Home>Finance>Why Would A Firm Consider Futures Contracts Instead Of Forward Contracts?

Finance

Why Would A Firm Consider Futures Contracts Instead Of Forward Contracts?

Modified: February 21, 2024

Discover the advantages of futures contracts over forward contracts for finance firms. Explore why these financial instruments are preferred in risk management and market speculation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition and Overview of Futures Contracts

- Definition and Overview of Forward Contracts

- Advantages of Futures Contracts over Forward Contracts

- Risk Mitigation in Futures Contracts

- Liquidity and Marketability of Futures Contracts

- Standardization and Accessibility of Futures Contracts

- Cost of Futures Contracts versus Forward Contracts

- Conclusion

Introduction

When it comes to managing financial risk, firms have several options, including utilizing derivatives contracts such as futures and forward contracts. These contracts help businesses hedge against price fluctuations in commodities, currencies, or financial instruments. While both futures and forward contracts serve a similar purpose, there are distinct advantages to using futures contracts over forward contracts.

In this article, we will explore the reasons why a firm might consider futures contracts instead of forward contracts. We will delve into the definitions and overview of both contract types, discuss the advantages of futures contracts, and highlight specific aspects such as risk mitigation, liquidity, standardization, and cost. By understanding these key factors, businesses can make informed decisions when it comes to risk management strategies.

Before we proceed, let’s first define and distinguish between futures contracts and forward contracts.

Definition and Overview of Futures Contracts

A futures contract is a legally binding agreement between two parties to buy or sell a specific asset (commodity, currency, stock, etc.) at a predetermined price and on a specific date in the future. These contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange, and are standardized in terms of contract size, expiration date, and deliverable quality.

Futures contracts are typically marked-to-market daily, meaning the gains and losses are settled daily based on the current market price. This system ensures transparency and minimizes the risk of default. Additionally, futures contracts are highly liquid, allowing traders to enter and exit positions easily.

Definition and Overview of Forward Contracts

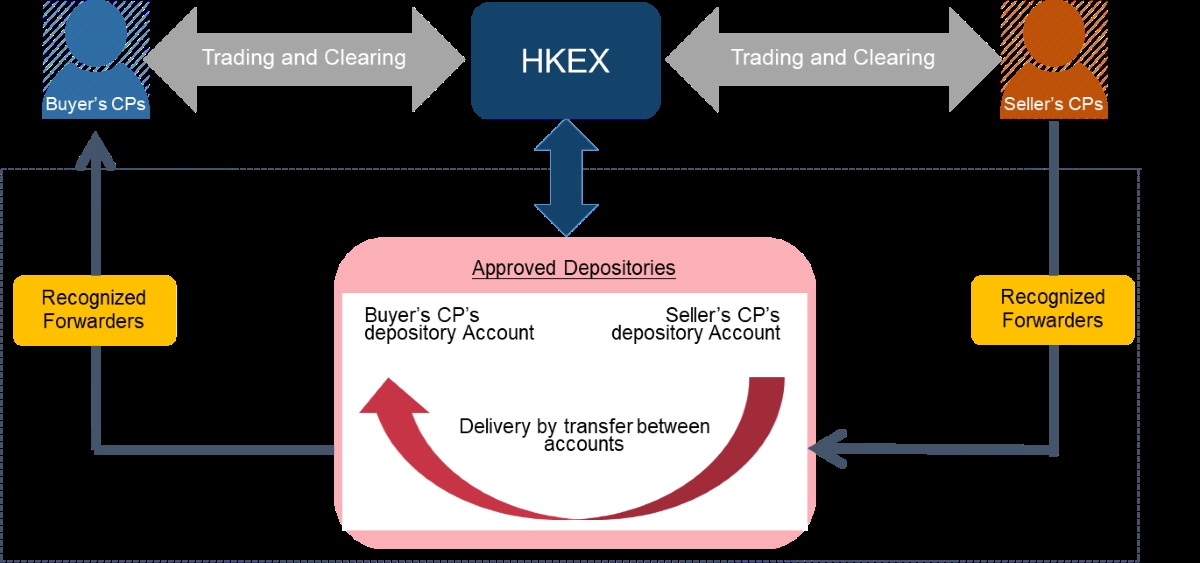

On the other hand, a forward contract is a private agreement between two parties to buy or sell a specific asset at a predetermined price on a specific date in the future. Unlike futures contracts, forward contracts are not traded on exchanges but are negotiated directly between the buyer and the seller. As a result, forward contracts are highly customizable to suit the specific needs of the parties involved.

Forward contracts are typically settled once at maturity, meaning the gains or losses are realized only at the expiration date. These contracts carry a higher risk of default due to the lack of centralized clearing and marking-to-market.

Now that we have established the definitions and differences between futures and forward contracts, let’s explore the advantages that futures contracts offer over forward contracts.

Definition and Overview of Futures Contracts

A futures contract is a standardized agreement between two parties to buy or sell a specific asset at a predetermined price and date in the future. These contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME), with each exchange specifying the contract size, quality, and expiration date. Many different types of assets can be traded as futures, including commodities, currencies, stock indexes, and interest rates.

One of the key features of futures contracts is their standardization, which provides a level playing field for all market participants. This standardization ensures that every contract traded on the exchange is identical in terms of the underlying asset, contract size, and settlement procedure. For example, a gold futures contract traded on the CME represents 100 troy ounces of gold with specific quality specifications. This standardization allows for easy comparison and efficient trading.

Futures contracts also have a predetermined expiration or delivery date. Depending on the contract, there can be monthly expirations or other specific dates throughout the year. The delivery date is when the buyer of the contract is obligated to take delivery of the underlying asset (in the case of a physical settlement) or settle the contract financially based on the difference between the contract price and the prevailing market price (in the case of a cash settlement).

Another important aspect of futures contracts is the concept of marking-to-market. This means that the gains and losses on the contract are settled daily based on the current market price. At the end of each trading day, the exchange adjusts the margin accounts of both the buyer and the seller to reflect the change in value of the futures contract. This system ensures transparency and minimizes the risk of default.

Futures contracts are highly liquid, meaning they can be easily bought or sold in the market. Due to their standardized nature and the presence of a centralized exchange, there is a constant flow of buyers and sellers. This liquidity allows traders and investors to enter and exit positions quickly, thereby reducing the impact of price fluctuations and providing more flexibility for risk management strategies.

In summary, futures contracts are standardized agreements to buy or sell a specific asset at a predetermined price and date in the future. The contracts trade on organized exchanges, with each contract representing a standardized unit of the underlying asset. Futures contracts offer transparency, liquidity, and the ability to hedge against price fluctuations, making them an attractive choice for risk management and speculation.

Definition and Overview of Forward Contracts

A forward contract is a private agreement between two parties to buy or sell a specific asset at a predetermined price on a future date. Unlike futures contracts, which are traded on organized exchanges, forward contracts are negotiated directly between the buyer and the seller, often through intermediaries such as banks or brokers. This allows for a greater degree of customization and flexibility in terms of contract specifications compared to futures contracts.

Forward contracts are used to hedge against price volatility, speculate on future price movements, or secure future supply or demand of an asset. The underlying assets of forward contracts can vary widely and include commodities, currencies, interest rates, and even certain securities.

One of the distinguishing characteristics of forward contracts is their bespoke nature. Parties involved in a forward contract can tailor the agreement to their specific needs, including the contract size, delivery date, and even the quality of the asset being exchanged. This flexibility can be advantageous for businesses that require specific terms that are not readily available in the standardized futures market.

Unlike futures contracts, which require daily marking-to-market and the posting of margin, forward contracts typically do not have these features. This means that parties to a forward contract are not required to adjust their cash positions on a daily basis based on the market price of the asset. Instead, the gains or losses on a forward contract are realized only at the expiration or settlement date.

Since forward contracts are private agreements, there is a higher risk of default compared to futures contracts, as there is no central clearinghouse to guarantee the performance of the contract. This default risk can be mitigated through the use of collateral or credit checks, but it is important for both parties to carefully consider the creditworthiness and reputation of their counterparties.

Another distinguishing feature of forward contracts is the lack of liquidity compared to futures contracts. Since forward contracts are not traded on exchanges, finding a willing counterparty to enter into a forward contract may be more challenging. Additionally, the lack of a standardized market for forward contracts can result in wider bid-ask spreads and higher transaction costs.

In summary, forward contracts are customized agreements between two parties to buy or sell an asset at a predetermined price on a future date. They offer flexibility and customization but carry a higher risk of default and have less liquidity compared to futures contracts trading on organized exchanges. Forward contracts are suitable for businesses and individuals seeking tailor-made solutions to their specific risk management or hedging needs.

Advantages of Futures Contracts over Forward Contracts

While both futures contracts and forward contracts serve similar purposes in managing financial risk, there are several advantages to using futures contracts over forward contracts. These advantages stem from the standardized nature, liquidity, risk mitigation, marketability, and cost-effectiveness of futures contracts.

Risk Mitigation: Futures contracts offer enhanced risk mitigation compared to forward contracts. The marking-to-market feature ensures that gains and losses are settled daily, reducing the risk of default. Additionally, the presence of a centralized clearinghouse provides counterparty guarantees, further mitigating counterparty risk.

Liquidity and Marketability: Futures contracts are highly liquid, meaning there is a constant flow of buyers and sellers in the market. This liquidity allows traders and investors to enter or exit positions quickly and easily. In contrast, forward contracts are not as liquid since they are privately negotiated agreements without a centralized exchange.

Standardization: Futures contracts are standardized in terms of contract size, expiration date, and deliverable quality. This standardization ensures fair and transparent trading, allowing for easy comparison and efficient trading. On the other hand, forward contracts can be customized to suit the specific needs of the parties involved, but this customization may limit their marketability and liquidity.

Accessibility: Futures contracts often have greater accessibility compared to forward contracts. They are traded on organized exchanges, making them widely accessible to market participants. This accessibility allows businesses and investors of all sizes to access and utilize futures contracts as part of their risk management strategies.

Cost Effectiveness: Futures contracts can be more cost-effective compared to forward contracts. Due to the standardized nature of futures contracts and the high level of liquidity, bid-ask spreads tend to be narrower, reducing transaction costs. Additionally, the absence of negotiation and customization in futures contracts can save time and resources for market participants.

Regulation and Oversight: Futures contracts are subject to regulatory oversight and often have stringent reporting requirements. This regulation provides a level of transparency and investor protection not always found in private forward contracts. The presence of a regulated exchange and clearinghouse also ensures a fair and orderly market for trading futures contracts.

Overall, the advantages offered by futures contracts make them a popular choice for businesses and investors seeking efficient risk management tools. The risk mitigation, liquidity, standardization, accessibility, cost-effectiveness, and regulatory oversight associated with futures contracts make them a reliable and widely-used instrument in financial markets.

Risk Mitigation in Futures Contracts

Risk mitigation is a crucial aspect of financial markets, and futures contracts provide efficient tools for managing and mitigating various types of risks. Here are the key ways in which futures contracts offer risk mitigation advantages:

Price Risk: Futures contracts allow market participants to hedge against price fluctuations in the underlying asset. By taking positions in futures contracts, businesses can lock in prices for future purchases or sales, protecting themselves from adverse price movements. This is particularly important for industries heavily dependent on commodities such as oil, grains, or metals, where price volatility can significantly impact profitability.

Counterparty Risk: Futures contracts traded on organized exchanges have the advantage of a centralized clearinghouse. The clearinghouse acts as the counterparty to both the buyer and the seller, guaranteeing the performance of the contract. This eliminates the risk of default from the individual counterparty, providing a level of security and reducing counterparty risk.

Liquidity Risk: In times of market stress, liquidity can dry up, making it difficult to enter or exit positions. However, futures contracts are highly liquid due to their standardized nature and the presence of a centralized exchange. This liquidity ensures that market participants can easily buy or sell contracts, reducing the impact of liquidity risk and allowing for efficient risk management.

Systemic Risk: Systemic risk refers to the risk of a widespread financial crisis or disruption that affects the entire market. Futures contracts are subject to regulatory oversight and surveillance, helping to mitigate systemic risk by ensuring fair and orderly markets. Additionally, the presence of margin requirements and daily marking-to-market helps contain systemic risk by reducing the buildup of excessive leverage and encouraging risk management practices.

Variety of Risk Management Strategies: Futures contracts offer a range of risk management strategies to suit the needs of market participants. Whether it is hedging, speculative trading, or arbitrage, futures contracts provide flexibility and numerous trading opportunities. Different contract maturities, such as monthly or quarterly expirations, allow participants to choose the appropriate time horizon for their risk management needs.

Transparency and Price Discovery: The trading of futures contracts on organized exchanges provides transparency in price discovery. The exchange-traded nature of futures contracts results in real-time price information, allowing market participants to make informed decisions. This transparency enhances risk mitigation by ensuring fair, competitive, and efficient pricing in the market.

By utilizing futures contracts, businesses and investors can effectively manage and mitigate various types of risks. Whether it is hedging against price fluctuations, mitigating counterparty risk, addressing liquidity concerns, or navigating systemic risk, futures contracts provide valuable risk mitigation tools for participants in financial markets.

Liquidity and Marketability of Futures Contracts

Liquidity and marketability are important considerations for market participants when choosing financial instruments for risk management or investment purposes. Futures contracts offer distinct advantages in terms of liquidity and marketability. Here are the key points highlighting the liquidity and marketability of futures contracts:

Liquidity: Futures contracts are highly liquid financial instruments. This means that there is a large number of participants willing to buy or sell contracts at any given time. The presence of active buyers and sellers in the market ensures that market participants can easily enter or exit positions without impacting the market price significantly.

High Trading Volume: The liquidity of futures contracts is often reflected in high trading volumes. Due to their standardized nature and the presence of organized exchanges, futures contracts attract a significant number of market participants, including institutional investors, speculators, and hedgers. High trading volumes provide reassurance that there are ample opportunities for liquidity and that market orders can be executed efficiently.

Centralized Exchange: Futures contracts trade on centralized exchanges, where all trades are recorded and cleared through a central clearinghouse. This centralization is crucial for ensuring liquidity as it provides a central marketplace where buyers and sellers can come together to transact. The exchange serves as a hub that consolidates the liquidity from various market participants, enhancing the liquidity and marketability of futures contracts.

Continuous Availability: Futures contracts trading on exchanges are available for trading during specified trading hours. This ensures that market participants have continuous access to the market, allowing them to adjust their positions in response to market developments or manage their risk exposure in a timely manner. The continuous availability contributes to the liquidity of futures contracts.

Bid-Ask Spreads: The liquidity of futures contracts is also reflected in narrow bid-ask spreads. The bid price represents the highest price at which buyers are willing to purchase the contract, while the ask price represents the lowest price at which sellers are willing to sell the contract. The tighter the spread between the bid and ask prices, the more liquid the market. Narrow bid-ask spreads reduce transaction costs for market participants and enhance marketability.

Standardization: Futures contracts are standardized in terms of contract size, expiration dates, and deliverable quality. This standardization contributes to the liquidity and marketability of the contracts. It allows for easy comparison and seamless trading between market participants. The standardized nature also facilitates price discovery and ensures efficient trading in the market.

Price Transparency: Futures contracts traded on exchanges offer price transparency, as the prices are publicly available to all market participants. Price transparency enhances market confidence, as participants have access to real-time price information. This transparency also contributes to liquidity by facilitating fair pricing and informed decision-making.

In summary, the liquidity and marketability of futures contracts make them attractive to market participants. The highly liquid nature, high trading volumes, centralized exchange, continuous availability, narrow bid-ask spreads, standardization, and price transparency all contribute to the ease of trading and attractiveness of futures contracts. This liquidity and marketability enhance efficiency and provide opportunities for risk management, speculation, and investment strategies.

Standardization and Accessibility of Futures Contracts

Standardization and accessibility are two key factors that contribute to the popularity and usefulness of futures contracts in financial markets. Let’s explore how the standardization and accessibility of futures contracts play a crucial role:

Standardization: Futures contracts are highly standardized financial instruments. Standardization refers to the uniformity in contract specifications, including contract size, expiration dates, and deliverable quality. This uniformity ensures that every contract traded on the exchange is identical, making it easier for market participants to compare prices, execute trades, and manage risk effectively.

The standardization of futures contracts eliminates the need for negotiation on contract terms for each transaction. Traders can simply enter into contracts with specified contract sizes and maturity dates, without the need for detailed negotiations. This streamlines the trading process, increases market transparency, and fosters greater efficiency in price discovery.

Furthermore, standardized futures contracts facilitate the development of robust secondary markets. Because of the uniformity in contract specifications, there is a large pool of potential buyers and sellers, resulting in increased liquidity. The availability of liquid secondary markets enables market participants to easily enter or exit positions, reducing transaction costs and providing flexibility for risk management strategies.

Accessibility: Futures contracts offer accessibility to a wide range of market participants, including individual traders, institutional investors, and businesses of all sizes. This accessibility arises from several factors:

Organized Exchanges: Futures contracts trade on regulated and organized exchanges such as the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX). These exchanges provide a centralized marketplace where buyers and sellers can trade with confidence. The exchanges bring together a broad range of participants, creating a competitive trading environment and ensuring seamless accessibility.

Regulatory Oversight: Futures contracts are subject to regulatory oversight by government agencies, such as the Commodity Futures Trading Commission (CFTC) in the United States. This regulatory oversight helps ensure fair and orderly trading, promotes investor protection, and gives market participants confidence in the integrity of the market. The presence of regulatory oversight adds credibility and enhances accessibility for market participants.

Low Barrier to Entry: Futures contracts have a relatively low barrier to entry compared to other financial instruments. Market participants can access futures contracts with lower capital requirements, especially when compared to other derivative instruments like options. This lower barrier to entry allows individuals and businesses of various sizes to access and utilize futures contracts as part of their risk management, investment, or speculation strategies.

Range of Available Contracts: Futures contracts are available for a wide range of asset classes, including commodities, currencies, stock indices, interest rates, and more. This diversity of available contracts provides opportunities for market participants to access and trade contracts in the markets they are interested in or have expertise in, increasing accessibility and choice.

In summary, the standardization and accessibility of futures contracts contribute significantly to their usefulness in financial markets. The standardization saves time and effort in negotiations, enhances liquidity, and fosters efficiency in price discovery. The accessibility of futures contracts enables market participants of all sizes to participate in trading and risk management, providing flexibility and opportunities in various market segments.

Cost of Futures Contracts versus Forward Contracts

When comparing the cost of futures contracts and forward contracts, several factors come into play. Let’s explore the key considerations that distinguish the cost aspects of these two types of contracts:

Transaction Costs: Transaction costs refer to the expenses incurred when entering into or exiting a contract. In general, futures contracts tend to have lower transaction costs compared to forward contracts. This is primarily due to the standardized nature of futures contracts, which allows for greater efficiency in trading and reduces the need for individual negotiation. As a result, bid-ask spreads for futures contracts tend to be narrower, leading to lower transaction costs for market participants.

Margin Requirements: Futures contracts require participants to post initial margin and maintain margin accounts. The initial margin acts as a deposit, typically a percentage of the total contract value, that is required to enter into a futures contract. The maintenance margin is a minimum level of account equity that must be maintained to keep the position open. These margin requirements ensure that market participants have sufficient funds to cover potential losses and promote financial stability in the markets. In contrast, forward contracts generally do not have margin requirements. The absence of margin requirements in forward contracts can result in higher counterparty risk and potentially higher costs for risk management.

Liquidity and Spread Impact: As mentioned earlier, futures contracts tend to be highly liquid due to their standardized nature and centralized exchange trading. The high liquidity of futures contracts minimizes the impact of bid-ask spreads, resulting in lower trading costs. This is particularly beneficial for frequent traders or those dealing with larger contract sizes. On the other hand, forward contracts, being individually tailored and privately negotiated, may have wider bid-ask spreads due to lower market liquidity. The wider spreads can increase transaction costs for participants entering or exiting forward contracts.

Customization Costs: While forward contracts offer customization to suit the specific needs of market participants, this customization can come at a cost. Customizing a forward contract may involve additional negotiation time and resources, which can increase the overall transaction costs. In contrast, futures contracts, being standardized, eliminate the need for customization and the associated costs. The lack of customization in futures contracts also ensures greater ease of trading and pricing efficiency.

Risk and Credit Costs: Forward contracts carry a higher risk of default compared to futures contracts due to the lack of a centralized clearinghouse and margin requirements. This increased risk can have an impact on the cost of entering into forward contracts. Market participants may incur additional costs for credit checks, collateral, or credit enhancements to mitigate counterparty risk. In contrast, futures contracts, traded on organized exchanges with clearinghouses and margin requirements, provide greater risk mitigation and thus potentially lower credit-related costs for market participants.

Overall, while the specific cost considerations may vary depending on the specific circumstances and contracts involved, futures contracts generally offer cost advantages over forward contracts. Lower transaction costs, tighter bid-ask spreads, standardized nature, lower credit and risk costs, and greater liquidity make futures contracts a more cost-effective choice for many market participants.

Conclusion

In conclusion, futures contracts offer several advantages over forward contracts, making them a preferable choice for many market participants. The standardized nature of futures contracts ensures transparency, fairness, and efficiency in trading. The presence of organized exchanges and centralized clearinghouses enhances liquidity, mitigates counterparty risk, and promotes market stability.

Futures contracts provide effective risk mitigation tools, allowing market participants to hedge against price fluctuations, manage counterparty risk, and navigate systemic risk. The high liquidity and marketability of futures contracts enable easy entry and exit from positions, reducing transaction costs and offering flexibility for risk management strategies.

Moreover, the accessibility of futures contracts to a wide range of market participants, along with regulatory oversight, ensures a fair and orderly marketplace. The cost advantages of futures contracts, such as lower transaction costs, narrower bid-ask spreads, and risk mitigation features like margin requirements, contribute to their attractiveness.

It is important to note that forward contracts, offering customization and tailored agreements, have their own advantages and may be suitable for certain situations. However, the standardized nature, liquidity, risk mitigation features, and cost advantages of futures contracts make them a preferred choice for many businesses, investors, and traders when it comes to managing financial risk and pursuing trading strategies.

Ultimately, the decision between futures contracts and forward contracts depends on the specific needs and circumstances of market participants. Careful consideration of factors such as risk tolerance, customization requirements, liquidity needs, and transaction costs should be taken into account when selecting the appropriate contract type.

In summary, futures contracts provide a standardized, liquid, and cost-effective means for managing financial risk, offering market participants the opportunity to hedge, speculate, and actively participate in the global financial markets with ease and confidence.