Finance

What Are Cash Dividends

Published: January 2, 2024

Learn all about cash dividends in finance. Understand how they work, their benefits, and how to calculate them. Start maximizing your investment returns today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in stocks, one of the most common ways for companies to share their profits with shareholders is through cash dividends. Cash dividends are a distribution of a company’s earnings to its shareholders in the form of cash payments.

In simple terms, cash dividends are like a reward for investors who own shares of a company. They serve as a way for the company to distribute its profits to shareholders and provide them with a tangible return on their investment. Cash dividends can be a desirable feature for investors, as they provide a regular income stream and can contribute to the overall performance and attractiveness of a stock.

While cash dividends are a fundamental aspect of investing, understanding how they work and their implications is crucial for both seasoned and novice investors. In this article, we will explore the concept of cash dividends in detail, including their definition, calculation, key dates, advantages, disadvantages, impact on stock price, and taxation.

Definition of Cash Dividends

Cash dividends refer to the distribution of a company’s profits to its shareholders in the form of cash payments. They are typically paid out on a regular basis, such as quarterly or annually, and are based on the company’s financial performance and the number of shares owned by each shareholder.

When a company decides to issue cash dividends, it sets a specific amount per share that will be paid out to the shareholders. For example, if a company declares a cash dividend of $0.50 per share and an investor owns 100 shares, they would receive a cash payment of $50.

Cash dividends are usually paid out of a company’s retained earnings, which are the accumulated profits from previous years that have not been reinvested back into the business. By distributing cash dividends, companies aim to reward shareholders for their investment in the company and to attract and retain investors.

It’s important to note that not all companies pay cash dividends. Some companies, especially in the technology and growth sectors, may choose to reinvest their profits into research and development, acquisitions, or debt reduction instead of distributing them to shareholders. These companies may offer the potential for capital appreciation rather than regular cash dividends.

It’s also worth mentioning that cash dividends are not guaranteed. A company’s board of directors has the discretion to determine whether to distribute cash dividends and at what rate. If a company is facing financial difficulties or needs to allocate its profits for other purposes, it may choose to reduce or omit cash dividends for a period of time.

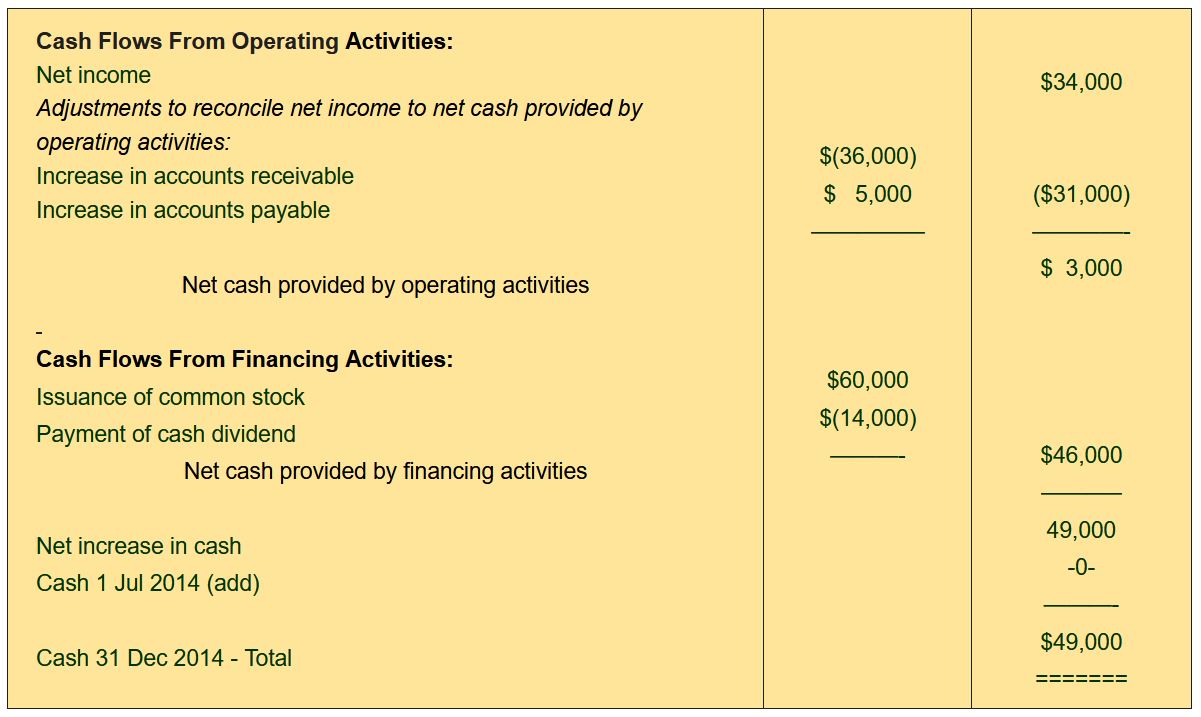

How Cash Dividends are Calculated

The calculation of cash dividends is based on a few key factors, including the company’s earnings, the number of outstanding shares, and the dividend payout ratio. Let’s explore each of these components in more detail:

Company Earnings: The first step in determining cash dividends is to assess the company’s earnings. These earnings represent the net profit the company generates during a specific period, usually a quarter or a year. It’s important to note that companies may choose to pay dividends out of their current earnings, or they may use retained earnings – the accumulated profits from previous years.

Number of Outstanding Shares: The next factor in calculating cash dividends is the total number of outstanding shares. This refers to the shares of stock that have been issued by the company and are currently held by investors. The more shares you own, the higher your cash dividend payment will be.

Dividend Payout Ratio: The dividend payout ratio is the proportion of earnings that a company decides to distribute as cash dividends. It is calculated by dividing the total amount of cash dividends paid by the company by its total earnings. For example, if a company has earnings of $1 million and pays out $200,000 in cash dividends, the dividend payout ratio would be 20%.

The dividend payout ratio is an essential factor for investors as it indicates the portion of a company’s earnings that is returned to shareholders rather than being retained by the company for future investments or expansion.

Once these factors are considered, the calculation of cash dividends is relatively straightforward. The formula to determine the cash dividend per share is:

Cash Dividend per Share = (Earnings x Dividend Payout Ratio) / Number of Outstanding Shares

It’s important to note that companies have the flexibility to adjust their dividend payout ratio based on various factors, such as their financial performance, growth plans, and cash flow requirements. Companies with stable earnings and a history of consistent dividend payments tend to have more predictable dividend calculations.

Ultimately, the calculation of cash dividends aims to distribute a fair and proportional amount of the company’s profits to shareholders, providing them with a tangible return on their investment.

Key Dates for Cash Dividends

When it comes to cash dividends, there are several key dates that investors need to be aware of to ensure they receive their dividend payments. These dates play a crucial role in determining eligibility and timing. Let’s take a closer look at each of these key dates:

Declaration Date: This is the date on which a company’s board of directors announces their intention to pay a cash dividend. The declaration date involves the board approving the dividend, setting the amount per share, and establishing the record date. It is important to note that the declaration of cash dividends does not guarantee their payment; it is simply an official announcement by the company.

Record Date: Also known as the ownership date, the record date is the specific date on which an investor must hold the shares to be eligible to receive the cash dividend. Only shareholders registered on the record date are entitled to the dividend payment. If an investor buys shares after the record date but before the ex-dividend date, they will still be eligible for the dividend.

Ex-Dividend Date: The ex-dividend date is the first day on which a stock trades without the right to receive the upcoming dividend payment. When a stock trades ex-dividend, it means that the buyer of the shares will not be entitled to the dividend, while the seller will still receive it. Typically, the ex-dividend date is set two business days before the record date to allow for proper settlement of transactions.

Payment Date: This is the date on which the company disburses the cash dividend to eligible shareholders. It is the day investors can expect to receive their dividend payments in their investment accounts. The payment date is usually a few weeks after the record date and allows the company time to finalize the dividend distribution.

It is crucial for investors to be aware of these dates and closely monitor them to ensure they meet the eligibility requirements and receive their cash dividend payments. Missing the record date or purchasing shares after the ex-dividend date could result in the investor not receiving the dividend for that particular period.

Financial websites, brokerage platforms, and company investor relations pages are valuable resources for staying informed about upcoming dividend dates. By being proactive and staying up to date with these key dates, investors can manage their expectations and make informed decisions regarding their investments.

Advantages of Cash Dividends

Cash dividends offer several advantages for investors. Let’s explore some of the key benefits:

1. Regular Income Stream: Cash dividends provide a regular income stream to shareholders. For individuals seeking consistent cash flow from their investments, cash dividends can be a reliable source of income. Additionally, investors can choose to reinvest the dividends or use them for their immediate financial needs.

2. Tangible Return on Investment: Cash dividends provide a tangible return on investment. As a shareholder, receiving a cash dividend is a direct acknowledgment of your ownership stake in the company and your entitlement to a share of its profits. This can boost investor confidence and satisfaction.

3. Income Stability: Companies that consistently pay cash dividends often demonstrate financial stability and profitability. Regular dividend payments can be a sign of a reliable and well-established company that generates consistent earnings, which can attract investors seeking more stable investments.

4. Reinvestment Opportunities: Cash dividends give investors the choice to reinvest their earnings back into the company. By purchasing additional shares, investors can potentially increase their ownership stake and benefit from any future growth or capital appreciation. This can be especially advantageous for long-term investors looking to compound their returns.

5. Value Indicator: Cash dividends can be viewed as an indicator of a company’s financial health and confidence in its future prospects. Companies that consistently increase their dividend payments over time may be perceived as financially strong and well-managed. This can attract new investors and potentially drive up the stock price.

6. Diversification: Including dividend-paying stocks in an investment portfolio can provide diversification benefits, reducing overall risk. Dividend stocks tend to be more stable and less volatile compared to companies that do not pay dividends. By diversifying across various dividend-paying stocks across different sectors, investors can potentially reduce their exposure to market fluctuations.

It’s important to note that the advantages of cash dividends may vary depending on an individual’s investment goals, risk tolerance, and overall investment strategy. While some investors prioritize regular income and stability, others may focus more on growth potential and capital appreciation.

Before investing in dividend-paying stocks, it is recommended to conduct thorough research and consider factors such as the company’s financial health, dividend history, and industry trends. Consulting with a financial advisor can also provide valuable insights and guidance.

Disadvantages of Cash Dividends

While cash dividends have their advantages, it’s important to consider the potential disadvantages as well. Here are some drawbacks to be aware of:

1. Opportunity Cost: When a company pays out cash dividends, it reduces the amount of capital available for reinvestment in the business. This can limit the company’s ability to pursue growth opportunities, such as research and development, acquisitions, or expanding into new markets. In some cases, companies may forgo dividends to reinvest in areas that can potentially generate higher returns in the long run.

2. Market Expectations: Companies that consistently pay out generous cash dividends may create market expectations for future dividends. If a company needs to reduce or eliminate its dividend payments due to financial challenges or strategic changes, it can lead to disappointment among shareholders and potentially result in a negative impact on the stock price.

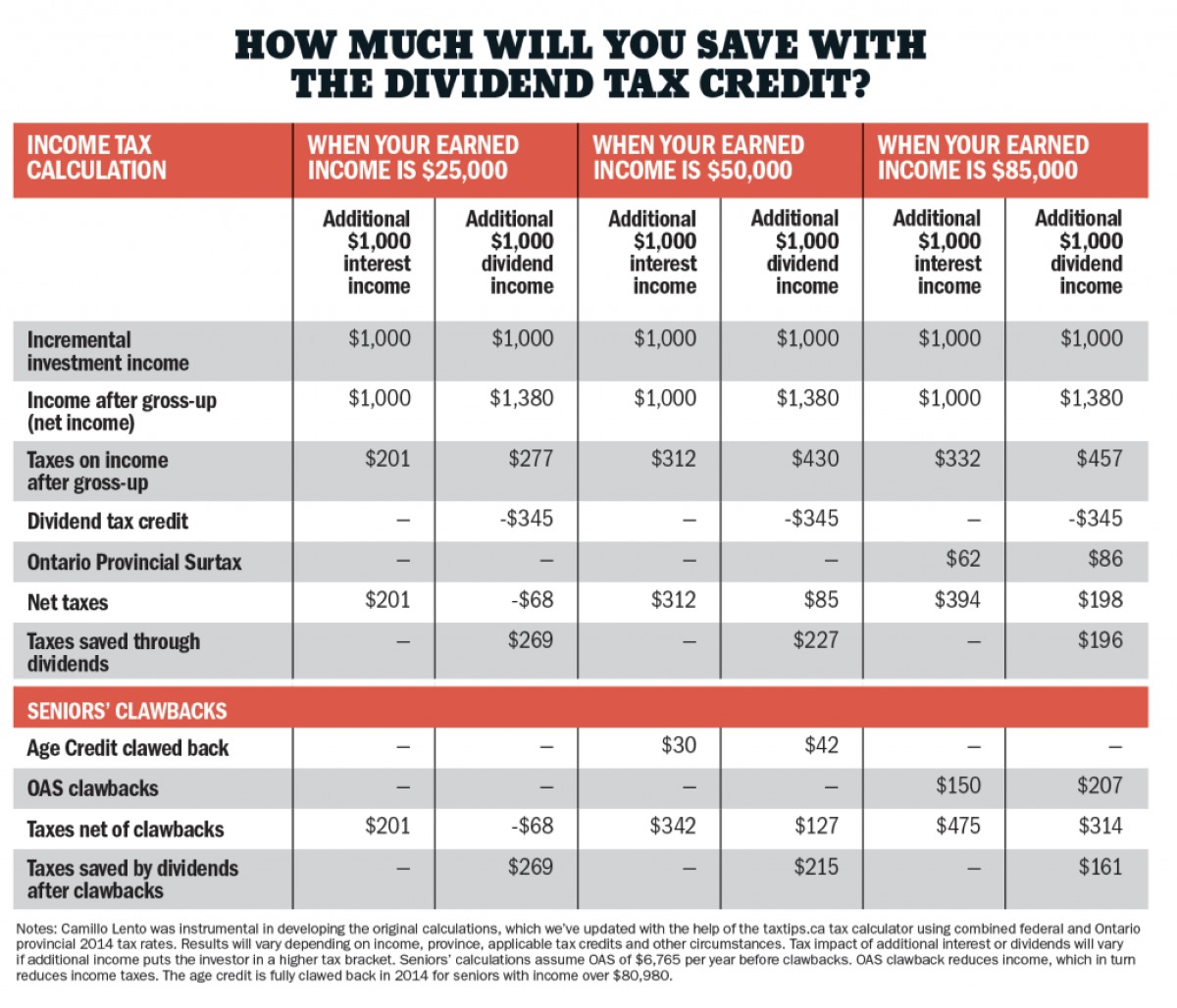

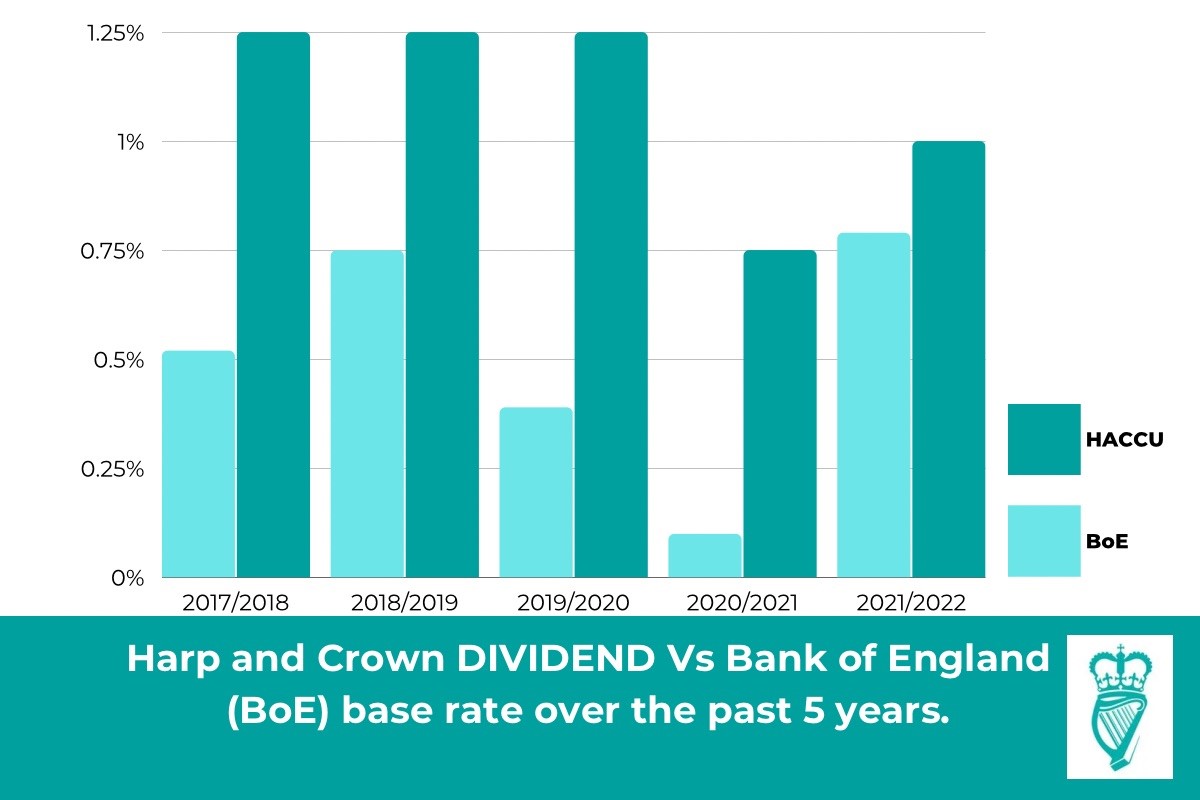

3. Tax Implications: Cash dividends are subject to taxation. The tax rate can vary depending on an individual’s income level and the tax laws of the country in which they reside. For some investors, dividend income may be taxed at a higher rate compared to other forms of investment income, such as capital gains. It’s important to consult with a tax advisor to understand the tax implications of cash dividends in your specific situation.

4. Lack of Control: As a shareholder, you have limited control over the decision-making process of the company. By receiving cash dividends, you are essentially relying on the management’s decision to distribute profits rather than reinvesting in the business. This lack of control can be a disadvantage for investors who prefer to have a say in how the company is managed.

5. Potential Signaling: In some cases, a significant change in dividend policy can signal underlying issues within a company. For example, a sudden decrease or suspension of dividend payments may raise concerns about the company’s financial health or future prospects. Shareholders may interpret such actions as a negative signal and react accordingly, potentially leading to a decline in the stock price.

6. Dividend Dependence: Some investors may become overly dependent on cash dividends as a source of income, especially during retirement. Relying too heavily on dividend payments can limit flexibility and potential growth in other areas of investment. It is important to diversify income sources to mitigate the risks associated with relying solely on dividend income.

While cash dividends can provide a steady income stream and tangible returns for investors, it’s crucial to consider these potential disadvantages and evaluate their impact on your investment strategy and goals. Balancing the desire for income with the need for potential growth and reinvestment is essential when evaluating the suitability of cash dividends in your investment portfolio.

Impact of Cash Dividends on Stock Price

Cash dividends can have an impact on the stock price of a company, although the relationship is complex and dependent on various factors. Here are some key points to understand:

1. Demand for Dividend-Paying Stocks: Investors who are seeking regular income may be attracted to dividend-paying stocks. The demand for these stocks can increase, driving up the stock price. This increased demand is especially evident among income-oriented investors, such as retirees or those seeking more stable returns.

2. Dividend Yield: The dividend yield is a measure of the dividend payout relative to the stock price. As the dividend yield increases, it can make a stock more attractive to income-focused investors. This increased demand can lead to an increase in the stock price to reflect the higher demand and lower dividend yield.

3. Perceived Financial Health: Consistent dividend payments can be seen as a sign of a company’s financial strength and stability. Companies that consistently raise or maintain their dividend payments may be viewed more favorably by investors, potentially leading to an increase in the stock price.

4. Dividend Policy Changes: Any changes in a company’s dividend policy, such as a decrease or suspension in dividend payments, can have a significant impact on the stock price. Negative changes may signal financial difficulties or a shift in the company’s future prospects, resulting in a decline in investor confidence and a lower stock price.

5. Dividend Reinvestment: Some investors choose to reinvest their dividends back into the company by purchasing additional shares. This reinvestment can contribute to an increase in demand for the stock, potentially driving up the stock price.

6. Overall Market Conditions: It’s important to consider that the stock price is not solely influenced by cash dividends. Other factors, such as overall market conditions, industry trends, company performance, and economic factors, also play a significant role. These factors can overshadow or offset the impact of cash dividends on the stock price.

It’s worth noting that the impact of cash dividends on stock price can vary based on individual investor preferences and market dynamics. Investors should conduct thorough research, consider their investment goals, and consult with financial advisors to evaluate the potential impact of cash dividends on the stock price of specific companies in their portfolio.

Taxation of Cash Dividends

When it comes to cash dividends, it is important for investors to understand the tax implications associated with these payments. The taxation of cash dividends can vary depending on the country in which an investor resides and their individual tax situation. Here are some key points to consider:

1. Taxed as Ordinary Income: In many countries, cash dividends are subject to taxation as ordinary income. This means that they are usually taxed at the individual’s applicable income tax rate, which can be higher than the tax rate for other forms of investment income, such as long-term capital gains.

2. Dividend Tax Rates: Some countries have specific tax rates for dividends that are lower than the ordinary income tax rates. These lower rates are designed to incentivize investment and promote shareholder participation in the capital markets. Investors should consult their local tax regulations or seek professional advice to determine the specific dividend tax rates applicable to them.

3. Qualified Dividends: In certain countries, including the United States, certain dividends may qualify for lower tax rates known as qualified dividends. To qualify for these lower tax rates, specific holding period requirements must be met, such as holding the underlying stock for a certain period of time. It’s important to understand the rules and qualifications for receiving preferential tax treatment on dividends.

4. Withholding Taxes: In some cases, dividends may be subject to withholding taxes, particularly if the investor is a non-resident or if there are tax treaties in place between countries. Withholding taxes are typically deducted at the source by the company distributing the dividends, and the remaining amount is provided to the investor. Investors may need to reclaim the withheld taxes or seek tax credits based on their country’s tax laws and agreements.

5. Tax Reporting: Investors receiving cash dividends are generally required to report those dividends on their tax returns. Companies issuing dividends typically provide documentation, such as Form 1099 in the United States, which details the amount of dividends received during the tax year. Investors should consult with tax professionals or follow local tax regulations to ensure accurate reporting.

It’s important for investors to be aware of their local tax laws and regulations regarding cash dividends. Seeking advice from tax professionals or utilizing tax resources provided by relevant government authorities can help investors navigate the tax implications associated with cash dividends and ensure compliance with tax requirements.

Investors should also keep in mind that tax laws and regulations can change over time, so it is important to stay informed and updated on any changes that may affect the taxation of cash dividends.

Conclusion

Cash dividends play a significant role in the world of investing, providing investors with a regular income stream and a tangible return on their investment. Understanding the definition, calculation, key dates, advantages, disadvantages, impact on stock price, and taxation of cash dividends is essential for investors looking to make informed decisions regarding their investment portfolio.

Cash dividends offer several advantages, such as providing a steady income stream, a tangible return on investment, income stability, reinvestment opportunities, and acting as an indicator of a company’s financial health. Diversifying with dividend-paying stocks can also provide stability and potential protection against market volatility.

However, cash dividends also come with some drawbacks, including the opportunity cost of potential reinvestment, market expectations, tax implications, limited control over company decision-making, and the risk of overdependence on dividend income.

In terms of the impact on stock price, cash dividends can influence demand for dividend-paying stocks, the dividend yield, perceived financial health, and overall market conditions. Understanding these factors can help investors assess the potential impact on stock prices resulting from cash dividend payments.

Finally, the taxation of cash dividends varies by country and individual circumstances. Investors should be aware of the tax implications, including potential withholding taxes, qualified dividends, and the need for accurate reporting on tax returns. Seeking professional advice and staying informed about tax laws and regulations is essential for efficient tax management.

In conclusion, cash dividends are a fundamental aspect of investing, offering advantages and disadvantages that should be carefully considered. By understanding the concept of cash dividends and their impact, investors can make informed investment decisions and tailor their strategies to align with their financial goals and risk tolerance.