high-growth companies often reinvest their profits back into the business instead of distributing them as dividends. Therefore, investors seeking dividend credit may have limited choices, especially in certain sectors or industries.

- Dependency on Dividend-Paying Companies: Relying heavily on dividend-paying stocks can lead to an over-concentration of investments in certain sectors or industries. This can increase portfolio risk if those sectors or industries face challenges affecting their ability to sustain or increase dividend payments.

Investors should carefully weigh the potential disadvantages of dividend credit against their investment goals, risk tolerance, and overall portfolio strategy. It is important to diversify investments and consider a balanced approach that aligns with individual financial objectives.

Examples of Dividend Credit Calculation

Let’s take a look at a couple of examples to illustrate how dividend credit is calculated:

Example 1:

Company XYZ declares a dividend of $0.50 per share for the quarter. Investor A owns 200 shares of the company’s stock. To calculate the dividend credit for Investor A, we multiply the dividend per share by the number of shares owned:

$0.50 (dividend per share) x 200 (number of shares) = $100

Investor A’s dividend credit for the quarter would be $100.

Example 2:

Company ABC announces a dividend of $1.20 per share for the year. Investor B owns 500 shares. We can calculate the dividend credit for Investor B as follows:

$1.20 (dividend per share) x 500 (number of shares) = $600

Investor B would receive a dividend credit of $600 for the year.

It’s important to note that the dividend credit calculation is based on the number of shares owned by the investor. Therefore, shareholders with a higher number of shares will receive a larger dividend credit compared to those with fewer shares.

Furthermore, dividend payments can be made on a quarterly, semi-annual, or annual basis, depending on the company’s dividend policy. The dividend per share can also vary from one period to another, as it is determined by the company’s board of directors and depends on various factors, including financial performance, cash flow, and strategic considerations.

Investors should keep in mind that the dividend credit they receive may be subject to taxes, depending on their jurisdiction and applicable tax laws. It’s advisable for investors to consult with tax professionals to understand the tax implications of dividend income in their specific situation.

These examples demonstrate how dividend credit calculation works, providing a clearer understanding of how investors receive returns on their investment in the form of dividends.

Conclusion

Dividend credit is a fundamental concept in finance that plays a crucial role for both individual investors and the broader market. It represents the portion of a company’s profits that is distributed to shareholders as a form of payment based on their ownership of the company’s shares.

In this comprehensive guide, we have explored the definition, working mechanism, and importance of dividend credit. We have discussed the factors that influence dividend credit, advantages, and disadvantages associated with this form of income, as well as provided examples of dividend credit calculations.

For investors, dividend credit offers several advantages such as regular income, income stability, potential for dividend growth, portfolio diversification, and an indicator of company strength. Dividend-paying stocks can provide a reliable source of returns, especially for income-focused investors seeking steady cash flow and long-term wealth accumulation opportunities.

However, it is important to consider the potential disadvantages, including market volatility, reduced capital for growth, tax implications, and the reliance on dividend-paying companies. Investors should carefully evaluate their investment objectives, risk tolerance, and overall portfolio strategy when incorporating dividend-paying stocks into their investment approach.

Understanding dividend credit and its implications allows investors to make informed decisions regarding dividend-paying stocks, capitalize on potential income opportunities, and navigate the ever-changing dynamics of the financial markets.

Remember, while dividend credit can be a valuable source of income, it is always essential to conduct thorough research, diversify investments, and seek professional advice to build a well-rounded and resilient investment portfolio.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in stocks and other financial instruments involves risks and past performance is not indicative of future results. Individuals should carefully consider their financial circumstances and consult with a qualified professional before making any investment decisions.